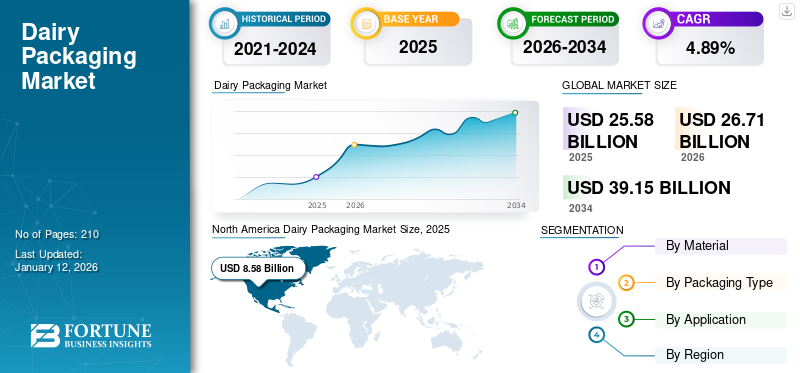

Dairy Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Glass, and Metal), By Packaging Type (Bags & Pouches, Boxes & Cartons, Jars & Containers, Films & Wraps, Bottles & Cans, and Others), By Application (Milk, Cream & Yogurt, Cheese, Ice Cream, Ghee & Butter, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global dairy packaging market size was valued at USD 25.58 billion in 2025 and is projected to be worth USD 26.71 billion in 2026 and reach USD 39.15 billion by 2034, exhibiting a CAGR of 4.89% during the forecast period. North America dominated the dairy packaging market with a market share of 33.55% in 2025.

Dairy packaging involves enclosing dairy items in containers to safeguard them from damage and contamination while preserving their quality. The rising need for beverages rich in natural calcium will drive the expansion of this market. Moreover, the increasing need for flexible packaging, attributed to its highly adaptable and easily recyclable characteristics, propels market growth. Amcor and Sonoco are the leading manufacturers, accounting for the largest market share.

GLOBAL DAIRY PACKAGING MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 25.58 billion

- 2026 Market Size: USD 26.71 billion

- 2034 Forecast Market Size: USD 39.15 billion

- CAGR: 4.89% from 2026–2034

Market Share:

- North America led the global market in 2025 with a 33.55% share, rising from USD 8.58 billion in 2025 to USD 8.97 billion in 2026.

- By material, plastic dominated the market, especially for milk packaging, owing to its light-blocking and sealing properties.

- By packaging type, bags and pouches held the largest share due to their portability, resealability, and customizable formats.

- By application, the milk segment led the market, expected to hold a 27.85% share in 2026, driven by rising health awareness and increasing milk consumption.

Key Country Highlights:

- United States: Increased per capita consumption of dairy products such as American cheese, butter, and yogurt continues to drive packaging demand.

- China: Urban demand for premium dairy products and food safety regulations accelerate adoption of secure packaging formats.

- India: Rising per capita fresh dairy consumption (expected to reach 108 kg by 2028) spurs strong packaging demand.

- Germany, France & Italy: Together led EU cheese production in 2023, boosting demand for packaging in processed and artisanal dairy segments.

- UAE: Dairy consumption surged by 39% during the pandemic, reflecting rising health consciousness and increased packaging needs.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Dairy Products Drives Market Growth

Global demand for dairy items is growing, propelled by factors such as population increase, higher disposable incomes, and an increased focus on maintaining a healthy lifestyle. Consumers rely on dairy for health and wellness, nutrition, enjoyment, celebration, and much more. Increasing consumer preference for dairy products has grown significantly as many shoppers are cautious with their expenditures, underscoring that dairy remains affordable and nutritious for consumers across all income levels. Dairy items offer protein, calcium, and other essential minerals, and their intake has been associated with numerous health benefits. The rising demand for dairy items is fueling the market growth.

Augmenting Demand for Eco-friendly Packaging Solutions Enhances Market Growth

With increasing consumer concern about plastic packaging waste, there is a strong push for packaging that can be recycled or composted. Materials such as paperboard, bioplastics, and plant-based films are gaining traction. There is a significant shift toward eco-friendly materials, such as biodegradable plastics and recyclable paperboard, in response to rising environmental concerns and stringent regulations. Manufacturers are adopting sustainable practices to reduce carbon footprints and appeal to environmentally conscious consumers.

