Turboprop Aircraft Market Size, Share & Industry Analysis, By End-User (Commercial and Military), By Point of Sale (New and Pre-owned), By Passenger Capacity (Upto 5 Passengers, 5-10 Passengers, and More Than 10 Passengers), By Component (Aerostructures, Avionics, Engine, Landing Gears, and Others), By Engine (Conventional and Hybrid), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

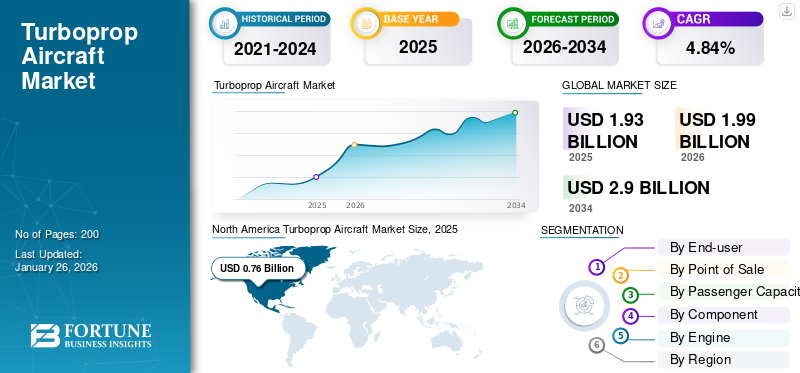

The global turboprop aircraft market size was valued at USD 1.93 billion in 2025 and is projected to grow from USD 1.99 billion in 2026 to USD 2.90 billion by 2034, registering a CAGR of 4.84% over the forecast period. North America dominated the turboprop aircraft market with a market share of 39.25% in 2025.

The turboprop aircraft industry comprises businesses that handle the concept, design, manufacturing, and marketing of aircraft powered by turboprop engines. These turboprop engines use a gas turbine to drive a propeller and hence are different from a traditional turbojet engine that depends on jet propulsion. Turboprop is widely used for regional and military general aviation due to its efficiency at low speeds and altitudes, making it suitable for short-haul flights and infrastructural operations in small airports.

The market is growing rapidly, driven by an increasing number of projects and recent developments, along with numerous sustainable hybrid technological advancements made in turboprop aircraft in various regions. Key players in the market include Airbus SE, Honeywell International Inc., Textron Aviation Inc., and Lockheed Martin Corporation, among others, which compete in the pricing and technological innovation in the market.

GLOBAL TURBOPROP AIRCRAFT MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 1.93 billion

- 2026 Market Size: USD 1.99 billion

- 2034 Forecast Market Size: USD 2.90 billion

- CAGR: 4.84% from 2026–2034

Market Share:

- North America dominated with a 39.77% share in 2025, led by strong regional demand and diverse commercial and military applications

Key Country Highlights:

- United States: Dominates on strong regional aviation, cargo, training, and defense needs.

- Canada: Supports regional air services and remote connectivity.

- Asia Pacific & Europe: Accelerating due to urban expansion and environmental mandates favoring turboprops for short-haul efficiency.

Market Dynamics

Market Drivers

Increased Demand for Regional Air Connectivity Leads to Substantial Market Growth

The increased demand for regional air connectivity is primarily driven by the need to enhance accessibility to underserved and remote areas, fostering economic growth and social integration tends to drive the market. As urbanization accelerates, metropolitan regions face congestion and rising operational costs, prompting a shift toward regional centers that can offer competitive advantages. Air connectivity is ideal for these regions as it helps in the effective transportation of goods and people to and from local economies.

The Regional Connectivity Scheme is an initiative by the Indian government to subsidize air travel, thereby motivating airlines to venture into less viable markets. Such schemes, apart from enabling tourism, promote infrastructure development in different regions, which stimulates employment and overall economic development. Improved air connectivity overcomes geographical obstacles, such as inaccessible or isolated areas due to water bodies, so that remote populations have access to basic services and opportunities. The emphasis on regional air connectivity is crucial for balanced country development and for meeting the growing demand for efficient transportation solutions. This is expected to fuel the turboprop aircraft market growth in the coming years.

Market Restraints

Limited Payload Capacity to Restrain Market Growth

The limited payload capacity in turboprop aircraft implies a reduced payload of passengers and cargo compared to jet aircraft. Turboprops are usually designed and oriented toward short- to medium-haul flights; hence, while they are effective in terms of fuel efficiency and operational costs, their size is small, and, consequently, engine power is low, resulting in a limited ability to carry weight. Consequently, airlines may find turboprops less suitable for high-demand routes where larger capacities are needed, leading to a preference for jet aircraft that can accommodate more passengers and cargo, ultimately impacting market competitiveness.

