Pharmacogenomics Market Size, Share & Industry Analysis, By Type (Products {Consumables and Equipment} and Services), By Techniques (Next Generation Sequencing, Polymerase Chain Reaction, Microarrays, In-situ Hybridization, and Others), By Application (Personalized Medicine, Drug Discovery, and Others), By Disease (Oncology, Neurology, Cardiology, and Others), By End User (Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

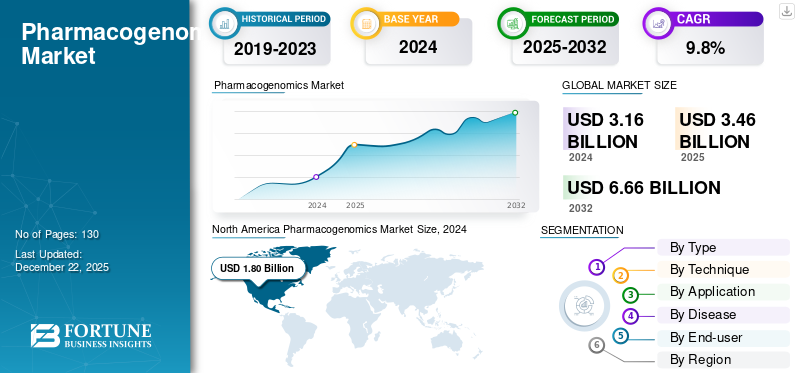

The global pharmacogenomics market size was valued at USD 3.46 billion in 2025. The market is projected to grow from USD 3.79 billion in 2026 to USD 8.09 billion by 2034, exhibiting a CAGR of 9.95% during the forecast period. North America dominated the pharmacogenomics market with a market share of 39.47 in 2025.

Pharmacogenomics refers to the study of genes in order to understand and analyze the response of medications to that particular patient. It also plays a prominent role in discovering and developing precision medicine. In addition, the study also helps healthcare providers to make decisions on treatment regimens that will have minimal or zero side effects on the patient.

The market’s growth is attributed to technological advancements in sequencing technologies, increasing demand for personalized medicine, and extensive investments in novel therapeutic options. Moreover, growing demand for targeted therapies is also projected to positively impact the market.

Some of the major players are Illumina Inc., Qiagen, Thermo Fisher Scientific, and PacBio, who focus on technological advancements, extensive investments, and new product introductions with enhanced capabilities to maintain substantial market share. In addition, strong focus on strategic partnerships & collaborations is also estimated to accelerate market growth.

MARKET DYNAMICS

Market Drivers

Strong Emphasis on Personalized Medicine and Advancements in Sequencing Boost Market Growth

The growing shift toward personalized medicine is one of the prominent drivers impacting the market growth. As the market is witnessing increasing awareness among patients as well as healthcare professionals about the benefits of targeted therapies, demand for pharmacogenomics testing is expected to grow.

In addition, advancements in next-generation sequencing (NGS) and bioinformatics are also estimated to have a positive impact on the market. Moreover, the increasing burden of chronic diseases and the aging population are catalyzing demand for more effective and safer medications, pushing the need for genetically based therapeutic decisions.

- For instance, in June 2025, bioMérieux announced an agreement to acquire Day Zero Diagnostics, a U.S.-based company engaged in genome sequencing-based diagnostics. This strategic acquisition will help the company strengthen its next-generation sequencing (NGS) and rapid diagnostics portfolio.

Market Restraints

Lack of Standardization for Genetic Testing and its Interpretation to Hamper Market Growth

Despite advancements in genomic science, there is considerable variability in pharmacogenomic data’s collection, analysis, and utilization across different laboratories and healthcare systems. This inconsistency often leads to disparities in test results, making it challenging for clinicians to confidently base treatment decisions on genetic information. Moreover, there is no universally accepted framework for interpreting and reporting pharmacogenomic results, which adds further complexity to integrating these tests into routine clinical practices.

- For instance, according to a study published by researchers at the University of Exeter in February 2021, genetic testing technology is unreliable for detecting very rare variants. Also, according to the study, the tests show variations.

In addition, the absence of coordinated regulatory guidelines and reimbursement policies across countries is also estimated to hamper the adoption of pharmacogenomics.

