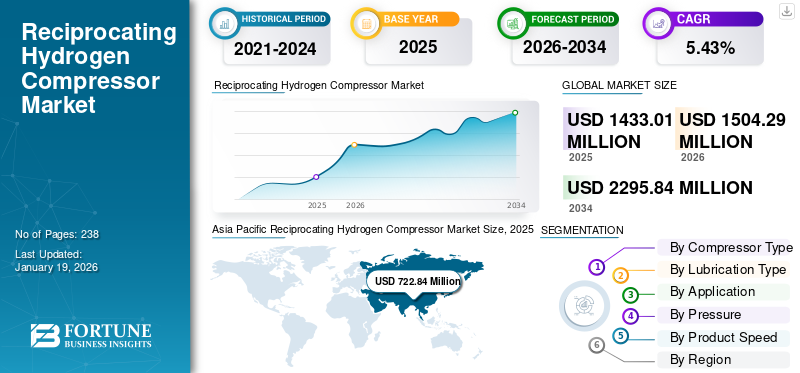

Reciprocating Hydrogen Compressor Market Size, Share & Industry Analysis, By Compressor Type (Single Acting, Double Acting, and Diaphragm), By Lubrication Type (Oil-Based and Oil-free), By Application (Refueling Stations, Production and Storage, and Industrial), By Pressure (Less Than 400 Bar, 401-700 Bar, and More than 700 Bar), By Product Speed (Low, Medium, and High), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global reciprocating hydrogen compressor market size was valued at USD 1433.01 million in 2025. The market is projected to grow from USD 1504.29 million in 2026 to USD 2295.84 million by 2034, exhibiting a CAGR of 5.43% during the forecast period. Asia Pacific dominated the global market with a share of 50.44% in 2025.

The global effort to cut carbon emissions and move toward sustainable energy sources is accelerating the swift uptake of hydrogen as a clean fuel. Hydrogen is progressively regarded as a fundamental element of the future energy landscape, particularly in areas where electrification poses difficulties, such as heavy industry, transportation, and power generation. This transition enhances the need for hydrogen infrastructure comprising effective compression technologies such as reciprocating hydrogen compressors. These compressors are widely used in hydrogen fuel cell vehicles as they are adaptable to various fuel cell system designs and operating conditions.

Kobelco (Kobe Steel) is certainly a significant participant in the global reciprocating hydrogen compressor sector, acknowledged for its extensive history and technological expertise in producing reciprocating, screw, and centrifugal compressors for numerous industrial uses, including hydrogen compression.

MARKET DYNAMICS

Market Drivers

Rising Adoption of Hydrogen as a Clean Energy Source to Drive Market Growth

Hydrogen is progressively acknowledged as a crucial clean energy resource in the global shift from fossil fuels. Its adaptability and promise for zero-emission energy render it appealing for areas where electrification poses difficulties, including heavy industry, transportation, and power generation. Governments and industries around the globe are pouring resources into hydrogen infrastructure to fulfil ambitious decarbonization and net-zero goals.

In September 2022, SIAD Macchine Impianti (SIAD MI) consented to provide hydrogen compressors to Nel. Nel, located in Oslo, is a technology firm focused on creating green hydrogen devices, such as electrolyzers and refueling stations. These factors are driving the reciprocating hydrogen compressor market growth in recent years.

Market Restraints

High Initial Costs to Hinder Market Growth

The acquisition and setup of reciprocating hydrogen compressors necessitate a considerable initial financial investment. This substantial upfront expense may deter prospective purchasers, especially smaller businesses and entities in developing areas, from entering or growing within the market. Small and medium-sized enterprises (SMEs) are particularly impacted, as the financial strain of obtaining and establishing these complex systems could be too high. This restricts market entry and hinders the speed of adoption in areas or industries with limited budgets.

Market Opportunities

Expansion of Hydrogen Infrastructure is Boosting Market Growth

The global initiative to decrease greenhouse gas emissions and shift toward a low-carbon economy is driving the need for hydrogen infrastructure. Hydrogen is acknowledged as a clean energy carrier, and its use is encouraged in transportation, power generation, and industry.

Continuous research and development initiatives in reciprocating hydrogen compressors, including India’s National Green Hydrogen Mission, promote the development of domestic technologies for effective hydrogen production and use, encouraging market expansion. In April 2025, Burckhardt Compression, a global leader in reciprocating compressor technology, received a contract in Sweden from a significant gas company to supply its MD10-L compressor package for hydrogen trailer filling purposes. The contract highlights Burckhardt Compression's dedication to promoting hydrogen mobility and energy infrastructure.

