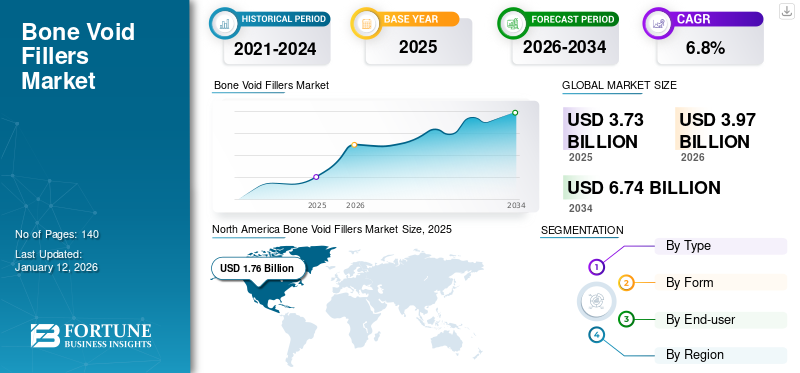

Bone Void Fillers Market Size, Share & Industry Analysis, By Type (Demineralized Bone Matrix, Collagen Matrix, Calcium Sulfate, Tri-calcium Phosphate, and Others), By Form (Gel, Granules, Paste, Putty, and Others), By End-user (Hospital, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global bone void fillers market size was valued at USD 3.73 billion in 2025. The market is projected to grow from USD 3.97 billion in 2026 to USD 6.74 billion by 2034, exhibiting a CAGR of 6.8% during the forecast period. North America dominated the global market with a share of 47.3% in 2025.

Bone Void Fillers (BVF) are absorbable, biocompatible, bioactive, and osteoconductive biologic materials that are used to fill gaps and voids of the skeletal system such as extremities, posterolateral spine, and pelvis. The biologic material provides stability and increases cell proliferation, resulting in the enhancement of bone regeneration for multiple types of orthopedic applications.

The bone void fillers market growth is attributed to the increasing prevalence of various bone diseases such as bone tumors and infections. Moreover, a growing geriatric population prone to fractures and bone injuries is anticipated to surge the demand for products to treat these injuries in the coming years. Furthermore, the growing demand for antibiotic eluting fillers for bone and the rising number of new product launches by market players are expected to boost the market expansion during the forecast period.

- In September 2021, Orthofix announced its launch of Opus Mg set, a magnesium-based settable bone void filler for orthopedic procedures.

Rise in such product launch initiatives is expected to increase the market revenue in the long term.

The emergence of COVID-19 declined the demand for fillers used for bones considering the cancellation and delay of elective orthopedic surgeries. Key market players recorded a significant decline in their revenues due to the COVID-19 pandemic. The sales were affected especially during the first half of 2020. In terms of revenue, the market witnessed a decline of 8.9% in 2020. However, in 2021, elective surgeries, such as orthopedic surgery and trauma surgery, started resuming as the regulations imposed by the government across various countries were relaxed. This led to an increased demand for these products in 2021.

Bone Void Fillers Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 3.73 billion

- 2026 Market Size: USD 3.97 billion

- 2034 Forecast Market Size: USD 6.74 billion

- CAGR: 6.8% from 2026–2034

Market Share

- North America dominated the global bone void fillers market with a 47.3% share in 2025, driven by a high incidence of orthopedic surgeries, increased adoption of synthetic fillers like tri-calcium phosphate and calcium sulfate, and strong presence of key players such as Zimmer Biomet and Stryker.

- By Type: Demineralized Bone Matrix (DBM) held the largest market share in 2024 due to abundant donor supply, faster healing, and reduced complications compared to autografts. Calcium Sulfate is expected to witness the fastest CAGR (2025–2032) owing to its antibiotic properties and increasing preference for synthetic options.

Key Country Highlights

- United States: Strong demand is driven by high prevalence of bone diseases, increased orthopedic surgeries, and growing use of antibiotic-eluting fillers. FDA approvals and M&A activity (e.g., Stryker-Wright Medical) are expanding product reach.

- Germany & U.K. (Europe): The region benefits from EU CE Mark approvals, especially for antibiotic-mixed void fillers (e.g., STIMULAN by BONESUPPORT AB), coupled with growing clinical adoption of synthetic bone graft alternatives.

- China & India (Asia Pacific): Rapidly growing aging population, rise in trauma and arthroplasty surgeries, and awareness of advanced bone graft materials are driving the demand for BVFs. Asia Pacific is projected to exhibit the highest CAGR through 2032.

- Japan: Advanced medical infrastructure and launches of DBM-based products like Medtronic’s Grafton DBM support market expansion. Demand is also driven by minimally invasive and resorbable solutions for spinal and orthopedic use.

- Brazil & GCC (LATAM & MEA): Growing healthcare infrastructure, rising number of orthopedic procedures, and increasing penetration of international players into emerging markets are gradually contributing to market growth.

