Two-Phase Data Center Liquid Immersion Cooling Market Size, Share & Trends Analysis, By Component (Solution & Services), By Application (High-Performance Computing, Edge Computing, Artificial Intelligence, Cryptocurrency Mining & Other (Cloud Gaming, OTT Platforms), By Cooling Fluid (Mineral Oil, Deionized Water, Fluorocarbon-based Fluids & Synthetic Fluids), By Data Center Type (Small & Medium Data Centers, Large Data Centers), By End Users (Cloud Service Provider, Colocation Data Center Providers, ISP & Telco, Enterprise) & Regional Forecast 2026-2034

TWO-PHASE DATA CENTER LIQUID IMMERSION COOLING MARKET SIZE AND FUTURE OUTLOOK

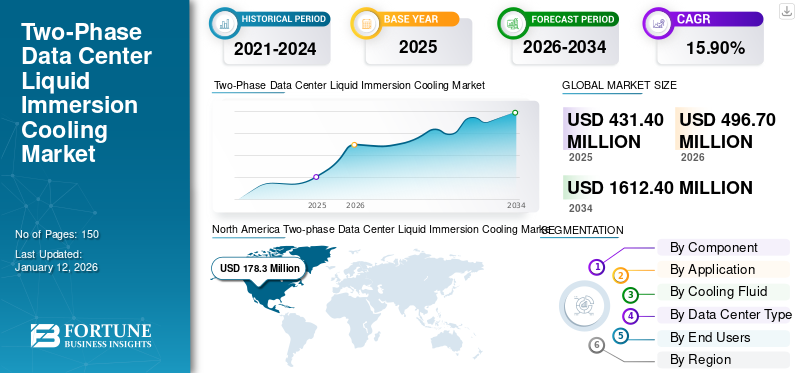

The global two-phase data center liquid immersion cooling market size was valued at USD 431.4 million in 2025 and is projected to grow from USD 496.7 million in 2026 to USD 1612.4 million by 2034, exhibiting a CAGR of 15.90% during the forecast period. The North America dominated global market with a share of 41.30% in 2025.

The global demand for two-phase data center liquid immersion cooling is increasing due to the ever-increasing need for computational power, especially with the rise of cloud services, edge computing, and various new technologies, which has brought significant attention to enhancing data center processing performance and energy efficiency, which drive the demand for the two-phase data center liquid immersion cooling. Liquid immersion cooling offers higher cooling efficiencies than traditional air cooling techniques, resulting in improved energy efficiency and reduced operational expenses. Moreover, the adoption of graphics processing units in data centers and hyper scale data centers creates the adoption of liquid cooling solutions, which contribute positively to market growth.

Major players such as Delta Electronics Inc (Delta Power Solutions), 3M, Giga-Byte Technology Co Ltd, The Chemours Company (Optional), and Green Revolution Cooling Inc., among others, are engaged in adopting expansion and adopted product launch and product development as a key developmental business strategy that supports small as well as hyper-scale data centers.

Post pandemic, the market experiences a rising demand for data center cooling solutions owing to the increasing data consumption and growing investment in upgradation and new data center infrastructure development. Moreover, rising global investment in data centers with growing demand for liquid cooling solutions fuels global two-phase data center liquid immersion cooling demand.

IMPACT OF GENERATIVE AI

Increasing Computational Need for AI to Stimulate Effective Cooling Solution Demand

The impact of generative AI on the data center liquid cooling market is profound and multifaceted, primarily driven by the increasing computational demands associated with AI workloads. As organizations adopt AI technologies, they require more powerful hardware to process complex algorithms and large datasets, leading to significant changes in data center operations and cooling requirements. Generative AI applications, particularly those utilizing advanced GPUs and specialized processors, generate substantially more heat than traditional computing tasks. The growing emphasis on sustainability within the tech industry also influences the implementation of single-phase and two-phase cooling for AI. Thus, organizations striving to reduce their carbon footprints with efficient cooling solutions become essential.

- For instance, in May 2024, LiquidStack revealed its involvement at Cisco Live, where it showcased its cutting-edge two-phase immersion cooling technology within the Cisco Sustainability Zone. In partnership with Cisco, the company will illustrate how immersion cooling improves the efficiency of optical networking devices while sustainably addressing the growing requirements of generative AI.