Brands are shifting away from traditional plastic containers toward more sustainable options. There is increasing demand for sustainable and recyclable packaging options due to growing environmental concerns and stricter regulations on plastic waste. Consumers and manufacturers alike are shifting toward biodegradable materials, recyclable plastics, paper-based packaging, and innovations such as edible packaging. The rising demand for eco-friendly packaging thus drives the global dairy packaging market growth.

MARKET RESTRAINTS

Rising Environmental Concerns Regarding Plastic Waste Impede Market Growth

While some dairy packaging, such as milk cartons, is recyclable, not all dairy packaging materials are easily recyclable, particularly those with mixed material layers (such as plastic-coated paper). Single-serve or small-portion packaging has become increasingly popular, particularly for products such as yogurt and flavored milk. However, the plastic used for packaging ends up in landfill waste. Many dairy packaging products are packaged in plastic, which contributes significantly to environmental pollution. As a result, there is increasing pressure to reduce plastic usage or switch to recyclable, compostable, or biodegradable alternatives, which poses a challenge for market growth.

MARKET OPPORTUNITIES

Implementation of Smart Packaging and Technology Integration Will Offer Growth Opportunities

Brands are integrating QR codes, RFID, and even augmented reality (AR) into their packaging to enhance consumer demand and engagement. These technologies can provide real-time information about the product's origin, freshness, or nutritional facts. Some dairy products now feature packaging that changes color to indicate temperature, signaling freshness or whether the product has been stored outside the recommended range. Advancements such as smart packaging, which monitors product freshness, and aseptic packaging, which extends shelf life without preservatives, are gaining traction in the market. Consumers increasingly seek transparency in food sourcing. Dairy packaging is adopting blockchain technologies to ensure traceability from farm to table, creating potential growth opportunities.

MARKET CHALLENGES

Regulatory Compliance and Contamination Prevention Issues Challenge Market Growth

Adhering to varying international packaging standards and regulations can be complex and costly for manufacturers. Dairy packages must adhere to strict labeling laws in different countries, which include nutritional information, allergen warnings, and expiration dates. Packaging must meet stringent food safety standards to avoid contamination risks and ensure that products remain safe for consumption during their shelf life.

Moreover, dairy products are susceptible to bacterial growth, which can lead to spoilage or foodborne illness. Packaging must protect against contamination during manufacturing, storage, and transportation. Packaging must be tamper-evident to ensure the safety and integrity of the product. Consumers need reassurance that the product is untouched, which presents a challenge for market development.

Download Free sample to learn more about this report.

DAIRY PACKAGING MARKET TRENDS

Growing E-commerce Sector and Demand for Premium Packaging Emerges as a Key Trend

With the growth of online grocery shopping, there is a need for packaging solutions that ensure dairy products remain safe, fresh, and intact during transportation. Specialized, durable, and insulated packaging is becoming more popular for e-commerce sales. Subscription services and direct-to-consumer delivery models in the dairy sector also drive demand for packaging that is optimized for long-distance shipping and minimizes spoilage.

The rise in on-the-go consumption has led to the development of single-serve and easy-to-use packaging formats, including pouches and smaller-sized bottles, catering to busy lifestyles. Furthermore, in competitive markets, dairy brands often use packaging to create a premium or differentiated product image. Innovative, aesthetically pleasing packaging, such as unique shapes or high-quality graphics, influences purchasing decisions, thus emerging as a prominent trend.

IMPACT OF COVID-19

The COVID-19 pandemic affected every sector, for better or worse, and altered individuals' lifestyles and dietary choices. The shutdown of restaurants and lockdowns led to a surge in home-cooked foods and heightened demand for butter, cheese, and similar products. Following the pandemic, the dairy packaging market expanded as the desire for healthy foods and beverages led to greater emphasis on secure packaging.

SEGMENTATION ANALYSIS

By Material

Increasing Need for Milk Packaging Enhances Demand for Plastic Material Segment

Based on material, the market is segmented into plastic, paper & paperboard, glass, and metal.

Plastic is the dominating material segment and contributes to the global dairy packaging market share. Bottles made of plastic material are most appropriate for holding pasteurized milk. The material is mainly utilized to package milk. Pigmented plastic material, such as PET, protects food from light, thereby aiding in the preservation of food flavor from light-induced lipid oxidation. Plastic material can also be sealed to increase shelf life and reduce food loss. The segment held 44.44% of the market share in 2026.

Paper and paperboard are the second-dominating segment and will experience steady growth in the coming years. Paperboard material gives stability and strength to the packaging and can be 100% recyclable, thus driving segment growth.