Bone Void Fillers Market Trends

Increasing Focus toward the Launch of Antibiotic Eluting Bone Void Fillers to Drive Market Growth

Clinical limitations, such as bone infection, during the procedures have increased the focus on the adoption of antibiotic eluting void fillers. The market players are focusing on increasing R&D activities and the subsequent launch of antibiotic eluting void fillers, which have also reduced bone infection during treatment.

For instance, in May 2022, BONESUPPORT AB received regulatory approval for the launch of antibiotic eluting void fillers in the market and also has a significant number of pipeline products.

Furthermore, the growing focus of market players on clinical trials to introduce products for the treatment of bone diseases is expected to fuel the market growth.

Citing an instance, in June 2021, Elute, Inc. announced that the company received its first clinical trial authorization from the U.S. FDA to use its antibiotic eluting void filler product. This was the first FDA authorization to use EP Granules with Tobramycin in patients to treat bone infections.

Such innovative product introductions are anticipated to fuel the growth of the market during the forecast period.

Download Free sample to learn more about this report.

Bone Void Fillers Market Growth Factors

Increasing Adoption of Synthetic BVF to Boost Market Growth

The increasing adoption of synthetic bone void fillers such as calcium sulfate and tri-calcium phosphate is expected to drive market growth. There are several advantages associated with these fillers such as high sterility, less risk of morbidity, and an infinite supply of these types of fillers instead of other bone graft substitutes. This is expected to impel the product demand during the forecast period.

The fillers are composed of tri-calcium phosphate, an osteoconductive calcium phosphate, and are considered to have the most similar chemical composition to human bones.

Besides, key players such as BONESUPPORT AB and Biocomposites launched their products in the synthetic segment. These companies have experienced strong growth in recent years due to the increased adoption of their products. Recently, these companies have received approvals for their products, which have been marketed across several countries in Europe.

- For instance, in 2020, BONESUPPORT AB received the U.S. Food and Drug Administration (FDA) approval for CERAMENT BVF to be used as a void filler for bones.

Such product launches are expected to drive the growth of the market over the forecast period. In addition, antibiotic-eluting bone void fillers (ABVF) provide both antimicrobial and osteoconductive properties, which reduce the rates of orthopedic device-related infections more effectively. This significant property is expected to surge their demand, driving the market growth.

Growing Burden of Bone Diseases & Other Bone Related Incidents to Drive Market Expansion

The increasing prevalence of bone-related diseases such as bone tumors and osteomyelitis is driving the growth of the market. Additionally, other types of trauma, bone lesions, and bone fractures also require the administration of these fillers.

According to the American Cancer Society, Inc., the estimated number of diagnosed cases of primary bone cancer will be 3,910 in 2022, which is expected to fuel the product demand in the forecast timeframe.

The major application area of these fillers is in treating chronic osteomyelitis. The disease is a clinical challenge for orthopedic surgeons. However, using void fillers with antibiotic properties is safe, reliable, and effective in treating contamination.

Such a high incidence of bone-related diseases is expected to boost the global market growth in the coming years.

RESTRAINING FACTORS

Under Penetration and Certain Clinical Limitations of Bone Void Fillers to Limit Market Growth

The growing clinical limitations and under penetration of bone void filling material led to a reduction in their adoption. This reduced adoption is due to the high risks associated with the usage of the material. These include adverse tissue reaction, incomplete bone formation or lack of bone formation, infection of the soft tissue and bone, and breakage of the fillers with or without particulate formation. Considering the adverse reaction, surgeons often prefer established techniques due to a proven track record, which leads to the limited utilization of bone void fillers, hampering market growth.

The growing risks associated with these fillers have also led to product recalls by the U.S. FDA, which negatively impacted the brand image and position of some market players.

- For instance, in February 2021, the U.S. FDA announced the recall of Skeletal Kinetics, Llc's OSTEOVATION RMX 10CC. The U.S. FDA stated that the product kits did not maintain their setting characteristics for the labeled shelf-life duration.

According to various researchers, autogenous and allograft bone transplantation is still a commonly performed procedure, thereby limiting the adoption of these fillers. In addition, the invasive nature of these fillers could limit their adoption across the globe over the estimated period.

Bone Void Fillers Market Segmentation Analysis

By Type Analysis

Rising Adoption of Demineralized Bone Matrix to Lead to the Segment’s Dominance

Based on type, the market is segmented into demineralized bone matrix, collagen matrix, calcium sulfate, tri-calcium phosphate, and others.

The demineralized bone matrix segment held the highest market share of 33.5% in 2026 and is expected to continue its dominance during the forecast timeframe. The segmental growth is attributed to the strong presence of demineralized bone matrix in the product portfolio of market players. Moreover, abundant donor sources, reduction of complications associated with autograft, and short recovery time are expected to fuel the segmental growth during the forecast period.