Reciprocating Hydrogen Compressor Market Trends

Adoption of Oil-Free and Dry Lubricated Technologies to Push Market Growth

Adopting oil-free and dry-lubricated technologies is driving growth in the market. These technologies eliminate the risk of hydrogen contamination, making them ideal for high-purity applications such as fuel cells, electronics manufacturing, and green hydrogen systems. Oil-free compressors also reduce maintenance needs, improve system reliability, and enhance safety, especially under high-pressure conditions.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Compressor Type

Superior Efficiency and Higher Suitability Lead Demand for Double Acting Hydrogen Compressors

By compressor type, the market is segregated into single acting, double acting, and diaphragm.

Double acting is the dominating segment in the market. Double acting compressors are preferred due to their high efficiency, as they compress hydrogen on both sides of the piston in every cycle, leading to increased output and reduced energy consumption compared to single-acting types.

By Lubrication Type

Global Push for Clean Energy to Lead Demand for Oil-based Compressors

By lubrication type, the market is bifurcated into oil-based and oil-free.

Oil-based is the dominating segment. Oil-based compressors are preferred in demanding industrial applications. The oil offers lubrication, minimizing wear and prolonging equipment longevity, essential for uninterrupted operation in fields such as oil and gas and chemicals.

By Application

Rising Need to Achieve High Compression Ratios Fuels Refueling Stations Segment Growth

By application, the market is categorized into refueling stations, production and storage, and industrial.

Refueling stations are growing fastest in the market. Reciprocating hydrogen compressors are widely used in refueling stations, owing to their ability to achieve high compression ratios that can compress hydrogen to high pressure (350-700 bar or higher), which is used in vehicle fuel tanks. Also, these compressors can handle a wide range of flow rates, which makes them suitable for various refueling station capacities.

By Pressure

Suitability of 401–700 Bar Pressure Range for Medium to Large Hydrogen Applications Boosts Segment Growth.

By pressure, the market is categorized into less than 400 bar, 401-700 bar, and more than 700 bar.

401-700 bar is the dominating segment in the market. The bar pressure range 401-700 is suitable for medium to large hydrogen applications, including refueling stations, industrial processes, and specific hydrogen storage and transportation systems.

By Product Speed

Demand for Elevated Flow Rates in Extensive Hydrogen Applications Fosters High Segment Growth

By product speed, the market is categorized into low, medium, and high.

High is the dominating segment in the market. Centrifugal compressors are ideal for extensive hydrogen applications that demand elevated flow rates. In these circumstances, high-speed performance enables effective compression with fewer stages and reduced equipment size, enhancing the appeal of the technology for industrial hydrogen infrastructure.

Global Reciprocating Hydrogen Compressor Market Regional Outlook

The market has been analyzed geographically over five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Reciprocating Hydrogen Compressor Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the dominant reciprocating hydrogen compressor market share, owing to widespread adoption of hydrogen as a clean energy source. Authorities and businesses are investing significantly in hydrogen infrastructure, including establishing hydrogen refueling stations and industrial hydrogen uses. Such investments directly drive the need for reciprocating hydrogen compressors, which play a crucial role in compressing, storing, and distributing hydrogen gas across different applications. The area is witnessing considerable industrial expansion and urban development, resulting in heightened energy and power requirements. Hydrogen is being more widely utilized as a clean energy solution to fulfill these needs, escalating the demand for hydrogen compressors.

North America

The market in North America is witnessing strong growth, fueled by the region's dedication to clean energy, government incentives, and the development of hydrogen infrastructure. The U.S. and Canada lead the way, making substantial investments in hydrogen as a sustainable energy source and facilitating the establishment of hydrogen refueling stations, industrial hydrogen uses, and storage options. Reciprocating hydrogen compressors are especially appreciated for their excellent efficiency, capability to manage elevated pressures, and dependability, making them a favored choice for hydrogen fueling stations and industrial applications.

Europe

Europe is emphasizing a transition to a low-carbon energy framework, with hydrogen, particularly green hydrogen created through electrolysis, considered a key component for decarbonizing industry, transportation, and energy systems. Significant capital is being invested in hydrogen production, storage, transportation, and distribution networks. Creating a comprehensive hydrogen infrastructure across Europe, which encompasses pipelines, storage units, and refueling stations, demands reliable compression technology, with reciprocating compressors crucial for effectively managing high-pressure hydrogen.