Market Opportunities

Integration of AI to Offer Development Solutions by Delivering Optimal Outputs

The integration of pharmacogenomics and AI is extensively impacting the shift of the focus on new techniques compared to traditional clinical decision-making and personalized medicine. AI-powered pharmacogenomics holds the capabilities to identify genetic markers related to specific diseases. In addition, this AI incorporation allows customization of medication dosage along with prediction of treatment outcomes, subsequently leading to superior treatment outcomes and patient care.

In addition, the market players are substantially focusing on the implementation of growth strategies, which are further expected to propel the market.

- For instance, in December 2024, PGxAI raised USD 1.5 million through rounds of series funding. This funding will be utilized to reshape precision medicine with the help of its proprietary algorithm. The company is planning to achieve this objective in collaboration with InterSystems, a leading player in patient data management.

Market Challenges

Difficulties in Data Transfer Functionalities within Pharmacogenomic and EHR Platforms to Offer a Challenge

Currently, the market is facing the issue of integration of pharmacogenomic data into electronic health records (EHRs) and clinical decision support systems. Even when pharmacogenomic testing is performed, the lack of seamless interoperability between testing platforms and healthcare IT systems means that valuable genetic insights are often underutilized or completely inaccessible at the point of care. At present, a number of institutions are engaged in research and development activities to find optimal solutions.

- For instance, in August 2024, the U.S. Department of Veterans Affairs announced its plan to study the automation of its pharmacogenomics data into EHR systems for better interoperability. The team is working on its impact and recommendations.

Additionally, the complexity of interpreting gene-drug interactions requires sophisticated clinical support tools that are still evolving and not uniformly adopted. Without reliable and accessible digital integration, pharmacogenomics remains isolated from the clinician’s workflow, creating a major bottleneck in its clinical implementation and long-term scalability.

PHARMACOGENOMICS MARKET TRENDS

Incorporation of Pharmacogenomic Biomarkers in Clinical Trials

The pharmacogenomics market space is witnessing growing integration of pharmacogenomic biomarkers in clinical trials and drug labeling. Regulatory agencies such as the FDA and EMA increasingly recognize the importance of genetic variability in drug response, prompting pharmaceutical companies to integrate pharmacogenomic endpoints early in the drug development process. This trend is leading to the development of companion diagnostics and precision drugs tailored to individual genetic profiles.

- For instance, in August 2024, Illumina, Inc. received FDA approval for its in vitro diagnostic (IVD) TruSight Oncology (TSO) comprehensive test. The FDA also approved its first two companion diagnostic indications. This newly introduced test is capable of investigating over 500 genes with an aim to profile a patient's solid tumor.

Additionally, there is a rise in the use of large-scale population genomics studies to uncover novel gene-drug interactions, which is helping expand the clinical relevance and utility of pharmacogenomics.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID‑19 pandemic had a multidimensional impact on the market. It acted as a significant catalyst for research & development activities and highlighted the relevance of genetic factors in therapeutic response. On the other hand, the pandemic also disrupted non-COVID pharmacogenomics innovation. Hospitals and labs prioritized COVID diagnostics and care, diverting attention away from ongoing pharmacogenomic services and biomarker development.

Moreover, supply chain interruptions during lockdowns affected access to reagents and testing platforms, further delaying PGx initiatives. In addition, substantial financial and personnel resources were redirected to address the pandemic, which slowed the advancement of new PGx biomarkers and post‑pandemic drug labeling efforts.

SEGMENTATION ANALYSIS

By Type

Increasing Number of Clinical Trials for Precision Medicine to Boost Service Segment Growth

Based on type, the market is classified into products and services.

The service segment dominated the market in 2024 owing to the increasing demand for personalized medicine and the vital role played by services in the conversion of raw data to actionable insights. The service segment majorly deals with data interpretation, analysis, and clinical reporting, which enables healthcare professionals to make treatment decisions. In addition, increasing number of product launches with enhanced capacities is also estimated to have a positive impact on the segment growth.

- For instance, in October 2023, QIAGEN announced the launch of its Pharmacogenomic Insights (PGXI), a new knowledgebase, specifically developed to assist translational and scientific researchers for a comprehensive understanding of patients’ responses to medications.

The product segment is estimated to register a considerable CAGR during the forecast period. Certain factors such as an increasing number of clinical trials for precision medicines, increasing investments for research & development, and the installation of new facilities to boost segment growth by 2032.

