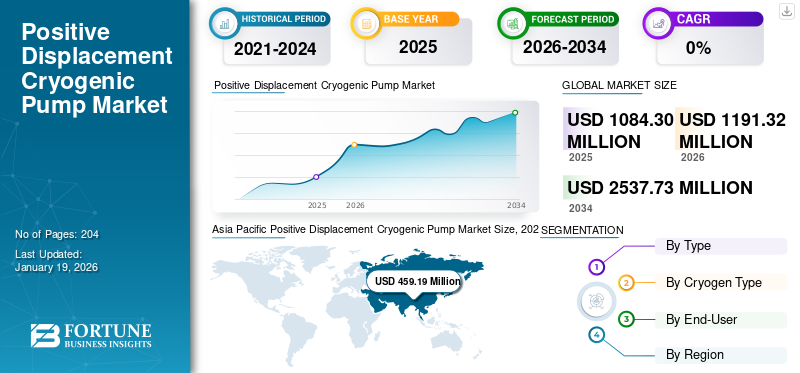

Positive Displacement Cryogenic Pump Market Size, Share & Industry Analysis, By Type (Reciprocating Pumps and Rotary Pumps), By Cryogen Type (Nitrogen, Oxygen, Argon, Liquefied Natural Gas, and Others), By End-User (Oil and Gas, Metallurgy, Power Generation, Chemical and Petrochemical, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global positive displacement cryogenic pump market size was valued at USD 1,084.30 Million in 2025. The market is projected to grow from USD 1,191.32 Million in 2026 to USD 2,537.73 Million by 2034, exhibiting a CAGR of 9.91% during the forecast period. The Asia Pacific dominated the global market, accounting for a 42.35% share in 2025.

Positive displacement cryogenic pumps are essential for handling and transporting LNG at extremely low temperatures. Global push toward cleaner fuels increase LNG adoption in power generation, shipping (marine bunkering), and heavy industries. Countries are investing in LNG terminals and infrastructure, boosting pump demand. Hydrogen, especially liquid hydrogen, needs cryogenic handling due to its low boiling point. Used in fuel cells, clean mobility, and energy storage, growing hydrogen projects globally are increasing cryogenic pump installations.

The adoption of cryogenic pumps is growing in the positive displacement segment due to rising demand for efficient handling of liquefied gas such as LNG, oxygen, and other sectors. Thus, the demand for cryogenic pumps is growing due to the above factors. The positive displacement pump segments are growing in raw material processing due to their ability to handle highly viscous, abrasive, and corrosive fluids with consistent flow and high efficiency.

Nikkiso Co., Ltd and SHI Cryogenics Group are widely recognized as major vendors in the global positive displacement cryogenic pump market. This is due to their deep expertise, advanced technology, and strong global presence in the critical industrial sector. The market share is growing due to a combination of technological, industrial, and environmental factors.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Liquefied Natural Gas (LNG) to Surge Market Growth

The growing global focus on cleaner fuels boosts LNG consumption across power generation, industrial, and marine sectors. This trend drives demand for positive displacement cryogenic pumps, which offer high precision and efficiency in transporting LNG under extreme cryogenic conditions. As LNG replaces diesel in marine transport, heavy trucks, and industrial burners, the need for compact, high-pressure cryogenic pumping increases. PD pumps are well-suited for small-to-medium scale LNG transfer applications such as refueling stations and portable LNG supply systems.

In January 2024, the Universal 2 ND Positive Displacement Pump (U2 ND) Series, created with industrial consumers in mind, was released by Waukesha Cherry-Burrell (WCB), a SPX FLOW brand. The pumps maximize cost and appropriateness for the industry sector while providing the high quality and longevity for which the Waukesha Cherry-Burrell brand is renowned.

MARKET RESTRAINTS

High Initial Investment and Maintenance Cost Restrains Market Expansion

Positive displacement cryogenic pumps require robust materials, precision engineering, and specialized insulation to handle extremely low temperatures and maintain reliability. This leads to significant upfront capital costs, making them less attractive for small- and mid-scale end-users. Moreover, due to continuous exposure to cryogenic fluids, these pumps often face seal wear, mechanical fatigue, and thermal contraction issues, resulting in frequent maintenance needs and higher lifecycle costs. Downtime for repairs or part replacement can disrupt operations, especially in critical industries such as LNG refueling or medical gas supply. These financial and operational challenges deter adoption, especially when alternative options including centrifugal cryogenic pumps, which offer lower maintenance and operational costs, are available.

MARKET OPPORTUNITIES

Growing Application in Aerospace to Create an Opportunistic Market Growth

Due to their high energy density and clean combustion properties, space and aerospace industries increasingly rely on cryogenic propellants such as liquid hydrogen (LH2) and liquid oxygen (LOX). These fluids must be handled at extremely low temperatures and under high pressure, requiring precise, reliable, and leak-free pumping systems. As global investments in commercial spaceflight, satellite deployment, and space exploration increase, the demand for advanced cryogenic fluid handling solutions is expected to grow, thereby driving the adoption of positive displacement cryogenic pumps.

