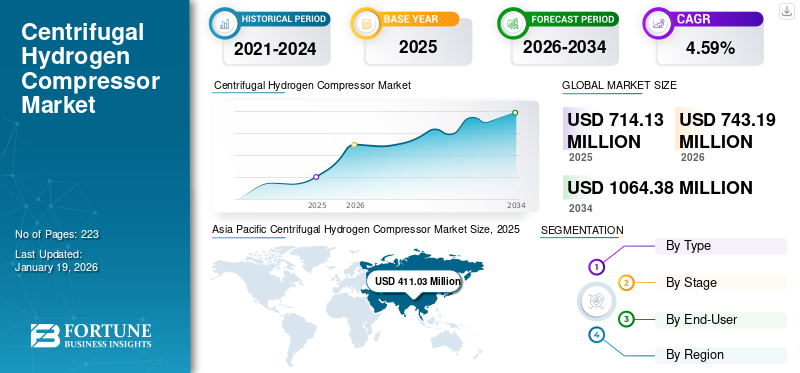

Centrifugal Hydrogen Compressor Market Size, Share & Industry Analysis, By Type (Oil-free and Oil-Based), By Stage (Single Stage and Multi Stage), By End-User (Power Plants, Hydrogen Refueling Station, Industrial Furnace, Petrochemical and Chemical, Pharmaceutical, Oil and Gas, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global centrifugal hydrogen compressor market size was valued at USD 714.13 million in 2025. The market is projected to grow from USD 743.19 million in 2026 to USD 1,064.38 million by 2034, exhibiting a CAGR of 4.59% during the forecast period. Asia Pacific dominated the centrifugal hydrogen compressor market with a share of 57.56% in 2025.

Hydrogen is becoming a major element in the global shift toward sustainable energy systems. Centrifugal hydrogen compressor plays a crucial role in compressing hydrogen for storage, transportation, and usage across diverse applications, such as fuel cell vehicles and industrial processes. Governments across the globe are implementing policies to promote hydrogen technologies through subsidies, tax benefits, and renewable energy mandates. Such initiatives foster investments in hydrogen infrastructure, increasing the need for specialized equipment such as centrifugal compressors. Oil-free centrifugal hydrogen compressors are specifically designed to compress hydrogen gas without the use of lubricants, a crucial feature for applications such as fuel cells and other hydrogen-related technologies.

Major players such as Siemens, Mitsubishi Heavy Industries Ltd., and MAN Energy Solutions are driving the market growth. Siemens Energy stands as a frontrunner in hydrogen compression technology, with more than 2,500 units functioning worldwide. The company offers innovative turbomachinery solutions tailored for applications involving pure hydrogen and those rich in hydrogen. Siemens emphasizes efficiency, dependability, and sustainability in its compressor designs, which are crucial for the storage, transportation, and integration of hydrogen into renewable energy frameworks.

In a recent development, Siemens inaugurated an advanced laboratory in Redmond, U.S., concentrating on cutting-edge turbocompressor solutions. This facility aims to foster decarbonization efforts across various industries.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Hydrogen Fuel Technologies to Drive Market Growth

The rising need for hydrogen fuel technologies is a major driver of the centrifugal hydrogen compressor market. As the global energy landscape shifts toward cleaner and more sustainable alternatives, hydrogen becomes an essential substitute for fossil fuels, especially in industries such as transportation, energy, and manufacturing. This change is generating significant demand for effective hydrogen compression systems, with centrifugal compressors playing a pivotal role in this infrastructure due to their capacity to manage the high flow rates and pressures necessary for hydrogen production, storage, and distribution. In July 2020, Siemens Energy was selected to provide centrifugal compressor systems for the HUGRS project of Saudi Aramco’s Hawiyah Unayzah Gas Reservoir Storage. The facility includes a gas injection plant with a capacity of 1500 million ft3/d (42 475 270 m3/d) and a gas withdrawal facility capable of managing up to 2000 million ft3/d (56 633 693 m3/d).

CENTRIFUGAL HYDROGEN COMPRESSOR MARKET TRENDS

Growing Deployment of Hydrogen Pipelines and Storage to Drive Market Expansion

Growing usage of hydrogen pipelines and storage systems is driving the adoption of centrifugal hydrogen compressors. As countries expand hydrogen-transport networks and develop large-scale storage facilities such as underground salt caverns and pressurized tanks, the need for increasing demand for high-capacity, continuous-duty compressors equipment rises. Centrifugal compressors are well-suited for these midstream applications due to their ability to efficiently handle large volumes of hydrogen at consistent flow rates, with lower maintenance and operational costs.