Download Free sample to learn more about this report.

Two-Phase Data Center Liquid Immersion Cooling Market Trends

Growing Demand for Hyper Scale and Cloud Computing Integration and 5G Infrastructure Boosts Market Growth

Data centers are witnessing significant growth, driven by the rapid expansion of hyperscale cloud computing and the deployment of 5G infrastructure. These trends are reshaping the data center industry, requiring innovative cooling solutions to meet increasing computational demands. Hyperscale data centers, which support cloud computing giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are experiencing exponential growth. These facilities adopt advanced cooling systems to handle high-density workloads generated by AI, machine learning, and big data analytics. This trend indicates a robust future for two-phase data center liquid immersion cooling technologies as they become integral components of modern data center infrastructure.

- For instance, the intelligence service provider company Synergy Research Group made an estimation for 2024 that there will be around 1,136 hyper-scale data centers in the world, up from 734 in 2020.

MARKET DYNAMICS

Market Drivers

Increasing Need for Data Center Energy and Cost Efficiency Drive Adoption of Advanced Immersion Cooling Solutions

As data centers expand to meet the demands of a digital world characterized by exponential data growth, traditional air cooling systems are becoming inadequate for managing the heat generated by high density computing environments. Two-phase data center liquid immersion cooling supports higher server rack densities, which is essential for maximizing space in urban data center environments where real estate is limited. As a result, organizations can achieve lower operational costs and improved energy efficiency, making two-phase immersion cooling an ideal solution due to its compact design and high processing density. All these advancements drive two-phase data center liquid immersion cooling market growth during the forecast period.

- For instance, in October 2024, Submer, a prominent liquid immersion cooling solution provider, completed a funding round to accelerate the adoption of its sustainable immersion cooling technology. The round raised USD 55.5 million to date for supporting innovative, IP-driven businesses, primarily in North America.

Market Challenges

High Initial Capital Investments and Complex Implementation Restrict Market Growth

The major concerns, including the total cost of ownership of two-phase data center liquid immersion cooling systems, have encountered significant challenges, primarily due to high initial total costs. Transitioning to two-phase cooling necessitates significant changes to existing data center infrastructure, including the installation of specialized tanks and compatible IT hardware. Many facilities do not have the capacity for these modifications without extensive renovations, further increasing costs and complexity. There are ongoing concerns regarding the environmental impact of some dielectric fluids used in two-phase systems, which could affect regulatory compliance and acceptance within the industry. This uncertainty can deter investment in such technologies.

Market Opportunities

Technological Advancements in Two-Phase Immersion Cooling Drive Enhanced Energy Efficiency in Data Centers

Recent advancements in the development of advanced cooling fluids further enhance the effectiveness of two-phase data center liquid immersion cooling compared to single-phase immersion cooling. Innovations such as nanoparticle-infused fluids are being explored to improve thermal conductivity even further. These enhancements promise to reduce the power consumption for pumps and cooling systems, making immersion cooling an even more attractive option for data center operators. As demand for high-performance computing rises, scalability becomes critical for data center operators. In summary, the opportunity presented by technological advancements in two-phase data center liquid immersion cooling is substantial. By leveraging enhanced efficiency, innovative eco-friendly cooling fluids, scalability options, and alignment with sustainability goals, this technology is poised to redefine thermal management in data centers, expanding two-phase data center liquid immersion cooling market share in the long term.

- For instance, in May 2024, Asperitas introduced its new Direct Forced Convection (DFC) immersion cooling solutions. The offering delivers a cooling capacity exceeding 3.6kW per U and 2000W per socket, with the first product, a 12U DFC tank.

SEGMENTATION ANALYSIS

By Component

Growing AI Workloads in Data Centers Fuels Solution Segment Expansion

By component, the market is classified into solution and services.

In component, the solution segment is dominating the market, growing exponentially driven by the growing adoption of Artificial Intelligence and big data technologies, which require enterprise servers. Moreover, the adoption of graphics processing units in data centers and hyperscale data centers creates the adoption of liquid cooling solutions, which contribute positively to the segment growth.

The services segment held 29% of the market share in 2024.