The calcium sulfate segment is expected to expand at the highest CAGR during 2025-2032. The growth is attributed to its antibiotic properties, leading to better results observed by users in lower-extremity osteomyelitis treatment. Moreover, the increasing number of product launches and adoption of synthetic void fillers, such as calcium sulfate, is expected to drive the segment growth during the forecast period.

- For instance, in April 2019, Exactech conducted its first successful surgery using InterSep, manufactured by Pacific Bioceramics. InterSep is a synthetic calcium sulfate bone void filler that is used for the complete resorption and replacement of bone during healing.

The collagen matrix segment held a substantial market share in 2024 and is anticipated to expand at a significant CAGR during the forecast period (2024-2032). This segmental growth is primarily influenced by the rising preference of surgeons and patients for collagen matrix due to their ease of use, minimal invasiveness, and faster healing times. Furthermore, the collagen matrix can be combined with other bone void fillers, such as growth factors or demineralized bone matrix (DBM), to enhance their performance and functionality. This allows for a more targeted approach to bone regeneration, driving the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Increasing Product Launches to Drive the Putty Segment’s Dominance

Based on form, the market is segmented into gel, granules, paste, putty, and others.

The putty segment held the highest market share of 33% 2025 and is projected to expand at the highest CAGR during the forecast timeframe. The rising prevalence of bone diseases is expected to increase the demand for demineralized bone matrix in the putty form, especially in developing countries that are more dependent on DBM as compared to other fillers. Furthermore, new product launches by the market players are expected to fuel the segmental growth in the long run.

- For instance, in 2019, in Japan, Medtronic Plc announced the launch of Japan's First DBM Bone Grafting product for spine and orthopedic procedures, called the Grafton DBM, which is present in putty form.

The paste segment is expected to expand at a substantial growth rate during the forecast period. The high preference and continuously increasing adoption of the paste form is due to its advantages such as better biocompatibility and osteoconductivity than other forms. Furthermore, growing research studies to enhance the benefits of paste fillers are expected to boost their demand during the forecast timeframe.

- For instance, in February 2020, a clinical investigation was initiated by BBS-Bioactive Bone Substitutes at the clinical centers in Finland and Poland. In this study, ARTEBONE paste was used as a bone void filler for infusions of the ankle and subtalar joints. The paste form showed no safety concerns or product-related complications. It reduced the known risks and morbidity associated with synthetic bone growth factor products.

Such positive results from research studies are expected to increase the adoption of paste form during the forecast period.

By End-user Analysis

Surge in Orthopedic Surgeries in Hospitals to Drive the Segmental Growth

On the basis of end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment is expected to dominate the global market with a share of 54.91% in 2026 during the forecast period. The growth is attributed to the rising number of hospitals in developed and developing countries. Moreover, a large patient pool visiting hospitals for treatment and increasing number of orthopedic procedures being conducted in hospital facilities are expected to contribute to the segmental growth during the analysis timeframe. Furthermore, rising number of hospital admissions due to an increase in the proportion of sports and accidental injuries is also expected to surge the market growth during the forecast period.

- For instance, according to the annual statistics summary published by Canadian Institute for Health Information (CIHI), in 2020, 63,496 hip replacement procedures were performed in Canada, which represented 2.4% increase compared to 2019.

The specialty clinics segment is anticipated to account for a substantial market share during the forecast period. The segmental growth is attributed to the number of specialty clinics providing orthopedic treatments and increased investment by governments and other organizations. Moreover, the treatment and management of bone voids requires specialized care and the adoption of these fillers across specialty clinics is expected to increase in the coming years.

The others segment (which includes medical institutions, ASCs, and trauma centers) is expected to grow at a moderate CAGR due to increasing demand for same-day surgical care.

REGIONAL INSIGHTS

On the basis of region, the global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Bone Void Fillers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the bone void fillers market share, accounting for USD 1.76 billion in 2025 and is expected to continue its dominance during the forecast timeframe. The rapid adoption of synthetic void fillers, which involve different material types such as tri-calcium phosphate and calcium sulfate and the increasing launch of advanced products by market players are expected to drive the market growth in the region. Moreover, an increasing number of patients suffering from bone diseases, rising bone surgeries, and a strong presence of key market players in the region are anticipated to drive the market growth in north america. The U.S. market is valued at USD 1.73 billion by 2026.

Europe

Europe held the second-highest market share in 2023 and is anticipated to expand at a substantial CAGR during the forecast period. The growth is attributed to the presence of strong and emerging market players such as Biocomposites and BONESUPPORT AB. Moreover, the approval of products used for the management and treatment of bone voids is expected to fuel the market growth in Europe. The UK market is valued at USD 0.19 billion by 2026, while the Germany market is valued at USD 0.27 billion by 2026.