In August 2024, Graham Corporation secured more than $65 million in contracts in the defense and space industry for its mission-critical turbomachinery and cryogenic pump products. The products are essential components that satisfy the stringent performance criteria of mission-critical applications.

Positive Displacement Cryogenic Pump Market Trends

Technological Innovation in Positive Displacement Cryogenic Pumps to Drive Market Growth

Recent innovations in positive displacement cryogenic pumps (PDCPs) enhance performance, reliability, and application versatility, leading to wider adoption across industries such as LNG, liquid hydrogen, aerospace, medical gases, and semiconductors. Key developments include: Magnetically-Coupled and Seal-Less Designs, eliminating mechanical seals, reducing leak risks, and maintenance in extreme cryogenic conditions. Smart Sensors and IoT integration enable real-time monitoring, predictive maintenance, and remote diagnostics, minimizing unplanned downtime. These innovations improve the operational efficiency, safety, and lifecycle performance of PDCPs, making them more attractive for established and emerging cryogenic applications. As industries demand higher purity, precise control, and compact solutions, positive displacement pumps are gaining ground, particularly in high-pressure, low-flow cryogenic environments where centrifugal pumps underperform.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Increasing Demand for High-pressure Reciprocating Pumps Across Industries to Push Market Growth

The market by type covers reciprocating pumps and rotary pumps.

The reciprocating pumps are the dominating segment in the market. Reciprocating pumps deliver very high pressures, making them ideal for applications such as liquid hydrogen or LNG injection, industrial gas cylinder filling, and pipeline pressurization where centrifugal pumps fall short. These pumps offer accurate and consistent flow rates, even with fluctuating pressure conditions, critical for metering, batch dosing, and cryogenic propellant feed systems (e.g., in aerospace or fuel stations).

Rotary pumps are the second leading segment in the market. Such dominance is due to their compact design, smooth flow delivery, and suitability for low-to-medium pressure applications such as LNG transfer, gas recovery, and cryogenic storage systems.

By Cryogen Type

Rising Applications of Nitrogen in Metal and Chemical Processing to Lead Segment Growth

The market is segmented by cryogen type into nitrogen, oxygen, argon, liquefied natural gas, and others.

Nitrogen is the dominating segment in the market. Liquid nitrogen is used in metal processing, electronics manufacturing, food freezing, pharmaceuticals, and chemicals. These applications require precise flow control and high-pressure transfer, where positive displacement pumps are ideal. Nitrogen is used for cryopreservation, surgical applications, and laboratory research in the medical and biotech sectors. These sectors prioritize purity and precision, which PD pumps deliver reliably.

Oxygen is the fastest growing segment in the market. Liquid oxygen (LOX) is essential in hospitals, emergency care, and home oxygen therapy. Positive displacement pumps are preferred for precise, contamination-free filling of medical oxygen cylinders and storage tanks. Oxygen is heavily used in steelmaking, cutting, and welding operations. These processes often involve high-pressure delivery systems, where positive displacement pumps provide accurate and reliable flow.

By End-User

Increasing Application in Midstream and Downstream Operations to Augment Oil and Gas Segment Growth

By end-user the market is segmented into oil and gas, metallurgy, power generation, chemical and petrochemical, marine, and others.

Oil and gas is the dominating segment in the market. The oil and gas industry heavily relies on liquefied natural gas (LNG) for storage, transport, and regasification. Positive displacement pumps are essential for high-pressure LNG transfer, fueling stations, and boil-off gas recovery systems.

Metallurgy is the fastest growing segment in the market. The metallurgy industry relies heavily on liquid oxygen, nitrogen, and argon for steelmaking, annealing, hardening, and cutting processes. These cryogenic gases are often delivered and injected at high pressures, where positive displacement pumps (PDPs) are preferred for their precise and stable flow.

POSITIVE DISPLACEMENT CRYOGENIC PUMP MARKET REGIONAL OUTLOOK

The market has been analyzed regionally in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is the dominating region in the market.

Asia Pacific

Asia Pacific Positive Displacement Cryogenic Pump Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 459.19 billion in 2025 and USD 510.45 billion in 2026. Position in the positive displacement cryogenic pump market share. Countries such as China, India, Japan, and South Korea are expanding LNG import terminals, pipelines, and regasification units to meet growing energy demands. Positive displacement pumps are essential for high-pressure LNG transfer and refueling stations, driving regional demand. Asia Pacific nations invest heavily in green hydrogen and fuel cell technology, especially Japan and South Korea. These projects require precise cryogenic liquid hydrogen transfer, where PD pumps are preferred for high-pressure, low-flow operations; thus all these factors drive Asia Pacific cryogenic pump market growth.

North America

The U.S. is a global leader in LNG exports, and the expansion of LNG terminals and liquefaction plants is driving demand for high-pressure, precision cryogenic pumps, where positive displacement pumps are essential. North America has a well-developed industrial gas industry (oxygen, nitrogen, and argon), used in healthcare, metal processing, and electronics. These sectors require accurate cryogenic gas transfer, favoring positive displacement pumps. Post-COVID healthcare investments and upgrades have accelerated the need for liquid oxygen systems and gas cylinder filling, a key application for PD cryogenic pumps.