By Application

Explosive Demand For AI Workloads Is Driving The Adoption Due To Its Need For Advanced Thermal Management

By application, the market is classified into high-performance computing (HPC), edge computing, artificial intelligence (AI), cryptocurrency mining, and others (cloud gaming, OTT platforms, etc.).

However, the Artificial Intelligence (AI) segment is projected to exhibit the highest CAGR, fueled by the explosive demand for AI workloads that generate immense heat from increasingly dense computing hardware, necessitating the advanced thermal management that immersion cooling provides. This rapid growth in AI infrastructure, alongside the emergence of cryptocurrency mining and the evolving demands of applications like cloud gaming and OTT platforms within the "Others" category, collectively underscores the broadening applicability and increasing adoption of two-phase liquid immersion cooling as a solution for efficient, high-density data center thermal management. This segment is anticipated to exhibit a CAGR of 17.13% during the forecast period.

In the application segment, the High-Performance Computing (HPC) segment holds the largest market share, as its substantial and long-standing heat loads make it a prime candidate for the superior cooling capabilities of two-phase immersion, which can reduce energy ‘

consumption by approximately 50% compared to air cooling.

The edge computing segment is expected to dominate the market share of 8% in 2025.

By Cooling Fluid

Effective Cooling Need in Super-Computing Drive Fluorocarbon-Based Fluid Demand

Cooling fluid is further categorized into mineral oil, deionized water, fluorocarbon-based fluids, and synthetic fluids.

The market features various fluids, each with distinct advantages and disadvantages influencing adoption. Fluorocarbon-based fluids currently hold the largest market share due to their excellent thermal properties, high dielectric strength, chemical stability, and relatively long historical use in immersion cooling applications, making them a trusted choice for many large-scale deployments despite potentially higher costs and environmental concerns compared to some alternatives.

Mineral oil offers a cost-effective and safe alternative with good performance, though its flammability requires specific safety measures. Deionized water provides superior thermal efficiency but faces challenges with conductivity, corrosiveness, and complexity. The segment is expected to dominate the market share of 16% in 2025.

Meanwhile, the Synthetic fluids segment is projected for the highest CAGR of 17.91% during the forecast period, driven by demand for improved performance, lower environmental impact, and better safety profiles, spurred by sustainability focus and regulatory pressures, positioning them for significant future market growth.

By Data Center Type

Growing Investments in Large Data Centers to boost Segment Expansion

By data center type, the market is categorized into small and medium sized data centers and large data centers.

Large data centers remain the dominant segment owing to the rising number of data centers, including small as well as large data centers across the globe, which need more data center immersion cooling units for efficient controls. The upsurge in demand for two-phase data center liquid immersion cooling in large data centers for AI processing and capabilities enhances the growth of the market. The segment is expected to dominate the market share of 84% in 2025.

Small and medium sized data centers segment is anticipated to exhibit a CAGR of 13.80% during the forecast period.

By End Users

Growing Need for Computational Infrastructure Bolsters Cloud Service Providers (CSPs) Segment Expansion

By end users, the market is classified into cloud service providers (CSPs), Colocation Data Center Providers, ISP & telco, and enterprise.

Cloud service providers (CSPs) are the dominant end users backed by the ever-increasing need for computational power, cloud services, edge computing, and various new technologies. It has brought significant attention to enhancing data center processing performance and energy efficiency, which drive the growth of the two-phase data center liquid immersion cooling. Further, expansion and upgradation of existing data center infrastructure create a substantial demand for cooling solutions across colocation data center providers, ISPs & telco, and enterprises.

The colocation data center segment is expected to dominate the market share of 28% in 2025.

The enterprise segment is anticipated to exhibit a CAGR of 10.76% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

TWO-PHASE DATA CENTER LIQUID IMMERSION COOLING MARKET REGIONAL OUTLOOK

North America

The market size in North America was valued at USD 203.2 million in 2026 and continues to remain the largest market owing to strong economic growth and the availability of major manufacturers such as Boyd, Vertiv Holdings Co, and Green Revolution Inc. in North America, including the U.S., and Canada. Furthermore, growth in the spending on the IT & telecom sector, 5G sector, and cloud service providers rising demand for high energy supply for data centers in North America creates an ample demand for more liquid cooling solutions, which will grow two-phase data center liquid immersion cooling market size progressively. The regional market size stood at USD 137.6 million in 2023.