MARKET RESTRAINTS

High Maintenance Costs to Hinder Market Growth

High upkeep expenses remain a notable element obstructing the centrifugal hydrogen compressor market growth. Although centrifugal compressors typically incur lesser maintenance expenses in comparison to other varieties, they still demand frequent and occasionally pricey maintenance to maintain peak functionality. This includes regular assessments, part substitutions, and expert servicing, which is costly, particularly for high-efficiency hydrogen compression systems that function in challenging environments.

MARKET OPPORTUNITIES

Government and Industrial Investments to Fuel Market Expansion

Governments globally are implementing policies and funding initiatives to promote the development of hydrogen infrastructure, which includes production, distribution, and refueling facilities. For instance, China’s 14th Five-Year Plan emphasizes innovations in hydrogen technology and the decarbonization of industrial sectors. Financial incentives, subsidies, and supportive regulatory frameworks across the Asia Pacific countries such as China, India, Japan, and South Korea are facilitating the growth of the hydrogen economy. This, in turn, is increasing the demand for centrifugal compressors in various hydrogen-related applications.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Oil-based Centrifugal Hydrogen Compressors Dominate Market Due to Efficient Cooling Capacity of Oil

By type, the market is divided into oil-free and oil-based.

The oil-based segment holds the majority of the centrifugal hydrogen compressor market share. Oil functions as an efficient cooling substance, eliminating up to 80% of the heat produced throughout the compression process. This enhanced cooling capability enables the compressor to work more effectively and manage greater compression ratios, a crucial feature for industrial hydrogen uses.

By Stage

Greater Reliability of Multi Stage in Achieving High Pressures and Large Flow Rates to Lead Segment Growth

By stage, the market is bifurcated into single stage and multi stage.

Multi stage is the dominating segment due to its reliable performance, exceptional reliability, and extended mean time between failures. They additionally ensure accurate regulation of gas delivery, which is essential for preserving process stability in industrial settings.

By End-User

Petrochemical and Chemical Segment Leads Due to Its Ability to Deliver High Flow Rates

By end-user, the market is categorized into power plants, hydrogen refueling station, industrial furnace, petrochemical and chemical, pharmaceutical, oil and gas, and others.

Petrochemical and chemical is the dominating segment in the centrifugal hydrogen compressor market. The industry requires large hydrogen compression stations capable of delivering high flow rates and operating continuously under demanding conditions. Centrifugal compressors are ideal for these needs due to their operational stability, high capacity, and reduced maintenance requirements when compared to other compressor types.

CENTRIFUGAL HYDROGEN COMPRESSORS MARKET REGIONAL OUTLOOK

The market has been analyzed geographically over five primary regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Centrifugal Hydrogen Compressor Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 411.03 million in 2025 and USD 431.13 million in 2026., owing to high investment growth and increasing government support for hydrogen infrastructure in the region. Rapid urban growth and industrial development are boosting energy usage across the region, especially in nations such as China, India, and Japan. This rising need for electricity is fueling a rise in hydrogen-based power projects, thereby boosting demand for hydrogen compressors, including centrifugal types. China and Japan are at the forefront of hydrogen compressor use in the region, propelled by extensive fuel cell implementations and government-supported clean energy programs. India is also emerging as a key player, supported by its swiftly expanding electricity generation capacity and solar energy projects.

North America

Industries across North America are increasingly prioritizing energy-efficient and reliable compression systems. Centrifugal compressors are preferred due to their operational efficiency, reduced maintenance requirements, and versatility in handling a wide range of pressures and capacities. These features help reduce operational costs and support compliance with environmental regulations.

The U.S. dominates the North America centrifugal hydrogen compressor market, due to high demand for these compressors in refining, petrochemicals, mobility, and hydrogen production in the country. Moreover, the majority of domestic and multinational companies have a presence in this country, which creates investment opportunities and technological advancements in this sector. Thus, these factors altogether make the U.S. a major country for current market share and growth over the forecast period.

As per the U.S. Department of Energy, the production of hydrogen is anticipated to increase considerably in support of clean energy objectives. This trend is driving the demand for effective hydrogen compression solutions such as centrifugal compressors.

Europe

The European Union's Green Deal and domestic policies vigorously support clean energy and hydrogen technologies. This has resulted in heightened investments in hydrogen infrastructure such as refueling stations, power plants, and industrial applications, which subsequently boosts demand for efficient hydrogen compressors, including centrifugal compressors. The oil and gas industry, chemical sector, and electricity generation are significant users of centrifugal compressors in Europe, representing a substantial portion of the demand. These sectors aim for energy-efficient and dependable compressors to enhance hydrogen management and decrease emissions.

Latin America

The centrifugal hydrogen compressor market in Latin America is witnessing significant growth, driven by the region’s rapid development of clean hydrogen production and its supporting infrastructure. Latin America holds a distinctive advantage to emerge as a global leader in clean hydrogen, leveraging its plentiful renewable energy resources such as solar, wind, and hydro to generate low-cost hydrogen for domestic consumption and export.

Middle East & Africa

The Middle East & Africa region possesses vast oil and gas reserves, especially in nations such as Saudi Arabia, UAE, Iran, and Qatar. The growth of oil and gas refineries, along with new exploration initiatives, is greatly enhancing the need for hydrogen compressors, which are crucial for hydrogen management, purification, and transport within these sectors. The increasing utilization of hydrogen fuel cell vehicles and the development of hydrogen refueling stations demand dependable and efficient hydrogen compressors, especially centrifugal ones, to guarantee safe and effective hydrogen storage and dispensing.

COMPETITIVE LANDSCAPE

Key Industry Players

Industry Participants Focus on Partnerships to Strengthen Their Supply Networks

Leading suppliers are introducing innovative and more effective centrifugal compressors specifically designed to address hydrogen's distinct characteristics, such as oil-free operation, high-pressure performance, and modular configurations. These advancements aimed to satisfy the changing requirements of hydrogen refueling stations and industrial applications. Major companies are expanding through partnerships, acquisitions, and collaborations to strengthen their supply networks and global reach. In April 2025, Kawasaki Heavy Industries, Ltd. commenced the building of an innovative demonstration facility for the KM Comp-H₂, a next-generation centrifugal hydrogen compressor intended for application in hydrogen liquefaction plants.

List of Key Centrifugal Hydrogen Compressor Companies Profiled

- Siemens (Germany)

- Mitsubishi Heavy Industries Ltd. (Japan)

- MAN Energy Solutions (Germany)

- CORDIS (U.S.)

- Minnuo Compressor (U.S.)

- Neumann and Esser (Germany)

- Ingersoll Rand (U.S.)

- Taizhou Toplong Electrical Mechanical Co., Ltd. (China)

- Sundyne (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Indian Compressors Ltd. (India)

- General Electric (U.S.)

- Bharat Heavy Electricals Limited (Delhi)

- Chart Industries (U.S.)

- Linde Plc (Ireland)

KEY INDUSTRY DEVELOPMENTS

- March 2025- German energy provider EWE announced that it has contracted the local company Neuman and Esser to provide two compressors for a proposed large-scale hydrogen cavern in the nation. EWE is transforming one of seven subterranean natural gas caverns at its location in Huntorf, situated in the Wesermarsch district of northern Germany, to facilitate hydrogen storage.

- August 2024- Linde entered into a lasting agreement for the supply of clean hydrogen to Dow’s Fort Saskatchewan Path2Zero Project. The firm planned to invest over USD 2 billion to construct and operate a large-scale integrated clean hydrogen and atmospheric gases facility in Alberta, Canada.

- November 2023- GE Vernova’s Power Conversion division and Next Hydrogen Solutions Inc. entered into a memorandum of understanding to combine Next Hydrogen’s electrolysis technology with GE Vernova’s power systems products to generate green hydrogen.

- June 2023- Ingersoll Rand Purchases Blower/Centrifugal Compressor Brand from Chart Industries. Ingersoll Rand Inc., an international supplier of essential flow creation and industrial solutions, signed a binding agreement to purchase Howden Roots LLC (Roots) from Chart Industries Inc. for a total cash payment of around USD 300 million.

- March 2021- Siemens Energy announced that it is collaborating with Intermountain Power Agency on a project aimed at incorporating hydrogen production and storage at a plant in Utah.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the electric motor. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.59% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Stage

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 714.13 million in 2025.

In 2025, the Asia Pacific market value stood at USD 411.03 million.

The market is expected to exhibit a CAGR of 4.59% during the forecast period (2026-2034).

The petrochemical & chemical segment leads the market by end-user.

Increasing demand for hydrogen fuel technologies is a key factor driving market growth.

Some of the major players in the market are Siemens, CORDIS, and Sundyne.

Asia Pacific holds the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us