- For instance, in April 2020, BONESUPPORT AB announced that their product offering of STIMULAN received a new CE Mark from the European Union to mix antibiotics such as vancomycin, gentamicin, and tobramycin in void fillers. It can be used as a treatment option in the management of infected bone and soft tissue.

Asia Pacific

Asia Pacific is expected to expand at the highest CAGR during the forecast period. The highest CAGR of the region is attributed to the increasing arthroplasty and trauma surgeries and the growing geriatric population. Moreover, increasing product launches by market players and growing awareness related to the treatment of bone voids are expected to drive market growth during the forecast timeframe. The Japan market is valued at USD 0.31 billion by 2026, the China market is valued at USD 0.23 billion by 2026, and the India market is valued at USD 0.11 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa markets are expected to expand at a comparatively lower CAGR during the forecast period. The growth is attributed to increasing healthcare expenditures, growing elective orthopedic surgeries, and increasing focus of market players to launch products in these regions during the projected timeframe.

List of Key Companies in Bone Void Fillers Market

Companies with a Strong Product Portfolio to Hold the Largest Market Share

Zimmer Biomet, Stryker, and DePuy Synthes are prominent players in the market and accounted for a significant market share in 2023. The market share of these companies is attributed to factors such as a strong product portfolio focused on the application area of the spine, which is the largest application area of bone void fillers. Furthermore, the introduction of products and acquisition of other companies are the major factors anticipated to strengthen the position of these companies in the market.

- For instance, in November 2020, Stryker acquired Wright Medical to strengthen the company’s biologics portfolio, including bone void fillers.

Other companies of bone void fillers include Biocomposites Ltd, BONESUPPORT AB, Collagen Matrix, Inc., and a few regional players. These companies are focusing on various strategic developments such as mergers & acquisitions, new product launches with advanced features, and expansion across untapped markets.

LIST OF KEY COMPANIES PROFILED:

- BONESUPPORT AB (Sweden)

- Biocomposites (U.K.)

- Collagen Matrix, Inc (U.S.)

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Arthrex, Inc. (U.S.)

- DePuy Synthes (U.S.)

- Graftys (France)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Abyrx, Inc. announced that it received additional U.S. FDA clearances for MONTAGE Settable, Resorbable Bone Putty as both a bone void filler and cranial bone cement.

- October 2022: Orthofix Medical Inc. announced the market release and first implant of its Legacy Demineralized Bone Matrix (DBM), a putty for filling voids and gaps in patients with traumatic injuries of the spine.

- July 2022: BONESUPPORT AB’s CERAMENT G, a resorbable, gentamicin-eluting ceramic bone void filler, received the De Novo classification by the U.S. FDA. This bone void filler is intended for use as part of the surgical treatment for osteomyelitis.

- January 2022: Synergy Biomedical, LLC launched a synthetic bioactive bone graft, BIOSPHERE FLEX SP EXTREMITIES. The product is a sheet putty composed of innovative spherical bioactive glass granules, which is combined with a porous collagen or sodium hyaluronate carrier.

- January 2022: Bone Solutions Inc launched Mg OSTEOINJECT, a bone void filler in the U.S. It is incorporated with magnesium, a critical component for bone health and development.

- January 2022: BONESUPPORT AB announced a distribution agreement with OrthoPediatrics Corp. to distribute CERAMENT BONE VOID FILLER to pediatric hospitals within the U.S.

- July 2021: Arthrex, Inc. announced an exclusive partnership with Celularity Inc. to distribute and commercialize Celularity’s biomaterial products for orthopedic surgery and sports medicine.

- December 2020: Collagen Matrix, Inc. announced the acquisition of Sunstar’s Degradable Solutions division, including its GUIDOR family of bone graft substitutes.

REPORT COVERAGE

An Infographic Representation of Bone Void Fillers Market

To get information on various segments, share your queries with us

The research report provides a detailed competitive landscape. It focuses on key aspects such as new product launches in the market. Additionally, it includes an overview of guidelines for the fillers, indication, site of placement of bone void filling material, and key industry developments such as mergers, partnerships, and acquisitions. Moreover, it covers the regional analysis of different segments, company profiles of key market players, and the impact of COVID-19 on the market. Besides this, the report provides epidemiology of bone tumors. The report also encompasses qualitative and quantitative insights that contribute to the growth of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.8% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Form

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 3.97 billion in 2026 to USD 6.74 billion by 2034.

In 2025, North America stood at USD 1.76 billion.

The market is projected to expand at a CAGR of 6.8% during the forecast period.

The demineralized bone matrix segment is set to lead the market by type.

Increasing clinical research, new product launches, rising prevalence of bone diseases, and surging penetration of synthetic bone void fillers among patients are the key factors driving the market.

Zimmer Biomet, Stryker, and DePuy Synthes are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic