Pick and Place Machines Market Size, Share & Industry Analysis, By Product Type (Manual, Semi-Automatic, and Automatic), By Speed (Less than 16,000 CPH, 16,000 - 50,000 CPH, and Above 50,000 CPH), By Application (Consumer Electronics, Automotive Equipment, Industrial Electronics, Public Transit, Medical, Telecommunications, and Others (Military, etc.)), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

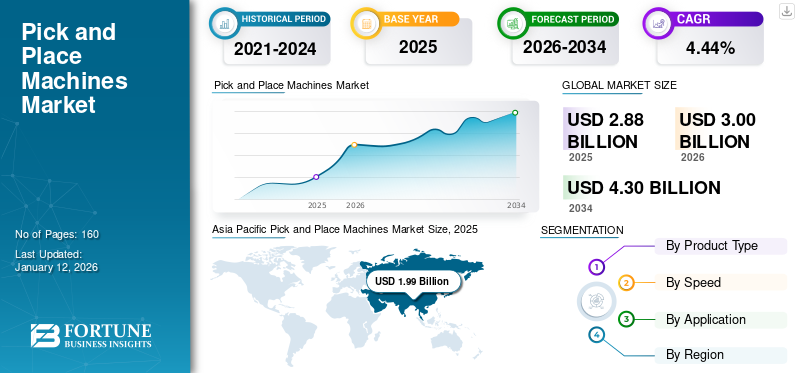

The global pick and place machines market size was valued at USD 2.88 billion in 2025. The market is projected to grow from USD 3 billion in 2026 to USD 4.3 billion by 2034, exhibiting a CAGR of 4.60% during the forecast period. Asia Pacific dominated the pick and place machines market with a share of 68.8% in 2025.

Pick and place machines play a crucial role in surface mount technology by accurately positioning components on circuit boards. The market is anticipated to experience significant growth, driven by the increasing demand for printed circuit boards across various sectors. Printed circuit boards serve as the foundation for nearly all electronic devices, rendering them indispensable in industries such as telecommunications, automotive, consumer electronics, and beyond. The electronics manufacturing industry has undergone considerable expansion, with PCBs being a key element, driving the market growth in the future. Furthermore, various government initiatives and investment strategies aimed at fostering local manufacturing and decreasing reliance on imports are likely to further elevate the demand for domestic PCB production.

Global Pick and Place Machines Market Overview

Market Size:

- 2025 Value: USD 2.88 billion

- 2026 Value: USD 3 billion

- 2034 Forecast Value: USD 4.3 billion

- CAGR: 4.60% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific held the largest share in 2024, supported by strong electronics manufacturing infrastructure across China, Japan, South Korea, and Taiwan

- Product Segment Leader: Automatic pick and place machines led demand, capturing the majority share in 2024

- Application Leader: The medical electronics sector is expected to register the highest growth rate, while the consumer electronics industry remains the largest contributor to market revenue

Industry Trends:

- Growing adoption of automatic pick and place systems for high-speed, precision assembly in electronics

- Integration of vision-based technologies, AI, and real-time diagnostics to improve placement accuracy and throughput

- Demand for systems capable of sub-micron precision and flexible changeover for high-mix, low-volume production

Driving Factors:

- Rising demand for consumer electronics and increasing automation across manufacturing operations

- Miniaturization of electronic components, driving need for advanced assembly technologies

- Expansion of factory automation initiatives and smart manufacturing investments across industries

Demand for miniature-sized electronic products is further generating demand for flexible and compact-sized PCBs. These machines offer consistent and faster component placement, optimizing the production of PCB assembly. Supportive government policies and strategic investments across industries, including automotive, aerospace, and others, are expected to bolster the market share. For instance, Schneider Electric, in December 2024, established a PCB manufacturing facility in Karnataka, India. These SMT machines use advanced technologies, such as computer vision systems and automated calibration, to precisely align components on a PCB. This accuracy ensures that the final product meets the necessary quality standards, making it functional and reliable. These machines play a crucial role in the SMT pipeline. Their speed, accuracy, versatility, and reliability have significantly impacted the electronics industry, allowing manufacturers to produce high-quality PCBs consistently and efficiently.

Key players in the market are collaborating with end users to develop machinery with advanced features such as setting placement priorities, as well as smart conveyors. Fuji Corporation, Zhejiang Neoden Technology Co., Ltd., and Juki Corporation are a few of the top players in the market, accounting for a prominent market revenue share in 2024. Market participants are focusing on new product launches to optimize production capacities.

Factory closures and restrictions due to the COVID-19 pandemic significantly slowed electronic production as the global pandemic unfolded. A decline in demand for pick-and-place machines across various regions can be attributed to several factors, including shortages of components and raw materials, disruptions in the supply chain, and heightened geopolitical tensions. Nevertheless, in the years following the pandemic, numerous manufacturing facilities have restarted their production activities. The market recovered its standing after the COVID-19 crisis and is anticipated to experience growth throughout the forecast period.

Growing Trend of Sustainability

Sustainable Manufacturing Practices to Bolster Market Development

Sustainability trends and the need for minimal environmental impact are driving the demand for energy-efficient pick and place machines. Changing expectations of customers, along with regulatory requirements, are increasingly necessitating the incorporation of sustainable practices within operations. Companies in the electronics manufacturing sector are complying with environmental standards and regulations to achieve energy efficiency and mitigate carbon emissions.

MARKET DYNAMICS

Pick and Place Machines Market Trends

Increased Miniaturization and AI-integration to Propel Market Growth

The integration of artificial intelligence and machine learning is enhancing capabilities in areas such as intelligent optimization of component placement, predictive maintenance, and defect detection. As electronic devices such as mobile phones, laptops, and others continue to miniaturize, there is a growing demand for machines capable of managing increasingly smaller components with exceptional precision. These machines are evolving into critical components of interconnected smart factories, where they exchange data and collaborate with other equipment to facilitate seamless and optimized production processes.

Download Free sample to learn more about this report.

Market Drivers

Automation and Growing Demand for Consumer Electronics to Support Market Growth

The application of pick and place machines is extensive in the development of Printed Circuit Boards (PCBs) across various industries. The escalating demand within the consumer electronics sector, driven by the increasing need for electronic devices such as TV sets and mobile phones, is significantly boosting the market for these machines. The surge in the popularity of smartphones, tablets, and laptops is notably influencing the adoption of flexible printed circuit boards, thereby contributing to the substantial expansion of this market. Additionally, the growing integration of consumer electronics and the expanding range of applications for these boards in the automotive sector is also playing a crucial role in the market's advancement. Industry experts project that the consumer electronics market will exceed USD 9.0 billion by 2029.

Emerging digital life scenarios, including remote education, smart diagnostics and treatment, and industrial risk management through artificial intelligence, have all been prominent factors in driving market growth. Regions are utilizing digital technology to monitor developments and anticipate pivotal shifts in industries such as 5G, cloud computing, and AI. PCBs find applications in a diverse array of products, from household appliances to ocean exploration devices. The market for flexible and functional Printed Circuit Board Assemblies (PCBAs) is gaining momentum due to heightened automation and enhanced sustainability efforts. The rising demand for robotics and the trend toward smart factories, supported by government initiatives, are further driving the growth of the market.

Market Challenges

Component Shortage and Supply Disruption to Hinder Market Growth

Limited availability of raw materials and shortage of components might delay the PCB manufacturing process, further impeding the pick and place machines market growth. The Printed Circuit Board (PCB) industry is notably experiencing challenges due to a shortage of essential raw materials required for their production. The availability of copper-clad laminates and copper foil, which serve as foundational components for PCBs, is becoming increasingly limited. Furthermore, PCB manufacturing is expected to temporarily slow down the market demand for SMT pick and place machines.

Market Opportunities

Advanced Vision Systems and Precision Placement to Bring Market Opportunities

Key players in the market are striving to develop SMT Machines with advanced vision systems to bolster the market growth. Precise vision systems offer detailed vision systems for small parts and precision cameras to enhance efficient component placement. Precision placement allows enhanced production capabilities and customized feeder capacity. Key players in the market are introducing pick and place machines with advanced features and efficient production capacities. For instance, SMTmax in November 2023 introduced QM-4044, table-top or stand-alone machines with 6000-7000 CPH and 44-feeder capacity.

SEGMENTATION ANALYSIS

By Product Type Insights

Automatic Pick and Place Machines to Cater Highest Revenue Market Share Owing to Government Regulations

The market segmentation by product type includes manual, semi-automatic, and automatic.

Automatic machines are projected to account for the highest revenue in the pick and place machines market share during the forecast period. The dominance is owing to supportive policies, technological developments, and increasing consumer demand. Automatic machines are also expected to show the highest growth rate due to growing interest in eco-friendly and sustainable solutions, particularly in industries such as manufacturing and healthcare. Automatic SMT machines provide fast speed, high accuracy, and enhanced production efficiency.

Manual and semi-automatic machines are expected to witness steady growth over the forecast period owing to a wide range of industry applications such as consumer electronics, automotive, telecommunications, industrial automation, and other sectors. Semi-automatic segment held 47.17% of the market share in 2026.

By Speed Insights

Less than 16,000 CPH Segment to Dominate as a Result of Automation and Industry 4.0

Based on speed, the market is classified into three segments that include less than 16,000 CPH, 16,000 - 50,000 CPH, and above 50,000 CPH.

Less than 16,000 CPH pick and place machines are preferred over other types of equipment. They accounted for the highest revenue market share in 2024. Industry 4.0 and increasing automation across manufacturing plants are generating strong demand for small pick and place machines. These machines offer precise and efficient placement of components with varied sizes. Key players are investing in SMT machines to automate the precision placement of components, fast changeovers, and software interfaces. Growing demand from the automotive industry to further enhance the growth of machines with less than 16,000 CPH. Less than 16,000 CPH machines are in high demand owing to their varied applications across diverse electronic products such as LED lighting, consumer electronics, defense, and aerospace sectors. The segment is expected to dominate the market share of 53.39% in 2026.

Changing industry needs and huge investments to boost the market growth from 16,000 CPH to 50,000 CPH and above 50,000 CPH machines. These machines are experiencing considerable growth owing to enhanced performance and increased production capacities. Machines with speeds ranging between 16,000 and 50,000 CPH will witness the highest growth during the forecast period. Above 50,000 CPH segment is anticipated to exhibit a CAGR of 3.06% during the forecast period.

By Application Insights

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics to Lead the Market Share Owing to Rising Disposable Income

Based on application, the market is classified into consumer electronics, automotive equipment, industrial electronics, public transit, medical, telecommunications, and others (military, etc). Other application segments include military and security.

The consumer electronics industry is continually evolving, with manufacturers adopting eco-friendly practices, such as using lead-free solder and recyclable materials, to reduce environmental impact. Increased disposable income, changing demographics, easy financing options, and a growing trend for smart devices are all bolstering the market for consumer electronics. The rise of middle-income groups across emerging countries rapidly boosts the demand for smart devices. In addition to this, increasing investment in emerging sectors such as semiconductors and related products is expected to further enhance the market growth. For instance, in December 2022, Bosch invested about USD 88 Mn in Malaysia to launch the Bosch semiconductor backend site and intends to invest USD 287 Mn more in this facility.

Automotive equipment segment is projected to acquire 38.23% of the market share in 2026.

The medical industry is rapidly transforming across regions owing to supportive regulatory policies in order to make healthcare efficient and accessible. Advancements in technology and wearable technology further bolster the demand for flexible PCBs across geographies, ultimately driving the market demand for pick and place machines.

Telecommunication segment is anticipated to exhibit a CAGR of 2.74% during the forecast period.

PICK AND PLACE MACHINES MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Pick and Place Machines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Government initiatives and policy support, along with the increasing demand for automotive electronics, telecommunications, and 5G technology, are significantly bolstering the PCB assembly market. The anticipated rollout of 5G technology is projected to enhance the demand for printed circuit boards, as the telecommunications infrastructure necessitates high-performance circuit boards. Initiatives such as the Production Linked Incentive (PLI) scheme for the electronics sector in India are promoting domestic PCB manufacturing by offering incentives for companies to invest in local production, thereby reducing dependence on imports. Furthermore, the swift adoption of smartphones, tablets, and wearable devices is driving a substantial rise in the demand for PCBs within the consumer electronics sector throughout the region. The regional market value in 2026 was USD 2.09 billion, and in 2025, the market value led the region by USD 1.99 billion.

China caters to the highest revenue market share owing to a wide range of industry applications, including IoT goods and consumer electronics. High-quality and flexible PCB boards are in high demand across applications, including industrial electronics, medical equipment, telecommunication, and robotics. China is expected to cater to the highest revenue market share in the Asia Pacific region as a result of raw materials availability and high-end technology. The market for China is likely to be USD 1.26 billion in 2026. The market for Japan is expected to be USD 0.23 billion and India is likely to reach USD 0.17 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is expected to witness strong, steady growth over the forecast period owing to rising demand for miniaturization. Technological advancements, the growing demand for electric vehicles, automation, and IoT are a few of the prominent factors that are generating strong growth over the forecast period. Growing PCB orders across the region owing to growth in the electronics and automotive industry would further boost the demand for the SMT machines market. North America is anticipated to account for the second-highest market size of USD 0.66 billion in 2026, exhibiting the second-fastest growing CAGR of 3.20% during the forecast period.

Advancing electronics manufacturing, and IoT integration, and adoption of smart manufacturing across sectors is significantly driving the market for pick and place machines in the U.S. Growing demand for electric vehicles, and consumer electronics to further generate strong demand for precise handling of components, ultimately driving the growth of pick and place machines in the U.S. market. The U.S. market size is estimated to be USD 0.54 billion in 2026.

Europe

Europe is anticipating to be the third-largest market with a value of USD 0.18 billion in 2026.