Market Opportunities

Fleet Modernization Acts as a Major Market Opportunity

Fleet modernization is the process of updating and upgrading an airline's aircraft in terms of efficiency, safety, and environmental sustainability. This tends to replace older aircraft with newer models that feature advanced technology, improved fuel efficiency, and reduced emissions. For example, modern aircraft can consume up to 30% less fuel than older aircraft and, therefore, significantly reduce carbon dioxide emissions, contributing to climate protection.

In the airline industry, upgrading the fleet is cost-effective as newer aircraft require less maintenance and are more reliable. Telematics and predictive maintenance systems also improve operations performance as they optimize routes and minimize downtime. Airlines are competing on stricter environmental regulations, and public opinion needs to be addressed. Thus, fleet modernization becomes strategic not only in terms of profitability but also in terms of global sustainability. This has allowed major market players to commit huge investments to renew fleets and adopt greener practices with the aim of increasing efficiency and reducing negative environmental impact.

Market Challenges

Competition From Jet Aircraft to Challenge Market Development

The main challenge to a turboprop model is the introduction of a jet plane. Jets move faster, have long ranges, and may fly at higher altitudes than turboprops, increasing efficiency over higher distances. This fits well into cruising altitude for several hours on most long flights-ideal for sipping fuel from a large oil tank. While turboprops are prominent in short-haul operations as they are lower in operating cost and can handle shorter runways, airlines, with a keen focus on the need for greater speed and higher capacity, still prefer jets in regional markets. This continues to affect the demand in the market.

Turboprop Aircraft Market Trends

Hybrid Electric Propulsion to Act as Major Market Trends

Hybrid electric aircraft provide a new look at aircraft development, combining conventional fossil fuel propulsion with electric motors. These use electric motors at those critical parts of flight that consume the most fuel, thus reducing the fuel-consuming parts. Hybrid-electric aircraft can cut fuel burn and emissions considerably by connecting batteries or fuel cells to power these electric motors.

Download Free sample to learn more about this report.

Growing demand for sustainable aviation solutions and decreasing energy costs and environmental impacts are driving the developments in hybrid-electric systems. Various experiments have shown that the hybrid configurations can reduce total fuel consumption, leading to optimal performance over different phases of flight. For instance, during takeoff, electric motors provide extra thrust so that conventional engines can be throttled back to save fuel. Another factor that makes battery technology critical to the future success of hybrid-electric aircraft is that lightweight and more efficient batteries could extend range and performance. With evolving global frameworks regulating transport based on environment-friendly technologies, next-generation regional air transport will most certainly be led by hybrid-electric propulsion, which promises tremendous likely commercial applications in a decade or less.

Impact of COVID-19

The COVID-19 pandemic intensively affected the dynamics of the production and sales of aircraft. During the first phase, the impact of the pandemic spread out in the form of mass shutdown of production and tremendous disturbances in supply chains, leading to an abrupt downfall in the selling of turboprop aircraft. Number of sales for 2020 were approximately 443 turboprop aircraft. Sales declined by 15.6% from 525 in 2019.

Turboprop fared the best, with the least decline in service fleets and scheduled flights, since it was more crucial in ensuring an essential air service for the remote communities where travel restrictions were in place. The pandemic also made the airlines change their way of operations and reduce capacities from larger jets to turboprops on most routes as the demand for regional small flights was stable. Passenger traffic fell sharply in every corner of the world, but the flexibility of the turboprops helped them fly through critical routes that were lifelines for local economies. Thus, it provides a way of innovating and modernizing the fleets of turboprop manufacturers in convergence with new safety and environmental standards.

Segmentation Analysis

By End-user

Increased Turboprop Adoption in Regional and Short-Haul Flights Propelled Commercial Segment Growth

On the basis of End-user, the market has been divided into commercial and military.

The commercial segment led the market, accounting for 74.81% of the global market share in 2026. One of the benefits of turboprop aircraft is cost-effectiveness, making them ideal for regional and short-haul flights. The key reason they are cost-effective is their fuel efficiency. Turboprops generally tend to consume much less fuel compared to jet engines, especially at lower altitudes and speeds that are perfect for short- to medium-distance travel. This allows airlines to stay profitable with reduced operating expenses. The segment is expected to dominate the market share of 74% in 2025.

