Synthetic Graphite Market Size, Share & Industry Analysis, By Product Type (Graphite Electrode, Graphite Blocks, Graphite Powder, and Others), By Application (Refractories, Batteries, Recarburising, Foundries, Lubricants, Friction Materials, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

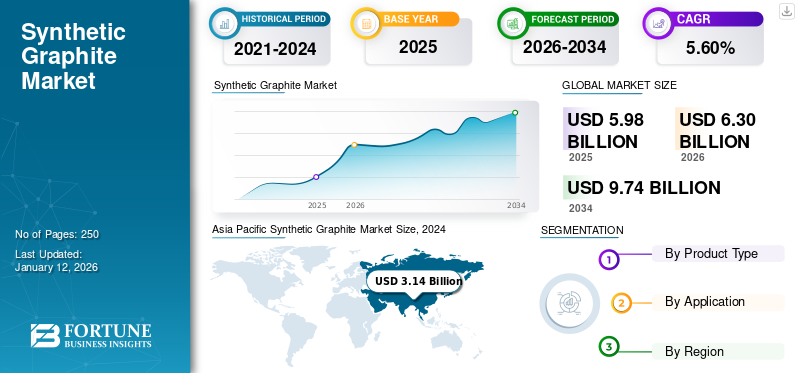

The global synthetic graphite market size was valued at USD 5.98 billion in 2025. The market is projected to grow from USD 6.30 billion in 2026 to USD 9.74 billion by 2034, exhibiting a CAGR of 5.6% during the forecast period. Asia Pacific dominated the synthetic graphite market with a market share of 56% in 2025.

Synthetic graphite is made from non-graphitic carbon, which is treated at high temperatures. Calcined petroleum coke and coal tar pitch are the primary feedstocks used to make synthetic graphite. It possesses excellent electrical conductivity, resistance to high temperatures, and chemical stability. Consequently, the market is experiencing significant growth, driven by its critical role in various applications such as lithium-ion batteries, metallurgy, and industrial components.

Growing demand for high-quality steel and momentum toward greener steel are fueling the need for Electric Arc Furnace (EAF)- based steel production. Synthetic graphite products are highly utilized in the steelmaking sector, where the graphite electrode serves as a conductive element that transfers electrical energy to the furnace, resulting in the formation of an electric arc that melts the materials. Therefore, the growing demand for EAF-based steel production is set to drive the global market growth during the forecast period.

- According to the South East Asia Iron and Steel Institute (SEAISI), the share of the EAF route in global steel production is anticipated to rise to 40% by 2030.

GLOBAL SYNTHETIC GRAPHITE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 5.98 billion

- 2026 Market Size: USD 6.30 billion

- 2034 Forecast Market Size: USD 9.74 billion

- CAGR: 56% from 2026–2034

Market Share:

- Asia Pacific led the synthetic graphite market in 2025 with a 56% share, rising from USD 3.33 billion in 2025 to USD 3.52 billion in 2026.

- By product type, graphite electrodes held the dominant share due to high demand from EAF-based steel production and EV batteries.

- By application, the refractories segment led the market in 2024, driven by graphite's thermal conductivity, shock resistance, and corrosion resistance.

- The batteries segment is projected to grow significantly during the forecast period, owing to the surge in EV adoption and lithium-ion battery demand.

- China's dominance in synthetic graphite production accounted for around 80% of the global supply in 2024.

Key Country Highlights:

- China: Massive steel production and EV sector growth continue to fuel demand for graphite electrodes. China also leads global synthetic graphite supply and is tightening export controls.

- United States: Growing EV adoption and battery manufacturing capacity drive synthetic graphite demand for anodes in lithium-ion batteries.

- Germany: A strong focus on clean energy, electric mobility, and refractories supports steady synthetic graphite demand.

- Brazil: Abundant graphite reserves and expanding battery-related industries support moderate growth across Latin America.

- Saudi Arabia & UAE: Emerging investments in EVs and battery materials contribute to demand growth in the Middle East & Africa region.

SYNTHETIC GRAPHITE MARKET TRENDS

Rising Technological Innovations to Surge Market Growth

Innovations in production processes by adopting environmentally friendly and optimized methods are expected to boost the synthetic graphite market growth. Advancements such as developing new methods for producing high-quality and efficient graphite using lower energy, and innovations in recycling practices will surge product demand from varied applications. Companies are involved in continuous research and development for optimizing the synthesis processes with the use of techniques such as electric arc furnaces and catalytic graphitization. This will support manufacturers to produce synthetic graphite with better properties and higher purity.

- Asia Pacific witnessed a synthetic graphite market growth from USD 2.97 billion in 2023 to USD 3.14 billion in 2024.

