Triethylene Glycol Market Size, Share & Industry Analysis, By Application (Natural Gas Dehydration, Solvents, Plasticizers, Humectants, Polyester Resins, and Others), By End-use Industry (Oil & Gas, Automotive, Textile, Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

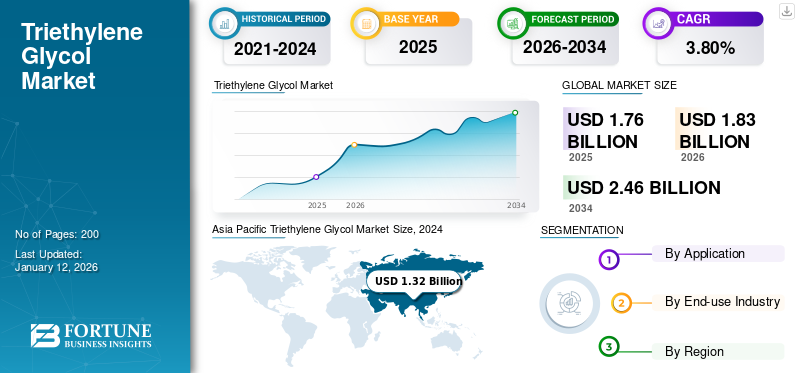

The global triethylene glycol market size was valued at USD 1.76 billion in 2025. The market is projected to grow from USD 1.83 billion in 2026 to USD 2.46 billion by 2034, exhibiting a CAGR of 3.80% during the forecast period. Asia Pacific dominated the triethylene glycol market with a market share of 1.37% in 2025.

Triethylene glycol (TEG), also known as triglycol, is a colorless, viscous liquid with the molecular formula C6H14O4. It is highly used in applications such as natural gas dehydration and as a base for smoke machine fluid. The market is driven by the product’s growing utilization as a humectant, a moisturizer and hydrating agent for skin and hair, a masking agent for odors, a viscosity regulator, and other applications. Its efficacy in offering hydrating effects in skincare products is set to drive market growth during the forecast period.

- According to the World Bank, the European Union alone exported beauty, make-up, and skincare products worth USD 12.8 billion in 2023.

Global Triethylene Glycol Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.76 billion

- 2026 Market Size: USD 1.83 billion

- 2034 Forecast Market Size: USD 2.46 billion

- CAGR: 3.80% from 2026–2034

Market Share:

- Asia Pacific dominated the Triethylene Glycol Market with a 1.37% share in 2025, driven by high demand from natural gas dehydration, plastics, and other industries across China, India, and Southeast Asia.

- By application, Natural Gas Dehydration is expected to retain the largest market share in 2025, supported by TEG’s cost-effectiveness, efficiency in water removal, and its critical role in extending the lifespan of gas pipelines and infrastructure.

Key Country Highlights:

- China: Dominates the regional market due to surging demand from the plastics and gas dehydration sectors; produced 232.4 bcm of natural gas in 2023, up 5.6% from 2022.

- United States: Largest global producer of dry natural gas (37.8 Tcf in 2023), driving TEG demand for water vapor removal and corrosion prevention in pipelines.

- India: Significant growth in plasticizer and humectant use across textiles and automotive applications is boosting TEG consumption.

- Europe: Rising consumption of TEG in chemicals, oil & gas, and cosmetics, supported by a strong R&D presence and high-value personal care industry (~USD 30 billion annually).

- Brazil/Mexico/Argentina: Key drivers of demand in Latin America due to strong oil & gas sectors.

- Middle East & Africa: Moderate growth backed by infrastructure development in UAE, Saudi Arabia, and South Africa, increasing TEG use in cementing aids and chemical solvents.

TRIETHYLENE GLYCOL MARKET TRENDS

Rising TEG Demand in the Automotive Industry to Propel Market Growth

Triethylene glycol finds applications in the automotive industry as a component in coolants, antifreeze and as a solvent or intermediate in the production of various automotive-related products, including brake fluids, lubricants, and plastics. Further, TEG's ability to absorb moisture (hygroscopic quality) makes it highly suitable for removing water from fluids. It is crucial in preventing corrosion and ensuring the proper functioning of hydraulic and brake systems. Increased product demand is attributed to its various beneficial properties and wide range of applications in the automotive industry.

- According to the European Automobile Manufacturers Association, in 2024, global car production reached 75.5 million units.

MARKET DYNAMICS

MARKET DRIVERS

Surging Demand for Natural Gas and Plasticizers to Drive Market Growth

The global triethylene glycol market growth is majorly driven by its essential role in natural gas dehydration processes. These processes remove water vapor to prevent pipeline corrosion and ensure efficient energy production. The increasing demand for natural gas as a cleaner energy source has significantly boosted TEG consumption. Additionally, TEG’s applications as a plasticizer in the automotive and construction industries and its use in producing solvents, lubricants, and polyester resins contribute to an increased market growth rate.