North America Two-phase Data Center Liquid Immersion Cooling Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The U.S. in North America remains the dominant country due to the rising demand for high energy supply for data centers in North America, which creates the demand for more liquid cooling solutions and fuels the market growth. Further, the adoption rate of Artificial Intelligence (AI) in North America increased by 71% in 2024 as compared to 65% in 2023, which enhanced the growth for two-phase data center liquid immersion cooling across Canada. The U.S. market size is estimated to be USD 182.9 million in 2026.

South America

Market growth in North America is attributed to high electricity costs and energy efficiency demand in countries such as Brazil, Argentina, and Chile. Data center operators are pushing toward more efficient cooling technologies, such as two-phase liquid immersion cooling solutions.

Europe

Europe is anticipated to account for the second-highest market size of USD 140.3 million in 2026, exhibiting the second-fastest growing CAGR of 15.13% during the forecast period.

Europe is witnessing progressive growth due to the increasing adoption of two-phase liquid cooling solutions across small and hyper-scale data centers, owing to it being 95% energy efficient as compared to traditional air cooling solutions, which makes it attractive as a data center application to reduce power usage. The market value in U.K. is expected to be USD 35.1 million in 2026. On the other hand, Germany is projecting to hit USD 26.4 million and France is likely to hold USD 16.01 million in 2025.

Middle East & Africa

The Middle East & Africa region is to be anticipated as the fourth-largest market with USD 21.6 million in 2026, owing to the heavy investment in the expansion of data centers and cloud server plants, which boosts the demand for sustainable cooling solutions and caters to the market's growth. GCC, Turkey, North Africa, and South Africa are investing in digital infrastructure and expanding data center applications, which enhances the demand for sustainable cooling solutions and fuels the market's growth. The GCC market size is expecting to be USD 8.48 million in 2025.

Asia Pacific

Asia Pacific is a rapidly third-growing region with a value of USD 120.3 million in 2026, due to the increasing adoption of Artificial intelligence, machine learning, and 5G infrastructure practices in data center applications across India, Japan, and China, which enhance the demand for efficient liquid cooling solutions and fuels the market growth. In addition, government investment in the construction of 5G infrastructure and data center infrastructure across China, Japan, and India creates the demand for liquid cooling solutions, enhancing market growth. The market value in China is expected to be USD 44.9 million in 2026.

On the other hand, India is projecting to hit USD 23.7 million and Japan is likely to hold USD 15.7 million in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

End Users Focused Product Innovation to Extend Manufacturers Market Presence

Major players such as Delta Electronics Inc (Delta Power Solutions), 3M, Giga-Byte Technology Co Ltd, The Chemours Company (Optional), and Green Revolution Cooling Inc., among others, are engaged in adopting expansion and acquisition as key strategic moves to intensify market competition. In addition, two-phase data center liquid immersion cooling manufacturers adopted product launch and product development as a key developmental business strategy that supports small and hyper-scale data centers.

- For instance, in April 2024, Accelsius introduced its NeuCool solution, featuring a patented two-phase direct-to-chip cooling system capable of exceeding 1500 W per server chip. The technology is designed to accommodate future performance demands driven by AI data centers and high-performance chips.

Major Players in the Two-phase Data Center Liquid Immersion Cooling Market

To know how our report can help streamline your business, Speak to Analyst

3M, Giga-Byte Technology Co Ltd, LiquidStack Holding NV, The Chemours Company, and Vertiv Holdings Co. are the largest players in the market. The global two-phase data center liquid immersion cooling market is consolidated, with the top 5 players accounting for around 36-38% of the market share.

List of Key Two-phase Data Center Liquid Immersion Cooling Companies Profiled:

- Boyd(U.S.)

- Delta Electronics, Inc. (Taiwan)

- GIGA-BYTE Technology Co., Ltd. (Taiwan)

- Green Revolution Cooling Inc. (U.S.)

- LiquidStack Holding B.V. (U.S.)

- Mitsubishi Heavy Industries Group (Japan)

- 3M (U.S.)

- The Chemours Company (U.S.)

- Vertiv Holdings Co. (U.S.)

- Wiwynn Corporation (Taiwan)

- CoolIt Systems (Canada)

- Iceotope Technologies (U.K.)

- DUG Technology (Australia)

- Avnet Inc (U.S.)

