Medicated Feed Additives Market Size, Share & Industry Analysis, By Type (Antimicrobials, Anticoccidials, Antiparasitics, and Others), By Animal Type (Companion {Feline, Canine, Avian, and Others} and Livestock {Poultry, Porcine, Bovine, and Others}), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

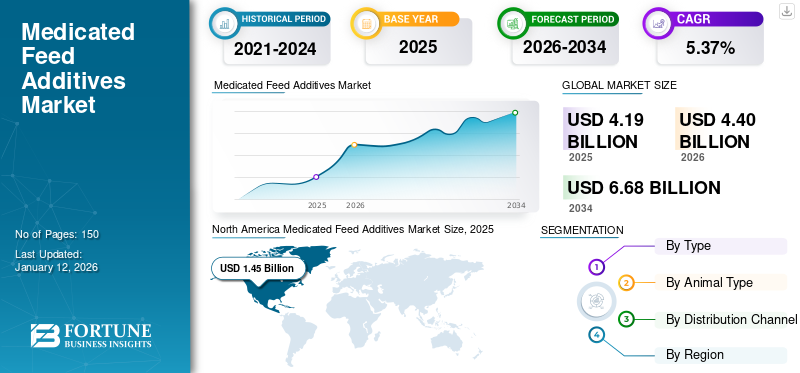

The global medicated feed additives market size was estimated at USD 4.19 billion in 2025. The market is projected to grow from USD 4.4 billion in 2026 to USD 6.68 billion by 2034, exhibiting a CAGR of 5.37% during the forecast period. North America dominated the medicated feed additives market with a market share of 34.51% in 2025.

Medicated feed is a mixture of animal food (feed) and veterinary medicinal products manufactured under controlled conditions for the purpose of treating or preventing disease in farmed animals, aquaculture species, and pets. Medicated feed is one of the oral routes to administer veterinary medicinal products to animals. It is generally used to treat diseases in large groups of animals, particularly in poultry, pigs, and fish, where the spread of infections is difficult to treat. The market is projected to grow significantly due to the rise in demand for quality animal protein, overflowing meat consumption, and growing awareness of animal nutritional requirements which work toward better health conditions of animals.

- For example, as per the data released by the Department for Environment, Food & Rural Affairs indicated the U.K.'s statistics on cattle, sheep, and pig slaughter and meat production for December 2024. The statistics showed that pig meat production reached 77,000 tonnes, reflecting an 8.9% increase compared to December 2023.

Thus, such scenarios collectively increase the demand for medicated feed additives for the prevention of infectious outbreaks in unhygienic confined spaces.

Moreover, the major players in the market include Cargill Incorporated, Kemin Industries, Phibro Animal Health, Elanco, and Virbac, among others. These companies are actively engaged in strategic collaborations and new product launches to magnify their market reach.

Medicated Feed Additives Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.19 billion

- 2026 Market Size: USD 4.4 billion

- 2034 Forecast Market Size: USD 6.68 billion

- CAGR: 5.37% from 2026–2034

Market Share:

- North America dominated the global medicated feed additives market with a market size of USD 1.45 billion in 2025, driven by a high livestock population, growing demand for animal protein, supportive government initiatives, and strong R&D and product launches.

- By type, Anticoccidials held the largest market share in 2024, owing to their growing use in poultry and pig farming to improve gut health, nutrient absorption, and disease resistance.

Key Country Highlights:

- Japan: While Japan’s medicated feed additives market is comparatively smaller, the country has strict safety standards for animal health and feed production. Companies like Meiji Holdings Co., Ltd. play a role in ensuring high-quality animal nutrition products.

- United States: The U.S. leads the North American region due to increasing meat consumption, high awareness of animal nutritional needs, and presence of major industry players. Strategic moves like Cargill's acquisition of two U.S. feed mills in September 2024 boosted manufacturing capacity for animal nutrition.

- China: China is witnessing rapid growth in animal farming and aquaculture. The joint venture between Evonik China and Shandong Vland Biotech (October 2023) aims to expand gut health solutions for farm animals, supporting regional growth.

