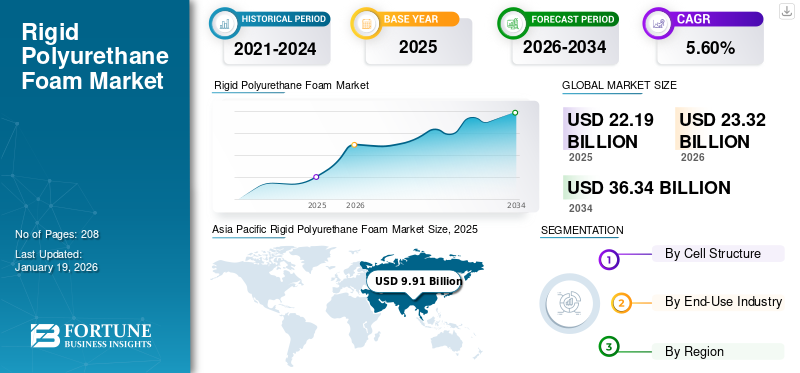

Rigid Polyurethane Foam Market Size, Share & Industry Analysis, By Cell Structure (Closed-cell and Open-cell), By End-Use Industry (Building and Construction, Automotive, Furniture, Packaging, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global rigid polyurethane foam market size was valued at USD 22.19 billion in 2025 and is projected to grow from USD 23.32 billion in 2026 to USD 36.34 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period. Asia Pacific dominated the rigid polyurethane foam market with a market share of 45% in 2025.

The global rigid polyurethane foam (PU) market is witnessing significant growth opportunities, driven by applications such as construction, automotive, and packaging. It is a high-performance insulation material known for its excellent thermal resistance, lightweight nature, and structural strength. It is produced by the chemical reaction of polyols with diisocyanates, forming a closed-cell or open-cell structure that provides superior insulating properties. The foam is available in panels, sprays, and molded forms, offering flexibility for various applications. It also contributes to mechanical reinforcement in structural components while maintaining minimal weight. Growing need from the construction and automotive sectors, particularly in emerging economies, will significantly drive the growth of the rigid PU foam industry.

Main players working in the industry include BASF, Covestro AG, Huntsman International LLC., Dow, and General Plastics Manufacturing Company.

RIGID POLYURETHANE FOAM MARKET TRENDS

Increased Use of Polyurethane Foam in Cold Chain Logistics to Fuel Market Expansion

The global expansion of cold chain logistics is a key trend driving growth in the rigid polyurethane foam industry. With rising demand for temperature-sensitive goods, including pharmaceuticals, vaccines, fresh produce, and frozen foods, reliable insulation has become critical for maintaining product quality during storage and transport. Rigid foam’s excellent thermal insulation and lightweight properties make it ideal for cold storage facilities, refrigerated transport units, and packaging solutions.

MARKET DYNAMICS

MARKET DRIVERS

Growing Importance of Building Energy Efficiency & Green Construction is Fueling the Market

The increasing global focus on energy efficiency and sustainability in buildings is a major driver of the rigid polyurethane foam market. Rigid polyurethane foam offers excellent thermal insulation properties, making it a preferred material for walls, roofs, floors, and structural panels. In addition, rising construction activity in both developed and emerging economies creates significant demand for effective insulation solutions. The foam's ability to reduce energy loss, lower utility costs, and improve indoor comfort makes it highly desirable in residential, commercial, and industrial sectors. With increasing demand for sustainable construction, polyurethane foam becomes an important growth driver in the market.

MARKET RESTRAINTS

Volatility in Raw Material Prices Could Restrain Market Growth

The rigid polyurethane foam market is highly sensitive to fluctuations in raw material prices, particularly polyols, isocyanates, and other petrochemical derivatives. Price volatility is often driven by crude oil market dynamics, supply chain disruptions, and geopolitical tensions. These uncertainties directly affect production costs for foam manufacturers, making it challenging to maintain competitive pricing and stable profit margins. Sharp increases in raw material costs can discourage end-users, particularly in price-sensitive sectors such as construction and packaging, from adopting polyurethane foam products.

MARKET OPPORTUNITIES

Rising Demand for Bio-Based Polyurethane Foam Poses a Strong Opportunity for the Market

The increasing global focus on sustainability presents significant opportunities for the development of bio-based rigid polyurethane foam. Growing environmental concerns over petrochemical dependency and regulatory pressures to reduce carbon footprints have accelerated research into renewable alternatives. Bio-based foam formulations, derived from plant oils or other renewable resources, offer comparable performance while addressing environmental impact concerns. Manufacturers are actively investing in developing eco-friendly variants that meet insulation, durability, and thermal resistance standards required in construction, refrigeration, and transportation.

- As per the India Brand Equity Foundation (IBEF), sustainable or green architecture is rapidly gaining momentum in India. India holds the third rank in the US Green Building Council's list of countries for Leadership in Energy and Environmental Design (LEED) in 2023. As the population of India, particularly in urban areas, is increasing, the need for sustainable and environmentally-friendly materials such as bio-based rigid polyurethane foam for green construction is also increasing.

MARKET CHALLENGE

Availability of Alternative Insulation Materials Could Challenge Market Growth

The presence of alternative insulation materials such as biopolymers, expanded polystyrene, and fiberglass poses challenges for the rigid polyurethane foam market growth. These alternatives are often perceived as cost-effective, readily available, and easier to handle in certain applications, especially in price-sensitive markets such as residential construction. Additionally, consumers consider biopolymer materials more environmentally friendly due to their non-petrochemical composition and recyclable properties. Moreover, stringent fire safety regulations in some countries also favor non-combustible insulation products.

TRADE PROTECTIONISM

Trade protectionism is emerging as a critical factor influencing the global rigid polyurethane foams industry. Increasing tariffs, import restrictions, and local content requirements implemented by various governments are reshaping international trade flows for raw materials and finished foam products. Key raw materials such as polyols, isocyanates, and specialty additives are often imported, making manufacturers vulnerable to geopolitical tensions, trade disputes, and fluctuating regulatory policies.

Download Free sample to learn more about this report.

Segmentation Analysis

By Cell Structure

Closed-cell Segment Leads, Driven by its Durability

Based on cell structure, the industry is divided into closed-cell and open-cell.

Closed-cell is the dominant segment, preferred for its superior thermal insulation, structural strength, and moisture resistance. The closed-cell structure minimizes water absorption, making it ideal for applications exposed to moisture, such as building insulation, roofing, and industrial refrigeration. Its high compressive strength also provides structural support, contributing to durability and energy efficiency in residential, commercial, and industrial construction.

Open-cell rigid polyurethane foam offers a lightweight, flexible, and cost-effective insulation solution for various applications. Unlike its closed-cell counterpart, open-cell foam has a lower density and provides excellent sound absorption, making it ideal for interior insulation in residential and commercial buildings. Its flexibility allows it to expand and fill gaps, improving air sealing and enhancing energy efficiency within building structures. Open-cell foam is often used in wall cavities, attics, and ceilings where vapor absorbency is desirable.

By End-Use Industry

Building and Construction Segment Dominates due to Superior Priorities of Polyurethane Foam

Based on end-use industry, the market is fragmented into building and construction, automotive, furniture, packaging, and others.

The building and construction industry is the largest end-user of rigid polyurethane foam, driven by the need for high-performance insulation to meet stringent energy efficiency regulations. Polyurethane foam’s superior thermal resistance, durability, and structural benefits make it an essential material for insulating walls, roofs, floors, and foundations in residential, commercial, and industrial buildings. It contributes to energy savings, occupant comfort, and reduced greenhouse gas emissions, aligning with global climate goals.

The automotive industry represents another growing application area for rigid polyurethane foam, fueled by the sector’s focus on lightweight materials, energy efficiency, and improved vehicle performance. Polyurethane foam is widely used for thermal insulation, acoustic control, and structural reinforcement in passenger vehicles, commercial fleets, and electric vehicles (EVs). Its lightweight properties help reduce overall vehicle weight, thereby enhancing fuel efficiency and contributing to emissions reduction efforts.

The furniture industry also utilizes rigid polyurethane foam for its versatility, comfort, and structural properties in various product designs. Foam is commonly used in the manufacturing of furniture frames, seating components, mattresses, and ergonomic support products. Its excellent load-bearing capacity and durability contribute to the production of long-lasting, lightweight furniture solutions suitable for residential and commercial applications. Polyurethane foam offers design flexibility, allowing manufacturers to create complex shapes.

Rigid Polyurethane Foam Market Regional Outlook

By geography, the market is categorized into Europe, Latin America, the Middle East and Africa, Asia Pacific, and North America.

Asia Pacific

Asia Pacific Rigid Polyurethane Foam Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest rigid polyurethane foam market size of USD 9.91 billion in 2025, driven by rapid urbanization, infrastructure development, and rising demand for energy-efficient construction materials. Nations such as China, India, Japan, and South Korea are investing heavily in residential, commercial, and industrial projects where heat insulation is a priority. The expanding middle class and growing emphasis on sustainable buildings are accelerating the use of polyurethane foam in insulation panels, spray foam, and structural components. Additionally, the region's oil and gas sector, particularly in Southeast Asia, uses rigid PU foam for pipeline insulation and offshore projects.

North America

North America holds a significant share of the rigid polyurethane foam market, driven by strict energy efficiency regulations and a well-established construction sector. The U.S. and Canada prioritize sustainable building materials to meet green building standards, boosting demand for high-performance insulation. The region’s colder climate further contributes to the widespread use of polyurethane foam in residential and commercial insulation panels, spray foam, and pipe insulation. Additionally, the growing adoption of energy-efficient appliances and refrigeration systems continues to expand foam consumption across manufacturing industries.

Europe

Europe represents a significant market for rigid polyurethane foam, driven by stringent building energy regulations and sustainability initiatives. The region’s strong focus on reducing carbon emissions has led to widespread adoption of energy-efficient insulation materials, especially in the residential and commercial construction industry. Europe’s well-established electronic appliances further drive foam usage in refrigeration applications. The automotive and transportation sectors also contribute to market expansion, leveraging lightweight insulation solutions to support emission reduction goals.

