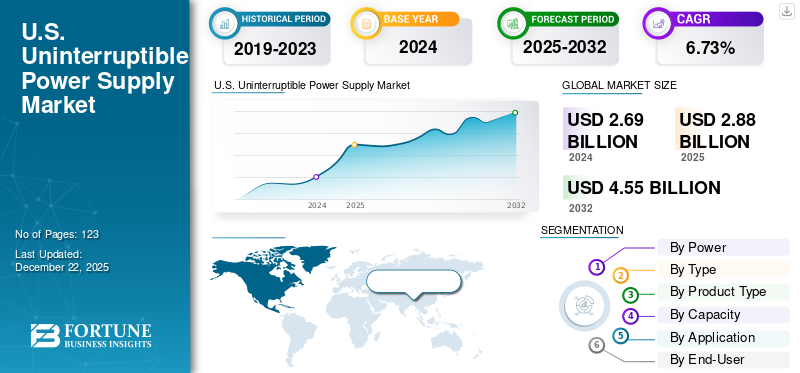

U.S. Uninterruptible Power Supply Market Size, Share & Industry Analysis, By Power (AC UPS {IT, NON-IT} and DC UPS {IT, NON-IT}), By Type (Modular UPS {IT, NON-IT} and Conventional UPS {IT, NON-IT}), By Product Type (Online/Double Conversion, Line Interactive, and Offline/Standby), By Capacity (Below 50 kVA, 51-200 kVA and Above 200 kVA), By Application (IT and Non-IT), By End-User (Industrial, Telecom, Data Center, Marine, Healthcare, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. uninterruptible power supply market size was valued at USD 2.69 billion in 2024. The market is projected to grow from USD 2.88 billion in 2025 to USD 4.55 billion by 2032, exhibiting a CAGR of 6.73% during the forecast period.

The uninterruptible power supply (UPS) is a device that delivers backup power to connected devices when the main power source fails. It utilizes batteries to ensure that power remains available during outages, enabling devices to keep operating for a limited time. When the primary power supply is interrupted, the UPS automatically switches to battery power, providing a steady flow of electricity to the connected devices. Typically, UPS units contain rechargeable batteries that are continuously recharged by the main power source. UPS systems are often utilized in a variety of settings, including computers, servers, networking equipment, and other essential systems.

The increasing dependence on technology in different industries, such as healthcare, telecommunications, and data centers, requires a consistent and reliable power supply. The companies are progressively implementing UPS systems to safeguard delicate equipment and avoid data loss during power outages, which is fueling market demand. Ongoing infrastructure initiatives focused on updating power systems and improving energy efficiency are further driving the supply market share in the recent years. As different sectors put money into cutting-edge technologies and automation, the necessity for dependable power sources becomes crucial.

The market growth is attributed to rising demand for dependable power solutions propelled by data center growth, technological progress, regulatory requirements, recognition of business continuity necessities, trends in urbanization, and the need for safeguards against regular power interruptions. Active Power, Ametek, Benning, and Borri are well-placed to capitalize on these trends and effectively stimulate a positive impact on market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Reliable, High-Performance UPS Drives the Market Growth

The need for UPS solutions is expected to increase considerably during the forecast period owing to the requirement for reliable and effective systems that ensures an uninterrupted power supply. Recognizing the necessity of providing a steady power supply during peak times has grown more crucially. The requirement for superior UPS systems is increasing rapidly due to the enlarged need for electricity resulting from the expanding population.

Key manufacturing sectors including retail, healthcare, telecom, and others are acknowledging the significance and necessity of the power protection and effective power storage features provided by the modular uninterruptible power supply. Additionally, the growing need to safeguard connected devices from regular power fluctuations is expected to be a key factor contributing to the expansion of this market in the U.S.

The U.S. uninterruptible power supply market is also expanding owing to the rising number of data centers. This expansion is fueled by the increasing need for data storage and processing, the growth of cloud computing, and the demand for dependable power protection and backup systems. The increase in data center development is driving the need for UPS systems, which are vital for providing continuous power and protecting essential IT infrastructure. As data center infrastructure continues to evolve, the UPS market is projected to see considerable growth in the upcoming years, offering major opportunities for advancement and innovation within the industry. Thus, the U.S. uninterruptible power supply market size is poised for substantial growth due to rising demand for reliable power solutions, expansion of data centers, technological advancements, supportive government policies, and increasing electricity consumption across various sectors.

Thus, owing to the factors above, the U.S. uninterruptible power supply market growth is anticipated to rise during the forecast period.

