Vanadium Oxide Market Size, Share & Industry Analysis, By Type (Vanadium Pentoxide (V2O5), Vanadium Trioxide (V2O3) and, Others), By Application (Steel & Metallurgy, Chemical Industry, Energy, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

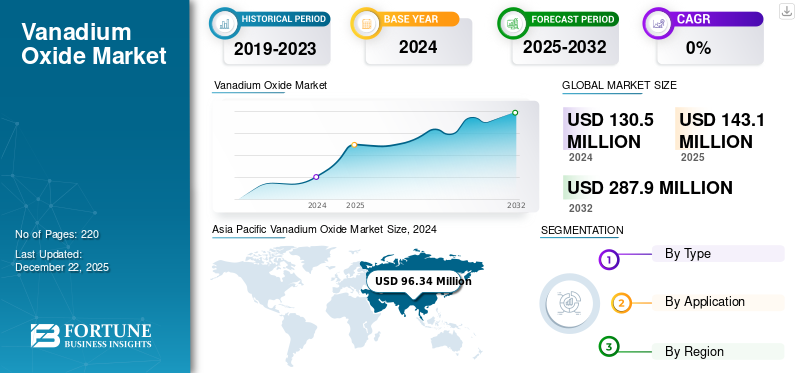

The global vanadium oxide market size was valued at USD 143.1 million in 2025 and is projected to grow from USD 153.7 million in 2026 to USD 312 million by 2034, exhibiting a CAGR of 10.4% during the forecast period. Asia Pacific dominated the vanadium oxide market with a market share of 74.00% in 2025.

The vanadium oxide includes a group of inorganic compounds where vanadium (V) is bonded to oxygen, existing in various oxidation states, with vanadium pentoxide (V₂O₅) and vanadium trioxide (V₂O₃) being the most widely utilized. These compounds are also relevant in research areas such as electrochemistry and thin-film coatings. Their thermal, electrical, and catalytic characteristics make the product necessary in high-performance material systems and advanced industrial technologies requiring functional inorganic chemistry.

The global market is witnessing significant growth opportunities driven by various applications such as metallurgy, energy, chemical, and automotive. The growing demand for infrastructure and increasing investments in renewable energy drive the vanadium oxide market growth.

The main players working in the market include Merck KGaA, Bushveld Minerals, HBIS GROUP, AMG TITANIUM, and China Ansteel Group Corporation Limited.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Strength and Lightweight Steel in Various Emerging Industries is driving Market Growth

The increasing use of high-performance steel across construction, transportation, and manufacturing is a major driver for the market. Vanadium Pentoxide (V₂O₅) is essential for producing ferrovanadium, a key alloying element that improves steel's strength, flexibility, and corrosion resistance. Infrastructure development in emerging economies and stringent fuel efficiency norms in the automotive sector are accelerating demand for lighter and stronger steel materials. As steel producers continue optimizing formulations to meet global standards, vanadium oxide remains a critical additive.

MARKET RESTRAINTS

Price Volatility Due to Supply Concentration Could Restrain the Market Growth

One major constraint impacting the market is high price volatility caused by concentrated supply chains. Significant global vanadium production is concentrated in a few countries, particularly China, South Africa, and Russia. Any disruptions in mining activity, environmental regulations, or export policies in these nations can severely impact the global supply chain, leading to sharp price fluctuations. Such unpredictability creates uncertainty for downstream industries, including high-strength steel and energy storage systems that depend on consistent pricing for long-term planning.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Infrastructure Creates a Strong Market Opportunity

As global investment in renewable energy continues to rise, there is growing demand for large-scale, long-duration storage solutions to stabilize power supply and manage intermittency. Vanadium redox flow batteries (VRFBs), which rely on high-purity Vanadium Pentoxide, are increasingly considered for grid applications due to their safety, long cycle life, and ability to scale energy and power. Emerging economies in Asia Pacific, Africa, and Latin America are investing in hybrid solar-storage systems where VRFBs can offer reliable performance. This shift presents a major opportunity for vanadium oxide producers.

- As per the Saur Energy article, India’s Vanadium Redox Flow Batteries (VRFB) market held a share of USD 70.69 million in 2024, projected to grow at a CAGR of 11.8% by 2031. This growth is due to India’s increasing investments in renewable energy and energy storage solutions. This growth brings opportunity for the vanadium oxide industry as it is used in battery production.

