DNA Sequencing Market Size, Share & Industry Analysis, By Products & Services (Products {Equipment and Consumables} and Software & Services), By Technique (Sanger Sequencing, Next-generation Sequencing, and Third-generation Sequencing), By Type (Whole Genome/Exome Sequencing, Epigenomics, Targeted Sequencing, Metagenomics, and Others), By Application (Drug Discovery & Development, Diagnostics, Personalized Medicine, and Others), By End-user (Biotechnology & Pharmaceutical Companies, Diagnostic Centers, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

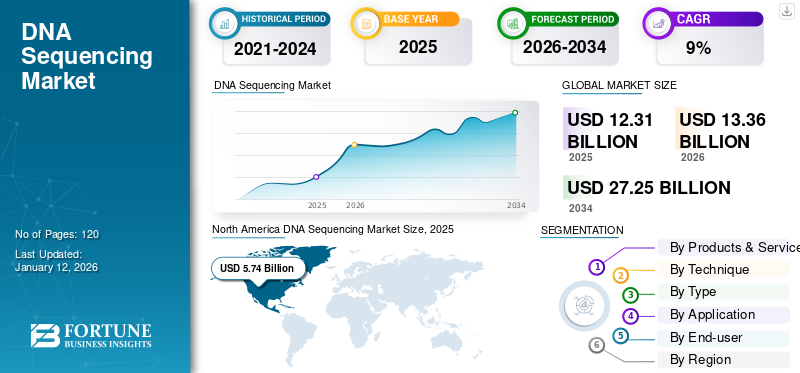

The global DNA sequencing market size was valued at USD 12.31 billion in 2024. The market is projected to grow from USD 13.36 billion in 2026 to USD 27.25 billion by 2034, exhibiting a CAGR of 9.32% during the forecast period. North America dominated the DNA sequencing market with a market share of 46.63% in 2025.

DNA sequencing is the process of determining the precise order of nucleotides in DNA molecules, which is crucial for identifying clinically significant mutations associated with diseases. This technology has far-reaching applications, including drug discovery and development, treatment response evaluation, personalized medicine, evolutionary biology, and forensic science. The market for DNA sequencing has experienced significant growth due to the commercialization of the Sanger sequencing method by Applied Biosciences. Innovations in nucleotide sequencing technologies have driven market expansion, allowing broader adoption in molecular biology across various applications. The emergence of Next-Generation Sequencing (NGS) and third-generation sequencing technologies has largely supplanted first-generation methods, offering high-throughput capabilities, rapid results, cost-effectiveness, and the ability to analyze millions of sequences simultaneously. These advancements enable for precise detection of low-frequency variants, accelerating the development of modern sequencing technologies.

The recent advancements in genomic research are significantly accelerating DNA sequencing market growth. Key factors contributing to this expansion include a rising patient demand for precision medicine in developed regions, increased investments within the industry, growing regulatory approvals, extensive research and development initiatives, the introduction of innovative products, services, and bioinformatics tools.

- For instance, in January 2024, Orchid launched a commercially available whole genome sequencing service known as Preimplantation Genetic Testing (PGT), aimed at assessing the risk of genetic diseases in IVF embryos.

Additionally, strategic initiatives by industry players to expand the use of DNA sequencing technologies in emerging markets are expected to drive market growth. Illumina, Inc., Thermo Fisher Scientific Inc., Oxford Nanopore Technologies plc., and PacBio are some of the key players operating in the market with advanced instruments, consumables, and software.

Global DNA Sequencing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 12.31 billion

- 2026 Market Size: USD 13.36 billion

- 2034 Forecast Market Size: USD 27.25 billion

- CAGR: 9.32% from 2026–2034

Market Share:

- Region: North America dominated the market with a 46.63% share in 2025. The region's leadership is driven by the presence of major industry players, significant R&D investments, large-scale multi-omics initiatives, and the strong clinical adoption of advanced sequencing technologies.

- By Technique: The Next-Generation Sequencing (NGS) segment held the largest market share. Its dominance is attributed to increasing patient demand for precision medicine, extensive R&D initiatives, growing regulatory approvals for NGS-based tests, and the continuous introduction of innovative products, services, and bioinformatics tools.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, Japan's market is driven by increasing investments in healthcare infrastructure and genomic research. Regional collaborations, such as the partnership between Singapore and India to map the Asian genome, are also enhancing the understanding of disease mechanisms and boosting the demand for sequencing.

- United States: The market is propelled by a robust biotechnology sector, advanced research infrastructure, and large-scale genomic studies. A key initiative is the Mayo Clinic's collaboration with Helix Inc. for the Tapestry DNA Sequencing Research Study, which aims to sequence the DNA of 100,000 patients to integrate genetic data into health records.