By Packaging Type

Bags and Pouches Lead the Market Due to Their Significant Benefits

Based on packaging type, the market is categorized into bags & pouches, boxes & cartons, jars & containers, films & wraps, bottles & cans, and others.

The bags and pouches is the dominant packaging type segment. Pouches and bags are becoming increasingly popular in the dairy industry due to their lightweight design, convenience for users, and ease of transport. Bags and pouches provide the adaptability to be customized with unique shapes, sizes, and styles. The improved barrier properties offered by the packaging type make them ideal for dairy items, providing optimal preservation of freshness via resealable features. The segment is set to capture 29.05% of the market share in 2026.

Boxes and cartons are the second-leading packaging type segment and are estimated to witness significant growth during the forecast period. Boxes and cartons are highly used for packaging a variety of dairy products, such as fresh milk, UHT milk, and condensed milk, as they eliminate harmful bacteria & microorganisms and provide a longer shelf life for perishable liquid food. This segment is likely to grow with a substantial CAGR of 3.82% during the forecast period (2025-2032).

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Health Awareness among Consumers Encouraged Milk Segment Growth

Based on application, the market is classified into milk, cream & yogurt, cheese, ice cream, ghee & butter, and others.

The milk segment held the largest market share in the application segment. Environmental factors such as light, temperature, oxygen, or microbial activity alter the nutrients and vitamins found in milk. Therefore, packaging for dairy products must serve as a barrier to maintain the shelf life and nutritional quality of the product. Milk and milk products help maintain the health of muscles, bones, nerves, teeth, skin, and eyesight. They also release energy from food, reduce fatigue, sustain healthy blood pressure levels, and support growth and brain development. Increasing health awareness among consumers and growing consumption of milk enhances the segment’s growth. This segment is estimated to hold 27.85% of the market share in 2026.

The cream and yogurt segment is a rapidly growing segment in the market. Yogurt is known for its nutritional benefits, such as being high in calcium, protein, and probiotics. Cream and yogurt manufacturers are transitioning toward using biodegradable or compostable materials to reduce their environmental impact. This segment is likely to grow with a CAGR of 3.85% during the forecast period.

DAIRY PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Dairy Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Dairy Consumption Drives Market Growth

North America dominated the market with a valuation of USD 8.58 billion in 2025 and USD 8.97 billion in 2026. The robust growth of specific dairy items, such as American cheese, butter, and yogurt drove dairy gains in 2021. U.S. per capita consumption of American cheese rose by 0. 5 pounds, whereas butter and yogurt saw increases of 0. 2 pounds and 0. 7 pounds, respectively. The U.S. market is set to be worth USD 7.05 billion in 2026.

- According to the USDA Economic Research Service (ERS), Americans are consuming more dairy than ever before. In 2020, Americans consumed about 655 pounds of dairy, and in 2021, this figure jumped to 667 pounds of per capita dairy consumption in the U.S.

Asia Pacific

Augmenting Consumption for Fresh Dairy Products Boosts Market Growth

Asia Pacific is the second-dominating region of the global market anticipated to gain USD 7.11 billion in 2026, exhibiting a CAGR of 5.64% during the forecast period (2025-2032). China held a substantial portion of the Asia Pacific dairy packaging market, propelled by its vast population and the rising demand for dairy products, especially within the urban middle class. The need for premium and secure packaging options is increasing, spurred by growing health consciousness and stringent food safety regulations. China is expected to reach the valuation of USD 2.32 billion in 2026.

- According to the FAO, the consumption of fresh dairy products in India is expected to increase by 2.3% a year, reaching 108 kg per capita in 2028.

India is anticipated to be worth USD 1.89 billion in 2026, while Japan is poised to be valued at USD 1.36 billion in the same year.

Europe

Growing Cheese Production and Consumption Enhances Europe’s Market Growth

Europe is the third-largest contributor to the market expected to hold USD 5.47 billion in 2026. The region has experienced a rise in dairy consumption, particularly flavored milk and yogurt. Cheese production is high, with popular varieties such as parmesan and provolone. Consumers are also gravitating toward convenient options such as pizza and packaged cheese slices, further driving market growth. the U.K. market is anticipated to reach a market value of USD 1 billion in 2026.

- According to the Europe Commission, in 2023, Europe was the leading cheese producer globally, led by Germany, France, and Italy, which produce a large portion of EU cheese. Germany produced 25 percent of the total amount of cow milk cheese in the region.

Germany is projected to be valued at USD 1.18 billion in 2026, while France is estimated to reach USD 0.83 billion in the same year.