By Technique

Technological Advancements and Capability of Next Generation Sequencing to Offer In-detailed Analysis Accelerates Segment Growth

Based on technique, the market is segregated into next generation sequencing, polymerase chain reaction, microarrays, in-situ hybridization, and others.

The next generation sequencing held a significant portion of the market in 2024. NGS offers comprehensive genotyping by simultaneously analyzing a substantial number of genetic variants and the multigenic influences of drug reactions. This important functionality plays a major role in pharmacogenomics, leading to the technology’s considerable adoption. Furthermore, the scalability and automation of NGS workflows are also projected to positively impact the segment growth.

- For instance, in May 2024, Oxford Nanopore Technologies announced the launch of its new Pharmacogenomics (PGx) Beta Program to boost personalized medicine developments. The company is conducting this program in collaboration with Twist Bioscience, which is offering its next-generation sequencing (NGS) target enrichment technology, specifically for this study.

Polymerase Chain Reaction (PCR) continues to hold the second-largest share of the market due to its high sensitivity, specificity, affordability, and rapid turnaround time for detecting known genetic variants. Moreover, PCR platforms, especially in emerging nations, are often more accessible than next-generation technologies, requiring less infrastructure and technical expertise.

By Application

Rising Focus on Development of Tailored Treatment Boost Personalized Medicine’s Application

Based on application, the market is categorized into personalized medicine, drug discovery, and others.

The personalized medicine segment dominates the market due to its central role in tailoring treatments based on individual genetic profiles. Moreover, as healthcare shifts from a one-size-fits-all model to precision care, personalized medicine is driving demand for genetic testing, clinical decision tools, and companion diagnostics in the pharmacogenomics ecosystem.

The drug discovery segment is estimated to hold a considerable market share. Pharmacogenomics is transforming drug discovery by enabling more targeted and efficient development of therapeutics.

By Disease

High Prevalence of Cancer and Substantial Investments for Cancer Prevention and Treatment to Lead Market During Forecast Period

Based on disease, the market is segmented into oncology, neurology, cardiology, and others.

The oncology segment held a dominant share of the market in 2024. Factors such as deep genetic underpinnings of cancer, coupled with the increasing demand for precision-targeted therapies for cancer, are expected to boost the segment growth. Moreover, pharma companies are increasingly leveraging pharmacogenomics during oncology drug development to improve trial outcomes and regulatory approval rates. Furthermore, as cancer prevalence increases globally and precision medicine becomes the standard of care, the adoption of pharmacogenomics is estimated to increase extensively during the forecast period.

- For instance, in June 2023, Diatech Pharmacogenetics announced a strategic collaboration with Janssen Pharmaceutica NV in order to improve access to precision medicine for patients with bladder cancer.

On the other hand, the cardiology segment held the second-largest market share in 2024. As cardiovascular diseases remain the leading cause of mortality, efforts are taken globally to optimize therapeutic outcomes and reduce healthcare costs, which has strengthened interest in prescribing precision medicine.

By End-user

Robust Focus on Research & Development to Accelerate Growth of Academic and Research Institutes

Based on end-user, the market is divided into academic and research institutes, pharmaceutical and biotechnology companies, and others.

The academic and research institute segment held a dominant share of the market in 2024. These institutions are responsible for driving early-stage discoveries, biomarker identification, and validation of gene-drug interactions. Moreover, academic centers often lead government-funded population and genome-wide association studies, which help uncover genetic variants influencing drug metabolism and efficacy.

On the other hand, biotech and pharmaceutical companies are estimated to register substantial growth over the forecast period. By incorporating pharmacogenomic insights early in the R&D process, these companies can identify responder subgroups, minimize adverse effects, and improve regulatory success rates. This benefit offered by pharmacogenomics is expected to leverage segment growth.

PHARMACOGENOMICS MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Pharmacogenomics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.36 billion in 2025 and USD 1.49 billion in 2026. The dominance of North America in the global market is attributed to strong infrastructure, high healthcare expenditure, and early adoption of precision medicine. The presence of major pharmaceutical companies, academic institutions, and regulatory support from bodies including the FDA offers a favorable environment for innovation and clinical integration of pharmacogenomic testing.

In the U.S., the increasing incidence of chronic diseases demands the need for tailored therapies. Moreover, reimbursement initiatives and investments in genomic databases are responsible for growth of the pharmacogenomics market.

