Sports Technology Market Size, Share & Industry Analysis, By Technology (Wearable Technology, AI and ML, GPS & Motion Tracking, VR/AR, Cloud & Big Data IoT, and Others), By Application (Performance Enhancement, Injury Prevention & Recovery, Talent Scouting & Recruitment, Fan Experience & Engagement, Broadcast & Media Analytics, Fitness & Health Monitoring, and Game Strategy & Tactical Analysis), By End-user (Sports Organizations & Leagues, Broadcasters and Media Companies, Sports Clubs, and Others), and Regional Forecast, 2026 – 2034

SPORTS TECHNOLOGY MARKET SIZE AND FUTURE OUTLOOK

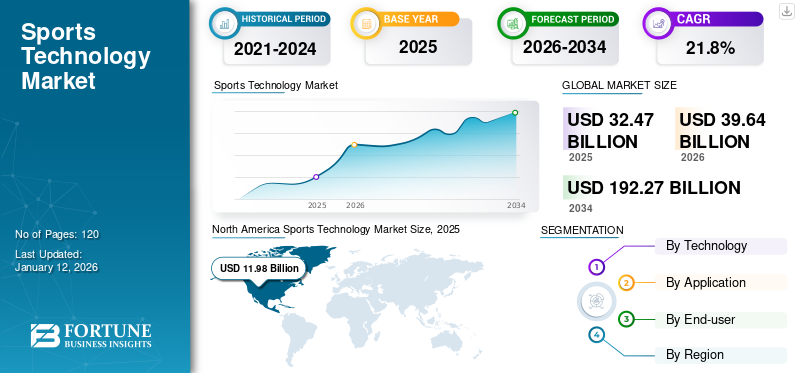

The global sports technology market size was valued at USD 32.47 billion in 2025. The market is projected to grow from USD 339.64 billion in 2026 to USD 192.27 billion by 2034, exhibiting a CAGR of 23.10% during the forecast period. North America dominated the sports technology market with a market share of 36.9% in 2025.

Sports technology refers to the use of various technologies, such as wearable technology, AI and ML, GPS tracking, virtual reality, and others, to enhance professional athletic performance, analysis, training, and overall sports experience.

Companies are increasingly focusing on the adoption of Virtual Reality (VR)/Augmented Reality (AR) to offer fans a more immersive and convenient way to enjoy sports from the comfort of their homes, often at a lower cost than attending live events. This trend is gaining rapid pace to boost market growth. For instance,

- According to industry experts, 34% of fans globally visited sporting venues often in 2023, compared to 47% in 2019.

- Also, 70% of fans prefer to consume sports content on smartphones rather than visiting sporting venues.

The market is dominated by established key players, such as Catapult, Garmin Ltd., Apple Inc., and Samsung. These players focus on engaging in partnerships with sports leagues and broadcasting companies to enhance the live-streaming experience for fans across the globe.

The COVID-19 pandemic had a positive impact on the market. With empty stadiums, clubs introduced AI-driven fan engagement tools, including virtual stadiums, online watch parties, and digital collectibles. During the lockdown period, teams started using wearables, video analytics, and virtual coaching tools to maintain training and fitness remotely. Due to this, tools such as Catapult, Hudl, and WHOOP witnessed an increased demand for remote performance tracking.

IMPACT OF TARIFF RECIPROCAL

Tariffs on imported hardware equipment used in the sports industry, such as wearable devices, VR headsets, sensors, and biometrics devices, escalate manufacturing and retail prices. Companies dependent on international suppliers for components may face higher production costs, affecting margins and pricing strategies. For instance,

- The U.S.-based sports technology firms importing components required to manufacture wearable devices from China may face higher costs due to tariffs imposed during trade disputes, which can reduce competitiveness.

IMPACT OF GENERATIVE AI

Increasing Need for Performance Enhancement and Coaching Aids Market Growth

Generative AI creates virtual training scenarios, replicating real opponents’ playing styles, which helps athletes train smartly and safely. Gen AI plays an important role in generating customized game strategies by analyzing opponent data, previous matches, and player statistics. This approach helps coaches in making optimal decisions. Further, this technology can auto-generate clips showcasing key plays, highlights, and mistakes, which helps in reducing post-game review time. Generative AI models simulate how athletes move and sprint their bodies and help them prevent fatigue-related risks.

In addition, GenAI enables sports organizations to be more personalized and innovative, and reduces routine tasks to benefit leadership and on-field operations. For instance,

- Natural Language Processing (NLP) techniques such as GPT-3 are used to auto-generate sports commentary from live match events. This AI-based commentary is capable of summarizing key moments of the game.

