Electric Three Wheeler Powertrain Market Size, Share & Industry Analysis, By Component Type (Motor {Motor Stator, Rotor, Shaft and Bearing, Permanent Magnet, Casing, Wiring & Connectors}, Traction Inverter {IGBT/SiC Power Module, Microcontroller, Sensing Element, and Others}, and On-board Charger), By Power Output (<3 kW, 3-10 kW, and >10 kW), By Battery Type (Lithium-Ion Batteries, Lead-Acid Batteries, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

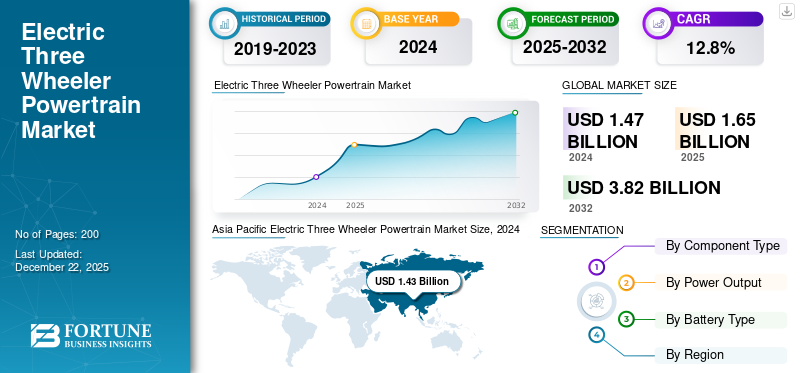

The global electric three wheeler powertrain market size was valued at USD 1.47 billion in 2024. The market is projected to grow from USD 1.65 billion in 2025 to USD 3.82 billion by 2032, exhibiting a CAGR of 12.8% during the forecast period.

An electric three wheeler powertrain consists of key components, including an electric motor, battery, controller, and drivetrain. The motor provides propulsion, the battery stores energy, the controller manages power flow, and the drivetrain transfers power to the wheels for movement.

The global market is driven by government incentives, rising fuel costs, environmental concerns, and advancements in battery technologies. These factors make electric three wheeler powertrain an affordable, efficient, and eco-friendly transportation option, particularly in urban areas.

- In March 2025, Omega Seiki Pvt. Ltd. and Clean Electric launched the Omega Seiki NRG, India's longest-range passenger electric three-wheeler. Equipped with a 15 kWh LFP battery pack, it offers a 300 km range on a single charge and supports a 150 km top-up in 45 minutes via Bharat DC-001 charging infrastructure. The vehicle comes with a 5-year or 200,000 km battery warranty and is designed for fleet operators and businesses seeking cost-effective, eco-friendly transportation solutions. Omega Seiki plans to deploy 5,000 units by the next financial year to meet the growing demand for electric mobility in India.

The market is led by players such as Bosch Mobility (Germany), Yamaha Motor (Japan), MAHLE Powertrain (U.K.), and Valeo SA (France) offering advanced, scalable powertrain solutions. These players focus on product innovation and technological development in high-performance and efficient powertrains fueling competitive edge.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Government Incentives and Favorable Environmental Regulations Fuel Market Growth

Government incentives, subsidies, and supportive policies, along with stricter environmental regulations, are significant drivers of the global market growth. These policies inspire the adoption of Electric Vehicles (EVs) by reducing costs, offering tax breaks, and providing infrastructure support for charging. Additionally, growing concerns over air pollution and carbon emissions have led governments globally to promote cleaner, eco-friendly transportation solutions. As the electric three wheelers help reduce emissions in urban areas, it becomes an attractive solution for governments aiming to achieve sustainability and environmental targets.

- In February 2025, Sierra Leone's Environmental Protection Agency (EPA-SL) launched the country's first electric mobility strategy, introducing electric three wheelers, known as e-kekes, in Freetown. Braced by the United Nations Environment Programme (UNEP) and co-financed by the European Union through the SOLUTIONSPlus project. The initiative aims to reduce greenhouse gas emissions, improve urban air quality, and promote sustainable transportation. The project includes deploying 15 e-kekes, establishing battery-swapping stations, and implementing regulatory frameworks to accelerate electric vehicle adoption.