- China: The market is expanding rapidly with strategic partnerships to increase local manufacturing capabilities, such as the collaboration between Illumina Inc. and HaploX to provide locally produced sequencing instruments. The strong presence of domestic genomics companies like BGI Genomics also contributes significantly to the region's growth.

- Europe: Growth is fueled by substantial government funding and major research initiatives, most notably the UK Biobank project. The increasing prevalence of cancer and genetic disorders in the region is also driving the demand for precise diagnostic tools, thereby increasing the use of targeted and whole-genome sequencing.

MARKET DYNAMICS

Market Drivers

Increasing Whole Genome Sequencing to Fuel Market Growth

The growth of clinical Whole Genome Sequencing (WGS) is a significant catalyst for the DNA sequencing market, driven by technological advancement and the rising demand for personalized medicine. This trend is further supported by decreasing sequencing costs, increased prevalence of genetic disorders, and the growing utilization of WGS in clinical diagnostics, treatment planning, and disease monitoring.

- For instance, a study published in January 2025 by researchers at Oxford Population Health stated that WGS led to new diagnoses for 25% of participants, with 14% of these diagnoses occurring in genomic regions that conventional methods cannot analyze. The study involved sequencing 100,000 genomes from approximately 85,000 NHS patients affected by cancer and rare diseases.

Enhanced capabilities in identifying genetic variations allow healthcare providers to offer tailored therapies, improving patient outcomes and accelerating the adoption of genomic technologies. Moreover, supportive regulatory frameworks and increased funding for genomic research are expected to facilitate the routine usage of whole genome sequencing in clinical practice, further propelling the DNA sequencing market growth trajectory.

Moreover, the expansion of genomics research, increased demand for personalized medicine, the use of sequencing data in drug discovery and development processes, and technological advancements in sequencing platforms are expected to fuel market growth.

Market Restraints

Lack of Skilled Testing Personnel to Deter Market Growth

One of the significant challenges hindering the expansion of the DNA sequencing market is the shortage of skilled personnel, particularly in emerging regions. The shortage of trained personnel in bioinformatics and genomics presents a significant barrier to the effective implementation of DNA sequencing technologies. Additionally, the complexity of data analysis requires specialized expertise in DNA sequencing, making it difficult for companies to fully leverage sequencing advancements. Furthermore, the error in the sequencing results further exacerbates market growth. For instance, a study published in PLoS One in September 2019 reported a false-positive rate of 1.3% in NGS panels, with some platforms exhibiting error rates as high as 20–40% in the sample size of 20,000. Such inaccuracies can reduce confidence in sequencing technologies and limit their widespread adoption.

MARKET OPPORTUNITIES

Rising Demand for Clinical Applications and Personalized Medicine to Spur Market Development

The role of DNA sequencing in personalized medicine has opened up significant opportunities within the DNA sequencing market, particularly as advancements in technology enhance the understanding of genetic predictors of disease. DNA sequencing plays a pivotal role in identifying genetic variations in various diseases, guiding treatment decisions, and improving disease prevention strategies. As personalized medicine continues to gain traction, the reliance on DNA sequencing is expected to grow, which will create significant opportunities for market players to innovate and expand their offerings. Additionally, increased partnerships among pharmaceutical companies and research institutions, ongoing advancements in DNA sequencing technologies, and decreased costs further enhance the feasibility of integrating genomic data into clinical practice. These factors are boosting the growing adoption of personalized medicine and DNA sequencing.

- For instance, in January 2024, The Mayo Clinic collaborated with Helix Inc. for the Tapestry DNA Sequencing Research Study, which aims to sequence the DNA of 100,000 patients. Such initiatives focused on integrating genetic data into patient health records, thereby facilitating personalized medicine based on individual genetic profiles.

MARKET CHALLENGES

Data Interpretation and Technical Errors May Challenge Market Growth

Different sequencing technologies exhibit varying error rates, especially in homopolymer regions, where inaccuracies are highly prevalent. This error rate can lead to false positives or negatives in variant calling, necessitating careful validation of results through additional sequencing methods or confirmatory tests. Additionally, short-read sequences complicates the mapping of sequences to reference genomes. Approximately 10% to 20% of the genome contains large repetitive structures which hinder accurate mapping and may results in misdiagnosis or missed variants. These challenges highlight the need for potential advancements aimed at reducing overall sequencing errors.

Furthermore, data privacy and security remain paramount concerns, as the sensitive nature of genomic data raises fears of misuse. The lack of robust global regulatory frameworks further complicates the landscape, impeding progress in this sector. All these factors create a challenging environment for the market.