MARKET DYNAMICS

Market Drivers

Growing Demand for AI and Machine Learning in Performance Analytics Drives Market Growth

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) in sports analytics changed the way professional athletes train, perform, and recover. Sports professionals leverage these advanced technologies to enhance their performance and achieve new heights in their professional careers. Machine learning uses algorithms and statistical models to analyze complex data sets and offer players and coaching staff deeper and more precise insights into every aspect of athletic performance, such as strengths, weaknesses, and areas of improvement. For instance,

- The National Football League (NFL) is using AI technology to study and analyze game videos, boosting the performance of their players.

- Also, Major League Baseball (MLB) is using AI to help teams make smarter decisions about their athletes.

Owing to these factors, the growing adoption of AI and ML technologies by sports organizations is boosting the sports technology market growth.

Market Restraints

High Implementation Cost of Technology May Hinder Market Growth

The higher cost of wearable devices and software platforms enabled with advanced technology may cause inconvenience for smaller clubs and sports bodies, limiting the usage of this technology in the sports industry. Upgrading a conventional stadium infrastructure with an advanced camera setup and modern facilities to transform it into a smart stadium involves a huge investment.

Moreover, with the increasing use of large datasets for analysis, the risk related to data privacy and security concerns from hackers also increases. Thus, these factors are expected to hinder market growth.

Market Opportunities

Rising Demand for Digitization of Fan Engagement through Apps and AR/VR Creates Lucrative Opportunities for Market Growth

Augmented Reality and Virtual Reality (AR/VR) are anticipated to transform the way fans engage with sports. These innovative technologies are used in live sports broadcasts to enable fans to watch the various sports games in virtual reality. For instance,

- According to Altman Solon’s 2022 Global Sports Survey, globally, sports fans’ awareness of AR and VR technologies in sports is still relatively low, at only 20%. In the U.S., Brazil, the UAE, and India, fans are more aware of the use of AR/VR technology in live sports broadcasts.

Further, Virtual Reality (VR) technology improves fan interactions through stadium tours, virtual fan experiences, and live games. Considering these factors, fans are planning to purchase VR devices in the coming years. With the use of VR technology, fans can enjoy the game comfortably by sitting in their homes, avoiding waiting time to purchase tickets and enter stadiums.

Some major football and basketball leagues enable fans to watch games in 360-degree virtual environments. This technology helps fans who cannot travel to stadiums. Thus, these factors play an important role in driving market growth during the forecast period.

Sports Technology Market Trends

Increasing Adoption of Wearable Devices by Sports Athletes is Fueling Market Growth

Wearable technology has a significant impact on the sports industry. Wearable devices that athletes wear physically are modern electronic devices, such as fitness trackers, smartwatches, smart rings, and more. These devices track, transmit, and analyze the personal data of an athlete, such as their movements, sleep patterns, heart rate, and several aspects of the human body. The data collected from these devices assists the coaching staff in detecting the weaknesses of athletes and training them smartly. Many football clubs use GPS trackers to monitor players’ running patterns. For instance,

- The National Football League (NFL) has implemented wearable device technology to monitor player health and reduce the risk of injuries.

- Also, National Hockey League (NHL) teams use wearable device technology to measure players’ heart rates and improve training efficiency.

Thus, these factors play a crucial role in fueling the sports technology market growth during the forecast period.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Technology

Rising Demand for Performance Monitoring and Optimization Boosted Adoption of Wearable Technology

Based on technology, the market is divided into wearable technology, AI and ML, GPS & motion tracking, VR/AR, cloud & big data IoT, and others (computer vision, etc.).

Wearable technology captured the largest market share of 32.29% in 2025, as professional athletes mainly use it to track speed, distance, heart rate, body temperature, and movement efficiency. These devices provide data-driven insights that help the coaching team to train athletes in a personalized way.

VR/AR technology is anticipated to grow at the highest CAGR during the forecast period, as fans can enjoy interactive experiences at home or in the stadium. Augmented reality technology provides real time data of players, graphics, and play visualization, which plays a vital role in increasing fan engagement to watch sports. Further, this technology helps coaches and players review match footage in 360-degree views.

By Application

Growing Adoption of AI and Data Analytics Boosted Popularity of Performance Enhancement

Based on application, the market is categorized into performance enhancement, injury prevention & recovery, talent scouting & recruitment, fan experience & engagement, broadcast & media analytics, fitness & health monitoring, and game strategy & tactical analysis.

Performance enhancement captured the largest market share in 2024. Sports organizations and coaching teams are increasingly using AI-powered tools to analyze athlete performance and create personalized training recommendations. Video analytics platforms help coaches break down game footage, identify players’ weaknesses, and suggest improvements. The segment is predicted to capture 22.63% of the market share in 2026.

