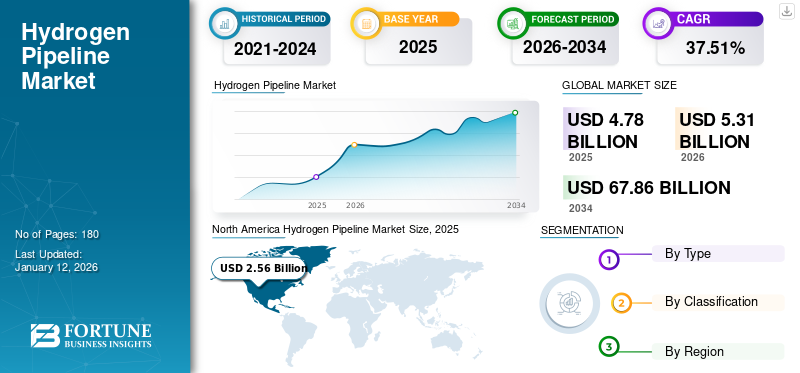

Hydrogen Pipeline Market Size, Share & Industry Analysis, By Type (Offshore and Onshore), By Classification (New and Repurposed), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global hydrogen pipeline market size was valued at USD 4.78 billion in 2025. The market size is projected to grow from USD 5.31 billion in 2026 to USD 67.86 billion by 2034, exhibiting a CAGR of 37.51% during the forecast period. North America dominated the global market with a share of 53.47% in 2025.

Hydrogen pipelines are critical infrastructures used for the efficient and large-scale transportation of hydrogen gas, supporting its role as a clean energy carrier in the global transition toward sustainable energy. These pipelines are specifically designed or retrofitted to handle hydrogen's unique properties, such as its low molecular weight, high diffusivity, and potential to cause embrittlement in certain metals. Existing natural gas pipelines are often used for conversion to transport hydrogen, offering a cost effective way to scale hydrogen distribution without requiring entirely new infrastructure.

Customized hydrogen pipelines are increasingly being developed in industrial hubs, connecting production sites, storage facilities, and end-users, including power plants, refineries, and hydrogen fueling stations, which play a key role in driving market growth. For instance, the European Hydrogen Backbone (EHB) project aims to establish a vast network of hydrogen pipelines across Europe. The U.S., Japan, and Australia are also advancing their hydrogen pipeline infrastructure.

Snam is one of the leading companies in the hydrogen pipeline market due to its extensive experience and infrastructure in energy transportation. Operating as one of Europe's largest natural gas pipeline networks and spanning over 41,000 km, Snam is strategically positioned to drive the change toward the transmission of hydrogen.

MARKET DYNAMICS

MARKET DRIVERS

Rising Hydrogen Production is Driving Market Growth

The rapid rise in hydrogen production, driven by the growth of green hydrogen from renewable energy sources, blue hydrogen using carbon capture technologies, and the growing need to eliminate the use of fossil fuel, is significantly boosting the development of hydrogen pipeline infrastructure. According to the International Energy Agency (IEA), global hydrogen demand continued its upward trajectory in 2023, reaching a record high of over 97 Mt, exhibiting around a 2.5% increase compared to 95 Mt in 2022. Centralized hydrogen production hubs in regions rich in renewable resources, such as Germany's national hydrogen strategy in 2020 and Australia's green hydrogen exports, necessitate extensive pipeline networks to distribute hydrogen efficiently across industries and urban centers. According to Germany's national hydrogen strategy, the demand for hydrogen in Germany is expected to reach 95-130 Terawatt hours (TWh) by 2030, further leading to the global hydrogen pipeline market growth in the coming years.

Rising Government Support for Developing Hydrogen Infrastructure to Lead Market Growth

The rising government support from developed and developing nations, including the U.S., India, China, Germany, the U.K., and many others, for escalating the production and consumption of hydrogen would accelerate the demand for hydrogen pipelines in the forecast period. For instance, in 2024, The European Commission approved Germany's USD 3.25 billion Hydrogen Core Network (HCN) scheme under EU State aid rules. This initiative supports the EU’s Hydrogen Strategy and ‘Fit for 55’ package by accelerating renewable hydrogen infrastructure. The HCN focuses on repurposing existing gas pipelines and constructing new hydrogen pipelines and compressor stations for long-distance hydrogen transport within Germany and integration into the broader European hydrogen network. Furthermore, government initiatives play a pivotal role in advancing hydrogen pipeline infrastructure by providing financial incentives, establishing regulatory frameworks, and fostering international collaboration. Programs, such as the U.S. Inflation Reduction Act (IRA) and the European Hydrogen Strategy, offer substantial funding and clear roadmaps to accelerate hydrogen infrastructure projects.