- In December 2024, Graphjet Technology achieved key breakthroughs in catalyzing graphitization to produce high-quality synthetic graphite with its patented green graphite production technology. A differentiator in the process is the proprietary catalyst formula that allows the company to produce high-quality graphite cost-effectively. The company is involved in the development of a patented green graphite production technology, which enables the production of graphite and graphene from palm kernel shells.

MARKET DYNAMICS

MARKET DRIVERS

Surging Demand for Refractories to Drive Market Growth

The global market is experiencing significant growth, driven by its unique set of properties required in refractories. Graphite, as a substantial mineral, plays a crucial role in refractories by enhancing thermal conductivity, improving thermal shock resistance, and reducing corrosion, ultimately boosting the performance and lifespan of refractory materials used in high-temperature applications. Graphite's high thermal conductivity helps dissipate heat quickly and evenly, minimizing stress within the refractory material. Therefore, surging demand for refractories will drive the market growth.

MARKET RESTRAINTS

Supply Chain Concentration May Hamper Supply-Demand Equation in the Market

According to the Minor Metals Trade Association (MMTA), China alone produces more than half of the graphite that is synthetically manufactured globally. In October 2023, China’s Ministry of Commerce and the General Administration of Customs announced that from December 2023, the nation would impose export restrictions on key lithium-ion battery anode raw materials, including high-purity synthetic graphite and its products. Therefore, China's dominance in synthetic graphite production poses supply risks for other regions, especially amid geopolitical tensions and export restrictions.

- According to the Minor Metals Trade Association (MMTA), China accounted for around 80% of synthetic graphite production globally in 2024.

MARKET OPPORTUNITIES

Surge in Electric Vehicle Adoption to Create Lucrative Opportunities in the Market

The surge in EV adoption globally has heightened the demand for lithium-ion batteries, where synthetic graphite is used as an anode material in battery production. Its properties, such as high purity and consistency, make it preferable over natural graphite in high-performance batteries. Synthetically manufactured graphite improves electrical conductivity and stores lithium ions, offering benefits such as faster charging and longer battery life compared to natural graphite. Therefore, a rise in EV demand is set to create lucrative opportunities in the market.

- According to the International Energy Agency, in 2023, around 14 million new electric vehicles were registered globally.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Graphite Electrode Segment Held Dominant Share Due to High Demand from EAF-Based Steel and EV Batteries

Based on product type, the market is segmented into graphite electrode, graphite blocks, graphite powder, and others.

The graphite electrode segment held the largest global synthetic graphite market share in 2024. Graphite electrodes are used to transfer electrical energy to melt steel in electric arc furnaces. Graphite electrodes offer several advantages, including high thermal and electrical conductivity, resistance to thermal shock, and chemical inertness, making them suitable for various applications, including steelmaking and batteries. Growing demand for EAF-based steel and EV batteries will consume the major chunk of global graphite production and will hold the dominant position in the market.

Graphite blocks are produced by the petroleum coke process. These blocks are mainly used in solar energy storage and lithium-ion batteries. These blocks also find application in electrical discharge machining (EDM) and various heat transfer applications. Their low thermal expansion, chemical stability, ease of machining, lightweight nature, and ability to resist thermal shock make graphite blocks essential for various industrial uses. This is expected to drive the segment growth significantly.

By Application

Refractories Segment Dominated the Market Due to Graphite’s High Utilization

Based on application, the market is segmented into refractories, batteries, recarburising, foundries, lubricants, friction materials, and others.

The refractories segment held the largest global market share in 2024. Synthetic graphite is used in refractories to enhance their performance by increasing thermal conductivity and reducing thermal gradients. For instance, its high thermal conductivity helps to quickly dissipate heat, reducing thermal gradients between the hot and cold faces of the refractory. Also, it is not wetted by molten slag, thus preventing slag from penetrating the refractory and causing corrosion, ultimately increasing the lifespan of the refractories. Therefore, the refractories segment is poised to remain a major application for the product in the foreseen period.

The batteries segment is expected to grow at a significant rate during the forecast period. The product is used as an anode material in lithium-ion battery cells in various ratios as per the required performance, battery model, and cost. Hence, the increasing demand for Lithium-ion Batteries (LIB) is anticipated to drive segment growth.

Synthetic Graphite Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Synthetic Graphite Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest global synthetic graphite market share in 2026, generating market revenue worth USD 3.52 billion. Asia Pacific is a major refractory material consumer and electrode producer. Synthetically produced graphite is highly utilized in these two applications, making Asia Pacific the dominant region globally.