- According to the International Energy Agency (IEA), global natural gas consumption increased by 2.8% in 2024. This rise drives up demand for triethylene glycol, essential in natural gas dehydration processes.

MARKET RESTRAINTS

Environmental and Health Concerns Challenge Market Growth

While TEG is generally considered to have low toxicity, improper disposal or accidental release can lead to environmental degradation, particularly affecting aquatic ecosystems. Additionally, prolonged or excessive exposure to TEG can irritate the eyes, skin, and respiratory system. These environmental and health risks demand stringent handling, usage, and disposal protocols, potentially increasing operational and production costs and thus posing challenges to market growth.

- According to the U.S. Environmental Protection Agency, over-circulation of triethylene glycol in natural gas dehydration systems can lead to increased methane emissions without significantly reducing gas moisture content. This inefficiency can result in environmental concerns, potentially restraining the market.

MARKET OPPORTUNITIES

Growing Product Consumption in Solvent Applications to Present Market Growth Opportunities

TEG is a versatile compound renowned for its exceptional solubility and low volatility. These properties make it ideal for various industrial applications, including cleaning agents, printing inks, and aromatic hydrocarbon separations. Its low volatility and high boiling point also make it an essential ingredient in these areas. The growing demand for efficient solvents in these sectors presents significant growth opportunities for the market.

- According to BASF’s financial report, global chemical production grew by 3.9% in 2024 and is poised to grow moderately in the foreseen period. This growth is expected to drive demand for triethylene glycol, which is utilized as a solvent and plasticizer in various industrial and consumer products such as lubricants, coolants, and textile treatments.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Increased TEG Usage in Natural Gas Dehydration to Extend Its Lifespan Boosted Segment Growth

Based on application, the market is segmented into natural gas dehydration, solvents, plasticizers, humectants, polyester resins, and others.

The natural gas dehydration segment dominated the triethylene glycol market in 2024. TEG is widely used in natural gas dehydration to remove water vapor, preventing issues including corrosion, hydrate formation, and pipeline plugging. It is relatively inexpensive compared to other chemicals utilized for natural gas dehydration, driving its demand on a larger scale. Water vapor in natural gas can freeze at low temperatures, forming hydrates that can block pipelines and equipment and it causes corrosion in pipelines and equipment. By reducing water content, TEG dehydration helps to extend the lifespan of these assets, making natural gas dehydration a major application area in the global market.

- As per World Energy & Climate Statistics, global gas production slightly increased in 2023 (+0.7%) after stagnation in 2022 (-0.1%).

Plasticizers are another prominent application area where TEG is highly used to improve the flexibility and durability of vinyl polymers. Growing demand for plasticizers in the plastic industry is set to drive the segment’s growth significantly during the forecast period.

- According to the Plastics Europe Association, in 2023, global plastic production was 413.8 million tons.

By End-use Industry

Oil & Gas Dominants Market Due to TEG’s High Utilization Rate

Based on the end-use industry, the market is segmented into oil & gas, automotive, textile, construction, and others.

The oil & gas segment has been identified as the largest consumer in the global market. In the oil and gas industry, TEG is primarily used as a dehydrating agent for natural gas, removing water vapor to prevent corrosion and ensure efficient processing and transportation. It is a highly effective absorbent for water and is used in gas dehydration systems to remove water from newly recovered natural gas before it is processed and transported further. As a result, the product is highly utilized in the oil & gas industry.

- According to the International Energy Agency, world oil demand growth is set to accelerate from 840 thousand barrels per day (kb/d) in 2024 to 1.1 million barrels per day (mb/d) next year, lifting consumption to 103.9 mb/d in 2025.

TEG is widely used in the textile industry as a moisture control agent, fabric conditioner, dye solvent, and fiber lubricant. It also helps maintain optimal humidity during processing and improves fabric softness and manageability, creating noticeable growth for the product.

- According to the Association of Textile Exchange, global fiber production is anticipated to reach 147 million tons by 2030, creating huge demand for TEG annually.

Triethylene Glycol Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Triethylene Glycol Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 1.37 billion in 2025 and USD 1.42 billion in 2026. In the global triethylene glycol (TEG) market, Asia Pacific is a major region in both manufacturing and utilization, with the growing demand from natural gas dehydration, plastics, and other industries. The market is expected to continue growing during the forecast period.

In Asia Pacific, China dominates the regional market, and major demand is driven by China's ongoing urbanization and infrastructure advancements. This has led to increased demand for plastics, which in turn fuels the demand for TEG. Also, China is the fourth largest gas manufacturer in the world, which creates massive demand for TEG in the country.

- According to the Center on Global Energy Policy at Columbia University, in 2023, China produced 232.4 billion cubic meters (bcm) of natural gas domestically, a 5.6% increase from 2022.

