Europe and North Africa Commercial Vessels Marine Engine Market Size, Share & Industry Analysis, By Engine Type (Two-stroke Diesel Engines, Four-stroke Diesel Engines, Diesel-Electric Engine, Dual-Fuel Engines, & Others), By Fuel Type (Green Fuel, Diesel, Electric, and Others), By Engine Power Capacity (10,000 kW to 80,000 kW, and Above 80,000 kW), By Vessel Type (Cargo Vessels, Tanker Vessels, Offshore & Support Vessels, Passenger Vessels, RO RO Vessels, & Others), By Fit Type (Line Fit and Retro Fit), By End User (Private Owners and Charter/Rental Fleets), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

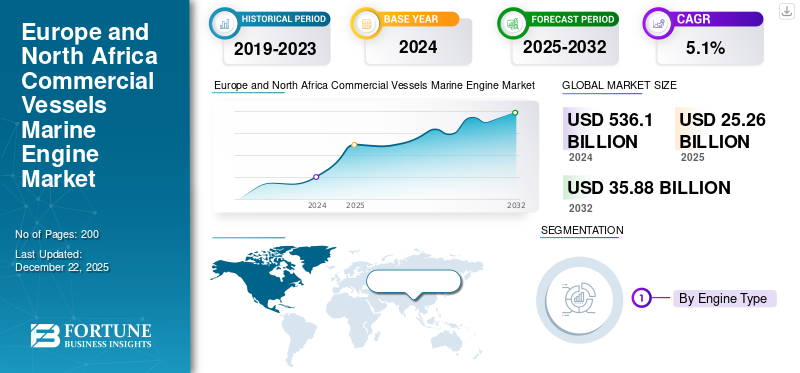

The Europe and North Africa commercial vessels marine engine market size was valued at USD 22.87 billion in 2024. The market is projected to grow from USD 25.26 billion in 2025 to USD 35.88 billion by 2032, exhibiting a CAGR of 5.1% during the forecast period.

A commercial marine engine is a propulsion or auxiliary engine fitted in various commercial vessels such as cargo vessels, oil tankers, and container ships, and so on, to transform fuel energy (most commonly diesel or gas) into mechanical power to propel the ship or supply power for onboard systems. Propulsion engines propel the ship, while auxiliary engines provide onboard power, both of which are essential in harsh marine conditions. Commercial marine engines are indispensable, as more than 80% of global trade by volume is transported by sea. Therefore, the world's economies rely significantly on these marine engines to ship goods from raw materials to finished products across the seas, supporting the global commercial ship marine engine market.

The market encompasses several major players such as MAN Energy Solutions, Wartsila Corporation, MTU Friedrichshafen (Rolls-Royce). Their broad product portfolios, innovative marine engines, and strong geographic expansion have supported their dominance in the global market.

Market Dynamics

MARKET DRIVER

Improvements in Engine Technology Are Fueling the Market Growth

Increased demand for commercial ship marine engines is driven by increased global seaborne trade volumes, tightening environmental legislation, and improvements in engine technology that minimize emissions. For instance, the recovery and expected growth of maritime trade IMO predicts trade may increase 40% to 115% by 2050 from 2022 levels, naturally creating demands for additional and improved engines. Besides that, stringent emissions standards such as the EPA's Tier 4 for diesel engines and the IMO's worldwide sulfur and NOx limits under MARPOL Annex VI have created the demand for more advanced and cleaner engines to be adopted in recent years.

- For instance, in April 2023, the IMO noted an annual increase of 3% in the global shipping fleet, emphasizing how trade growth in regions such as Europe is driving the demand for engines. Similarly, the integration of hybrid propulsion in European ferries to achieve emission standards goals demonstrates the industry's transition toward sustainable marine engineering.