DNA SEQUENCING MARKET TRENDS

Advancements in Sequencing Technologies is a Latest Market Trend

The Third-Generation Sequencing (TGS) market is experiencing significant growth, driven by advancements in sequencing technologies that allow longer read lengths and improved accuracy compared to previous generations. Single-Molecule Real-Time (SMRT) sequencing and nanopore sequencing are the leading third-generation sequencing technologies gaining traction due to their ability to provide comprehensive genomic information, which is crucial for applications in precision medicine and genetic research. This third-generation sequencing enables the detection of structural variants and comprehensive genome analysis with enhanced resolution, making it indispensable for advancing personalized healthcare solutions. Additionally, the market is increasingly characterized by integrated solutions that combine hardware, software, and bioinformatics tools, enhancing the efficiency of genomic research and clinical diagnostics.

There is a growing use of sequencing technologies for cancer diagnosis, prognosis, and treatment to detect circulating tumor DNA and genetic biomarkers, contributing to the growth of the market. Furthermore, AI and machine learning tools are used to analyze massive genomic datasets, accelerating research outcomes and improving the accuracy of genomic analysis.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

During the initial stages of the COVID-19 pandemic, the market experienced a slight downturn due to various challenges. Global lockdowns, disruptions in supply chains, and reduced manufacturing capacity contributed to this decline in early 2020. However, as the first pandemic of the post-genomic era, COVID-19 boosted numerous genomic initiatives aimed at understanding the SARS-CoV-2 virus for diagnostic and therapeutic development. These projects significantly increased the implementation of genomic technologies, including DNA sequencing.

By late 2020, this surge in genomic research drove a notable rise in demand for DNA sequencing products and services. Moreover, the market rebounded strongly in 2021, returning to pre-pandemic levels by 2022. The market is expected to continue its growth trajectory as advancements in technology and expanding applications in personalized medicine and drug discovery drive further demand in the coming years.

SEGMENTATION ANALYSIS

By Products & Services

Products Segments Dominated the Market due to Technological Advancements

Based on products & services, the market is segmented into products and software & services. The products segment is further classified into equipment and consumables.

The products segment dominated the market in 2026 with a share of 63.29%, driven by technological advancements and a growing focus on personalized medicine. Additionally, an increasing number of new equipment and kit launches for new applications is expected to further boost segment growth. In the products, the consumables segment is expected to grow at the highest CAGR during the projected period.

- For instance, in January 2024, Illumina, Inc. launched an update to its NovaSeq X Series, introducing a single-flow-cell system and new kits. Such technological advancements are expected to drive segment growth.

The services & software segment is expected to grow at the highest CAGR in the near future attributed to the increasing applications of DNA sequencing across various fields, including oncology, rare diseases for drug discovery, diagnostics, and therapeutics. The increasing demand for sequencing services and software is further supported by the rising incidence of cancer and other chronic diseases, which is expected to drive the need for early diagnostics and contribute to segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Technique

NGS Segment Dominated the Market Due to Increasing Patient Demand for Precision Medicine

Based on technique, the market is segmented into Sanger sequencing, Next-Generation Sequencing (NGS), and Third-Generation Sequencing (TGS).

The next-generation sequencing segment dominated the market in 2024, driven by increasing patient demand for precision medicine, extensive R&D initiatives, industry investment, rising regulatory approvals, and the introduction of futuristic products, services, and bioinformatics tools. The segment is predicted to capture 85.99% of the market share in 2026.

- For instance, in May 2024, QIAGEN launched the QIAseq Multimodal DNA/RNA Library Kit, which simplifies library preparation for whole transcriptome and genome sequencing. Such innovations boost NGS applications, fueling further segment growth.

The TGS segment is expected to grow at the highest CAGR during the forecast period. TGS technology enables long read sequencing, processing read lengths up to several million bases, allowing for better genome assembly and improved analysis of complex regions such as repetitive sequences or structural variants. Additionally, this technique can directly detect epigenetic modifications. This increasing focus on epigenetics modifications in diagnosis and drug discovery is expected to further fuel segment growth.

The sanger sequencing segment is set to grow with a CAGR of 8.03% during the forecast period (2025-2032).

By Type

Growing Use of NGS in Cancer Diagnostics Fueled the Targeted Sequencing Segment

Based on type, the market is segmented into whole genome/exome sequencing, epigenomics, targeted sequencing, metagenomics, and others.

Targeted sequencing accounted for the major share of the market in 2024. The rising prevalence of genetic diseases and cancers is driving demand for comprehensive genomic analysis, which can be achieved through target sequencing. As a result, targeted sequencing is increasingly being integrated into routine clinical practice, particularly for cancer diagnostics, rare disease identification, and prenatal testing, driving segment growth.

The epigenomics segment is expected to grow at the highest CAGR of 11.49% during the forecast period (2025-2032). The increasing prevalence of chronic diseases, particularly cancer, is a major factor driving the demand for epigenomic research and applications. As per the WHO report in February 2024, Over 35.0 million new cancer cases are predicted by 2050, marking a 77.0% increase from the 20 million cases reported in 2022. This rising cancer incidence fuels the demand for innovative epigenomic research and therapies aimed at understanding and manipulating epigenetic modifications associated with cancer progression and treatment response. Additionally, technological advancements such as the introduction of long-read sequencing for the direct study of epigenetic modifications, are expected to further fuel segment growth.