Another benefit is the inherent lower maintenance of turboprops compared to jets, primarily due to fewer parts and a simple engine design. This gives reliability and less maintenance, adding to reduced cost of ownership of the aircraft in its lifespan. The easy availability of parts and trained maintenance personnel also contribute to reduced downtime, which enhances operational efficiency. In addition, turboprops can access smaller airports with shorter runways that jets cannot reach, and this enables airlines to serve underserved markets effectively. This capability not only enhances connectivity but also reduces ground travel time for passengers. Overall, the lower fuel and maintenance costs combined with the operational flexibility make aircraft a cost-effective solution for regional air travel in the present competitive aviation landscape.

The military segment accounted for a significant market share in 2024. This segment is anticipated to exhibit a CAGR of 3.53% during the forecast period. Geopolitical tensions and global defense modernization programs have resulted in upgrading and expanding the military turboprop fleets across the world with increased investments. This ensures that turboprop aircraft remain relevant and in demand for various military applications.

By Point of Sale

Increase In Aircraft Deliveries for Regional Connectivity to Augment New Segment Growth

Based on the point of sale type, the market is segmented into new and pre-owned.

The new segment accounted for the largest market share of 84.46% in 2026 and is expected to grow at the highest CAGR during the forecast period. Regional connectivity demand is growing due to the need for better access to air travel in under-served or remote locations. This promotes the growth of the local economy and social integration. For instance, India's UDAN (Ude Desh Ka Aam Nagrik) scheme makes air travel from smaller towns affordable and accessible to major cities. Improved connectivity opens up new possibilities in business, education, and tourism, therefore reducing road congestion and travel time. This creates new routes with the growth of regional airlines, thus bringing in tourists and creating jobs for local communities. Regional connectivity supports the aviator sector. Hence, regional expansion reinforces broader economic goals of balanced regional development, therefore requiring new deliveries of aircraft to support this growth.

The pre-owned segment accounted for a substantial market share in 2024. Most airlines are updating their fleets to enhance efficiency and lower maintenance costs. As the older turboprop aircraft come toward the end of their service life, the demand for pre-owned models offering reliable performance at a lower acquisition cost is on the rise.

By Passenger Capacity

Growth in Tourism Boosted the Upto 5 Passengers Segment Growth

Based on passenger capacity, the market is segmented into upto 5 passengers, 5-10 passengers, and more than 10 passengers.

The upto 5 passengers segment accounted for 51.32% of the market share in 2026. There is an ongoing growth in tourism, fueled by a rebound in travel demand, as consumers increasingly look for differentiated and experiential experiences. In 2025, new trends toward local immersion, eco-tourism, and wellness retreats evolved as a reflection of the need of travelers for authenticity and to connect with communities. As restrictions due to the pandemic eased, many people started traveling, bookings, and spending on flights and accommodations. Digital technology enhances personalization and allows travelers to be more flexible in experiencing design to fit their personal preferences. There is also robust growth in air travel and increased disposable incomes during economic recovery times, which encourage further growth in the tourism sector and innovation through this sector. This growth in tourism is expected to fuel upto 5 passengers market. The segment is expected to dominate the market share of 51% in 2025.

The 5-10 passengers segment accounted for a significant market share in 2024 and is expected to grow at the highest CAGR of 5% in the forecast period. Operations-related flexibility makes aircraft useful for work in almost all kinds of environments. Such aircraft can operate from shorter runways and less developed airports, making them appropriate for regional and remote destinations where larger jets cannot land. This opens up access for airlines to link underserved areas with major hubs, thereby enhancing accessibility and regional connectivity. Turboprops are designed to be adaptable to all kinds of weather. As such, their services are guaranteed in all types of operational scenarios. Operators can optimize routes for maximum profitability and minimum commercial risk in untested markets by adjusting the capacity according to traffic demand, therefore driving the need for medium-capacity turboprops.

To know how our report can help streamline your business, Speak to Analyst

By Component

Growth in Low Emission Initiatives Augmented Engine Segment Growth

Based on the component, the market is divided into aerostructures, avionics, engine, landing gears, and others.

The engine segment captured 34.77% of the market share in 2026. The segment is expected to record the highest CAGR over the forecast period. Increased awareness about the environment and the desire of the aviation industry to decrease its carbon footprint serve as a driving factor for the engine segment in the market. Turbo-prop engines inherently are more fuel efficient and emit less CO2 per passenger mile than jet engines while accomplishing the same distances.

Furthermore, new developments in engine technology allow the direct use of sustainable aviation fuels, which massively decreases lifecycle emissions. Indeed, the necessity of 'green travel' through regulatory pressure makes the major aircraft manufacturers and operators respond to the given goals provided by internationally established environmental requirements for innovation in both design and operations.