Growing Need for Emergency Power in Remote Areas is Enhancing the Demand of UPS

The demand for emergency power in isolated regions is a major factor contributing to the expansion of the UPS (Uninterruptible Power Supply) market. With the growing population and dependency on digital technologies, the need for dependable power solutions in remote areas has heightened. A major factor contributing to the growth of the market in remote regions is the development of essential infrastructure, including telecom networks, oil and gas sites, and renewable energy projects. These distant locations frequently function in difficult settings with restricted access to dependable grid electricity and becoming vulnerable to power failures and interruptions.

Global uninterruptible power supply systems are utilized to offer emergency power support, preventing possible interruptions and safeguarding delicate equipment and information. The rising investment in remote critical infrastructure projects, encouraged by the need to enhance connectivity and promote sustainable energy efforts, is driving the demand for UPS solutions customized for the specific needs of these distant areas.

Distant townships, factories, facilities, and other spaces in remote areas are anticipated to sustain UPS's demand owing to the several benefits offered, as such areas are more prone to outages, power cuts, and power-related issues. The market for power generation UPS is set to experience significant growth fueled by the increasing need for dependable power solutions, the expansion of data centers and telecommunications infrastructure, technological progress, support from the government, and the rising consumption of electricity in different sectors.

MARKET RESTRAINTS

High Cost of Installation and Maintenance to Restrain Market Growth

The U.S. uninterruptible power supply (UPS) market faces a challenge due to high installation expenses and costly maintenance. The high initial costs of UPS systems, particularly advanced models such as modular and high-capacity units, pose a significant barrier in the market.

For small and medium-sized businesses and residential users, the price of a UPS system can be prohibitive. Additionally, advanced features such as lithium-ion batteries, energy-efficient designs, and intelligent monitoring systems further increase cost, limiting adoption among a huge number of customers.

Further, a skilled workforce is required for the maintenance and upkeep of advanced UPS systems, which adds to the costs, making it more expensive for businesses to adopt these systems. For organizations operating on tight schedules or budgets, such complexities can outweigh the perceived benefits of UPS systems. The increasing sophistication of UPS systems can lead to technological complexity. This can raise upfront costs and require specialized expertise for installation and maintenance. The discarding of exhausted batteries and other UPS parts creates environmental issues. Producers are progressively concentrating on creating environmentally friendly solutions.

Disruptions to the supply chain caused by natural disasters, geopolitical tensions, or pandemics can impact the availability of components needed for UPS manufacturing. This can lead to production delays and increased costs.

MARKET OPPORTUNITIES

Growing Technological Advancements to Create Opportunities for the Market

The increasing adoption of cloud computing and cloud-based solutions has led to a rise in data centers in the U.S. Prominent cloud services companies including Google, Amazon Web Services (AWS), and Microsoft Azure have initiated several extensive data center projects in recent years. They are anticipated to spearhead cloud computing advancements moving forward. Furthermore, improvements and breakthroughs in UPS technology strive to provide affordable protection for edge and micro data centers.

Additionally, manufacturers are consistently concentrating on research and development to create innovative and efficient Uninterrupted Power Supply solutions to satisfy consumer needs. These improvements enhance efficiency and modularity in UPS while also decreasing footprint, boosting connectivity, and lowering total ownership costs, providing value to those looking to save time, reduce expenses, and mitigate management risks. Enhancements in battery technology are expected to bolster the growth of the market. Lithium-ion and lithium-polymer technologies are now key components in UPS systems. The adoption of these advanced battery technologies significantly improves the overall performance and user experience of UPS systems.

MARKET CHALLENGES

Complexity of Power Quality Issues to Create Challenge for Market Growth

Power quality includes a range of disturbances, such as voltage spikes, sags, harmonics, and frequency fluctuations. These problems can result from irregular utility supply, the operation of heavy machinery, or backfeeding from additional industrial users on the same grid. This variability makes the design and deployment of UPS systems more complex, as they must be able to tackle various power quality issues at the same time.

Effective oversight of power quality necessitates ongoing monitoring and evaluation. Different facilities do not have the essential visibility into detailed power quality data, making it challenging to pinpoint and resolve issues proactively. This absence of insight impedes the efficiency of UPS systems and complicates their incorporation into current infrastructure.