MARKET RESTRAINTS

High Infrastructure Costs to Constrain Market Growth

Building dedicated pipelines for hydrogen or retrofitting existing natural gas pipelines to handle hydrogen requires substantial investment. This is due to the need for specialized materials, advanced construction techniques, and safety measures to address issues such as hydrogen embrittlement and leakage. The high capital costs of infrastructure, including the installation of compression stations and storage facilities, deter private and public sector investment. Furthermore, the cost of hydrogen-compatible materials, such as advanced alloys and coatings, adds to the financial burden. These high upfront costs create a challenge for scaling hydrogen transportation systems, especially in regions where hydrogen demand has yet to reach critical mass.

MARKET OPPORTUNITIES

Efforts for Increasing Green Methanol Production Expected to Offer Lucrative Opportunities

The rising inclination toward green methanol globally is expected to provide an opportunity for the expansion of the market, as the production of green methanol requires green hydrogen as the feedstock. For instance, European Energy is set to deliver 200,000-300,000 tons of e-methanol to Maersk annually by 2025 and is developing the world's first large-scale commercial e-methanol production facility. The green hydrogen will be provided by a 50-megawatt electrolyzer and compressed by Howden. This project is a significant step toward CO2-neutral shipping at a large scale and the use of 100% renewable energy in the maritime industry, which aims to cut the global shipping industry's annual greenhouse gas emissions by at least half by 2050, as compared to 2008 levels. Thus, the requirement for hydrogen to be sent to different locations would play a key role in necessitating hydrogen pipelines.

MARKET CHALLENGES

Hydrogen Embrittlement to Challenge Market Growth

When hydrogen infuses metals, particularly common pipeline materials, including carbon steel, it causes the metal to become brittle, increasing the risk of cracks and failures. This phenomenon forces engineers to select hydrogen-resistant materials, such as stainless steel or advanced alloys, which are less prone to embrittlement but often come at a higher cost. Additionally, pipeline designs need to incorporate reinforcements or coatings to protect against hydrogen diffusion, further raising infrastructure costs. To mitigate these risks, advanced welding techniques, leak detection systems, and regular inspections are critical to ensuring pipeline safety. As a result, overcoming hydrogen embrittlement is essential for creating a reliable, cost-effective hydrogen transportation network, particularly as demand for hydrogen grows globally and cross-border pipeline projects become more common.

HYDROGEN PIPELINE MARKET TRENDS

Cross-border Trade of Hydrogen is one of the Key Market Trends

Cross-border hydrogen trade in recent times has emerged as a key trend in the development of hydrogen pipeline infrastructure, enabling the efficient and large-scale transportation of hydrogen across regions and countries. As hydrogen emerges as a globally traded commodity, pipelines are becoming essential for connecting production hubs in resource-rich regions with high demand industrial and urban centers. Projects such as the H2Med pipeline (linking Spain and France) and proposed corridors between North Africa and Europe exemplify how cross-border pipelines facilitate seamless hydrogen transport, reducing costs associated with liquefaction and shipping. These pipelines not only support regional energy security but also help nations achieve their decarbonization goals by creating reliable supply chains for green and low-carbon hydrogen. Furthermore, cross-border infrastructure encourages international collaboration and investment, strengthening the foundation for a global hydrogen economy while ensuring scalability and long-term sustainability.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant but mixed impact on the market. On one hand, the pandemic caused delays in ongoing projects and disrupted supply chains, slowing the progress of hydrogen infrastructure development. Travel restrictions and workforce shortages hindered construction timelines for new hydrogen pipeline networks. On the other hand, the pandemic highlighted the need for cleaner energy solutions, leading to renewed interest in hydrogen as a key component of post-pandemic recovery and the green transition. As a result, while short-term disruptions occurred, the long-term momentum for hydrogen pipeline development has remained strong, with continued investment in projects aimed at decarbonizing industries and supporting energy security.

SEGMENTATION ANALYSIS

By Type

Rising Production of Hydrogen and its Application as a Renewable Source Drives Onshore Segment Growth

Based on type, the market is bifurcated into offshore and onshore. The onshore segment holds the major share of the market owing to the significant investments from major energy companies, especially in Europe, North America, and parts of Asia Pacific. This market is being driven by the global push toward decarbonization, with hydrogen as a key solution for reducing emissions across various industries. Large-scale investments in hydrogen infrastructure, particularly in the EU and North America, are accelerating the growth of this market. These regions are actively advancing hydrogen adoption as part of their clean energy transition strategies, which further fuels the demand for onshore hydrogen pipeline networks.

The offshore segment is currently smaller but is projected to grow at the fastest rate due to the growth of green hydrogen projects. Several European countries are leading in this area, driven by initiatives to harness offshore wind energy for hydrogen production. The push for offshore hydrogen production from renewable sources and the commitment to decarbonization are key growth drivers, especially in Europe, where offshore hydrogen infrastructure is becoming a central component of the green energy transition.