- For instance, in August 2024, Orlando VA Healthcare System (OVAHCS) started pharmacogenomics testing for veterans who are currently enrolled in VA health care. This program is being conducted under the National Pharmacogenomics program.

Europe

The market in Europe held a significant share in 2024. Certain factors such as collaborative research initiatives, favorable regulatory frameworks, and strong clinical trial activity are playing a vital role in Europe pharmacogenomics market growth. In addition, Germany, the U.K., and France are driving innovation through publicly funded genomic programs and healthcare digitization.

- For instance, in February 2025, a pharmacogenomics trial, PROGRESS, which Manchester University NHS Foundation Trust is conducting in collaboration, announced its plan to expand pharmacogenomics testing across England.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. Asia Pacific is emerging as a high-growth region in the pharmacogenomics market, driven by rising healthcare investments, increasing prevalence of lifestyle-related diseases, and expanding access to genetic testing. China, Japan, South Korea, and India are making strategic moves to integrate genomics into healthcare, supported by national initiatives and public-private partnerships.

- For instance, in November 2024, Inocras Inc. and Summit Pharmaceuticals International Corporation entered into a collaboration to commercialize their whole genome sequencing (WGS) analysis services. Moreover, this collaboration will also work on transforming healthcare in Japan by leveraging bioinformatics and genomic data.

Latin America and the Middle East & Africa

Latin America and the Middle East are gradually expanding their presence in the pharmacogenomics market, though adoption remains limited compared to more developed regions. In Latin America, countries including Brazil and Mexico are investing in genomic research and pilot programs to support precision medicine. The Middle East, particularly the Gulf countries, is advancing pharmacogenomics through government-backed healthcare digitization and partnerships with global biotech firms.

- For instance, in April 2025, the Department of Health, Abu Dhabi (DoH), and M42 announced a program in collaboration to leverage management of Alzheimer’s disease with the help of pharmacogenomics reports.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Emphasis on Collaborations and Technology Sharing to Drive Revenue Growth for Key Market Players

The market is moderately consolidated, as few players are actively engaged and holding considerable market share. Players such as Illumina, Thermo Fisher Scientific, Qiagen, and F. Hoffmann-La Roche Ltd are some of the players actively operating in the market and have comparatively considerable global pharmacogenomics market share.

Moreover, other major players including Bio-Rad Laboratories Inc., Dynamic DNA Laboratories, Eurofins Scientific, Pathway Genomics, and others, are focusing on expansion of their service portfolio and strengthening their market share. These market players have also increased their emphasis on mergers and partnerships with other players to expand their service offerings.

LIST OF KEY PHARMACOGENOMICS MARKET COMPANIES PROFILED

- Hoffmann-La Roche Ltd. (Switzerland)

- Illumina (U.S.)

- Thermo Fisher Scientific (U.S.)

- Qiagen (Germany)

- Agilent Technologies (U.S.)

- Myriad Genetics (U.S.)

- Admera Health, LLC (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Pathway Genomics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: UGenome AI and PlexusDx announced a strategic partnership to enhance drug-gene interaction insights through technology exchange. This program aims to provide better care in terms of precision medicine.

- May 2025: Helix announced the launch of its new suite of pharmacogenomics (PGx) tests, which are specifically designed to detect patients with DYPD gene variants. These variants are found in patients with increased risk of side effects from certain chemotherapies.

- October 2024: Agilus Diagnostics announced the launch of its new pharmacogenomics testing service. This service aims to offer personalized treatment approaches to the patients.

- August 2023: Manulife announced the launch of its Personalized Medicine program to offer genetic tests at minimal costs.

- April 2022: GeneIQ and Synchrony Pharmacy entered into a strategic partnership with the aim of providing real-time pharmacogenomics services to nursing homes.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.95% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Technique

|

|

|

By Application

|

|

|

By Disease

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.46 billion in 2025 and is projected to reach USD 8.09 billion by 2034.

In 2025, the market value stood at USD 1.36 billion.

The market is expected to exhibit a CAGR of 9.95% during the forecast period of 2026-2034.

By technique, the next-generation sequencing technique segment led the market.

The key factors driving the market are the increasing prevalence of chronic conditions and the rising demand for precision medicine.

Illumina, Thermo Fisher Scientific, and Roche are the top players in the market.

North America dominated the market in 2024 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us