Market Dynamics

MARKET RESTRAINTS

Stringent Emission Norms to Hamper Market Growth

The marine engine industry for commercial ships faces significant challenges with regard to environmental compliance, resulting in significant cost burdens. This is particularly due to stringent International Maritime Organization (IMO) rules that require far-reaching alterations to reduce harmful emissions. Under the IMO’s 2008 NOx Technical Code, ship engines are subject to increasingly tighter controls on nitrogen oxides emissions. Tier III requirements call for low and high-speed engines to emit no more than 3.4 g/kWh in emission control areas, forcing operators to install selective catalytic reduction systems or replace engines altogether.

Market Dynamics

MARKET OPPORTUNITIES

Rising Demand for Retrofit Modern Engines to Present Significant Growth Opportunities

Global maritime trade recovered from recent shocks and is projected to expand moderately, creating a steady baseline need for propulsion and auxiliary power upgrades as older tonnage is renewed or retrofitted. According to UNCTAD, global maritime trade reached 12.3 billion tonnes in 2023 with projected average growth of about 2.4% annually by 2029, underpinning demand for new building and retrofit modern engines.

Strong IMO and regional targets force owners to invest in lower-emission engines, exhaust after-treatment systems, or alternative-fuel propulsion to comply with regulations and remain competitive. The IMO’s 2023 GHG Strategy (net-zero by 2050 with interim reduction checkpoints) and the introduction of carbon-intensity measures create explicit compliance pathways that are translating into demand for advanced engine designs and conversion kits.

- For instance, in October 2024, Garden Reach Shipbuilders and Engineers (GRSE) Ltd entered into a contract with Carsten Rehder Schiffsmakler and Reederei GmbH & Co. KG from Germany to build and supply an additional specialized multi-purpose cargo ship with a displacement of 7,500 DWT.

Europe and North AFRICA Commercial Vessels Marine Engine

MARKET TRENDS

Growing Integration of Dual Fuel Engines in Vessels to Drive Product Demand

The growth in demand for dual-fuel momentum or propulsion is clearly accelerating. According to DNV’s Alternative Fuels Insight (AFI), new orders for alternative-fuelled ships hit 19.8 million GT in H1-2025, up 78% versus all of 2024, despite an overall slowdown in newbuilds. Within these orders, LNG and methanol dual-fuel designs dominate; DNV reported 166 methanol-fuel newbuild orders (32% of the AFI orderbook) in 2024. Regulation is steering engine specs toward electrification, shore power, and hybridization. The IMO’s EEXI/CII rules (in force since 1 Jan 2023) push efficiency upgrades, engine-power limitations, and auxiliary-system optimization. In the EU, FuelEU Maritime and related rules mandate zero-emission at-berth, starting in 2030 for AFIR-covered ports and extended to all EU ports equipped with on-shore power (OPS) from 2035. This is creating demand for engines integrated with battery-hybrid systems, PTO/PTI, and OPS-ready auxiliaries, enabling ships to cut emissions in port while improving CII ratings at sea.

- For instance, in June 2025, Maersk revealed plans for a new series of vessels, each capable of carrying 17,480 TEUs, that will feature dual-fuel methanol This class of container ships is set to improve Maersk’s services by linking Eastern Asia to Northern Europe.

MARKET CHALLENGES

Unstable fuel Prices to Challenge the Growth of the Market

Unstable fuel prices are a key constraint, since oil and gas prices account for about 50-60% of shipping costs, based on shipping industry estimates. Price volatility creates operational planning challenges and budget disturbances that may lower shipping demand by 10-15% during periods of high prices.

These unstable industry trends hinder Europe and North Africa commercial vessels marine engine market growth. Manufacturers face unpredictable demand patterns, while ship-owners struggle to justify expenditures in more efficient but costly engine technologies when future fuel costs remain unreliable. Furthermore, the marine engine industry faces a critical shortage of qualified labor that severely limits operations and expansion. As per BIMCO/ICS Seafarer Workforce reports, there could be a shortfall of around 90,000 qualified marine officers by 2026.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Engine Type

Duel Fuel Engines Segment to Display Fastest Growth due to its Rising Adoption

By engine type, the market is classified into two-stroke diesel engines, four-stroke diesel engines, diesel-electric engine, dual-fuel engines, and others.