To know how our report can help streamline your business, Speak to Analyst

By Classification

Growing Need for Efficient and Safe Hydrogen Transportation is Fueling Installation of New Hydrogen Pipelines

By classification, the market is segmented into new and repurposed. New hydrogen pipelines hold a major share of the market as they are specifically designed for hydrogen transportation, ensuring optimal performance, efficiency, and safety. These projects are often integrated into large-scale green or blue hydrogen production hubs, playing a critical role in connecting production, storage, and end-use facilities. The infrastructure is built using advanced materials, such as high-strength steel alloys and hydrogen-resistant coatings, to prevent hydrogen embrittlement and minimize leakage, thus ensuring long-term reliability.

The repurposed segment is expected to grow at the fastest rate in the coming years, owing to its characteristics of cost-effectiveness and faster alternatives for building new infrastructure. It involves upgrading materials, compressors, and safety systems to handle hydrogen’s unique properties. This approach is gaining market demand due to its lower costs and the extensive availability of natural gas networks.

HYDROGEN PIPELINE MARKET REGIONAL OUTLOOK

The market has been studied geographically across four main regions: North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Hydrogen Pipeline Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Government’s Initiatives to Boost Hydrogen Production Push North America’s Market Growth

North America holds the dominant global hydrogen pipeline market share due to the rising government efforts to increase the use of hydrogen as a clean source of energy. Hydrogen-related initiatives, such as the Hydrogen Strategy for Canada, the Hydrogen Demand Action Plan for the U.S., and others, aim to increase production and consumption for its utilization in various end-user industries and increase the demand for hydrogen pipelines. In addition, funding and investments such as Canada’s Clean Hydrogen Investment Tax Credit (ITC) between 2023 and 2035, which includes an amount of around USD 12.6 billion, would also play a key role in the expansion of the North American market.

U.S.

Growing Need for Clean Energy Solutions to Drive the Market in the U.S.

A combination of government policy & investments, private sector investment, technological advancements, and a growing need for clean energy solutions is driving the expansion of hydrogen pipelines in the U.S. As hydrogen develops as a key component of energy security, industrial decarbonization, and global trade, the development of hydrogen pipelines becomes integral to meeting the U.S. climate goals and domestic energy needs. In February 2022, the U.S. Department of Energy allocated USD 9.5 billion to fund clean hydrogen initiatives as part of the Infrastructure Investment and Jobs Act. The initiatives include Regional Clean Hydrogen Hubs, Clean Hydrogen Electrolysis Program, and Clean Hydrogen Manufacturing and Recycling Programs. USD 8 billion was provided to develop at least four Regional Clean Hydrogen Hubs, USD 1 billion for the Clean Hydrogen Electrolysis Program, and USD 500 million for Clean Hydrogen Manufacturing and Recycling Initiatives. This investment signifies a strong commitment to advancing hydrogen technology, creating substantial opportunities for growth and innovation for the hydrogen pipelines.

Asia Pacific

Robust Development of Hydrogen Infrastructures in Regional Countries to Foster Market Growth

Asia Pacific is anticipated to grow at the fastest rate in the forecast period as the region is witnessing rapid development in the field of hydrogen by China, Japan, South Korea, Australia, Singapore, and other countries. Japan’s Basic Hydrogen Strategy, China’s national hydrogen strategy, Australia’s Hydrogen Industry Mission, South Korea’s Hydrogen Economy Scheme, and others would play a vital role in the development of renewable-based hydrogen. The Basic Hydrogen Strategy, launched in 2017 in Japan, set a goal of increasing hydrogen consumption to 3 million tons per year by 2030 and 20 million tons per year by 2050, which included goals to have 800,000 hydrogen fuel cell vehicles and 900 hydrogen refueling stations by 2030. It further comprised the utilization of 800,000 tons of hydrogen for power generation, accounting for 1% of Japan’s electricity supply. Hence, these initiatives intend to boost the production and consumption of hydrogen for its application in transportation, power generation, and industries, which play a key role in generating the demand for hydrogen pipelines during the forecast period.

China

Stringent Government Policies Favoring Hydrogen Expansion to Strengthen the Market

The launch of hydrogen policy in the 14th Five-Year Plan (2021-2025), aims to substantially raise the share of renewable hydrogen in total energy consumption by 2035. This includes extending the utilization of hydrogen energy from transportation to a diverse array of sectors, including metal smelting, electricity provision, and residential end-use purposes. Thus, the government's initiative to boost hydrogen application, excessive production, and consumption of chemicals and petroleum products soars the need for hydrogen pipelines to utilize and provide hydrogen to different regions efficiently. Hence, the inclusion of hydrogen policy in the government's 14th five-year plan is expected to lead the market for hydrogen pipelines in China.

