RF GaN Market Size, Share & Application Analysis, By Device Type (RF Power Amplifiers, RF Transistors, Switches, Low Noise Amplifiers (LNA), and Others), By Material Type (GaN-on-SiC, GaN-on-Si, and Others), By Application (Radar Systems, Satellite Communications, Telecommunication Infrastructure, Electronic Warfare, Avionics, and Others) and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

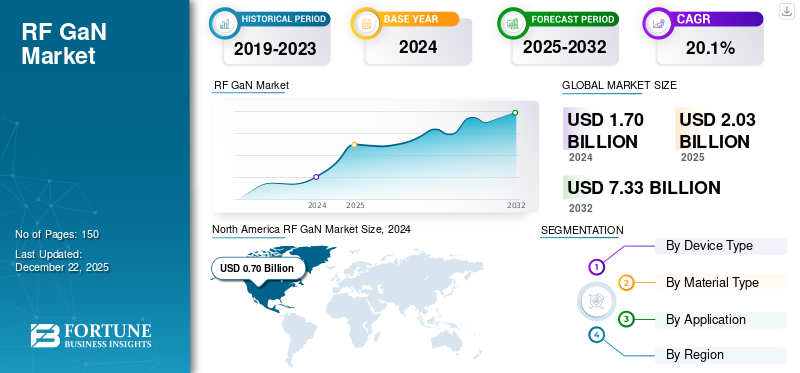

The global RF GaN market size was valued at USD 2.03 billion in 2025. The market is projected to grow from USD 2.44 billion in 2026 to USD 9.55 billion by 2034, exhibiting a CAGR of 18.60% during the forecast period.

The RF GaN industry includes the development, production, and utilization of gallium nitride semiconductor devices designed for high-frequency and high-power radio frequency applications. The market serves various sectors such as radar systems, satellite communications, telecommunication infrastructure, electronic warfare, avionics, and test and measurement equipment, highlighting the extensive adoption of RF GaN technology in high-frequency and high-performance applications.

Qorvo, Inc., Sumitomo Electric Device Innovations, NXP Semiconductors N.V., MACOM Technology Solutions, Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics N.V., Mitsubishi Electric Corporation, Microchip Technology, and Broadcom Inc. are among the key players in the market. These companies are involved in product innovation, strategic collaborations, and technological advancements to strengthen their position in the market.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs between major economies have increased raw materials and components costs in the market, raising production expenses. These tariffs have disrupted supply chains, causing delays for manufacturers and suppliers. For instance,

- According to the Information Technology and Innovation Foundation, the 25 percent tariff imposed on semiconductor imports to the U.S. would result in a 0.18 percent reduction in U.S. economic growth during the first year.

To tackle these challenges, companies are switching toward localized sourcing and expanding their supply networks to reduce dependency on affected regions. Although these challenges persist, demand for RF GaN technology remains robust due to its crucial role in various applications.

RF GaN MARKET TRENDS

Growing Integration of GaN Technology in Satellite Communication Systems Boosts Market Growth

The growing integration of GaN technology in satellite communication systems is expected to expand the RF GaN market share significantly. For instance,

- Industry experts estimate that the satellite services sector generated more than USD 110 billion in 2023.

GaN devices provide superior power density and efficiency, critical for the demanding satellite communication requirements, including long-distance signal transmission and high data throughput. As satellite networks expand globally to support broadband connectivity and defense applications, the demand for GaN-based components continues to rise.

Furthermore, the ability of GaN technology to operate effectively in harsh environmental conditions, such as extreme temperatures and radiation, makes it ideal for space applications. This reliability and robustness help improve satellite communication equipment's overall performance and lifespan. Consequently, increased demand for GaN technology in this sector is fueling innovation and investment, contributing to the sustained growth of the market.

MARKET DYNAMICS

Market Drivers

Rising Adoption of GaN Technology in 5G Infrastructure Supports Market Growth

The increasing adoption of GaN technology in 5G infrastructure drives the RF GaN market growth. For instance,

- The National Centre for Communication Security forecasts that 5G telecom networks will contribute nearly 2% to India's GDP by 2030. The 5G sector is expected to generate revenues of approximately USD180 billion by that year.

GaN devices offer higher power efficiency and better performance at high frequencies than traditional silicon-based components, making them well-suited for 5G applications. As telecom infrastructure companies expand their 5G networks, demand for advanced RF components supporting faster data speeds and greater connectivity is rising.

Moreover, GaN technology enables more compact and energy-efficient designs, which are critical for the dense deployment of 5G base stations and small cells. Its superior thermal management and durability ensure reliable operation in demanding network environments. These advantages have increased investment in GaN-based solutions, further accelerating market growth.

Market Restraints

High Manufacturing Costs and Integration Challenges to Limit Market Growth

Compared to traditional silicon components, the high manufacturing costs associated with GaN devices remain a significant barrier for widespread adoption. Additionally, challenges related to material defects and yield issues during the fabrication process can limit production efficiency and increase costs. The complexity of integrating GaN technology into existing systems also poses technical hurdles for manufacturers and end-users. Furthermore, competition from alternative technologies, such as silicon carbide (SiC) and advanced silicon solutions, may constrain market expansion.

Market Opportunities

Increasing Demand for Energy-Efficient and High-Performance Components Creates Substantial Growth Opportunity

The expanding demand for energy-efficient and high-performance components presents a substantial growth opportunity for the market. As industries increasingly prioritize energy efficiency and system performance, GaN technology stands out for its ability to operate at higher voltages, frequencies, and temperatures with lower power consumption. RF GaN devices are ideal for next-generation telecommunications, aerospace, defense, and consumer electronics applications.

The rapid growth of data-intensive technologies such as IoT, 5G, and autonomous systems is further fueling need for advanced RF components capable of delivering consistent, high-efficiency performance. For instance,

- According to IoT Analytics, the market is projected to grow by 13%, reaching 18.8 billion in 2024. This forecast, however, is lower than that in 2023 due to ongoing cautious spending by enterprises.

GaN's superior thermal management and power density capabilities offer a competitive edge in these evolving markets. As a result, manufacturers are expected to invest more in GaN innovation, positioning the technology as a key enabler of future high-performance electronic systems.

SEGMENTATION Analysis

By Device Type

RF Power Amplifiers Segment Lead Due to Their Critical Role in High-Power Applications

Based on device type, the market is divided into RF power amplifiers, RF transistors, switches, Low Noise Amplifiers (LNA), and others.

The RF Power Amplifiers segment is projected to dominate the market with a share of 48.02% in 2026. RF power amplifiers lead and are expected to grow at the highest CAGR due to their critical role in high-frequency, high-power applications such as radar, 5G base stations, and satellite communications. Their superior efficiency, power density, and linearity make them essential for next-generation communication and defense systems.

RF transistors hold the second-largest share in the market, as they are fundamental components in RF front-end modules, offering high gain and efficiency across various frequencies. Their widespread use in commercial and military applications further strengthens their market position.

By Material Type

GaN-on-Silicon Carbide (SiC) Dominates Due to Superior Thermal and Performance Characteristics

Based on material type, the market is divided into GaN-on-SiC, GaN-on-Si, and others.

The GaN-on-SiC segment is expected to lead the market, contributing 66.60% globally in 2026. The GaN-on-SiC segment dominates the market owing to its superior thermal conductivity, high power density, and performance in high-frequency applications, making it the preferred choice for defense and aerospace systems. Its proven reliability in harsh environments further reinforces its market leadership.

The GaN-on-Si segment is projected to witness the highest CAGR due to its lower production costs and compatibility with existing silicon manufacturing infrastructure. This enables broader adoption in commercial and consumer-grade applications. This cost-effectiveness drives its growth in high-volume markets such as telecom and IoT.

By Application

To know how our report can help streamline your business, Speak to Analyst

Radar Systems Segment Holds the Largest Market Share, Driven by Rising Defense Budgets and Advanced Technology Needs

The Radar Systems segment will account for 38.99% market share in 2026. By application, the market is fragmented into radar systems, satellite communications, telecommunication infrastructure, electronic warfare, avionics, and others.

Radar systems hold the highest share and are expected to grow at the highest CAGR during the study period due to increasing defense budgets and the need for advanced, high-resolution radar technologies. GaN's high power output and efficiency are critical for next-generation radar systems across land, sea, and air platforms.

Satellite communications hold the second-largest share as global demand for broadband connectivity and real-time data transmission rises. GaN's performance in space-grade conditions and its ability to reduce payload weight make it highly suitable for modern satellite systems.

RF GaN MARKET REGIONAL OUTLOOK

North America

North America RF GaN Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.84 billion in 2025 and USD 1.01 billion in 2026. North America dominates the market due to the strong presence of leading semiconductor manufacturers and advanced research and development infrastructure. The region benefits from substantial government and defense spending, which drives demand for high-performance RF components in military and aerospace applications. Additionally, early adoption of 5G technology and well-established telecommunications infrastructure further reinforce North America's market leadership. The U.S. market is projected to reach USD 0.59 billion by 2026.