MARKET RESTRAINTS

Higher Cost of Batteries and Charging Infrastructure Hinder Market Expansion

High battery costs and limited charging infrastructure remain key restraints for the electric three vehicle market growth. Despite advancements in battery technology, the initial cost of electric three wheelers is still relatively high compared to conventional vehicles, limiting its adoption. Additionally, the scarcity of sufficient charging stations, especially in rural or developing areas, reduces the convenience of using electric vehicles. These factors contribute to consumer hesitation, as potential buyers may face long wait times to charge or incur higher upfront costs, affecting market expansion and the widespread adoption of electric three wheelers.

MARKET OPPORTUNITIES

Expansion of Battery Technology and Urbanization Presents Lucrative Market Opportunities

The ongoing advancements in battery technology, including enhancements in energy density, cost reduction, and charging time, present significant opportunities for the global market. These innovations are making electric three wheelers more affordable, efficient, and practical for consumers, thus enhancing their adoption rates. Furthermore, rapid urbanization in emerging economies is driving the demand for efficient, affordable, and eco-friendly transportation solutions. Electric three wheelers are well-suited for passenger carriers and goods carriers in urban areas due to their compact size and lower operational costs. It also offers a compelling alternative to traditional vehicles, creating vast opportunities for market expansion.

- In January 2024, Montra Electric, the EV brand of the Murugappa Group, launched its Super Auto electric Three Wheeler in Tirunelveli, Tamil Nadu. Equipped with a 10 kW lithium-ion battery, the Super Auto offers an ARAI-certified range of 203 km and an on-road range of 155 km per full charge. It features a top speed of 55 km/h, accelerates from 0 to 20 km/h in 4 seconds, and has a seating capacity of four. The vehicle is backed by a 3-year/100,000 km warranty, with an optional 2-year/50,000 km extended warranty. Montra Electric aims to promote eco-friendly transportation solutions and initiated test drives and awareness programs for auto drivers in the region.

ELECTRIC THREE WHEELER POWERTRAIN MARKET TRENDS

Shift Toward Smart and Connected Vehicles are Prominent Trends Reshaping Market Growth

The integration of cutting-edge technologies, such as IoT, AI, and telematics, is shaping current trends in the market of electric three wheeler powertrain. Electric three wheelers are becoming more intelligent, offering features such as real-time tracking, predictive maintenance, and better vehicle management systems. These smart capabilities not only enhance user experience but also provide fleet operators with better control over their assets, improving efficiency and reducing costs. Furthermore, consumers are increasingly seeking connected solutions, such as mobile apps for vehicle monitoring and performance tracking. These trends are aligning with the growing demand for advanced, sustainable, and user-friendly electric vehicles, bolstering the market growth over the forecast period.

In July 2022, Faction announced its upcoming fleet of driverless electric three wheelers powered by Nvidia’s Drive AGX system, targeting last-mile delivery and micro-mobility markets in the U.S. Their D1 model, based on Arcimoto’s platform, offers over 100 miles of range, 75 mph top speed, and 500-pound cargo capacity, blending autonomous driving with teleoperation for efficiency and safety.

Segmentation Analysis

By Component Type

Advancements in Motor Components Enhance Powertrain Performance, Boosting Segment Growth

The market is segmented by component type into motor, traction inverter, and on-board charger.

The motor segment dominates the global market and is further divided into motor stator, rotor, shaft and bearing, permanent magnet, casing, wiring & connectors. This dominance is attributed to the growing demand for higher efficiency and performance from electric three wheeler users. The development of advanced motor technologies contributes significantly to improving vehicle performance, such as range, acceleration, and overall efficiency. With the rising demand for cost-effective and energy-efficient transportation solutions particularly in urban areas, there is an upsurge in innovative motor components. This drives the adoption of these vehicles, making them more reliable and affordable for consumers in both developed and developing regions.