Latin America

Latin America is investing significantly in clean (green and blue) hydrogen initiatives, utilizing its plentiful renewable resources, solar, wind, and hydro, to generate competitively priced hydrogen. This increase in hydrogen production directly raises the need for reciprocating hydrogen compressors, which are crucial for compressing, storing, and transporting hydrogen gas for local consumption and export.

Countries such as Chile, Argentina, and Uruguay aspire to become significant global exporters of hydrogen, especially in Europe and Asia. Extensive hydrogen export initiatives necessitate strong infrastructure, which includes high-capacity compressors to transport hydrogen through pipelines and terminals. Numerous mega-projects set for completion by 2030 are fueling investment in hydrogen compression technology.

Middle East & Africa

The Middle East & Africa region, including Saudi Arabia, UAE, Iran, and Qatar, possesses a robust oil and gas sector featuring many refineries and active oil projects. These sectors necessitate hydrogen compressors for refining, chemical synthesis, and power generation, increasing the demand for reciprocating hydrogen compressors. Governments in the area are concentrating on altering their energy composition by integrating hydrogen to lessen reliance on oil, gas, and coal. This entails upgrading grid infrastructure and implementing subsidy reforms to promote clean energy, increasing the demand for hydrogen compressors.

COMPETITIVE LANDSCAPE

Key Industry Players

Introduction of Innovative and Effective Reciprocating Compressors by Key Players to Drive Market Growth

Numerous suppliers, including SIAD Macchine Impianti, Atlas Copco, and Ingersoll Rand, highlight oil-free compressors for clean hydrogen applications. Suppliers provide modular, adjustable packages to accommodate particular process demands and expand with the requirements of hydrogen infrastructure. In September 2023, Atlas Copco introduced the H2P, a hydrogen compressor designed to adapt to the electrolysis production profile. With its speed-controlled technology, the compressor can offset variations in hydrogen production and guarantee peak efficiency, thus minimizing energy losses.

List of Key Reciprocating Hydrogen Compressor Companies Profiled

- SIAD Macchine Impianti (Italy)

- KOBELCO (Japan)

- Nel ASA (Norway)

- KWANGSHIN (South Korea)

- Mikuni Group (Japan)

- Burckhardt Compression (Switzerland)

- Siemens (Germany)

- Reavell (U.K.)

- IDEX India (India)

- Atlas Copco (Sweden)

- Ventos Compressors (Italy)

- IHI Rotating Machinery Engineering Co., Ltd. (Japan)

- Ariel Corporation (Ohio)

- Hitachi Ltd (Japan)

- BORSIG GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- In September 2024, Project collaborators H2 MOBILITY, HOERBIGER, and ARIEL announced the establishment of new standards to advance hydrogen refueling infrastructure for trucks and buses. In Düsseldorf, they are building Europe's most robust hydrogen refueling station, boasting a daily dispensing capability of more than five tons. This "refueling station of the future" sets the new H2 MOBILITY benchmark and signifies a major advancement toward a sustainable and dependable transportation infrastructure.

- In July 2024, BORSIG ZM Compression GmbH (BZM) and HH2E AG reached an agreement for a long-term collaboration focused on the design and provision of integrally geared turbo compressors and reciprocating compressors, essential machinery for setting up a green hydrogen production facility.

- In January 2024, Siemens Digital Industries Software announced that REJOOL, a startup concentrating on hydrogen compression devices, has embraced the Siemens Xcelerator as a Service portfolio of industry software to assist in launching its PIONYR hydrogen compression technology into the market.

- In December 2023, Kyoto Fusioneering (KF) declared its collaboration with MIKUNI JUKOGYO CO., LTD. (MIKUNI), a leading manufacturer focused on compressors and vacuum pumps, to jointly develop advanced vacuum pumps essential for fuel exhaust in fusion energy power facilities.

- In February 2020, Burckhardt Compression entered into an agreement with GRZ to develop innovative hydrogen compression technology collaboratively.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the electric motor. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.43% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Compressor Type

|

|

By Lubrication Type

|

|

|

By Application

|

|

|

By Pressure

|

|

|

By Product Speed

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1433.01 million in 2025.

In 2025, the Asia Pacific market value stood at USD 722.84 million.

The market is expected to exhibit a CAGR of 5.43% during the forecast period of 2026-2034.

The refueling stations are the fastest-growing segment in the market by application.

Rising adoption of hydrogen as a clean energy source to drive market growth.

Some of the top major players in the market are SIAD Macchine Impianti, KOBELCO, and Nel ASA.

Asia Pacific dominated the market with a share of 50.44% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us