The strict regulatory possibility and lack of government support have been contributing to a slow growth in Europe’s pick and place machine market. However, key players in the market are heavily investing in new manufacturing plants to boost PCB assembly and production. For instance, Taiwan Semiconductor Manufacturing Co. (TSMC) invested about USD 10.9 billion in a chip fabrication plant in Germany. The demand for advanced and specialized PCB assembly has been steady due to automation and artificial intelligence. The rise of miniaturization in fields such as 5G, wearable devices, and IoT has significantly influenced the market for pick and place machines across the countries. The market for U.K. and Germany is likely to be USD 0.04 billion in 2025, whereas France is projected to reach USD 0.03 billion in 2025.

South America

South America region is expected to be the fourth-largest region with a value of USD 0.05 billion in 2025.

The demand for electronic components is growing throughout South American countries due to a range of industrial applications, including telecommunications, consumer electronics, industrial electronics, and semiconductors. The primary factors propelling this industry include the rising requirement for electronics in various sectors such as telecommunications, computing, healthcare, energy, and defense. This growth is further enhanced by the integration of digital technologies, including cloud computing, artificial intelligence, the Internet of Things, and 5G.

Middle East & Africa

The market is set to experience steady growth in the Middle East & African region over the forecast period owing to its applications across consumer electronics, military devices, and electric vehicles. Expanding semiconductor production facilities and SMT assembly plants across countries in the region are further expected to bolster the demand for these machines. The GCC market size is expected to hit USD 0.02 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Substantial Investment and Collaborative Strategy to Enhance Market Players across Regions

The SMT machines market is moderately consolidated owing to the presence of a significant number of players across regions. Key players in the market are striving to develop new and high-performance models to meet end-user demands. For instance, in October 2023, Mycronic, an electronics assembly solutions provider, introduced two new machine models, MYPro A40SX and A40LX, with high-speed mounted technology. Market participants are enhancing their market growth through strategic collaboration and mergers with technology companies across regions.

List of Key Pick and Place Machines Companies Profiled

- Juki Corporation (Japan)

- Panasonic Corporation (Japan)

- Fuji Corporation (Japan)

- DDM Novastar (U.S.)

- Zhejiang Neoden Technology Co.,Ltd (China)

- Shenzhen ETON Automation Equipment Co.,Ltd (China)

- Siemens AG (Germany)

- Mycronic AB (Sweden)

- Europlacer (U.S.)

- Goldland (Indonesia)

- Yamaha Motor Co., Ltd. (Japan)

- ASM Assembly Systems GmbH (Norway)

- MIRAE (South Korea)

- I-PULSE (India)

- Nordson Corporation (U.S.)

- Hanwha Precision Machinery (China)

- Kyoritsu Electric (India )

- Shenzhen HanChengTong Technology Co., Ltd. (China)

- Manncorp Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Nemco Limited, a U.K.-based company invested about USD 0.5 Mn in Advanced SMT assembly machines to enhance their production capacities and meet increasing end-user requirements.

- January 2024: Xalten Systems, an Indian-origin company, launched an advanced pick and place machine in the electronics manufacturing sector.

- June 2023: Mantracourt Electronics announced an investment of about USD 0.5 Mn to expand its manufacturing facility and increase production efficiency. The new machines enhanced runtime and increased placement speed to 40,000 CPH.

- March 2022: Hanwha Precision Machinery attended the IPC APEX EXPO in 2022, held at the San Diego Convention Center, California. The manufacturing company exhibited its PCB assembly machines such as pick and place machines and others.

- November 2021: Nano Dimension announced the acquisition of Essemtec AG based in Switzerland. Essemtec AG has product offerings that include pick and place equipment and other SMT machinery.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Speed, Application, and Region |

|

Segmentation |

By Product Type

By Speed

By Application

By Region

|

|

Key Market Players Profiled in the Report |

Juki Corporation (Japan), Panasonic Corporation (Japan), Fuji Corporation (Japan), Zhejiang Neoden Technology Co.,Ltd (China), Siemens AG (Germany), Mycronic AB (Sweden), Europlacer (U.S.) , Yamaha Motor Co., Ltd. (Japan), Hanwha Precision Machinery (China), MIRAE (South Korea) |

Frequently Asked Questions

The market is projected to record a valuation of USD 4.3 billion by 2034.

In 2025, the market was valued at USD 2.88 billion.

The market is projected to grow at a CAGR of 4.6% during the forecast period.

The automatic pick and place machine is dominating the market demand across the globe.

Growing demand for consumer electronics and increasing factory automation are expected to drive the market demand across regions.

Juki Corporation, Fuji Corporation, and Neoden Technology are a few of the top players in the market.

Asia Pacific is expected to lead the market demand, catering to the highest revenue market share.

By application, the medical sector is expected to witness the highest growth during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us