Latin America

Rising Demand for Dairy Products & Retail Expansion Drives Market Growth in Latin America

Latin America is the fourth largest market foreseen to grow with the valuation of USD 2.94 billion in 2026. The region will experience steady growth over the projected period. Increasing demand for dairy and plant-based products in the region is driving the need for diverse packaging solutions. Retail expansion and e-commerce are also contributing to market growth. Increasing demand for dairy products, advancements in packaging technology, and a focus on sustainability are key factors propelling market growth.

- According to a recent report from Dairy Global, Milk production in Latin America rose by 3. 3% in the first half of 2022 compared to the equivalent period last year. Beneficial weather conditions have played a role in this growth, assisting countries that were affected by drought in restoring production to a growth trajectory.

Middle East & Africa

Heightened Health and Wellness Concerns Thrives Market Growth

The Middle East region will foresee significant growth during the projected period. The pandemic heightened the focus on nutrition and healthy eating in the region. Rising cases of diabetes, obesity, cardiovascular disease, and various other disorders in the region have further intensified the focus, driving the demand for dairy products and boosting market growth.

- The U.S. Dairy Export Council states that consumers in the UAE increased their dairy intake by 39% during the pandemic as part of a broader initiative to promote healthy eating.

Saudi Arabia is expected to grow with a valuation of USD 0.69 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global dairy packaging market is highly fragmented and competitive, with significant players dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The key developments by the manufacturers offer potential growth opportunities.

Major players in the industry include Amcor, Sonoco, Sealed Air, Berry Global, Tetra Pak International, Silgan Holdings, and others. Other companies operating in the market are also focused on analyzing market trends and delivering advanced packaging solutions.

List of Key Dairy Packaging Companies Profiled

- Amcor (Switzerland)

- Sonoco (U.S.)

- Sealed Air (U.S.)

- Berry Global (U.S.)

- Tetra Pak International (Switzerland)

- Silgan Holdings (U.S.)

- Constantia Flexibles (Austria)

- DS Smith (U.K.)

- ProAmpac LLC (U.S.)

- Mondi (U.K.)

- International Paper (U.S.)

- Huhtamaki Oyj (Finland)

- AptarGroup Inc. (U.S.)

- WestRock (U.S.)

- Coveris (U.K.)

KEY INDUSTRY DEVELOPMENTS

- August 2024- CCL Label introduced an enhanced version of its EcoFloat low-density polyolefin sleeve material, referred to as EcoFloat WHITE. The innovative technology is set to be a game-changing solution for the dairy sector, especially regarding high-density polyethylene (HDPE) containers typically utilized yogurt, probiotic beverages, and related items.

- July 2024- MilkyMist collaborated with SIG and AnaBio Technologies and introduced the world's first long-lasting probiotic buttermilk in aseptic carton packaging. The revolutionary product provides consumers with a nutritious and healthy choice while guaranteeing a long shelf-life without refrigeration.

- July 2024- Delamere Dairy launched its new CartoCan Flavoured Milk line for its on-the-go customers. The CartoCan is entirely recyclable, minimizes plastic waste, and provides a practical option compared to its 500ml glass bottle version.

- November 2023- Sidel launched a new PET bottle for dairy products. The mini-size packaging is designed for products such as drinking and probiotic yogurts with capacities between 65ml and 150ml and is ideally suited for ambient and cold chain processes.

- April 2022- Amcor launched recycle-ready coffee dairy packaging in the European market. The new range is incorporated for coffee and dairy items that require higher standards of product safety, packaging ease, and operability on packaging lines.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market will experience remarkable expansion due to increasing partnerships, mergers, and investments. These initiatives boost the demand for dairy packaging products. In August 2023, A U.K.-based food packaging company, PFF Group, implemented a USD 2.6 million thermoforming system at its Sedgefield facility as part of a USD 5.3 million investment initiative in new processing technology for the dairy packaging sector.

REPORT COVERAGE

The market research report provides a detailed market analysis, covering key aspects, such as top key players, competitive landscape, service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, the report highlights current market trends and key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.89% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Packaging Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 25.58 billion in 2025.

The market is likely to grow at a CAGR of 4.89% over the forecast period (2026-2034).

The milk application segment led the market in 2026.

The market size of North America stood at USD 8.58 billion in 2025.

The key market drivers are increasing demand for dairy products and augmenting demand for eco-friendly packaging solutions.

Some of the top players in the market are Amcor, Sonoco, Sealed Air, Berry Global, Tetra Pak International, Silgan Holdings, and others.

The global market size is expected to reach USD 39.15 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us