- Europe: Europe held the second-largest market share in 2024. Growth is fueled by strict regulations on medicated feed manufacturing and rising poultry meat consumption. The EU’s Directive 90/167/EEC revision ensures harmonized standards for medicated feed production. In April 2024, EUPAHW and EU invested USD 389.6 million to improve animal health and welfare.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Animal Protein to Boost Market Growth

One of the principal factors driving the growth of the market is the rising demand for quality animal protein. The feedlot industry has developed to fulfill this rise in demand for animal protein with a streamlining focus on livestock products farming and animal health. Key industry players are focusing on the expansion of their manufacturing capacity to cater to the changing market demands.

- For instance, in November 2023, GrainCorp acquired Performance Feeds, a feedlot and pasture-based liquid feed supplement manufacturer.

Additionally, the medicated feed additives industry players are focusing on diversifying their product portfolio through strategic collaborations and acquisitions. Also, there has been an increase in animal welfare activities by various key industry entities.

MARKET RESTRAINTS

Antibiotic Resistance Due to Medicated Feed Additives Restricts Product Adoption and Market Growth

Microorganisms develop resistance to antimicrobial compounds if exposed repeatedly. This antimicrobial resistance (AMR) reduces the effectiveness of the antibiotic over time. When high doses of antibiotics are used, they are absorbed by the tissues in the body, leaving residues of antibiotics behind. These residues can present themselves in humans when consumed and can lead to the development of antibiotic-resistant bacteria in the environment. Such scenarios hamper the adoption of antibiotic-based feed products, which, in turn, limits market growth.

Furthermore, many government organizations are implementing a ban on antibiotic-based products in food-producing animals, thus restraining the adoption and market growth.

- For instance, in November 2024, the Food Safety and Standards Authority of India (FSSAI) implemented a ban on the utilization of antibiotics in producing food animals. Such factors may limit the adoption of antibiotic-based feed additives and thus restrict market growth.

MARKET OPPORTUNITIES

Development of Veterinary Feed Additives for Companion Animals May Cater Toward Market Growth

The medicated feed additives industry largely caters to livestock animals, with limited products available for companion animals or non-food-producing animals. Rising pet ownership and disposable incomes among owners increase the demand for medicated feed for pet animals. Such scenarios lead to a shift in focus of major companies to develop and launch a range of medicated feed for companion animals, thus offering expanded opportunities for market growth.

- For instance, in February 2025, Virbac announced the launch of a novel Veterinary HPM Digestive Support wet diet for the nutritional management of both digestive issues and convalescence. The digestive support was available for dogs as well as for cats and provided separate species-specific dog and cat convalescence diets, which were tailored to nutritional requirements.

MARKET CHALLENGES

Scarcity of Raw Materials and Price Hikes to Limit Market Growth

The market is subjected to various risks in supply chain management. The scarcity of raw materials, such as active pharmaceutical ingredients results in the price hike of medicated feed additive products. In addition, the demand uncertainty and storage issues result in the inefficiency of the feed mills business. High costs associated with the medicated feed additive, especially natural and multifunctional variants, hinder its adoption in small and medium-scale farms.

- For instance, in November 2021, American meat producers witnessed supply chain disruptions in terms of some life-saving medications, such as penicillin. They witnessed price hikes due to the scarcity of active pharmaceutical ingredients.

Additionally, limited availability due to inconsistent quality, higher costs as compared to standard feeds, navigating complex regulations, logistical challenges, and potential issues with finding a reliable supplier add to the challenges of the feed industry.

MEDICATED FEED ADDITIVES MARKET TRENDS

Shift toward Sustainable Development is Among Prominent Market Trends

The global market is pacing forward toward more sustainable and responsible use of animal medicines. The approach adopted focuses on preventing or reducing the incidences of zoonotic diseases. The sector holds a crucial role in enhancing sustainability and presenting solutions to issues regarding greenhouse gas (GHG) emissions, nutrient leakage, antimicrobial resistance, and deforestation.

Leading companies in the sector are streamlining efforts on strategic collaboration and expansion of product offerings in alternatives to traditional antimicrobials through bioactive. These developments play a critical role in catalyzing global market trends.

- For instance, in February 2025, Indian Herbs participated in the Poultry India Expo 2024 to showcase its diverse product portfolio of natural alternatives across the range of natural alternatives in segments of antimicrobials, growth promoters, and immunopotentiators.