MARKET CHALLENGES

Environmental and Waste Management Concerns Could Challenge the Market Growth

Despite its utility, vanadium oxide production is closely tied to environmental concerns, particularly emissions, hazardous waste, and land degradation from mining. Refining vanadium-bearing ores often produces solid and liquid waste that requires careful disposal to avoid contamination. Improper handling can lead to soil and groundwater pollution. Regulatory bodies in developed and emerging markets are tightening environmental norms, necessitating producers to implement cleaner processing technologies and better waste treatment solutions.

VANADIUM OXIDE MARKET TRENDS

Integration of Vanadium in Advanced Battery Innovation is an Emerging Market Trend

The rise of next-generation energy storage solutions drives continued interest in vanadium-based chemistries beyond traditional redox flow batteries. Researchers are investigating vanadium’s role in hybrid battery systems, solid-state batteries, and novel aqueous electrolyte technologies to address safety, energy density, and material sustainability issues. This trend is supported by growing funding for green energy research from both public and private sectors. As global attention shifts toward flexible, long-life energy storage, advanced battery R&D involving vanadium will shape the market's future growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing use of Vanadium Pentoxide V₂O₅ Segment in Steel and Energy Applications is driving the Segment Growth

Based on type, the market is classified into Vanadium Pentoxide (V₂O₅), Vanadium Trioxide (V2O3), and others.

Vanadium Pentoxide (V2O5) segment holds the largest vanadium oxide market share, as it is extensively used across metallurgy, energy, and chemical sectors. Its primary application is producing ferrovanadium, an essential additive in high-strength and low-alloy steels. Due to its oxidative efficiency, it is also widely used as a catalyst in the sulphuric acid production process. V₂O₅ is gaining higher value in the energy sector, particularly in vanadium redox flow batteries (VRFBs). Its rising role in green technologies makes it a strategic material in the global shift toward cleaner energy solutions.

Vanadium Trioxide (V2O3) is a specialized compound within the market, appreciated for its unique electronic and thermochromic properties. It is primarily used in ceramic materials, optical coatings, and as an intermediate in vanadium metal production. It also serves as a mediator in preparing vanadium alloys used in aerospace and defense. As interest in functional materials grows, V₂O₃ is increasingly investigated for use in next-generation electronics and sensor applications.

By Application

Steel & Metallurgy Application Dominates de due to Growing Energy and Aerospace Sectors

Based on applications, the market is classified into steel & metallurgy, chemical industry, energy, and others.

The steel & metallurgy segment holds largest share in the market, especially Vanadium Pentoxide (V₂O₅), due to its critical role in producing ferrovanadium alloys. These alloys enhance tensile strength, durability, and corrosion resistance in structural steels used across construction, automotive, oil & gas, and aerospace sectors. A smaller quantity of vanadium significantly improves steel performance, making it ideal for pipelines, tools, and infrastructure exposed to high stress and extreme temperatures.

In the chemical industry, vanadium oxide plays a key role as a catalyst and intermediate compound in various processes. Vanadium Pentoxide (V₂O₅) is most prominently used to produce sulfuric acid via the contact process, one of the largest-volume chemical reactions globally. The growth of sustainable chemical production methods has elevated demand for efficient and reusable catalysts, strengthening the case for vanadium-based compounds.

The energy sector is rapidly emerging as a high-potential application area for vanadium oxide, driven primarily by the rising adoption of vanadium redox flow batteries (VRFBs). Vanadium Pentoxide (V₂O₅) is a core material in these systems, enabling long-duration energy storage that supports renewable integration and grid stability. Contrasting to lithium-ion batteries, VRFBs use the same element in both the positive and negative half-cells, offering better safety.

Vanadium Oxide Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, and the Rest of the World.

Asia Pacific

Asia Pacific Vanadium Oxide Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 106.2 Million in 2025 and USD 117.4 Million in 2026. Asia Pacific region holds the largest share in the market, with China leading the region and accounting for majority of global vanadium oxide output, supported by its vast reserves, large-scale metallurgy operations, and government-led infrastructure projects. India and Japan are emerging markets, driven by construction growth, automotive demand, and efforts to diversify energy storage technologies. Across the region, strong industrial growth, rising demand for high-performance steels, and expansion of chemical manufacturing plants continue to fuel the usage.