The aerostructures segment is expected to record a significant CAGR over the forecast period. Advances in the material and light composites in manufacturing processes offer a more agile, high-performance product that increases aircraft aerodynamic performance for better fuel efficiencies and reduced operating costs.

The landing gears segment is expected to exhibit a CAGR of 4.17% during forecast period.

By Engine

Growing Demand for Regional Air Travel Augmented Conventional Segment Growth

Based on the engine, the market is divided into conventional and hybrid.

The conventional segment accounted for the dominating market share in 2024. There are various growth drivers for traditional turboprop aircraft engines. The growing demand for regional air travel requires efficient aircraft, especially in terms of the ability to launch from relatively short runways. Turboprop engines, therefore, are an effective solution for short-haul routes. In addition, their capability at low altitudes has made the aircraft more operationally cost-effective than the rising fuel prices. Modernization programs in the military sector also contribute to growth, as turboprop engines are preferred in transport and surveillance operations due to their versatility and efficiency. Improved technologies further enhance engine performance and reliability, making the product more appealing. Altogether, these factors lead to a higher expansion of the segment in the market. The segment is expected to dominate the market share of 74% in 2025.

The hybrid segment is expected to record the highest CAGR of 4.98% over the forecast period. These offer better fuel efficiency and also have the traditional combustion engine coupled with electric motors. This allows them to significantly reduce fuel consumption at critical phases, including takeoff and climb. In this regard, this dual power source will cut down operational costs and carbon emissions in accordance with the sustainability goals for the entire globe. Advances in battery technology also increase the range and efficiency of hybrid systems. The flexibility of hybrids allows the operators to use electric power for operations in cities, which enhances their appeal. Hybrid turboprop engines are now emerging as a solution for the future of regional air travel as regulatory pressures for greener aviation intensify.

Global Turboprop Aircraft Market Regional Outlook

Geographically, the market is analyzed across North America, Europe, Asia Pacific, and the rest of the world regions.

North America

North America Turboprop Aircraft Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 0.76 billion in 2025. A growth in military turboprop aircraft is a major reason for the dominance of the region in the market. Military turboprops are utilized for a number of applications and represent a significant component in underpinning different operational requirements. For instance, the Lockheed C-130 Hercules is one of the multi-engine versatile turboprop transports. It has specialized missions, such as troops, medical evacuation, or cargo missions that require operation from unpaved runways. Besides this, it can also be used for aerial refueling, surveillance, and search and rescue missions. Since 1956, the C-130 has been in service and, to this day, forms the backbone of military forces throughout the world, providing itself, time and time again, a reliable and effective workhorse in all challenging environments and mission profiles. The U.S. market reaching USD 0.69 billion by 2026.

The U.S. accounted for a dominating market share in the region due to the presence of major market players and major manufacturers such as Lockheed Martin Corporation. These OEMs account for a majority market share in the turboprop market, therefore driving growth in the market due to continuous technological advancements and their collaborations with the government.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.54 billion in 2025, exhibiting the second-fastest growing CAGR of 4.56% during the forecast period. The European market is forecasted to achieve a higher growth rate in the coming years. An increased demand for regional connectivity and environmental sustainability is fueling growth in the European market. Most of Europe's routes are under 1,000 km, making it one of the ideal markets for short-haul operations, which utilize turboprops as relatively cost-effective solutions for airlines. For example, Tarom, Romania's national flag carrier, has recently taken on new aircraft to improve its regional services. Further, the new small and medium-sized airports in Europe support this growth by contributing to the development of less-served regions. Another factor enhancing this market is the development of this trend by the emission targets by aviation since turboprops emit less than jets. The UK market reaching USD 0.11 billion by 2026 and the Germany market reaching USD 0.21 billion by 2026.

Asia Pacific

The Asia Pacific market is forecasted to achieve the highest growth rate in the coming years. The region is predicted to be the third-largest market with a value of USD 0.38 billion in 2025. The growth factors for the market majorly include an increasing demand for regional connectivity along with higher air passenger traffic. India and China are investing heavily in building aviation infrastructure and creating new small and medium-sized airports that offer chances for short-haul routes. For instance, in 2019, the AVIC launched the MA700 turboprop, trying to tap into the booming domestic market for regional air travel. In addition, an increase in the middle-class population with rising disposable income in the region is also seen as a boosting factor that raises demand for low-cost air traveling solutions and, consequently, promotes the growth of the market. The Japan market reaching USD 0.09 billion by 2026, the China market reaching USD 0.16 billion by 2026, and the India market reaching USD 0.08 billion by 2026.