- In January 2023, Nutreco and BiomEdit announced a strategic partnership to provide livestock producers with innovative feed additives developed through microbiome technology. The development and commercialization of these ultra-specialty feed additives called BiomEdit addresses the livestock producers' health and sustainability challenges.

Additionally, the market has witnessed increasing focus on natural alternatives such as probiotics and prebiotics, phytogenic feed additives due to increasing regulatory pressure and consumer preference to restrict antimicrobial resistance.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic exhibited a slightly positive impact on the market. The research focus during COVID-19 was shifted more toward human health and witnessed many supply chain disruptions. The market is expected to recover from the downturn caused by COVID-19, driven by increased demand for animal protein in the food industry and a growing awareness of the nutritional needs of animals. Animal husbandry was at an all-time high, with poultry and meat industries booming. Such factors led to an amplified demand for medicated feed additives during this period.

SEGMENTATION ANALYSIS

By Type

Increased Awareness of Animal Health Paved Way for Dominance of Anticoccidials Segment

On the basis of type, the global market is segmented into antimicrobials, anticoccidials, antiparasitics, and others.

Anticoccidials held the maximum portion of the market with a share of 34.80% in 2026. Owing to the rising focus of animal farmers on gut health, anticoccidials specialize in regulating intestinal flora, reducing pathogen load, enhancing nutrient absorption, and improving feed efficiency. The segment is witnessing significant growth with new product launches.

- For instance, in March 2021, Elanco launched two anticoccidials, ZoaShieldä and Clinacox, as an intestinal integrity product in the U.S. market. These products are the alternative to antibiotics for coccidiosis control in poultry animals.

Antiparasitics held a significant market share. Parasitic infections include roundworm infections, tapeworm infections, tick-borne diseases, and protozoal infections caused by endo- and ectoparasites such as helminths. Antiparasitics are most commonly used in poultry flocks and pig herds to control internal parasites and external parasites. The development of multidrug resistance, particularly in livestock animals, is an evident issue in parasites. Thus, to overcome these issues, various key entities collaborated for the development of antiparasitics-based feed additives, thus boosting the growth of the segment in the market.

- For example, in May 2024, QuailGuard, LLC, in a joint venture with Park Cities, Quail Coalition, received the U.S. FDA approval for the use of an anthelmintic drug called QuailGuard for parasite control in wild huntable quail population in Texas. The U.S. FDA concluded the safety of the drug when integrated into medicated feed safe.

On the other hand, the antimicrobials segment held the substantial global medicated feed additives market share in 2024. Large culture systems such as cattle form, poultry, and fish are more susceptible to bacterial infections that are managed by in-feed antibiotics. Such implications surge the segmental growth. In consideration of this need for antimicrobials, key industry players are focusing on new product launches.

- For instance, in July 2022, Kemin Industries, a global ingredient manufacturer of medicated animal feed, launched ENTEROSURE, a novel antimicrobial solution. The solution was an intestinal health feed additive that assisted in the development of resilient intestines and better performance against enhanced enteritis & colibacillosis.

To know how our report can help streamline your business, Speak to Analyst

By Animal Type

Livestock Segment Dominated Market Due to Rise in Demand for Quality Animal Protein

In reference to the animal type, the market is segmented into companion and livestock.

The livestock segment held the dominant market share of 90.52% in 2026.. This segment is further classified as poultry, porcine, bovine, and others. The growth of this segment is compelled by the increasing adoption of animal husbandry to fulfil the growing demand for animal meat, dairy products, and others.

- For instance, in September 2019, Huvepharma received U.S. FDA approval for the generic monensin for combination use with other drug feed additive products in the manufacturing of Type B and Type C medicated feeds used in cattle.

The companion animal segment is expected to grow with moderate CAGR over the forecast period. This is due to the limited focus and limited product offering in this segment.

By Distribution Channel

Veterinary Hospitals Segment Leads Owing to Easy Access to a Licensed Veterinarian Practitioner

Based on distribution channel, the market is divided into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary hospitals segment holds the dominant market share of 45.31% in 2026.. The factors influencing the growth in the segment include various government initiatives, along with easy access to a licensed veterinarian practitioner, among others. Various collaborations with multiple entities offer lucrative segmental growth opportunities in the market.