The fan experience & engagement segment is expected to grow at the highest CAGR of 26.70% during the forecast period, as smart stadiums provide stadium apps that enable fans to upgrade their seats, order food, access personalized content, and access interactive maps. Furthelr, smart stadiums use AI and IoT technologies for crowd control, real-time updates, and targeted advertising.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Surge in Demand for Performance and Tactical Enhancement Propelled Adoption of Sports Technology in Sports Organizations & Leagues

Based on end-user, the market is classified into sports organizations & leagues, broadcasters and media companies, sports clubs, and others (athletes, coaches & trainers, etc.).

Sports organizations & leagues captured the highest market share in 2024, as wearables and GPS tracking devices are increasingly used by leagues such as the National Football League (NFL), National Basketball Association (NBA), and English Premier League (EPL) to collect real-time athlete performance data. Moreover, systems such as Hudl, Catapult, and STATSports analyze player movements, tactics, and fitness by using wearable devices. The segment is anticipated to attain 35.39% of the market share in 2026.

Broadcasters and media companies are anticipated to grow at the highest CAGR of 26.60% during the forecast period. These companies are increasingly using augmented reality technology to enhance broadcasts with dynamic visuals and real-time stats overlays. Additionally, they use 360-degree and virtual reality streaming for seats and immersive viewing experiences, especially in motorsports and football games, to attract more fans.

SPORTS TECHNOLOGY MARKET REGIONAL OUTLOOK

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa and Asia Pacific.

North America

North America Sports Technology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest sports technology market share in 2025. In the region, sports such as American football, baseball, basketball, and golf have dominated the market. However, emerging games such as soccer, esports, and ice hockey are also gaining popularity among people. Esports are becoming more well-known among youngsters, owing to investments of big brands in tournaments, sponsorships, and gaming events. As a result of these factors, North America is expected to become a hub for more niche sports. For instance,

- In April 2025, Utah Jazz and Utah Hockey Club owner Ryan Smith invested over USD 1 billion to launch tech startups operating within sports in partnership with private equity firm Accel. Through this investment, Ryan Smith plans to expand its investment team.

North America Sports Technology Market Size, 2021-2034 (USD Billion)

In the U.S., people are very enthusiastic about sports. National Football League (NFL), National Hockey League (NHL), National Basketball Association (NBA), Major League Soccer (MLS), and Major League Baseball (MLB) are some of the major sports leagues in the country. The U.S. is a leader in sports entertainment, as it hosts major events such as the Super Bowl and the NBA finals to attract huge audiences. For instance,

- In July 2024, Catapult extended its strategic partnership with USA Volleyball. Through this partnership, the company provided its innovative athlete monitoring technology to the USA Volleyball national team for the 2024 Summer Olympics in Paris and helped them to enhance their performance.

These factors play an important role in fueling market growth across the U.S. the U.S. market continues to grow, predicted to be valued at USD 10 billion in 2026.

South America

The adoption of sports technology is growing significantly in South America, owing to the region’s passionate sports culture, particularly around football (soccer), and a rising interest in innovation to enhance athlete performance and fan engagement. Leading football clubs in Brazil, Argentina, and Colombia are significantly using GPS trackers and biometric wearables to optimize player performance. Furthermore, stadiums across the region are implementing AI, IoT, and 5G technology for security monitoring and enhancing the fan experience in the stadiums.

Europe

Europe is the second largest market, expected to be valued at USD 9.79 billion in 2026, exhibiting a CAGR of 22.10% during the forecast period. In Europe, sports technology is growing at a prominent pace. Europe is home to many of the world’s most prestigious sports leagues, especially tennis, soccer, and rugby. The U.K. market is set to reach a valuation of USD 1.82 billion in 2026. The U.K., Spain, France, Italy, and Germany are home to some of the biggest soccer clubs with global fanbases. These sports clubs generate huge revenues through broadcasting rights and sponsorships. Moreover, Europe is experiencing a growing interest in niche sports such as motorsports, handball, and cycling. Thus, with growing fan bases, tournaments become more accessible in the region. For instance,

- In February 2025, Sportradar Group AG, a Switzerland-based company, engaged in a partnership with Major League Baseball (MLB). Through this partnership, the company aims to provide MLBs with complete statistical data and Audiovisual (AV) content and support future growth opportunities.

Germany is projected to hit USD 1.87 billion in 2026, while France is poised to be valued at USD 1.31 billion in the same year.

Middle East & Africa

The Middle East & Africa is the fourth leading region, expected to showcase noteworthy growth with a valuation of USD 2.94 billion in 2026. Increasing focus on hosting international events to accelerate digital transformation in sports is fueling market growth. In 2022, Qatar hosted the FIFA World Cup, where the country invested heavily in smart stadiums. For instance,

- According to industry experts, the market value of sports tourism in the Middle East was approximately USD 600 billion in 2022. Moreover, the projected annual growth for the region’s sports industry by 2026 is 8.7%.