- Submer Technologies (Spain)

- Allied Control (U.S.)

- Asperitas (Netherlands)

- Chengdu Westerntec (China)

- Engenuity Technologies (Australia)

- DCX The Liquid Cooling Company (Poland)

KEY INDUSTRY DEVELOPMENTS:

- February 2025: Vertiv launched Vertiv Liquid Cooling Services, which is designed to help customers optimize system availability, improve operational efficiency, and address the growing complexities of advanced liquid cooling systems.

- November 2024: Vertiv collaborated with Compass to develop a cutting-edge cooling solution capable of switching between liquid and air cooling to address the requirements of high-density computing. The company will manufacture the Vertiv CoolPhase Flex system, which combines refrigerant-based air cooling with liquid cooling capabilities. The initial units are set to be installed at a Compass site in Q1 of 2025.

- November 2024: CoolIT Systems announced that it will present its latest AI cooling innovations at the Supercomputing Conference 2024 (SC24). The company highlights two key liquid cooling methods: single-phase cooling, which uses water or a water-glycol mixture that remains in liquid form, and two-phase cooling, where refrigerants alternate between liquid and gas phases.

- July 2024: Iceotope announced the opening of Iceotope Labs, its first dedicated facility focused on liquid cooling research and testing, situated at its headquarters in Sheffield. The lab includes a fully functional small-scale data center utilizing liquid cooling, along with climate-controlled testing rooms and designated spaces for thermal, mechanical, and electronic evaluations of components such as CPUs, GPUs, racks, and manifolds.

- May 2024: Schneider Electric joined the NVIDIA Partner Network (NPN) to contribute its expertise in high-density data center power and cooling infrastructure, supporting the growing adoption of accelerated computing and AI workloads. In parallel, Vertiv has launched Vertiv 360AI, a comprehensive range of high-density data center solutions designed to meet the increased power and cooling demands of AI workloads, offering integrated power, cooling, enclosures, lifecycle services, and digital management.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The increasing adoption of advanced cooling solutions, particularly two-phase liquid immersion cooling, is attracting significant investment interest. This surge in funding reflects the growing recognition of the technology's potential to address critical challenges in high-density computing environments, offering substantial energy savings and superior thermal management. Consequently, numerous companies are securing capital to support their innovative cooling technologies, expand manufacturing capabilities, and accelerate market penetration, signaling a robust growth trajectory and creating substantial opportunities within the sector.

- October 2024: Submer completed a funding round to accelerate the adoption of its sustainable immersion cooling technology. The round raised USD 55.5 million to date for supporting innovative, IP-driven businesses, primarily in North America.

- September 2024: LiquidStack Holding obtained USD 20 million in fresh funding from Tiger Global Management. The firm intends to utilize the investment to increase its manufacturing capabilities, enhance its direct-to-chip and immersion cooling product range, and bolster its commercial and research and development activities.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, component type, cooling fluid, end users, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.90% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Component

By Application

By Cooling Fluid

By Data Center Type

By End Users

By Region

|

|

Key Market Players Profiled in the Report |

Boyd (U.S.), Delta Electronics, Inc. (Taiwan), GIGA-BYTE Technology Co., Ltd. (Taiwan), Green Revolution Cooling Inc. (U.S.), LiquidStack Holding B.V. (U.S.), Mitsubishi Heavy Industries Group (Japan), 3M (U.S.), The Chemours Company (U.S.), Vertiv Holdings Co. (U.S.), and Wiwynn Corporation (Taiwan) |

Frequently Asked Questions

The market is projected to reach USD 1612.4 million by 2034.

In 2025, the market was valued at USD 431.4 million.

The market is projected to grow at a CAGR of 15.90% during the forecast period.

The cloud service providers (CSPs) segment leads the market.

The increasing need for data center energy and cost efficiency drives the adoption of advanced immersion cooling solutions.

Boyd, Delta Electronics, Inc., GIGA-BYTE Technology Co., Ltd., Green Revolution Cooling Inc., LiquidStack Holding B.V., Mitsubishi Heavy Industries Group, 3M, The Chemours Company, Vertiv Holdings Co., and Wiwynn Corporation are the top players in the market.

North America is expected to hold the highest market share.

By application, Artificial Intelligence is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us