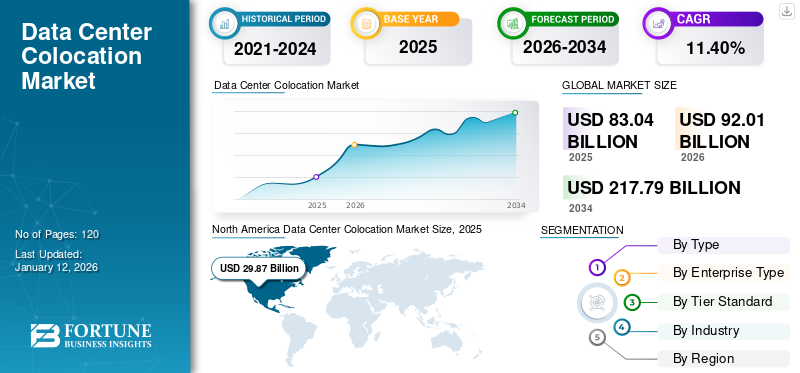

Data Center Colocation Market Size, Share & Industry Analysis, By Type (Retail Colocation, Wholesale Colocation, and Hybrid Colocation), By Enterprise Type (Large Enterprises and Small and Medium-sized Enterprises), By Tier Standard (Tier I, Tier II, Tier III, and Tier IV), By Industry (IT & Telecom, BFSI, Healthcare, Retail, Government & Defense, Manufacturing, Media & Entertainment and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global data center colocation market size was valued at USD 83.04 billion in 2025. The market is projected to grow from USD 92.01 billion in 2026 to USD 217.79 billion by 2034, exhibiting a CAGR of 11.40% during the forecast period. North America dominated the global market with a share of 36.00% in 2025.

Organizations are generating unprecedented volumes of data through AI, IoT, edge computing, cloud applications, and digital platforms. For handling this huge amount of data, demand for colocation is increasing as it provides a scalable, secure infrastructure without requiring enterprises to build their own data centers. According to industry experts, global data creation will reach 175 zettabytes by 2025, up from 59 zettabytes in 2020.

Key players, including Equinix, Digital Realty, EdgeConnex, and Stack Infrastructure, are adopting various strategies such as mergers, acquisitions, and joint ventures with cloud, telco, and infrastructure firms. Additionally, companies are partnering with major cloud providers including AWS, Azure, Google Cloud, and enhancing software-defined interconnection platforms.

IMPACT OF GENERATIVE AI

Generative AI has significant impact on data center colocation, GenAI models such as ChatGPT, Gemini, and Claude. These models require enormous computational power, particularly during training and real-time inference, leading hyperscalers and AI startups to seek colocation services that can support dense GPU clusters, high power loads (50–100+ kW per rack), and low-latency interconnects to cloud and edge environments. According to Dell’Oro Group, AI-driven data center capex is projected to exceed USD 500 billion by 2027, and a sizable share of that will flow into colocation facilities that offer flexibility, fast deployment, and proximity to cloud availability zones. As a result, colocation providers are increasingly redesigning their facilities to accommodate AI workloads, investing in liquid cooling, high-density power, and fiber-rich interconnection ecosystems.

Get comprehensive study about this report by, Download free sample copy

IMPACT OF RECIPROCAL TARIFF

The reciprocal tariff has a significant impact on data center colocation as data centers rely heavily on imported servers, networking hardware, cooling systems, and backup power solutions, many of which are sourced across borders from the U.S., China, Taiwan, Germany, and Japan. When reciprocal tariffs are applied to IT hardware or construction materials, it increases the capital expenditure (CAPEX) required to build or expand colocation facilities, delaying deployments or escalating pricing for end users.

Moreover, tariffs can impact sourcing strategies, pushing colocation providers to localize procurement, enter joint ventures with regional hardware vendors, or negotiate long-term supplier contracts to hedge against price volatility. In the long run, sustained reciprocal tariffs may also lead to the fragmentation of global colocation ecosystems, encouraging providers to build regional supply chains but limiting scalability and cost-efficiency.

Data Center Colocation Market Trends

Rising Demand for Edge Data Centers to Aid Market Growth

The growing demand for edge data centers is significantly driving the expansion of the market, as organizations increasingly seek infrastructure that processes data closer to where it is generated. Edge data centers are smaller distributed facilities, designed to reduce latency and enable real-time data processing for applications such as IoT, autonomous vehicles, smart cities, 5G, industrial automation, and AR/VR. This shift from centralized to decentralized computing models has made colocation providers critical enablers of edge deployment, especially in locations where building private infrastructure is neither cost-effective nor feasible.