The dual-fuel engines are estimated to be the fastest-growing segment during the forecast period from 2025 to 2032, with the highest projected CAGR of 8.0%. The widespread adoption of dual-fuel engines across various ship types is propelling this growth, fueled by strict environmental laws and technological innovations that enable engines to operate on both traditional heavy fuel oil and cleaner choices green fuels.

- For instance, in April 2023, Svitzer and Caterpillar signed an MOU for the deployment of methanol dual-fuel solutions to power Svitzer's new vessels and retrofit current tugs.

The two-stroke diesel engines segment accounted for the largest market share in 2024, with a share of 33.18%. This domination is the result of numerous key technical and economic benefits that make these engines highly suitable for extensive maritime use. Two-stroke engines are well equipped to utilize HFO due to their engine's high-duty capability and operational characteristics. This fuel efficiency translates into significant cost reductions for shipping companies, propelling the segmental dominance in the market.

To know how our report can help streamline your business, Speak to Analyst

By Fuel Type

Green Fuel Segment to Showcase Fastest-Growth due to Rising Adoption of Advanced Engines

By fuel type, the market is divided into green fuel, diesel, electric, and others.

The green fuel segment is anticipated to be the fastest-growing segment during the forecast period, with a projected CAGR of 6.5%. Growth is being driven by the adoption of advanced engines designed to utilize green fuel as a primary decarbonization solution, enabling operational flexibility while reducing environmental impact. Global standards, such as the IMO's greenhouse gas strategy, which targets a 50% decrease in emissions by 2050, are driving research and development expenditures in green fuels.

- For instance, in February 2025, Wartsila signed a Lifecycle Agreement with CMA Ships, a French shipping firm and subsidiary of CMA CGM. This agreement covers 14 large container vessels powered by LNG that are currently operational, with the order recorded in the first quarter of 2025.

Electric is estimated to be the second-fastest segment, with a CAGR of 5.7% during the forecast period (2025-2032).

By Engine Power Capacity

10,000 kW to 40,000 kW Segment Led due to High Vessel Utilization

By engine power capacity, the market for Europe and North Africa commercial vessels marine engine is divided into Upto 10,000 kW, 10,000 kW to 40,000 kW, 40,000 kW to 80,000 kW, and above 80,000 kW.

The 10,000 kW to 40,000 kW segment dominated the market in 2024, with a share of 32.92% and is estimated to be the fastest-growing segment during the forecast period (2025-2032). The growing requirement of this capacity range stems from its widespread use in bulkers, tankers, and other vessel types. A large share of the global fleet by capacity usually falls within the low-to-mid tens of megawatts, which corresponds to this engine capacity power.

- For instance, in May 2025, the Wenchong shipyard in China placed an order for four sets of 3 × MAN 8L21/31 MK2 GenSets for the building of four 4 × 96m C-CSOVs. The engines are set to be delivered with part-load optimization aimed at enhancing fuel efficiency. Additionally, they will be integrated into an innovative diesel-electric system that adheres to Dynamic Positioning stage 2 (DP2) standards established by the DNV classification society. Altogether, the 12 engines have more than 20,000 kW of power. The L21/31 engine offers numerous benefits, including industry-leading fuel efficiency and minimal noise and vibration levels.

40,000 kW to 80,000 kW is estimated to be the second-fastest growing segment during the forecast period (2025-2032), with a CAGR of 5.8%. The expansion is fueled by the fast growth of Ultra Large Container Ships (ULCS) and the shipping industry's constant quest for economies of scale. This power range is ideal for the propulsion needs of the world's largest commercial ships, which are rapidly emerging as the dominant force in international container shipping.

By Vessel Type

Growing Expansion of E-commerce and Shipping Boosted Cargo Vessel Segment’s Growth

By vessel type, the market for Europe and North Africa commercial vessels marine engine is divided into green cargo vessels, tanker vessels, offshore and support vessels, passenger vessels, RO RO vessels, and others.