Europe

Europe is the second-largest market for triethylene glycol. The growing demand for TEG in Europe is primarily driven by its use as a dehydrating agent in natural gas processing and its applications in the chemical, oil & gas, and plastics industries. The increasing investments of the European Union in R&D in the automobile, ICT, and healthcare sectors are a few factors driving market growth.

- According to the Cosmetics Europe - The Personal Care Association, it is estimated that the European cosmetics and personal care industry brings around USD 30 billion to the national economy annually.

North America

North America is projected to be the fastest-growing region in the global market during the forecast period. The demand for TEG in North America is expected to continue growing, driven by increased requirements for the product from plasticizers, natural gas processing, and other industrial applications. The massive regional growth is anticipated on the back of the U.S., which is the largest natural gas producer in the world. TEG, being an essential ingredient for removing water vapor from natural gas and preventing pipeline corrosion and hydrate formation, drives its demand in the country.

- According to the U.S. Energy Information Administration, in 2023, the U.S. produced 37.8 trillion cubic feet (Tcf) of dry natural gas.

Latin America

Latin America is a significant region contributing to TEG demand, with higher growth anticipated in the coming years. Latin America has a substantial and growing oil and gas industry, leading to increased demand for TEG. Prominent countries such as Brazil, Mexico, and Argentina are expected to drive regional demand over the forecast period.

Middle East & Africa

The Middle East & Africa region is poised to experience moderate growth in the global TEG market due to growing infrastructure investment in countries including UAE, Saudi Arabia, and South Africa. TEG is widely used as a cementing aid and as a solvent in various chemical processes. Thus, with the expansion in infrastructure, demand for commodities such as oil and gas, cement, and chemicals will rise significantly, driving demand for TEG in the coming years.

COMPETITIVE LANDSCAPE

Key Market Players

Capacity Expansion and Investment in Innovative Technologies to Create a Progressive Environment for Market Growth

The market is concentrated with companies such as BASF, Dow, Mitsubishi Chemical Corporation, Nan YA Plastics, and Orlen, accounting for a significant market share. Players operating in the triethylene glycol market, including BASF, SABIC, PKN Orlen, and others, are implementing various organic and inorganic strategies to enhance their presence in the market. Strategies such as capacity expansion and joint ventures are among the prominent ones chosen by market leaders.

Companies are investing in building new triethylene glycol production plants, especially in regions with high demand, to increase their production capacities. They are also focusing on upgrading existing facilities to increase yield and efficiency. Companies are forming joint ventures and partnerships with other companies and organizations to exchange technological expertise, broaden market reach, and lower operational costs. Such strategies will create a progressive environment for the market’s growth.

LIST OF KEY TRIETHYLENE GLYCOL COMPANIES PROFILED

- Arham Petrochem (India)

- BASF (Germany)

- Dow (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Nan YA Plastics (China)

- Orlen (Poland)

- PTT Global Chemical (Thailand)

- SABIC (Saudi Arabia)

- Sevron (France)

- Shell (U.K.)

KEY INDUSTRY DEVELOPMENTS

- December 2023: INEOS successfully acquired LyondellBasell’s Ethylene Oxide and Derivatives business and production facility located at Bayport, Texas, U.S. The deal includes an ethylene oxide plant, ethylene glycols plant, and glycol ethers plant with production capacities of 420 kilotons, 375 kilotons, and 165 kilotons, respectively.

- December 2023: In a strategic step toward reducing carbon emissions, SABIC collaborated with Scientific Design (SD) and Linde Engineering. This joint effort seeks to investigate ways to make the EG production process eco-friendly, focusing on creative approaches that greatly lower the carbon impact and introducing technology for low-emission processes.

- October 2023: To meet the increasing demand and as per BASF’s customer-focused corporate strategy, the company expanded its capacities for ethylene oxide and ethylene oxide derivatives at its Verbund site in Antwerp, Belgium. The expansion will add around 400 kilotons of annual production to its existing capacity.

- July 2021: India Glycols Limited (IGL) and Clariant AG established a 51-49% joint venture named Clariant IGL Speciality Chemicals Private Limited, focusing on renewable ethylene oxide derivatives.

- May 2021: PKN ORLEN announced to plan to expand its existing capacities at the Płock Production Plant. As per the company’s strategic Petrochemical Development Programme, the expansion will comprise five additional production units, including a new large ethylene oxide and glycol plant.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 3.80% during 2026-2034 |

|

Segmentation |

By Application

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.83 billion in 2026 and is projected to reach USD 2.46 billion by 2034.

In 2025, the market value stood at USD 1.37 billion.

The market is expected to exhibit a CAGR of 3.80% during the forecast period of 2026-2034.

The natural gas dehydration segment led the market by application.

Surging demand for natural gas and plasticizers to drive market growth.

BASF, Dow, Mitsubishi Chemical Corporation, and Nan YA Plastics are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us