According to IDC, by 2025, 75% of all enterprise-generated data will be created and processed outside traditional centralized data centers or the cloud, up from less than 10% in 2018. This trend is fueling the rise of edge data centers and, consequently, colocation services that offer modular, scalable, and geographically distributed infrastructure. For example, Equinix, Stack Infrastructure, and EdgeConneX are investing in edge-ready colocation facilities in Tier II and Tier III cities to support use cases requiring ultra-low latency (often under 20 milliseconds). Moreover, as telecom operators roll out 5G networks, they increasingly colocate mobile edge computing (MEC) infrastructure in regional data centers to support network slicing, content delivery, and cloud gaming, further strengthening the colocation value proposition. Thus, the rising demand for edge data centers is expected to drive data center colocation market growth.

MARKET DYNAMICS

Market Drivers

Increasing High-Density Computing Workloads and Adoption of AI to Boost Market Growth

Adoption of AI and high-density computing workloads is reshaping the needs of enterprises for the infrastructure. As AI applications, particularly machine learning (ML), deep learning (DL), and generative AI models, become more computationally intensive, thereby increasing the demand for high-performance infrastructure. These workloads require powerful GPUs, large-scale memory bandwidth, and robust thermal management systems, which traditional enterprise-owned data centers often lack. As a result, companies are increasingly turning to colocation providers that offer high-density, AI-optimized environments.

For instance, Generative AI requires ultra-dense GPU clusters such as NVIDIA H100s or A100s operating at 50 to 100+ kilowatts (kW) per rack, compared to conventional enterprise racks, which typically run at 5–10 kW. Most legacy enterprise facilities are not equipped to support such density, nor do they have the advanced liquid or immersion cooling systems necessary to maintain stable temperatures. Leading colocation providers such as Equinix, Digital Realty, Aligned, Vantage, and Stack Infrastructure are now building AI-ready zones with specialized designs to accommodate these workloads, offering high-power density, scalable interconnects, and proximity to cloud GPU resources.

Therefore, increasing high-density computing workloads and the adoption of AI are boosting the data center colocation market share.

Market Restraints

High Initial Setup and Integration Cost Hampers Market Growth

High initial setup and integration costs restrict the widespread adoption of data center colocation, especially among small and mid-sized enterprises (SMEs) and organizations with limited IT budgets. While colocation is generally more cost-effective than building and maintaining a private data center, it requires considerable upfront investment to transition workloads, configure infrastructure, and establish connectivity within the colocation facility.

Market Opportunities

Sustainability and Green IT Requirements are Expected to Generate Opportunities

Enterprises increasingly prioritize environmental responsibility along with performance and cost efficiency. With growing pressure from regulators, investors, and customers to reduce carbon footprints, companies are shifting their IT infrastructure strategies toward energy-efficient, carbon-conscious solutions. Colocation facilities are now being designed with advanced energy-saving technologies such as liquid cooling, free-air cooling, modular UPS systems, and AI-based power management, enabling significantly lower Power Usage Effectiveness (PUE) compared to traditional enterprise data centers. While in-house data centers often operate at an average PUE of 1.7 to 2.0, leading colocation providers such as Equinix, Digital Realty, and Iron Mountain maintain PUEs as low as 1.2 or even 1.1.

Moreover, the adoption of renewable energy in colocation is accelerating. According to Uptime Institute, nearly 70% of colocation operators in North America and Europe now offer green power purchasing options. At the same time, companies such as Google, AWS, and Equinix have committed to 100% renewable energy use across their colocation platforms. This allows enterprises to meet sustainability targets and ESG reporting requirements without building their own green-certified facilities. Green colocation providers offer a ready-made path for enterprises to achieve their decarbonization goals while maintaining access to high-performance, scalable, and compliant IT infrastructure. Therefore, the sustainability and green IT requirements will provide a lucrative opportunity for the players in the market.

SEGMENTATION ANALYSIS

By Type

Retail Colocation Leads Owing to Increasing AI Workloads and Edge Computing

Based on type, the market is segmented into retail colocation, wholesale colocation, and hybrid colocation.

Among these, retail colocation dominated the market with a share of 50.26% in 2026, owing to its rising demand for flexibility, proximity, cost control, and hybrid cloud support, particularly among SMEs, content providers, and regional operators. As edge computing, 5G, and AI workloads continue to grow, retail colocation will remain a critical infrastructure solution enabling decentralized, resilient, and agile digital operations.