U.S. UNINTERRUPTIBLE POWER SUPPLY MARKET TRENDS

Rising Awareness of Business Continuity to Drive the Market Growth

Organizations in different sectors are becoming more dependent on their IT infrastructure for everyday functions. Interruptions result in significant financial losses and harm to a company's reputation. Consequently, companies are focusing on the installation of UPS systems to guarantee ongoing uptime and safeguard essential data and services during power outages.

Many sectors encounter strict regulations concerning operational continuity and data security. Companies are allocating resources to UPS systems not just to adhere to these regulations but also as a component of more extensive risk management approaches. This recognition is propelling investments in backup power solutions that alleviate risks tied to power disruptions.

IMPACT OF COVID-19

The pandemic accelerated the adoption of remote work and digital transformation in various sectors, resulting in an increased need for dependable power solutions. Companies are putting money into UPS systems to guarantee the uninterrupted functioning of essential IT infrastructure, minimizing the chances of downtime during power failures.

As companies acknowledge the significance of business continuity planning, there is an increasing emphasis on investments in UPS systems to protect operations from unforeseen power interruptions. This recognition is especially evident in industries such as healthcare, finance, and telecommunications, where continuous service is essential.

SEGMENTATION ANALYSIS

By Power

The Evolution of Cloud Computing, Big Data Analytics, and IoT has Powered the Demand for Data Centers, Driving Segmental Growth

Based on power, the market is segmented into AC UPS and DC UPS.

AC UPS is the dominating segment. The growth of cloud computing, big data analytics, and IoT has fueled demand for data centers in the country. Data centers highly deploy AC UPS systems for continuity of operations without any interruptions as they manage vast amounts of critical data. Thus, the growth and importance of data centers in business scenarios are anticipated to encourage the expansion of AC UPS.

The DC UPS segment is the second dominating segment in the market. The market for DC UPS systems is expected to grow owing to the rising adoption of electric vehicles. Electric vehicle charging stations and related infrastructure require DC UPS systems for efficient energy storage and distribution. A DC UPS is essential for maintaining uninterrupted functionality and safeguarding against power interruptions in applications powered by DC.

By Type

Rising Demand for Reliable Power Solutions to Drive the Conventional UPS Segment Growth

By type, the market is divided into modular UPS and conventional UPS.

Conventional UPS is the fastest-growing segment in the market. Conventional UPS systems are usually constructed as one large unit that offers power backup and conditioning. They are available in different sizes and setups, from compact models ideal for office spaces to extensive systems meant for industrial-level uses. Conventional UPS systems are highly favored as they have been in use for a long time, demonstrating their reliability and effective performance. They are cost-effective compared to modular systems, thus making them an economical preference for certain applications.

The modular UPS also accounted for a significant share in the market. The demand for modular UPS is increasing as it offers the ability to add modules to increase the power capacity and/or runtime of the UPS as per the changing power requirements. A modular UPS is intended to handle the added load and operate efficiently, thereby protecting the health and lifespan of the UPS and offering cost savings. These factors are anticipated to drive the demand for reliable power solutions segment of the U.S. uninterruptible power supply market in the coming years.

By Product Type

Increasing Demand for Data Center Solutions to Drive the Online Conversion UPS Growth

By product type, the market is divided into online/double conversion, line interactive, and offline/standby.

Online conversion UPS is the dominant segment in the market. Online conversion UPS offers a clean, reliable power supply essential to industries requiring uninterrupted uptime. Sectors such as data centers, hospitals, communications networks, manufacturing facilities, and others that rely heavily on grids are largely supported by online conversion UPS. Online conversion UPS are generally more expensive and require more energy to operate as they offer unparalleled protection.

Line interactive UPS is generally used in low-demand applications. These systems are deployed mostly in rackmount applications below 5 kVA.

Offline/Standby UPS is the most basic type of system intended for small, non-critical applications, protecting them against momentary loss of power. They are utilized to protect workstations, terminals, or equipment below 1 kVA. Standby UPS are cost-effective; however, they offer limited protection against power fluctuations and are mostly recommended for non-critical applications.

By Capacity

Growth of IT Infrastructure to Drive the below 50kVA segment Growth

Based on capacity, the market is segmented into below 50 kVA, 51 kVA to 200 kVA, and above 200 kVA. The below 50 kVA segment is expected to witness the most significant growth owing to its increasing application in small-scale enterprises for cost-effective backup power solutions. Further, the growing prevalence of remote work environments has also accelerated demand for small UPS systems for safekeeping equipment such as computers, routers, modems, and others. As organizations continue to invest in IT infrastructure, the demand for UPS systems to protect servers, networking equipment, and other critical devices has increased. The below 50 kVA segment is particularly well-suited for supporting small server rooms and network closets, where space is limited but reliability is essential.