North America

North America holds a significant share in the market, driven by a large metallurgy sector and emerging energy storage applications. The U.S. remains a key consumer, with steady demand from steel production and aerospace-grade alloy production. Imports dominate the region’s vanadium oxide supply, creating opportunities for domestic processing facilities. Canada’s growing mining sector may play a larger role in the regional supply landscape in the future, with increased federal and state investments in clean technology and resilient infrastructure.

Europe

Europe remains a significant market for vanadium oxide, largely supported by strong sustainability goals, circular economy policies, and advanced metallurgy standards. Countries such as Germany, France, and the Netherlands are investing heavily in green steel technologies, which utilize ferrovanadium to produce stronger, lighter, and more recyclable materials. Although the region faces challenges related to raw material imports and stringent environmental policies, regulatory alignment and financial incentives for energy storage are boosting the product demand.

Latin America

Latin America is an emerging player in the market, with growing industrial activity and increasing interest in renewable energy infrastructure. Brazil and Argentina are the region’s most promising markets, with expanding construction and metallurgical sectors that use vanadium-based steel alloys. Additionally, Latin America is gradually exploring energy storage solutions. International partnerships and investments in exploration projects may help unlock the region’s market potential.

Middle East & Africa

The Middle East & Africa market shows steady growth, driven by expanding steel industry, mining, and energy diversification initiatives. South Africa, one of the leading vanadium producers, plays a central role as a supplier in global markets. In the Middle East, demand is driven by infrastructure projects, energy storage, and the development of domestic value chains for metals and chemicals. Countries such as Saudi Arabia and the UAE are increasing investment in smart energy systems where vanadium-based technologies are important.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Position in Market

The vanadium oxide market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include Merck KGaA, Bushveld Minerals., HBIS GROUP, AMG TITANIUM, and China Ansteel Group Corporation Limited, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, thus intensifying competition in the industry.

LIST OF KEY VANADIUM OXIDE COMPANIES PROFILED

- Merck KGaA (Germany)

- Treibacher Industries AG (Austria)

- S. Vanadium LLC (U.S.)

- TAIYO KOKO Co.,Ltd. (South Africa)

- Goldmann Group (U.S.)

- Bushveld Minerals (South Africa)

- HBIS GROUP(China)

- Largo Inc. (Canada)

- AMG TITANIUM (U.S.)

- China Ansteel Group Corporation Limited (China)

KEY INDUSTRY DEVELOPMENTS

- November 2024: HBIS Co., Ltd. has completed the first phase of its vanadium flow battery (VFB) energy storage project, supporting China's "Dual Carbon" strategy. The initial 100 MW production line is now ready for commercial use. This project is a joint venture between HBIS subsidiary Chengde Vanadium Titanium New Material and VRB Energy.

- September 2022: U.S. Vanadium recently completed a USD 5.8 million upgrade to its vanadium processing facility in Hot Springs, Arkansas. This investment included installing an industrial belt filter plant, significantly improving vanadium recovery rates, reducing operating costs, and enhancing recycling operations.

- February 2022: U.S. Vanadium and Austrian-based CellCube (Enerox GmbH) have significantly expanded their sales agreement for ultra-high-purity vanadium redox flow battery (VRFB) electrolyte. Under the new five-year agreement, CellCube can purchase up to 3 million additional liters per year of US Vanadium's electrolyte, a substantial increase from the initial agreement for 580,000 liters/year signed in September 2021.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.4% from 2026-2034 |

|

Unit |

Value (USD Million) Volume (Kiloton) |

|

Segmentation |

By Type · Vanadium Pentoxide (V2O5) · Vanadium Trioxide (V2O3) · Others |

|

By Application · Steel & Metallurgy · Chemical Industry · Energy · Others |

|

|

By Geography · North America (By Type, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Russia (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Application, and Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Application, and Country) o GCC (By Application) o South Africa (By Application) · Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 153.7 million in 2026 and is projected to reach USD 312 million by 2034.

In 2025, the market value stood at USD 143.1 million.

The market is expected to exhibit a CAGR of 10.4% during the forecast period of 2026-2034.

The Vanadium Pentoxide (V2O5) segment led the market by type in 2025.

The growing use of vanadium in high-performance steel, which is used across construction, transportation, is set to be the key factor in driving the market.

Merck KGaA, Bushveld Minerals, HBIS GROUP, AMG TITANIUM, and China Ansteel Group Corporation Limited are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

The increasing demand from the steel industry and the surging need for energy storage solutions will likely drive the product's adoption in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us