The cargo vessel segment held the largest share of the Europe and North Africa commercial vessels marine engine market and remains the dominant category in the vessel type segment, holding the highest share of 35.24% in 2024. The expansion of e-commerce and shipping is reflected in the modal transition from air to sea freight for certain cargo types. This shift is driving greater demand for sea freight services, particularly for large shipments and non-perishable deliveries where cost-effectiveness outweighs speed. According to UNCTAD’s Review of Maritime Transport 2024, the world’s general cargo ship fleet reached around 2.4 billion DWT.

- For instance, in June 2023, A.P. Moller. (Maersk) announced plans to upgrade an existing ship to operate on dual-fuel methanol, enabling the use of green methanol as fuel. The industry’s first engine retrofit is scheduled for mid-2024, with plans to implement the same modifications on sister vessels during their special survey in 2027.

The passenger vessels segment is estimated to be the fastest-growing segment, with a projected CAGR of 8.4% during the forecast period (2025-2032). The cruise ships sector has proven highly resilient, with worldwide cruise passenger capacity projected to surpass the pre-pandemic level by 18% in 2024. Throughout the forecast period, factors such as lower wages, robust government support, and rising disposable incomes fueling demand for luxury travel experiences are expected to drive segmental growth.

By Fit Type

Retro Fit Segment Dominated due to Growing Demand for Engine Replacement

By fit type, the market doe Europe and North Africa commercial vessels marine engine is segmented into line fit and retro fit.

The retro fit segment accounted for the largest market share at 63.98% in 2024 and is estimated to be the fastest-growing segment during the forecast period (2025-2032). The ongoing upgradation of old fleet vessels' marine engines, many of which are extremely populating and significant contributors to global carbonization, with advanced green propulsion fuel engines is driving this growth. Retrofitting activities are creating robust opportunities for new entities to establish themselves in the market.

- For instance, in April 2024, Hapag-Lloyd and Seaspan Corporation formed a partnership to upgrade and convert five 10,100 TEU container vessels, currently powered by traditional MAN S90 engines, into dual-fuel engines capable of running on methanol. Once retrofitted, these ships will remain under a long-term charter from Seaspan to Hapag-Lloyd.

Line fit segment gain momentum in the upcoming years as new build vessel requirements are growing in the European region.

By End User

Charter/Rental Fleets Dominated the Market due to Operational Flebility

By end user, the master is segmented into private owners and charter/rental fleets.

The charter/rental fleets segment accounted for the largest Europe and North Africa commercial vessels marine engine market share in 2024 at 53.23%. European ship-owners control the largest share of the world's deadweight capacity, as per the European Community Shipowners' Associations (ECSA) Annual Report 2023. However, much of this tonnage operates under charter deals instead of direct liner services. This long-standing model allows shipowners and charterers (traders, commodity houses, or logistics companies) to manage operations. The dominance of the charter fleets in Europe is linked to the region’s hub for commodities and energy trade. For instance, Eurostat emphasizes that more than 70% of the external freight transport of the EU in terms of volume is seaborne, and most of this involves bulk commodities such as crude oil, coal, LNG, and grain. As commodity producers and sellers, rather than ship-owners, need flexible shipping capacity, charter/rental fleets are favored more than over outright ownership of tonnage.

- For instance, in December 2024, Hengli Heavy Industry secured a contract with MSC, one of Europe's leading shipping companies, to construct 10 ultra-large container ships powered by LNG dual-fuel technology, each with a capacity of 24,000 TEU. The overall value of the contract is approximately USD 2.3 billion.

The private owners segment is expected to witness significant growth during the forecast period (2025-2032), with a projected CAGR of 5.6%. The expansion of the segment is attributed to better financing adaptability, decision-making agility, innovation capacity, and investment attractiveness. As shipping becomes increasingly capital-intensive and technology-focused, private owners are in the best position to invest in advanced ships and facilities, thereby supporting the continued growth of this segment.