- In June 2024, Bolt, TRÍ, and Watu launched a pilot program in Tanzania to introduce electric three wheelers or “bajajis,” for urban transport. Each vehicle offers a 100+ km range at 40 km/h, 55 km/h top speed, 4 kW electric motors, 8 kWh LFP battery, 5-hour charging, digital display with rear camera, heavy-duty suspension, USD 3,500 price (excluding VAT), and 2,000-cycle battery warranty.

The traction inverter segment in the market is driven by its essential function in managing motor performance and energy efficiency. It converts DC from the battery to AC for the motor, enabling precise speed and torque control, critical for heavier loads and commercial use. Moreover, advancement in inverter technology drives the growth of the segment in the forecast period.

By Power Output

Affordable Power Output of <3 kW Fuels Segment’s Growth

Based on power output, the market is categorized into <3 kW, 3-10 kW, and >10 kW.

The <3 kW segment’s leadership is driven by its ability to cater to the mounting demand for affordable and energy-efficient mobility solutions in urban and peri-urban regions. Electric three wheelers with power outputs under 3 kW offer a cost-effective option for short-distance commuting and last-mile connectivity. The lower purchase and operating costs, combined with government incentives and the increasing need for environmentally friendly transportation, make <3 kW electric three wheelers particularly attractive for consumers in developing regions. The growing urbanization and rise in demand for compact, eco-friendly vehicles further drive segmental growth.

- In January 2024, Hero MotoCorp’s Surge unveiled the Surge S32, a modular electric vehicle that transforms from a Three Wheeler to a scooter in three minutes. Inspired by Batman’s Batmobile, the S32 features a 10 kW motor and 11 kWh battery for the 3W and a 3 kW motor with a 3.5 kWh battery for the scooter.

The >10 kW segment is propelled by escalating demand for high-performance commercial and passenger vehicles. These heavier e03ws, used for goods transport or public mobility, need robust motors and greater load, steeper terrain, and faster cruising. All these factors develop the demand for the segment in the upcoming period.

By Battery Type

Higher Energy Density and Longer Lifespan Boosts Lithium-Ion Batteries Leadership

The market is classified by battery type into lithium-ion batteries, lead-acid batteries, and others.

The lithium-ion battery segment is the leading category in the global electric three wheeler powertrain market. These batteries are favored due to their higher energy density, longer lifespan, and faster charging capabilities compared to lead-acid batteries and other alternatives. This makes lithium-ion batteries a key enabler for the expansion of electric three wheelers, particularly in markets where range, efficiency, and vehicle uptime are critical. As consumer demand for electric mobility continues to rise, especially in urban areas with high transportation needs, lithium-ion batteries become the go-to choice for manufacturers seeking to offer vehicles with better performance and lower total cost of ownership. Additionally, innovations in lithium-ion battery technology continue to improve their affordability and performance, further driving their adoption.

- In February 2021, Omega Seiki Mobility launched the Rage+ Frost, a refrigerated electric three wheeler designed for last-mile delivery of COVID-19 vaccines, pharmaceuticals, and food. Developed with TransACNR, these types of commercial vehicles feature a battery-powered carriage that keeps vaccines stored for 72 hours at -20°C, uses swappable lithium-ion batteries, and offers low running costs at USD 0.0058/km.

The market of lead-acid battery segment is driven by its low upfront cost mature, reliable technology that handles high surge currents, and well-established recycling networks, which is crucial in cost-sensitive emerging markets. OEM adoption remains strong due to compatibility with existing vehicle systems and cold-weather robustness, which drives the demand for the segment in the forecast period.

Electric Three Wheeler Powertrain Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

Asia Pacific Electric Three Wheeler Powertrain Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds a significant share of the global market, driven by a growing emphasis on sustainability and reducing carbon emissions. Governments across the region are presenting policies that support clean energy alternatives, including electric vehicles. Additionally, the escalating cost of fuels and consumer demand for eco-friendly transportation options are pushing market growth. Electric three wheeler powertrain offers an attractive solution for urban mobility, particularly in cities aiming to reduce traffic congestion and pollution. Increased investment in EV infrastructure and technology adoption further fuels the growth of the market in North America.