- In December 2024, over USD 65 billion was invested in sports development in GCC countries. This investment is expected to boost sports industry growth in the region.

The GCC market is estimated to reach a value of USD 0.77 billion in 2025.

Asia Pacific

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region is witnessing a rapid shift in the sports sector, driven by infrastructure development and increased investment. China is estimated to reach a valuation of USD 2.37 billion in 2026. India, China, Australia, and Japan are massively investing in sports, with an emphasis on cricket, soccer, and basketball. Additionally, Esports are thriving in South Korea and China, with growing sponsorships creating a million-dollar industry. These factors are expected to fuel market growth across the region. For instance,

- In August 2024, Catapult launched an innovative sideline video solution for football, owing to growing demand worldwide. Earlier in 2024, the National Collegiate Athletics Association (NCAA) Football Rules Committee officially permitted the usage of sideline video solutions for live review.

India is expected to stand at USD 1.57 billion in 2026, while Japan is poised to reach USD 2.10 billion in the same year.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Companies are Implementing Acquisition and Collaboration Strategies to Gain a Strong Foothold

Industry participants are concentrating on expanding their global geographical presence by showcasing industry-specific services. Key industry participants are adopting initiatives such as acquisitions and partnerships to gain a competitive edge across the region. Moreover, companies are also introducing new solutions to expand their consumer base. Increased R&D spending for product innovations is enhancing market expansion. Therefore, leading players are executing their strategic approaches to maintain their competitive edge in the market.

List of Key Sports Technology Companies Profiled:

- Apple Inc. (U.S.)

- Samsung (South Korea)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Catapult (Australia)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Garmin Ltd. (U.S.)

- Johnson Controls (Ireland)

- Huawei Technologies Co., Ltd. (China)

- Schneider Electric (France)

- NEC Corporation (Japan)

- Hawk-Eye Innovation Ltd. (U.S.)

- Sportradar AG (Switzerland)

- Dream Sports Group (India)

- HCL Technologies Ltd. (India)

- Panasonic Corporation (Japan)

- Sony Corporation (Japan)

- Genius Sports Group (U.K.)

- Nacsport (Spain)

- Honeywell International Inc. (U.S.)

….and more

KEY INDUSTRY DEVELOPMENTS:

- April 2025: La Liga leads in AI expertise worldwide, focusing on the Middle East and the U.S. The AI technology will help La Liga provide effective match analysis and automate real-time video content for digital platforms.

- March 2025: Catapult launched Vector 8, an athlete performance monitoring platform. This platform will enable teams and sports clubs to make accurate and real-time decisions through live experiences. This platform is expected to transform the future of the athlete monitoring experience.

- March 2025: Sportradar Group AG acquired IMG ARENA and its global sports betting rights portfolio. Through this acquisition, the company aims to enhance its content and product offering and provide its platform to various games, including tennis, soccer and basketball.

- January 2025: Catapult increased its R&D spending on wearable technology, owing to a rise in women's professional sports and wearable integration. These technologies include GPS devices and video analysis software, which are essential to evaluate the performance of athletes.

- August 2024: Cisco became the official WiFi partner for Allianz Arena, located in Munich, Germany. The partnership includes the deployment of 1,500 WiFi 6 access points. In addition, the company will roll out 5G and real-time analytics to optimize fan experiences.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Catapult, Garmin Ltd., Apple Inc., Microsoft, and Samsung, are increasingly adopting IoT, AI, and Machine Learning (ML) technologies to enhance the smart stadium experience and provide detailed analysis of athlete performance. Furthermore, major leagues and tech firms are forming alliances to integrate cutting-edge tools. For instance,

- Microsoft partnered with the National Basketball Association (NBA) to provide advanced security and scalability using its cloud platform.

- In June 2021, Catapult acquired SBG Sports to show consolidation and expansion strategies. Through this acquisition, Catapult aims to accelerate its video analysis technology capabilities and provide an enhanced platform for sports leagues worldwide.

These factors are expected to create a lucrative opportunity for market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Application

By End-user

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is expected to reach USD 192.27 billion by 2034.

In 2025, the market was valued at USD 32.47 billion.

The market is projected to grow at a CAGR of 21.8% during the forecast period.

By application, the performance enhancement segment led the market.

Growing demand for AI and machine learning in performance analytics drives market growth.

Apple Inc., Samsung, Cisco Systems, Inc., IBM Corporation, Catapult, Telefonaktiebolaget LM Ericsson, Garmin Ltd., Johnson Controls, Huawei Technologies Co., Ltd., and Schneider Electric are the top players in the market.

North America held the highest market share in 2025.

By end-user, broadcasters and media companies are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us