The 51 kVA to 200 kVA segment is expanding owing to its large-scale application in mid-sized enterprises and institutions such as schools, hospitals, and other enterprises for supporting a range of critical operations. Growing integration with renewable energy systems is also supporting the growth of this segment.

By Application

Increasing Frequency of Power Outages to Drive the Segment Growth

Based on application, the market is segmented into IT and non-IT.

The IT application is anticipated to dominate the segment owing to the growing demand for IT infrastructure from online banking, e-commerce, and similar avenues that require constant uptime. UPS system supports these critical applications by providing reliable support and maintaining continuity of business operations. The rising incidence of power outages due to extreme weather events has heightened awareness concerning the need for reliable backup power solutions within the IT sector. Organizations are motivated to invest in UPS systems to mitigate potential losses associated with unexpected disruptions. Expansion of data centers is also anticipated to aid the segment growth. Numerous industries are growing in demand for data centers to support a variety of functions, such as cloud storage. Data protection and business continuity regulations require IT facilities to ensure uninterrupted operations, which further drives the adoption of reliable UPS solutions in IT applications.

Non-IT applications such as healthcare equipment, industrial facilities, and others highly employ UPS systems to shield devices from inconsistent power supply, as disturbances such as power surges and spikes can harm critical equipment.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Rising Demand for Digital Services, Critical Power Reliability Needs, and High Energy Consumption Requirements to Drive the Segment Growth of Data Centers

Based on end-users, the market is divided into industrial, telecom, data center, marine, healthcare, and others.

The data center is anticipated to dominate the U.S. uninterruptible power supply market share. The swift expansion of digital services and cloud computing has resulted in a notable rise in the amount of data centers throughout the U.S. As companies become more dependent on data-centered operations, the demand for dependable power solutions becomes critical. This movement is bolstered by considerable investments from leading tech firms, including Google and Microsoft, in enhancing their data center facilities in the U.S.

In the industrial sector, the demand for UPS systems is driven by the protection of industrial machinery and automation systems from power fluctuations and outages and the reduction of damage and downtime. Further, manufacturing operations require constant and reliable power supply to prevent production losses and related issues.

Telecom is another significant sector that highly deploys UPS systems for support. Telecom towers, data switches, and communication hubs require constant power to ensure the provision of telecom services and connectivity without any interruptions.

U.S. UNINTERRUPTIBLE POWER SUPPLY MARKET COUNTRY OUTLOOK

The market has been studied geographically across the U.S.

U.S.

Rising Demand for Reliable Power Solutions to Drive the Market Growth in the U.S.

As different sectors become more dependent on technology, the demand for reliable power sources has grown. This is especially clear in areas including manufacturing, healthcare, and IT, where any loss of power can result in significant operational losses. market is experiencing steady growth driven by rising reliance on digital infrastructure and technology across industries, which has made uninterrupted supply critical. Frequent power outages due to natural disasters, aging infrastructure, and increasing energy demand are driving demand for U.S. uninterruptible power supply to ensure continuous operations and protection of equipment.

Trends including cloud computing, big data analysis, and the Internet of Things (IoT) necessitate constant power to maintain business operations. UPS systems are crucial for safeguarding against power surges, voltage fluctuations, and frequency distortions that can affect vital infrastructure such as telecommunications networks and renewable energy facilities.

Progress in battery technology and modular UPS designs, coupled with smart monitoring systems, is propelling the market ahead. UPS solutions are currently being incorporated into edge computing and power backup systems to maintain power quality and prevent voltage spikes and frequency variations. The market is projected to keep expanding as companies focus on safeguarding their essential infrastructure and digital resources.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players Are Focusing On Providing Reliable And Efficient UPS Systems To Sustain Their Positions

The market is mostly fragmented, with key players operating in the industry. In the U.S., ABB Ltd. is dominating the market. In December 2024, ABB introduced the PowerValue 11T G2, a cutting-edge uninterruptible power supply designed to deliver reliable, uninterrupted power for small IT applications and other critical single-phase loads. This new addition to ABB’s UPS portfolio exemplifies the company’s dedication to addressing the growing demand for efficient, scalable, and sustainable energy solutions. The single-phase UPS was officially introduced at an exclusive event attended by a select group of customers, including representatives from hospitals, banks, and industrial companies, underscoring its relevance across diverse sectors.