- For instance, in February 2025, the government of India launched the National Livestock Mission with the aim of encouraging entrepreneurship initiatives and breed improvement in poultry, sheep, goat, and piggery. Government hospitals are often mediators to gain advantages of these government initiatives, thus gaining a significant influence in the market.

Veterinary clinics are anticipated to have a significant share of the market, followed by veterinary hospitals. The potential of the segment is attributed to a one-stop solution for the availability of prescription-based medicated food additives and rising awareness of animal health. Various initiatives and investments by government bodies to expand the reach of medical assistance also catalyze segmental growth.

- For instance, in June 2024, the Food and Agriculture Organization of the United Nations (FAO) handed over a community seed bank and a veterinary clinic to Amran government authorities under The European Union-funded project “Joint Actions for Food Security and Nutrition (ProAct II)”. This veterinary clinic provides access to medical care, including complicated surgeries and medicated feed, to nearly 4,000 livestock keepers.

Pharmacies & drug stores are expected to maintain a stable position during the forecast period. Easy accessibility and convenience for procuring medicated feed products with proper guidance is one of the prominent factors for segment expansion in the market.

MEDICATED FEED ADDITIVES MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Medicated Feed Additives Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In terms of region, the North America region dominates the global market in 2024. North America's medicated feed additives market size was estimated at USD 1.45 billion in 2025. The market is expected to grow remarkably over the forecast period. The growth in the region is estimated due to the high livestock population, increasing demand for quality animal proteins, government aid to improve animal health, and continuous research and development, leading to various product launches in the region. Additionally, due to the competitive nature of the market, it has witnessed various collaborations and pivotal acquisitions to expand and diversify the product portfolio related to the market. The U.S. market is projected to reach USD 1.44 billion by 2026.

- For instance, in October 2024, Phibro Animal Health Corporation completed the acquisition of certain water-soluble products and the medicated feed additive product portfolio from Zoetis Inc. This development aligns with the company's purpose to optimize global animal health and nutrition. Such developments in the region and various initiatives to provide growth opportunities in the market support the growth.

U.S.

The U.S. dominated the North America region. The rise in demand for animal protein and increasing awareness regarding the nutritional requirements of the animals are anticipated to support the country's medicated feed additives market growth. Additionally, the presence of key players and strategic acquisitions in the country advocate for the expansion of manufacturing capabilities to reinforce the economic development of the company.

- For instance, in September 2024, Cargill, an international food corporation, acquired two U.S. feed mills. This strategic acquisition expanded the company's manufacturing and distribution capabilities of animal nutrition and health businesses in the country.

Europe

Europe held the second position in the global market in 2024. The growth of the region is driven by increased consumption of animal-derived products such as meat and eggs and rising demand for medicated animal feed for poultry. The European market is characterized by strict regulation and production standards. The UK market is projected to reach USD 0.34 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

- For instance, in January 2019, as per the data published by the European Commission, the EU revised guidelines in Directive 90/167/EEC. The directive set harmonized standards and created a legal framework for the safe manufacturing and distribution of medicated feed. The changes were implemented due to different production standards and the adequate usage of medicated feed to combat antimicrobial resistance.

Furthermore, the European market is placing greater emphasis on collaboration and investment opportunities to improve animal health and welfare, as well as to promote cross-sector collaboration.

- For instance, in April 2024, The European Partnership on Animal Health and Welfare (EUPAHW), in collaboration with the European Union, invested USD 389.6 million over the period spanning over seven years to boost research and facilitate cooperation in the field of animal health.

Asia Pacific

The Asia Pacific medicated feed additives market is expected to grow at the fastest CAGR during the forecast period. The region has a vast population dependent on livestock for their livelihood. Additionally, increasing disposable incomes and urbanization demand also drive the regional market growth. The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.33 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

Furthermore, to cater to the growing market demand in the region, various key industry players are collaborating to expand their product offerings and maximize profits. The collaborations are intended to provide novel products that resolve the gut health issues in farm animals. These developments influence the expansion of the market in the area.