Europe and North Africa Commercial Vessels Marine Engine Market Regional Outlook

The Europe region held the largest commercial vessels marine engine market share in 2024, accounting for 81.01% share, and is anticipated to grow at a CAGR of 5.5% during the study period. Europe's commercial vessels' marine engine market dominance is underpinned by its position within a major shipping cluster. European ports handled 3.4 billion tonnes of freight in 2023, indicating steady seaborne freight activity across short-sea and deep-sea trade, which continues to drive demand for propulsion and auxiliary power. European ship-owners have a huge ownership percentage of global tonnage (ECSA lists approx. 39.5% world deadweight capacity). This gives them considerable influence over fleet renewal and engine-specification decisions emanating from Europe.

- For instance, in June 2025, the German container shipping company Hapag-Lloyd received the twelfth and last ship of its environmentally friendly Hamburg Express class.

Growing research capabilities, technological advancements in marine engines, and demand for eco-friendly engines are fueling strong uptake across Europe. In addition, in 2025, emerging countries in the region, such as northern European countries, are anticipated to reach a market size of 6.47 billion, with Germany projected at 2.00 billion and Italy at 2.19 billion.

Europe has also introduced regulatory measures, such as the extension of the EU ETS to maritime shipping operations, with phased implementation (40% in 2025, 70% in 2026, and 100% from 2027) and FuelEU Maritime, which mandates the adoption of renewable/low-carbon fuels and shore power. These policies compel owners and operators to invest in cleaner engines, dual-fuel retrofits, hybrids, and OPS-capable auxiliaries to achieve compliance and prevent carbon costs.

The commercial vessels marine engine market is experiencing high growth in the North Africa region, with a CAGR of 3.4%. In 2024, the market value stood at USD 4.34 billion. The region’s location along the Mediterranean Sea at key maritime chokepoints, notably the Suez Canal, which links Europe, Asia, and Africa via the Red Sea shipping lanes, drives strategic demand. As per the European Environment Agency, sulfur oxide emissions from Mediterranean shipping fell by 30% between 2015 and 2022 due to regulatory enforcement, increasing demand for compliant marine engines across the North African shipping industry.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are focusing on Advancement in Marine Engines to Expand their Market Presence

Europe’s leadership in the commercial vessels marine engine market is reinforced by strategic technological advancement and cross-border expansion. Leading market players leverage decades of engineering experience, large-scale manufacturing bases, and R&D capacities across the region. Players such as Wartsila, MAN Energy Solutions, and Rolls-Royce maintain global leadership through continuous innovation and strategic collaboration.

- For instance, in May 2024 at Riviera Maritime Media’s 27th International Tug & Salvage (ITS) Convention & Exhibition in Dubai, UAE, three original equipment manufacturers (OEMs) unveiled next-generation tugboat engine technologies. Engine manufacturers are gearing up to adopt technologies that utilize methanol, LNG, and other alternative fuels for tugboats.

Major strategic initiatives among European marine engine key players are concentrated on alternative fuel technology and digitalization, in response to market expansion driven by environmental legislation and decarbonization requirements. MAN Energy Solutions has placed itself at the forefront of methanol propulsion technology with the 2025 delivery of the world's most powerful methanol-fuelled two-stroke engine, rated at 82,440 kW, for container ships. At the same time, the company is developing dual-fuel ammonia engines under the NH3 Spark project, funded by Denmark's Energy Technology Development and Demonstration Programme.

LIST OF KEY EUROPE and NORTH AFRICA COMMERCIAL VESSELS MARINE ENGINE COMPANY PROFILED:

- ABB Marine & Ports (ABB) (Switzerland)

- Bergen Engines AS (Norway)

- Caterpillar / MaK (Caterpillar Motoren GmbH) (Germany)

- Deutz AG (Germany)

- Hyundai Heavy Industries (South Korea)

- Iveco Group (Italy)

- Kongsberg Maritime (Norway)

- MAN Energy Solutions SE (Germany)

- Mitsubishi Heavy Industries (Japan)

- Rolls-Royce Power Systems / MTU (mtu brand) (Germany)

- SCHOTTEL GmbH (Germany)

- Siemens Energy (Germany)

- Volvo Penta (Sweden)

- Wartsila Corporation (Finland)

- WinGD (Winterthur Gas & Diesel) (Switzerland)

- Yanmar Europe B.V. (Netherlands)

KEY INDUSTRY DEVELOPMENT

- June 2025 – HD Hyundai Marine Solution obtained a contract to retrofit the engines of 74 ships, enhancing its footprint in the eco-friendly vessel sector. With global demand for engine modifications anticipated to reach billions of USD as a result of tighter environmental standards, the company aims to expand its market presence further.