Latin America

Latin America presents steady growth opportunities for the rigid polyurethane foam industry, driven by increasing construction activities, industrial development, and rising awareness of energy-efficient materials. Countries such as Brazil, Mexico, and other countries are investing in infrastructure modernization and residential construction, where effective insulation is essential to reduce energy consumption and improve building performance. The region’s warm climate conditions further amplify demand for insulation materials in both new construction and renovation projects.

Middle East & Africa

The Middle East and Africa region offers steady growth potential for the rigid polyurethane foam market, primarily driven by expanding construction activities, energy sector investments, and extreme climate conditions. The region’s focus on enhancing building energy efficiency, especially in the Gulf countries, supports the demand for high-performance insulation materials. Polyurethane foam is widely used in residential and commercial buildings to reduce cooling loads and improve indoor comfort, particularly in hot desert environments.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Capacity Expansion to Strengthen their Market Presence

The rigid polyurethane foam market is highly competitive, with key industry participants emphasizing on sustainability, mergers & acquisitions, and capacity expansion to reinforce their market presence. Key global companies include BASF, Covestro AG, Huntsman International LLC., Dow, and General Plastics Manufacturing Company. These players compete on the basis of cost efficiency, regional dominance, and product innovation. While global leaders lead in developed markets, regional players are growing aggressively in emerging economies, intensifying competition in the market.

LIST OF KEY RIGID POLYURETHANE FOAM COMPANIES PROFILED

- BASF (Germany)

- Covestro AG (Germany)

- Huntsman International LLC. (U.S.)

- Dow (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)s

- Rogers Corporation. (U.S.)

- Amino (Brazil)

- General Plastics Manufacturing Company (U.S.)

- Performix by Plasti Dip International (U.S.)

- Krupashree Peb Private Limited (India)

KEY INDUSTRY DEVELOPMENTS

- October 2022: BASF launched new sustainable products in their rigid polyurethane (PU) foam segment, namely, Elastopor, Elastopir, and spray foam Elastospray, which contain recycled PET. These products are ideal for the production of facade and roof elements of buildings used for industrial purposes.

- March 2022: Dow announced a new product addition of VORASURF - the low cyclics, low volatile silicone surfactants. This product expansion is aimed at supporting rigid PU foam formulations and addressing key energy efficiency and sustainability opportunities in construction and spray applications.

- February 2022: Covestro AG launched climate-neutral MDI (methylene diphenyl diisocyanate) for its polyurethane rigid foam insulation. The new MDI grades of products can be used in various applications such as construction, cold chain, and the automotive sectors.

- May 2025: Huntsman International LLC launched an intumescent polyurethane coating system, which is developed for automotive applications, which are useful in passive fire protection of metal and composite substrates used in electric vehicles.

- April 2024: Huntsman International LLC launched a new product named SHOKLESS, a durable polyurethane foam, designed to protect electric vehicle batteries. The new product offers a flexible choice for safeguarding the structural integrity of EV batteries in case of impact or a thermal event.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.6% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation

|

By Cell Structure · Closed-cell · Open-cell |

|

By End-Use Industry · Building and Construction · Automotive · Furniture · Packaging · Others |

|

|

By Geography · North America (By Cell Structure, End-Use Industry, and Country) o U.S. (By End-Use Industry) o Canada (By End-Use Industry) · Europe (By Cell Structure, End-Use Industry, and Country) o Germany (By End-Use Industry) o U.K. (By End-Use Industry) o France (By End-Use Industry) o Italy (By End-Use Industry) o Rest of Europe (By End-Use Industry) · Asia Pacific (By Cell Structure, End-Use Industry, and Country) o China (By End-Use Industry) o Japan (By End-Use Industry) o India (By End-Use Industry) o Rest of Asia Pacific (By End-Use Industry) · Latin America (By Cell Structure, End-Use Industry, and Country) o Brazil (By End-Use Industry) o Mexico (By End-Use Industry) o Rest of Latin America (By End-Use Industry) · Middle East & Africa (By Cell Structure, End-Use Industry, and Country) o GCC (By End-Use Industry) o South Africa (By End-Use Industry) o Rest of Middle East & Africa (By End-Use Industry) |

Frequently Asked Questions

The global rigid polyurethane foam market was valued at USD 22.19 billion in 2025 and increased to USD 23.32 billion in 2026, with the market projected to reach USD 36.34 billion by 2034.

In 2025, the market value stood at USD 9.91 billion.

The market is expected to exhibit a CAGR of 5.6% during the forecast period (2026-2034).

By cell structure, the closed-cell segment leads the market.

Growing building and construction industry is the key factor in driving the market.

BASF, Covestro AG, Huntsman International LLC., Dow, and General Plastics Manufacturing Company are some of the leading players in the market.

Asia Pacific dominates the market in terms of share.

The growing green construction industry in developing countries is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us