Download Free sample to learn more about this report.

The U.S. leads the market due to strong demand from the aerospace and defense sector, which relies on high-power and high-frequency devices for radar, electronic warfare, and satellite communications. Furthermore, its advanced semiconductor R&D ecosystem, significant government support, and the presence of key manufacturers are driving the rapid adoption of the RF GaN technology.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR in the market, driven by rapid urbanization, expanding telecommunications infrastructure, and increasing defense investments across countries such as China, India, and South Korea. The region's large consumer base and growing demand for IoT, 5G, and smart devices are also fueling the adoption of GaN technology. Moreover, increasing manufacturing capabilities and government initiatives supporting semiconductor production contribute to the market's growth. The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

Europe

Europe holds a significant share of the market due to its strong aerospace, defense, and telecommunications industrial base. The presence of prominent semiconductor companies and collaborative government-industry programs supports continuous innovation and adoption of GaN technology. Additionally, stringent regulatory standards and increasing focus on energy-efficient technologies bolster the region's demand for advanced RF components. The U.K. market is projected to reach USD 0.10 billion by 2026, while the Germany market is projected to reach USD 0.09 billion by 2026.

Middle East and Africa (MEA) and South America

MEA and South America are expected to experience slower growth in the market owing to limited industrial infrastructure and lower levels of investment in advanced semiconductor technologies. The regions face challenges such as economic instability and slower adoption of next-generation communication networks compared to more developed markets. A smaller defense expenditure and less developed telecommunications infrastructure further contribute to the subdued growth prospects.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Market players operating the market are focusing on introducing new product portfolios to boost their market positioning by deploying technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, partnerships, and acquisitions to reinforce their product offerings. Such strategic launches help companies to maintain and grow their market share in a rapidly evolving application.

Long List of Companies Studied (including but not limited to)

- Qorvo, Inc. (U.S.)

- Sumitomo Electric Device Innovations (Japan)

- NXP Semiconductors N.V. (Netherlands)

- MACOM Technology Solutions (U.S.)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics N.V. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Microchip Technology (U.S.)

- Broadcom Inc. (U.S.)

- Ampleon Netherlands B.V. (Netherlands)

- RFHIC Corporation (South Korea)

- Integra Technologies, Inc. (Japan)

- Fujitsu Limited (Japan)

- Northrop Grumman Corporation (U.S.)

- Aethercomm, Inc. (U.S.)

- GaN Systems Inc. (Canada)

- More..

KEY APPLICATION DEVELOPMENTS

- In July 2025, Incize and Atomera collaborated to advance GaN-on-Si technologies for RF and power applications. The partnership aims to leverage the complementary strengths of both companies to accelerate innovation in next-generation semiconductor solutions.

- In April 2025, TagoreTech Inc. plans to triple its revenue within the next four years. It aims to achieve this growth by concentrating on GaN-based RF products and expanding its operations in Kolkata.

- In April 2025, STMicroelectronics and Innoscience signed a joint development agreement aimed at the advancement of GaN technology. The collaboration is intended to enhance manufacturing capabilities and accelerate the development of GaN-based solutions.

- In January 2025, Guerrilla RF introduced the GRF0030D and GRF0020D, a new class of GaN on Silicon Carbide (SiC) HEMT power amplifiers delivering up to 50W of saturated power. These transistors are designed for integration into custom MMICs for wireless infrastructure, military, aerospace, and industrial heating applications.

- In December 2024, GlobalFoundries was awarded USD 9.5 million in federal funding to enhance GaN-on-silicon semiconductor manufacturing. The funding supports the production of GaN chips for high-performance and energy-efficient applications across automotive, datacenter, IoT, aerospace, and defense sectors.

- In November 2024, MACOM Technology Solutions Inc. received a DoD-funded project under the CHIPS and Science Act to develop advanced GaN on silicon carbide process technologies. The initiative focuses on developing semiconductor manufacturing processes designed for high-voltage operation and millimeter-wave RF and microwave applications.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trend analysis and highlights vital Application developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 18.60% from 2026 to 2034 |

|

|

Segmentation |

By Device Type

By Material Type

By Application

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 9.55 billion by 2034.

In 2025, the market size stood at USD 2.03 billion.

The market is projected to grow at a CAGR of 18.60% during the forecast period.

By application, the radar systems segment is leading the market.

Growing demand for compact, high-performance devices is a key factor driving expansion of the market.

Qorvo, Inc., Sumitomo Electric Device Innovations, NXP Semiconductors N.V., MACOM Technology Solutions, and Analog Devices, Inc. are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us