In Asia Pacific, China dominates the regional market due to the country’s massive steel production capacity and continuously expanding EV sector, which is driving the demand for graphite electrodes. China is the largest graphite electrode producer and consumer, and thus, it will drive the regional demand during the forecast period.

- The China Iron and Steel Association has planned to expand its EAF steel production share in the long-term run and is set to reach the target where steel EAF technology should account for over 30% of total crude steel production by 2035.

North America

North America is the second-largest region in the market. The product demand in North America is projected to surge, driven by the growing electric vehicle (EV) market and the need for lithium-ion battery anodes. As synthetic graphite becomes a dominant material in these applications, there will be significant regional market growth during the forecast period.

- According to the North American Graphite Alliance, the North American region accounts for about 3% of the global graphite reserves.

Europe

Europe is projected to be the second fastest-growing region in the global market. The demand for products comes mainly from refractories. However, the rapidly expanding EV sector is set to become the growth factor of the European market in the forthcoming years.

- According to the ECGA - European Carbon and Graphite Association, the European region imports around 100 kilotons of natural graphite annually, primarily from China, Tanzania, and Mozambique.

Latin America

The Latin American market is expected to grow moderately, driven by the rising demand for electric vehicles (EVs) and energy storage systems. Brazil and Argentina are anticipated to play key roles in the region's growth. Brazil is among the leading areas that have an abundance of graphite reserves, creating a progressive environment for market growth.

Middle East & Africa

The demand for products in the Middle East & Africa is expected to grow due to growth factors such as rising demand for electric vehicles (EVs) and lithium-ion batteries. As synthetic graphite is a key component in battery anodes, product demand is likely to expand from these sectors. Countries, including Saudi Arabia and UAE are exploring and investing in graphite and other battery materials, which will drive regional growth in the coming years.

COMPETITIVE LANDSCAPE

Key Industry Players

Investment in Graphite Electrode and Battery Grade Graphite to Become a Key Strategy in the Market

The global market is concentrated with companies such as Asbury Carbons, Eagle Graphite, HEG Limited, Imerys S.A., and Mineral Commodities Ltd., accounting for a significant market share. The leading companies are positioned to gain a high generation of revenues due to the surging demand for anode materials for lithium-ion batteries, particularly in electric vehicles (EVs) and in energy sectors; graphite anode is a key material. Major companies in the market are focusing on expanding their manufacturing facilities, investing in research and development, and developing infrastructure to meet the growing demand for the product. Major companies such as Novonix, POSCO Chemical, and others are heavily investing in capacity expansion in response to the increasing demand for lithium-ion batteries, particularly for EVs.

LIST OF KEY SYNTHETIC GRAPHITE COMPANIES PROFILED

- Asbury Carbons (U.S.)

- EagleGraphite (Canada)

- HEG Limited (India)

- Imerys S.A. (France)

- Mineral Commodities Ltd. (Australia)

- Nacional de Grafite (Brazil)

- Novonix (Australia)

- SGL Carbon (Germany)

- Superior Graphite (U.S.)

- Tirupati Carbons & Chemicals Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- January 2025: NOVONIX Limited and PowerCo SE have signed an agreement under which NOVONIX will supply high-performance synthetic graphite to meet the needs of PowerCo’s electric vehicle battery gigafactories.

- December 2024: HEG successfully expanded its graphite electrode plant's capacity to 100 kilotons. With this expansion, the company will make it the single largest plant in any location in the entire Western world. This expansion will position HEG to yield cost advantages over other large producers.

- January 2024: Graphano Energy Ltd. announced that it has completed its drilling program on its wholly owned Standard and Lac Aux Bouleaux (LAB) Graphite Properties in Quebec. With this exploration, the company is planning to expand its footprint in the global graphite market and to leverage the growing demand generated from electric vehicles.

- July 2023: Graphite One Inc. announced that the company’s wholly owned subsidiary, Graphite One (Alaska), Inc., was awarded USD 37.5 million in a technology investment agreement grant by the U.S. Department of Defense (DoD).

- June 2023: Superior Graphite announced its plan to construct a new anode materials facility with an investment of USD 180 million. The move will enable the company to meet the rising demand for its product from the electronic vehicles and energy storage industries in Europe and North America.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, product types, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.60% during 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.30 billion in 2026 and is projected to reach USD 9.74 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 3.33 billion.

The market is expected to exhibit a CAGR of 5.60% during the forecast period of 2026-2034.

By application, the refractories segment led the market in 2025.

Surging demand for refractories is expected to drive market growth.

Asbury Carbons, EagleGraphite, HEG Limited, Imerys S.A., and Mineral Commodities Ltd. are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us