The U.S. holds a notable portion of the North American market, propelled by government policies that incentivize green transportation. Higher tax credits, rebates, and grants are making electric vehicles more accessible. Additionally, the urban mobility landscape is changing as cities focus on reducing traffic congestion and pollution, creating demand for small electric vehicles. The shift toward electric vehicles, supported by infrastructure improvements such as EV charging networks, is enabling more U.S. consumers and businesses to adopt electric three wheelers. Increased awareness of sustainability further accelerates this transition toward green and efficient transport options.

- In November 2024, Aptera began testing its first production-intent three wheeler prototype, marking a major milestone in its electric vehicle development. The company aims to revolutionize sustainable transportation with its lightweight, ultra-efficient design. The testing phase is crucial for refining the vehicle’s performance before its anticipated launch as Aptera pushes toward commercial production of the innovative EV.

Europe

Europe holds a crucial share of the global market due to aggressive environmental policies and a robust EV infrastructure. European countries, especially those in the EU, are committed to achieving zero-emission transportation, making electric vehicles a priority. Policies such as tax incentives and low-emission zone subsidies have greatly accelerated electric vehicle adoption. Moreover, the region boasts an expanding network of charging stations, making electric three wheelers more viable. European consumers and businesses are increasingly seeking cleaner alternatives to traditional vehicles, further driving electric three wheeler powertrain market growth in the region.

- In May 2025, Morgan unveiled the XP-1, an all-electric three wheeler prototype weighing just 1,540 pounds. Powered by a 134-horsepower motor and a 33 kWh battery, it delivers a 150-mile range. The XP-1 features four drive modes, improved aerodynamics, fast and bi-directional charging, and adjustable suspension, signaling Morgan’s move toward lightweight and sporty electric vehicles.

Asia Pacific

Asia Pacific accounted for the largest electric three wheeler powertrain market share in 2024, largely due to rapid urbanization and the expanding demand for cost-effective transportation solutions. India, China, and Southeast Asian nations are witnessing a surge in electric three wheeler adoption due to their growing population, increasing traffic congestion, and high pollution levels. Electric three wheelers provide an affordable, sustainable, and efficient alternative for last-mile connectivity. Government initiatives promoting green transportation, lower vehicle taxes, and incentives further boost the demand, while local manufacturers are focusing on producing affordable, high-performance models tailored to the region’s needs.

- In January 2025, Hyundai Motor Company introduced E3W and E4W electric last-mile mobility concepts at the Auto Expo 2025 in India. The company is also exploring the possibility of entering this new segment through a partnership with local two- and Three Wheeler manufacturer TVS Motor Company.

Rest of the World

The rest of the world, including regions such as South America and the Middle East & Africa, is experiencing high growth in the market, driven by emerging economies focusing on sustainable development. The need for affordable and low-emission transportation solutions is growing across the region, where electric three wheelers offer an ideal solution for short-distance travel and deliveries. Governments are introducing supportive policies, such as tax incentives, subsidies, and low-emission zones, to encourage the adoption of electric vehicles. These regions are noticing increased interest from international manufacturers that seek to tap into new markets with cost-effective EV solutions.

- In May 2025, U Power Limited, in partnership with Treep Mobility Group S.A.C., launched its AI-powered UOTTA battery-swapping technology in Peru. After a pilot with two stations, one three wheeler, and ten two-wheelers, Treep plans to convert its fleet, with expected orders of over USD 1 million. UOTTA reduces operating costs by 30-40% and targets Peru’s 100,000+ moto taxis. The system uses AI to optimize efficiency and meet customer demand, tapping into a South American market where over 300,000 new electric three- and two-wheelers are added annually.