Rest of the World

Rest of the World is expected to be the fourth-largest market with a value of USD 0.03 billion in 2024. The rest of the world market is forecasted to achieve a higher growth rate in the coming years. The market growth in Latin America and the Middle East & Africa is supporting regional connectivity and infrastructural development. For instance, in Latin America, the Cessna 208 Caravan is an extremely popular air taxi service, flying mostly to dirt runways in rural areas to access inaccessible communities. Low-cost carriers and investment in regional aviation infrastructures are contributing to increased demand for turboprops in Africa. They are ideal for short runs and will facilitate an economical method of developing economies and encouraging tourism.

Competitive Landscape

Key Industry Players

The competitive landscape of the global aircraft market offers insights into various competitors. This includes an overview of each company, their financial performance, revenue generation, market potential, investments in research and development, new initiatives, strengths and weaknesses, product and brand portfolios, product launches, mergers and acquisitions, and their applications. The data provided focuses specifically on the companies' engagement within the market. Key competitors in the market are ATR, Raytheon Technologies, Textron Aviation, and Lockheed Martin, focusing on such advancements as hybrid-electric frameworks and next-generation aeronautics. The military showcase is especially vigorous, with turboprops just like the C-130J being a centerpiece of most operations since they offer flexibility and reasonableness. In general, the showcase is semi-consolidated, with a center on effectiveness and adaptability.

List of Key Turboprop Aircraft Companies Profiled:

- General Electric (U.S.)

- Safran (France)

- Honeywell International Inc. (U.S.)

- PBS AEROSPACE (U.S.)

- Turb Aero (Australia)

- Rolls-Royce plc. (U.K.)

- Pratt & Whitney. (Canada)

- RTX Corporation (U.S.)

- Textron Aviation Inc. (U.S.)

- Daher Aircrafts (France)

Key Industry Developments

- August 2024- NASA and magniX revealed the de Havilland Canada DHC-7-103 turboprop airplane (N650MX), which is able to be advance adjusted into a half-breed electric inquire about testbed with the retrofit of Magni650 electric impetus units, beneath NASA's Electrified Powertrain Flight Exhibit (EPFD) project.

- September 2023- Pratt & Whitney Canada advanced its extension into hybrid-electric aero impetus in association with Collins Aviation, a kin company inside the aerotech aggregate RTX, and U.K.-headquartered GKN Aviation. Having coordinated a lightweight 1-megawatt electric engine created by Collins into a high-efficiency fuel-burning motor, Pratt & Whitney joined forces with GKN Aviation to create the tall voltage, tall control electrical wiring interconnector framework (EWIS) for the RTX hybrid-electric flight demonstrator extend.

- February 2023 – Safran Helicopter Motors effectively completed ground tests of a "more-electric" variation of its Tech TP turboprop motor at its Tarnos office. The Ardiden 3-based innovative demonstrator consolidates innovations from the Clean Sky ACHIEVE venture, coming about in more productive and more maintainable working modes.

- February 2023- Safran run a hybrid-electric turboprop motor beneath the European Union's Clean Sky 2 inquiry about the program. The adjusted Tech TP innovation demonstrator has completed ground tests at Safran Helicopter Motors in Tarnos, France. Based on Safran's Ardiden 3 turboshaft motor, Tech TP may be a demonstrator.

- December 2022- Raytheon Innovations announced the motor run of the company's first territorial hybrid-electric flight demonstrator, checking a key turning point toward flight testing, focused on starting in 2024. The drive system's introductory run was put at Pratt & Whitney's development office in Longueuil, Quebec, and performed as anticipated. The framework completely coordinates a 1 MW electric motor developed by Collins Aviation with a proficient Pratt & Whitney fuel-burning motor adjusted for hybrid-electric operation.

Report Coverage

The report analyzes the market in-depth and highlights crucial aspects, such as prominent companies, market segmentation, competitive landscape, airport types, and technology adoption. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth over the years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.84% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By End-user

By Point of Sale

By Passenger Capacity

By Component

By Engine

By Region

|

Frequently Asked Questions

The market size was valued at USD 1.93 billion in 2025 and is projected to grow from USD 1.99 billion in 2026 to USD 2.90 billion by 2034

The market is projected to record a CAGR of 4.84% during the 2026-2034 forecast period.

The new segment by point of sale accounted for a majority of the market share in 2024.

Increased demand for regional air connectivity will lead to substantial market growth.

Honeywell International Inc., General Electric, and Safran are some of the leading players in the market.

The U.S. dominated the global market in 2024.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us