List of U.S. Uninterruptible Power Supply Companies Profiled

- ABB Ltd. (Switzerland)

- Active Power (U.S.)

- AMETEK, Inc. (U.S.)

- BENNING Elektrotechnik and Elektronik GmbH & Co. KG (Germany)

- Chloride (France)

- Borri (Italy)

- Delta Electronics, Inc. (Taiwan)

- Falcon Electric (U.S.)

- GE Healthcare (U.S.)

- Hayley Systems (Canada)

- HindlePower (U.S.)

- La Marche (U.S.)

- LTI Power Systems (U.S.)

- Primax Technologies Inc. (Canada)

- Riello (Italy)

- SENS (U.S.)

- Toshiba (Japan)

- Vertiv (U.S.)

- Eaton (Ireland)

- Schneider Electric (France)

KEY INDUSTRY DEVELOPMENTS

- In December 2024, Schneider Electric, the frontrunner in the digital transformation of energy management and automation, revealed the introduction of its new Galaxy VXL, an exceptionally efficient, compact, modular, scalable, and redundant 500-1250 kW (400V) 3-phase uninterruptible power supply (UPS), equipped with improved cybersecurity, software, and safety attributes.

- In August 2024, Vertiv, an international supplier of essential digital infrastructure and continuity solutions, launched the Vertiv Liebert GXE, an online double-conversion single-phase uninterruptible power supply (UPS) offered in 6 kVA power ratings in either tower or rackmount setup. This system is intended to deliver dependable power to distributed IT networks and edge computing applications across different industry sectors, including enterprise, government, manufacturing, finance, education, and retail.

- In June 2024, Eaton, a power management firm, revealed the North American introduction of its Eaton Tripp Lite series cloud-connected uninterruptible power supply. Offering affordable battery backup and surge protection, Eaton claims the solution comes with cloud-enabled remote monitoring to ease power management for uses, including retail point-of-sale (POS) systems, casino gaming machines, banking ATMs, and additional applications.

- In January 2024, Luso Electronics disclosed a new partnership arrangement with AMETEK IntelliPower to enhance its extensive array of rugged UPS power protection solutions that cater to a diverse selection of defense and industrial applications. Luso believes that the agreement is a natural expansion of its portfolio; it provides a broad range of products for defense and extreme industrial applications, and they are eager to collaborate with the IntelliPower team to support the U.K. market with its robust UPS and power solutions.

- In September 2021, ABB introduced a groundbreaking MV UPS that delivers a continuous and dependable power supply of up to 24 kV for data centers and other essential facilities to safeguard servers and mechanical loads while minimizing downtime. HiPerGuard promotes sustainability with the utmost levels of efficiency currently accessible in the market, at 98 percent, equating to a possible reduction in carbon emissions of 1,245 tons over an average 15-year lifespan.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investments in the U.S. uninterruptible power supply market expansion present significant opportunities for the major players as investment in essential infrastructure such as data centers and manufacturing facilities generates a need for the dependable power backup that UPS systems offer. Furthermore, as technology progresses and organizations become more dependent on digital solutions, the necessity for UPS systems to avert downtime and safeguard data grows. Moreover, increased funding in renewable energy sources and intelligent power grids can also result in heightened demand for UPS systems to maintain power stability.

- In September 2023, Aggreko, the top global provider of mobile modular power, temperature regulation, and energy solutions, revealed the acquisition of a range of uninterruptible power supply (UPS) systems to complement its powerful temporary power generators during events. Through this multi-million dollar investment, Aggreko persists in its investment in cutting-edge technology to facilitate the smooth broadcasting of events for the nation's largest television networks. The acquisition of this technology occurs just before Aggreko is prepared to deliver broadcasting power solutions for more than a hundred games in one of America's prominent professional sports leagues.

REPORT COVERAGE

The U.S. Uninterruptible Power Supply market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations offering uninterruptible power supply. Besides, the report provides insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.73% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power

|

|

By Type

|

|

|

By Product Type

|

|

|

By Capacity

|

|

|

By Application

|

|

|

By End-User

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.69 billion in 2024.

The market is likely to grow at a CAGR of 6.73% over the forecast period (2025-2032).

The data center segment leads the market.

Increasing demand for reliable, high-performance UPS for uninterrupted power supply

ABB Ltd. (Switzerland), Active Power (U.S.), AMETEK, Inc. (U.S.), BENNING Elektrotechnik und Elektronik GmbH & Co. KG (Germany) and others are some of the market's top players.

The market size is expected to reach USD 4.55 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us