Hybrid colocation is estimated to grow with the highest CAGR during the forecast period. Hybrid colocation offers physical control of hardware (important for regulated data) and private connectivity to clouds, reducing exposure to internet-based threats. It enables organizations to dynamically shift workloads between on-premises, colocated infrastructure, and the cloud based on performance, compliance, or cost-efficiency needs.

By Enterprise Type

Large Enterprises are Rapidly Adopting Data Center Colocation to Support Digitalization

Based on enterprise type, the market is bifurcated into large enterprises and small and medium-sized enterprises.

Large enterprises captured a leading market share with a share of 62.88% in 2026. The demand for data center colocation among large enterprises is growing steadily due to their need for scalable, secure, and cost-optimized infrastructure that supports digital transformation, hybrid IT models, and global expansion.

Small and medium-sized enterprises are expected to register the highest CAGR during the forecast period. The demand for data center colocation among Small and Medium-sized Enterprises (SMEs) is rising rapidly, driven by their growing need for scalable, secure, and cost-efficient IT infrastructure without the burden of owning and operating their own data centers. As SMEs undergo digital transformation and adopt cloud-based, AI, and edge applications, colocation offers them a strategic solution to improve performance, enhance reliability, and stay competitive without large capital investments.

By Tier Standard

Popularity of Tier II Data Centers is Increasing Due to Enhanced Cooling Technologies

The tier standard has been segmented into tier I, tier II, tier III, and tier IV.

Tier II is estimated to grow with the highest CAGR during the forecast period and accounting for 39.18% market share in 2026. Tier II designs are being enhanced with modern cooling technologies, modular UPS, and renewable energy integrations, allowing lower PUEs (~1.5–1.7) while keeping costs down.

Among these, Tier III dominated the market in 2024. Tier III facilities offer 99.982% uptime (or ~1.6 hours of downtime annually), which meets the SLA requirements of most enterprises without the additional complexity and cost of Tier IV (which offers 99.995% uptime).

By Industry

IT & Telecom to Dominate as they Generate and Process a Huge Amount of Data

The industry has been segmented into IT & telecom, BFSI, healthcare, retail, government & defense, manufacturing, media & entertainment, and others.

Among these, IT & telecom dominated the market in 2024. IT & telecom companies generate and process enormous amounts of data from services such as streaming, mobile usage, social media, cloud computing, 5G networks, and IoT. Colocation provides the infrastructure capacity to handle growing bandwidth and storage needs without the delay and capital costs of building new data centers.

Healthcare is estimated to grow with the highest CAGR during the forecast period. Building and maintaining private data centers is expensive and complex. Colocation offers a cost-effective alternative with predictable operational expenses, enabling healthcare organizations to pay for only the space, power, and bandwidth they need.

To know how our report can help streamline your business, Speak to Analyst

DATA CENTER COLOCATION MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Data Center Colocation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 29.87 billion in 2025 and USD 32.73 billion in 2026. The demand for data center colocation in North America is experiencing significant growth, driven by digital transformation, cloud adoption, AI integration, and 5G expansion.

Download Free sample to learn more about this report.

In the U.S., the market is expected to experience a strong growth rate during the forecast period, as the U.S. is the global hub for cloud computing, AI, big data analytics, and SaaS companies that generate a massive amount of data. Colocation provides the physical infrastructure and connectivity backbone to host cloud nodes, AI/ML workloads, content delivery platforms, and enterprise applications. According to Cisco, U.S. data center IP traffic is expected to exceed 11 ZB per year by 2025, up from 6.8 ZB in 2021. The U.S. market is valued at USD 26.97 billion by 2026.

Building and operating an in-house Tier III or IV data center in the U.S. involves tens to hundreds of millions in CapEx and ongoing OpEx. Colocation provides a shared facility model, allowing businesses to lease space (retail or wholesale) while avoiding infrastructure maintenance and capital lock-up.

Asia Pacific

The Asia Pacific region is expected to grow with the highest CAGR during the forecast period. The region is home to more than half of the world’s internet users, led by China, India, Indonesia, and Southeast Asia. The rapid adoption of smartphones, e-commerce, online education, and video streaming drives demand for low-latency, high-availability infrastructure that colocation providers offer.

Japan, South Korea, Singapore, and Australia are investing in AI R&D and digital twins, therefore, increasing the demand for high-density colocation facilities.The Japan market is valued at USD 4.61 billion by 2026, the China market is valued at USD 5.64 billion by 2026, and the India market is valued at USD 3.18 billion by 2026.