- December 2024 – Maersk entered into contracts with three shipyards to acquire 20 container ships equipped with dual-fuel propulsion, collectively offering a capacity of 300,000 TEU. These acquisitions complete Maersk planned newbuilding orders as part of its fleet renewal strategy.

- August 2024 – Wartsila entered into an agreement with Norwegian company Eidesvik to supply equipment for modifying an offshore platform supply vessel (PSV) to run on ammonia fuel. The vessel is anticipated to commence ammonia operations in the first half of 2026, making it the first ship in the world to operate on ammonia fuel in service.

- June 2024 – X Press Feeders is at the forefront of promoting sustainable shipping by integrating MAN Energy Solutions' innovative 5S50ME methanol dual-fuel engine into its fleet. This initiative introduces the first scheduled feeder routes in Europe that utilize this environmentally friendly fuel, showcasing the company’s commitment to minimizing its ecological impact.

- February 2024 - German Tanker Shipping (GTS), an operator of oil and chemical tankers, selected MAN ES’ propulsion system, which includes both main and auxiliary engines along with the MAN Alpha propeller, for four oil and chemical tankers.

REPORT COVERAGE

The Europe and North Africa commercial vessels marine engine market analysis provides an in-depth study of the market size & forecast by all the market segments included in the report. It includes details on market trends and dynamics that are expected to drive the market during the forecast period. It offers information on the engine type, fuel type, engine power capacity, vessel type, fit type, end users, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historic Period |

2019-2023 |

|

Growth Rate |

5.1% CAGR During 2015-2032 |

|

Unit |

USD Billion |

|

Segmentation |

By Engine Type · Two-stroke Diesel Engines · Four-stroke Diesel Engines · Diesel-Electric Engine · Dual Fuel Engines · Others By Fuel Type · Green Fuel · Diesel · Electric · Others By Engine Power Capacity · Upto 10,000 kW · 10,000 kW to 40,000 kW · 40,000 kW to 80,000 kW · Above 80,000 kW By Vessel Type · Cargo Vessels · Tanker Vessels · Offshore and Support Vessels · Passenger Vessels · RO RO Vessels · Others By Fit Type · Line Fit · Retro Fit By End User · Private Owners · Charter/Rental Fleets |

|

Geography |

Europe (By Engine Type, By Fuel Type, By Engine Power Capacity, By Vessel Type, By Fit Type, By End User, and By Country) · U.K. (By Fit Type) · France (By Fit Type) · Italy (By Fit Type) · Germany (By Fit Type) · Greece (By Fit Type) · Spain (By Fit Type) · Northern Europe (By Fit Type) · Rest of Europe (By Fit Type) North Africa (By Engine Type, By Fuel Type, By Engine Power Capacity, By Vessel Type, By Fit Type, By End User, and By Country) · Algeria (By Fit Type) · Egypt (By Fit Type) · Libya (By Fit Type) · Morocco (By Fit Type) · Tunisia (By Fit Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 22.87 billion in 2024 and is projected to reach USD 35.88 billion by 2032.

In 2024, the market value stood at USD 4.34 billion.

The market is expected to exhibit a CAGR of 5.1% during the forecast period of 2025-2032.

By engine type, the dual fuel engines segment is poised to display the fastest growth.

Improvements in Engine Technology are a key factor driving the market.

ABB Marine & Ports (ABB) (Switzerland), Bergen Engines AS (Norway), Caterpillar / MaK (Caterpillar Motoren GmbH) (Germany), Deutz AG (Germany), and Iveco Group (Italy) are the top players in the market.

Europe dominated the market in 2024

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us