COMPETITIVE LANDSCAPE

Key Industry Players

Global Powerhouse Collaboration and Local Innovation Intensify Competition in Electric Three Wheeler Powertrain Market

The electric three wheeler powertrain market is highly competitive and rapidly growing, with global leaders such as Bosch Mobility (Germany), Yamaha Motor (Japan), MAHLE Powertrain (U.K.), and Valeo SA (France) offering advanced, scalable powertrain solutions. Indian companies such as CLN Energy, Eastman Auto & Power, Altigreen, E-trio, JK Fenner, and Virya Electric Powertrains focus on cost-effective, localized innovations for last-mile mobility, leveraging India’s booming EV adoption. Minghong Vehicle (China) adds regional diversity. While Bosch and Valeo leverage R&D and global reach, Indian firms drive market penetration through affordability and tailored solutions for domestic needs, fueling the competition in the market.

LIST OF KEY ELECTRIC THREE WHEELER POWERTRAIN COMPANIES PROFILED

- Bosch Mobility (Germany)

- Yamaha Motor Co., Ltd. (Japan)

- MAHLE Powertrain Ltd (U.K.)

- CLN Energy Ltd. (India)

- Eastman Auto & Power Ltd. (India)

- Altigreen (India)

- Valeo SA (France)

- E-trio (India)

- JK Fenner (India)

- Minghong Vehicle (China)

- Virya Electric Powertrains Pvt Limited (India)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, Euler Motors launched the updated HiLoad electric three wheeler with a 13 kWh battery pack, offering a 170 km ARAI-certified range and 688 kg payload. The new model features design upgrades for better ergonomics, improved suspension, wider tires, and advanced software such as remote immobilization. Euler aims to deploy over 6,000 units in FY2024.

- In May 2025, Rilox EV launched the Bijli Trio electric three wheeler, targeting urban logistics and last-mile delivery for small and medium businesses. The Bijli Trio combines affordability, versatility, and eco-friendly design, offering an efficient and sustainable solution for city-based cargo transport. This launch supports the growing demand for clean mobility in India’s urban logistics sector.

- In November 2024, Ola Electric announced plans to enter India’s electric three wheeler market, aiming to launch a passenger autorickshaw in late 2025 and a cargo model in 2026. Leveraging its existing two-wheeler technology, Ola will use shared electronics, battery architecture, and powertrains to reduce costs. The company is currently testing the passenger model, reportedly named ‘Raahi,’ in Bengaluru.

- In April 2023, TVS Motor announced plans to enter the electric three wheeler cargo vehicle segment. The company aims to tap into the growing demand for eco-friendly and cost-effective logistics solutions. With this move, TVS seeks to strengthen its position in the electric vehicle market, offering sustainable alternatives for the rapidly expanding cargo transportation sector in India.

- In March 2023, Zen Mobility announced the launch of its maiden cargo electric Three Wheeler, the Zen Micro Pod, in Q1 FY24. Designed in Germany and manufactured in India, it features a lightweight composite chassis, a 2kW motor, and a modular battery with a 120+ km range. Targeting last-mile delivery, Zen has begun pilot production and aims for over 10,000 units annually.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on the technological advancement and demand in key regions/countries, Porter's five forces analysis, key industry developments, new product launches, and details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.8% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component Type

|

|

By Power Output

|

|

|

By Battery Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.47 billion in 2024 and is projected to reach USD 3.82 billion by 2032.

In 2024, the market value stood at USD 1.43 billion.

The market is expected to exhibit a CAGR of 12.8% during the forecast period of 2025-2032.

Bosch Mobility (Germany), Yamaha Motor (Japan), MAHLE Powertrain (U.K.), and Valeo SA (France), among others lead the market.

Asia Pacific dominated the market in 2024 by holding the largest share.

Major factors favoring electric three-wheeler powertrain adoption include government incentives, rising fuel costs, expanding charging infrastructure, environmental sustainability goals, cost competitiveness, growing e-commerce and last-mile delivery needs, and increasing consumer preference for affordable, green urban mobility solutions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us