- For instance, in October 2023, Evonik China Co., Ltd and Shandong Vland Biotech Co., collaborated to build a joint venture to expand their presence in gut health solutions products for farm animals globally. The joint venture combined the specific strengths of both partners, including Vland's market access, regulatory capabilities in China as well as fast innovation cycles. The joint venture benefitted from Evonik’s global sales force and market access, R&D and global regulatory capabilities.

Latin America and Middle East & Africa

The Middle East & Africa and Latin America medicated feed additive markets are expected to grow at a stable pace during the forecast period. The Latin America region is largely dependent on livestock farming for its meat requirements and accounts for approximately 43.0% of the nation's agricultural GDP. The major poultry companies in the region are investing in their expansion and capacity production.

- For instance, in January 2024, JBS invested USD 114.0 million to construct three new feed factories in the southern region of Brazil. The development aligns with the company's investment plan for expansion and capacity improvement.

Such indicators with high reliance on livestock farming and hefty investment for capacity expansion primarily drive the growth in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strong Global Presence and Robust Product Offerings by Prominent Players to Strengthen their Positions

In terms of the competitive landscape, the market reflects a consolidated competition structure with a few key players having a stronghold due to their diverse product portfolio and strategic initiatives. Some of the notable players in the market are Cargill, Incorporated, Phibro Animal Health Corporation, CHS Inc., and Kemin Industries. Emphasis on strategic collaboration, acquisitions, and product launches accompanied by a strong geographical presence over the globe is expected to spur the company's share in the market.

Other key players, such as Nutreco and Godrej Agrovet Limited, are also focusing on their research and development initiatives to discover novel treatments and launch new products. These initiatives to cater to the unmet demand for medicated feed and expand their product portfolio contribute to their growth.

LIST OF KEY MEDICATED FEED ADDITIVE COMPANIES PROFILED

- Archer Daniels Midland Company (ADM) (U.S.)

- Cargill, Incorporated (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- Godrej Agrovet Limited (India)

- Novozymes A/S, (Denmark)

- Nutreco (Netherlands)

- CHS Inc. (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Kemin Industries (U.S.)

- Alltech Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Tejo Marine Biotechnology GmbH received the U.S. Food and Drug Administration approval for a new drug called Faunamor for the treatment of Ichthyophthirius multifiliis, commonly known as white spot disease in ornamental fish, including those commonly kept in home aquariums and outdoor hobby ponds.

- March 2025: TechMix launched an updated equine product line and added a new family of colostrum-based products to support horses' performance and well-being.

- January 2025: Godrej Agrovet Limited (Godrej Agrovet) launched a fish lice controller named Argo Rid. The drug was developed in collaboration with the Indian Council of Agricultural Research (ICAR) and the Central Institute of Fisheries Education (CIFE). The product helps in the healing of lesions due to parasitic attachment (Argulus Spot) on the fishes.

- January 2024: The Norwegian Food Safety Authority approved the use of genetically modified canola oil in salmon feed. When used in fish feed, the fish performed better and got more omega-3, fewer dark spots, and redder color in the fillet.

- January 2021: Cargill unveiled one of the world’s largest premix and animal nutrition facilities in Ohio with an investment of USD 50.0 million for the development of the facility.

REPORT COVERAGE

The global medicated feed additives market report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, animals, and distribution channels. Besides this, it offers insights into the market trends, drivers, and opportunities, and also offers other key insights that include key industry development, new product launches, and others. In addition to the factors mentioned above, it encompasses the impact of COVID-19 on the market and several factors that have contributed to the segmental and regional growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Animal Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 4.19 billion in 2025.

By registering a CAGR of 5.37%, the market will exhibit steady growth during the forecast period of 2026-2034.

Based on type, the anticoccidials led the market.

The rising demand for animal protein and increasing awareness of animal nutrition is expected to drive the growth of the market.

Phibro Animal Health Corporation, Cargill, and Archer Daniels Midland Company are the top players in the market.

North America is expected to hold the largest share of the market.

Concerns regarding protection from outbreaks of various animal diseases, innovative product launches, and a surge in strategic initiatives by key players would drive the adoption of medicated feed additives.

The current market trends include a shift toward sustainable development, a focus on gut health, and a rise in natural alternatives, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us