Europe

As European enterprises accelerate cloud adoption, enterprises are embracing hybrid cloud and multi-cloud strategies. Colocation facilities act as connectivity hubs, offering direct interconnects to major cloud providers such as AWS, Azure, and Google Cloud. Cloud IT infrastructure spending in Europe is expected to grow at 17% to 20% CAGR through 2028, boosting demand for colocation-based cloud on-ramps. The UK market is valued at USD 4.51 billion by 2026, while the Germany market is valued at USD 3.52 billion by 2026.

Middle East & Africa

Governments are investing heavily in smart cities, fintech, AI, and IoT infrastructure as part of national strategies such as Saudi Arabia’s Vision 2030, UAE’s Digital Government Strategy 2025, and others. These initiatives require local data processing and hosting, which is accelerating demand for colocation.

South America

The region is witnessing progress in 5G rollout plans across Brazil, Chile, and Peru, which surges the demand for next-gen services such as smart cities, autonomous vehicles, IoT, and video streaming. These applications need low-latency data processing, driving the need for colocation facilities.

Competitive Landscape

Key Industry Players

Market Players Opt for Merger & Acquisition Strategies to Expand Their Presence

Players in the market adopt a variety of strategic initiatives to drive growth, gain a competitive advantage, and meet the evolving demands of digital transformation. Players form alliances with cloud service providers, telecom operators, and interconnection platforms to enhance their value proposition. With increasing pressure from customers, regulators, and ESG investors, colocation providers are heavily investing in renewable energy, liquid cooling, and energy-efficient designs. To access new markets, and consolidate leadership, companies are entering into strategic M&A activities.

Long List of Companies Studied

- Equinix, Inc. (S.)

- Digital Realty (U.S.)

- NTT Global Data Centers (Japan)

- Cyxtera Technologies (U.S.)

- Iron Mountain (S.)

- Cyrus One (U.S.)

- Edge ConneX (S.)

- Stack Infrastructure (S.)

- Chindata Group (China)

- AirTrunk (Australia)

- Global Switch (U.K.)

- Ooredoo (Qatar)

- Globenet (U.S.)

- KIO Networks (Mexico)

… and more

KEY INDUSTRY DEVELOPMENTS

- June 2025 – Global Switch launched a Liquid Cooling Suite at its data center in London’s Docklands. The suite features single and two-phase immersion cooling systems and direct-to-chip technologies.

- April 2025 – Apollo acquired the European colocation business developed and managed by STACK infrastructure.

- July 2024 – Digital Realty acquired a data center that is a highly connected colocation in the Slough Trading Estate. The aim of the acquisition is to enter into the West London submarket and complement existing colocation capabilities in the City and Docklands.

- August 2024 – Airtrunk has become a DGX-Ready colocation partner of NVIDIA to test the capabilities of AI.

- January 2024 – Evoque Data Center Solutions has acquired Cyxtera to build a data center company with over 50 locations, primarily in North America.

INVESTMENT OPPORTUNITIES

The global data center colocation market is undergoing rapid transformation, driven by increasing digitalization, AI adoption, and hybrid cloud deployment across industries. Companies are increasingly shifting from owning and operating their own data centers to leveraging colocation services to reduce capital expenditures, improve uptime, and meet compliance demands. In particular, generative AI workloads, which require high-density computing and advanced cooling systems, are pushing demand for next-generation colocation centers with rack densities of 30–50 kW, far exceeding legacy capacities. This shift is creating significant investment opportunities in high-performance and AI-ready facilities.

REPORT COVERAGE

The market research report provides a detailed analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several aspects that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Enterprise Type

By Tier Standard

By Industry

By Region

|

|

Companies Profiled in the Report |

• Equinix, Inc. (U.S.) • Digital Realty (U.S.) • NTT Global Data Centers (Japan) • Cyxtera Technologies (U.S.) • Iron Mountain (U.S.) • Cyrus One (U.S.) • Edge ConneX (U.S.) • Stack Infrastructure (U.S.) • Chindata Group (China) • AirTrunk (Australia) |

Frequently Asked Questions

The market is projected to record a valuation of USD 217.79 billion by 2034.

In 2025, the market was valued at USD 83.04 billion.

The market is projected to grow at a CAGR of 11.40% during the forecast period of 2026-2034.

The retail colocation is expected to lead the market in terms of share.

Increasing high-density computing workloads and adoption of AI are few factors supporting market growth.

Equinix, Digital Realty, NTT Data, CyrusOne, Global Switch, and Iron Mountain are the top players in the market.

North America is expected to hold the largest market share.

By industry, the healthcare sector is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us