U.S.

The U.S. is among the top global exporters of LNG, with continued investments in liquefaction terminals and LNG bunkering infrastructure. Positive displacement pumps are used for precise high-pressure LNG transfer, fueling market demand. Federal and state initiatives (such as the U.S. Hydrogen Hubs Program) boost infrastructure for liquid hydrogen production, storage, and fueling stations PD pumps are required for accurate cryogenic hydrogen handling.

Europe

The EU heavily invests in green hydrogen projects as part of its climate goals (e.g., REPowerEU). Positive displacement pumps are crucial for high-pressure cryogenic hydrogen transfer, especially in refueling stations and electrolyzer systems. To reduce dependence on Russian gas, European countries are expanding LNG import terminals and storage capacity, boosting demand for reliable LNG pumping solutions, a key application for PD pumps. Europe’s healthcare, metal fabrication, and electronics sectors require large volumes of liquid oxygen, nitrogen, and argon, often handled through PD pumps for cylinder filling and distribution.

Latin America

Countries such as Brazil, Argentina, and Mexico are investing in LNG import terminals, small-scale liquefaction plants, and LNG-based power generation. Positive displacement pumps are crucial for precise, high-pressure LNG handling in these applications. The region’s expanding healthcare, metal fabrication, and food processing sectors are increasing demand for liquid oxygen, nitrogen, and argon, which require accurate and contamination-free cryogenic transfer, a key strength of PD pumps.

Middle East & Africa

Countries such as Qatar, UAE, and Nigeria invest in LNG liquefaction, regasification, and distribution projects to meet domestic and export demand. Positive displacement pumps are used for high-pressure, accurate cryogenic LNG transfer, especially in small-scale and remote locations. The UAE and Saudi Arabia are investing in space exploration and satellite launch programs, which require cryogenic fuel handling systems, a niche where PD pumps are essential due to their accuracy and pressure control.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Suppliers are Actively Engaged in Acquisitions Leading to Higher Market Share

In November 2024, through its Brazilian subsidiary, Ebara Bombas América Do Sul (EBAS), Ebara Corp. acquired 80% of the shares in the Uruguayan pump sales business Asanvil S.A. Currently, Asanvil is a branch of EBAS. Asanvil, founded in 2012, specializes in the assembly, marketing, and after-sales support of conventional pumps and associated goods. By purchasing the company, Ebara will establish a new sales hub in Uruguay, increasing its presence in the expanding South American market for pumps used in agriculture, construction, industry, and other industries.

List of the Key Positive Displacement Cryogenic Pump Companies Profiled

- HYDRO PROKAV PUMPS INDIA PRIVATE LIMITED (India)

- Ingersoll Rand (U.S.)

- Alfa Laval (Switzerland)

- Grundfos (Denmark)

- IDEX Corporation (U.S.)

- Schlumberger Limited (U.S.)

- The Weir Group (U.K.)

- KSB (Germany)

- Sulzer Limited (Switzerland)

- Flowserve Corporation (U.S.)

- Dover Corporation (U.S.)

- Goulds Pumps (U.S.)

- Blackmer (U.S.)

- PCM (France)

- Seepex (Germany)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, Larsen & Toubro (L&T) placed an order with KSB Limited to deliver boiler feed pumps. The pumps are intended for two NTPC supercritical power plant projects: the Nabinagar Stage-II (3x800 MW) and the Gadarwara Stage-II (2x800 MW). The purchase comprises 15 sets of main boiler feed pumps, motors, booster pumps, and other equipment. These will be employed in massive thermal electricity production.

- In July 2025, the acquisition of Fives Group's cryogenics business unit, a specialist in cryogenic heat transfer and pump technologies, was finalized by Alfa Laval. With the acquisition of Fives Energy Cryogenics based in France, Alfa Laval is now better positioned to support the worldwide movement toward cleaner energy to a strong technology platform.

- In March 2025, the INNOMAG TB-MAG Dual Drive Pump, the first seal-less pump in the world that prevents leaks and establishes a new benchmark for environmental protection and safety, was launched by Flowserve Corporation, a top supplier of flow control goods and services to the infrastructure markets worldwide.

- In November 2024, Ingersoll Rand Inc. purchased Penn Valley Pump Co. Inc. (PVP), a top producer of double disc pumps. The deal's financial details were not made public. For usage in the food, chemical, industrial, and municipal sectors, PVP has been designing, enhancing, and producing its Double Disc PumpTM line of positive displacement pumps.

- In September 2022, NETZSCH will introduce PERIPRO Peristaltic positive displacement cryogenic pumps, its newest product line. For challenging applications, these NETZSCH hose pumps have a robust design and large rollers to increase service life and reduce energy usage.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the positive displacement cryogenic pump market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.91% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By Cryogen Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1,084.30 million in 2025.

In 2025, the Asia Pacific market value stood at USD 459.19 million.

The market is expected to exhibit a CAGR of 9.91% during the forecast period.

The oil and gas segment leads the market by end user.

Rising demand for liquefied natural gas (LNG) to drive market growth

Some of the top major players in the market are Ingersoll Rand, Alfa Laval, and Grundfos, among others.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us