Europe

Government’s Focus on Carbon Neutrality to Push Market Growth in Europe

Europe is the second leading market across the globe due to the rising government initiatives for decarbonization. Initiatives, comprising the European Green Deal and the Hydrogen Strategy, are making significant investments in hydrogen production, infrastructure, and research. The region notices hydrogen as a key component in transitioning to a sustainable energy system, particularly in sectors such as transportation, industry, and heating.

Rest of the World

Stringent Government Initiatives to Positively Impact the Market

Hydrogen development initiatives such as the UAE's National Hydrogen Strategy, Saudi Arabia's National Hydrogen Strategy in 2020, and many others by the regional country would be the prime factors for enhancing the market in the region. For instance, the UAE National Hydrogen Strategy aims to be a top global producer of low-carbon hydrogen by 2031. Moreover, In Mexico, the Hydrogen Association was formed in 2021, which identifies that the adoption of green hydrogen in Mexico as an alternative fuel for energy production could generate nearly USD 60 billion in investments. Additionally, the Federal Electricity Commission of Mexico intends to produce electricity with green hydrogen by replacing natural gas, as proposed in its 2023-2027 business plan. Thus, the production & consumption of hydrogen on a large scale would augment the demand for hydrogen pipelines in the country during the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Globally, companies, including Desfa, Enagas, Snam, and Gasunie, are some of the key players constructing hydrogen pipelines. These companies are actively repurposing existing natural gas pipelines and developing dedicated hydrogen corridors to enable cross-border hydrogen transportation, supporting Europe’s transition to a hydrogen-based energy system.

Snam is actively repurposing its existing natural gas infrastructure to make it compatible with both hydrogen blends and pure hydrogen transportation, reducing the need for entirely new networks. As a key contributor to the European Hydrogen Backbone (EHB) initiative, Snam plays a crucial role in creating a cross-border hydrogen pipeline network to support Europe’s decarbonization goals.

List of Key Hydrogen Pipeline Companies Profiled

- DESFA (Greece)

- Enagás S.A. (Spain)

- The ROSEN Group (Germany)

- Fluxys (Belgium)

- GAZ-SYSTEM (Poland)

- Snam (Italy)

- GRTgaz (France)

- Energinet (Denmark)

- Teréga (France)

- Gasunie (Netherlands)

- ONTRAS Gastransport GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Trans Adriatic Pipeline AG (TAP) contracted Penspen, a leading consulting firm in the U.K., to assess the feasibility of blending hydrogen into TAP's existing gas pipeline. Penspen's U.K. engineering team will review TAP's above-ground installations, block valves, and compressor stations to support the pipeline's capacity expansion for hydrogen and renewable gases, promoting long-term sustainability and decarbonization in Europe.

- November 2024: Groningen Seaports received around USD 4.76 million in EU subsidies from the Just Transition Fund (JTF) to build a hydrogen pipeline connecting the ports of Eemshaven and Delfzijl in the Netherlands. Developed by the NorthGrid Foundation, the Kickstart pipeline used innovative techniques for quick installation and delivery of high-purity hydrogen, supporting the region's green hydrogen economy.

- November 2023: The Netherlands began constructing the first section of its 1,200-kilometer national hydrogen network, making it the first country in Europe with such infrastructure. Operated by Nederlandse Gasunie, the initial 30-kilometer section, worth around USD 108.23 million, connects Tweede Maasvlakte near Rotterdam to Shell's Pernis refinery. The full network, valued at around USD 1.62 billion, aims to support clean hydrogen production and demand, backed by EU subsidies.

- December 2022: Air Liquide completed a 4 km hydrogen pipeline connecting its hydrogen network in the Ruhr region to ThyssenKrupp's steel plant in Duisburg, a key site for steel decarbonization. Part of the H2Stahl laboratory, funded by the German Federal Ministry for Economic Affairs and Climate Protection, the pipeline supports efforts to reduce carbon emissions in steel production.

- December 2022: Swedish company OX2, along with Gasgrid Finland, Nordion Energi, and Copenhagen Infrastructure Partners, explored the development of the Baltic Sea Hydrogen Collector (BHC)—a large-scale offshore pipeline to transport green hydrogen across Finland, Åland, Sweden, Denmark, and Germany.

REPORT COVERAGE

The global hydrogen pipeline market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 37.51% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Classification

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.78 billion in 2025.

The market is likely to grow at a CAGR of 37.51% over the forecast period (2026-2034).

The onshore segment is expected to lead the market in the forecast period.

The market size of North America stood at USD 2.56 billion in 2025.

Rising hydrogen production is one of the key factors driving market growth.

Some of the top players in the market are Desfa, Enagas, Snam, and Gasunie.

The global market size is expected to reach USD 67.86 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us