The whole genome/exome sequencing segment is estimated to hold 45.98% of the market share in 2026.

By Application

Diagnostics Segment Leads due to Technological Advancements

In terms of application, the market is classified into drug discovery & development, diagnostics, personalized medicine, and others.

The diagnostics segment dominates the market and is expected to grow at a substantial CAGR of 9.35% during the projected period. The increasing prevalence of cancer and genetic disorders is expected to drive the demand for DNA sequencing technologies. Additionally, advances in technology have enhanced the ability to detect diseases at an early stage, leading to better patient outcomes, further driving segment growth. Additionally, the expansion of diagnostics laboratories is expected to drive segment growth.

The drug discovery & development segment accounted for the second-largest share of the market anticipated to hold 41.71% in 2026. In drug discovery & development, sequencing technologies are essential for identifying genetic variants, target identification, biomarker discovery, clinical trial optimization, and others. Key factors driving the segment growth include advancements in sequencing technologies, particularly NGS and TGS, and growing investments in genomics research from both the public and private sectors. For instance, in January 2020, the Department of Biotechnology (DBT) initiated the Genome India Project, aiming to create a comprehensive genetic database by sequencing the genomes of 10,000 individuals across diverse geographic and ethnic backgrounds in India. Such initiatives are increasing the demand for sequencing products and services.

By End-user

Growth in Personalized Medicine Drives Diagnostic Centers Segment Growth

By end-user, the market is classified as biotechnology & pharmaceutical companies, diagnostic centers, academic & research institutes, and others.

The diagnostic centers segment held the largest market share in 2024. The growth can be attributed to the increasing reliance on Next-Generation Sequencing (NGS) technologies for clinical applications, particularly in oncology, where early and accurate cancer diagnosis is critical. Additionally, the expansion of personalized medicine is expected to fuel segment growth. The segment is estimated to grow with a substantial CAGR of 9.57% during the forecast period (2025-2032).

The academic & research institutes held a significant share of the market. Technological advancements and the introduction of new-generation devices and kits for research purposes are expected to drive segment growth. Additionally, growing collaboration among market players and research institutes for R&D initiatives are further fueling segment growth.

- For instance, in August 2023, PacBio, along with GeneDx, announced a research collaboration with the University of Washington to implement long-read whole genome sequencing for neonatal diagnostics.

The biotechnology & pharmaceutical companies segment is poised to gain 25.0% of the market share in 2025.

DNA SEQUENCING MARKET REGIONAL OUTLOOK

North America

North America DNA Sequencing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, generating revenue of USD 5.74 billion in 2025 and USD 6.21 billion in 2026. The region's dominance can be attributed to the presence of major players such as Illumina, Inc., Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies, Inc. Additionally, huge R&D investments and multi-omics initiatives are significant factors contributing to the growth of the market. The clinical applications of Whole Genome Sequencing (WGS) and a liquid biopsy companion diagnostic using NGS for cancer treatment decisions, is expected to fuel segment growth.

- For instance, in January 2024, Illumina, Inc. and Janssen Research & Development, LLC partnered to develop a novel Molecular Residual Disease (MRD) assay, a whole-genome sequencing kit designed to detect Circulating Tumor DNA (ctDNA) for multi-cancer research applications.

U.S.

The strong and established presence of major players in the U.S. and a robust biotechnology sector supported by an advanced research infrastructure fosters the development and application of DNA sequencing products and services. Additionally, the rising emphasis of the U.S. government authorities on the approval of novel products and new product launches is propelling the adoption of advanced devices in the U.S. The U.S. marke is expanding and is set to reach USD 5.59 bllion in 2026.

- For instance, in October 2024, Illumina, Inc. launched its MiSeq i100 Series of sequencing systems, delivering unmatched benchtop speed and simplicity to advance Next-Generation sequencing (NGS) for laboratories.

Europe

Europe is the second largest market anticipated to gain USD 3.15 billion in 2026, exhibiting a CAGR of 9.44% during the forecast period (2025-2032). The increasing prevalence of cancer and genetic disorders has increased the demand for precise diagnostic tools, such as targeted sequencing, which allows for the examination of the genome in the region. The U.K. market continues to grow, projected to reach a value of USD 0.72 billion in 2026. Additionally, government funding and research initiatives such as the UK Biobank, continue to fuel market growth. Germany is expected to be worth USD 0.72 billion in 2026, while France is poised to be valued at USD 0.43 billion in 2025.

Asia Pacific

Asia Pacific is the third largest market set to be worth USD 2.60 billion in 2026. The region is anticipated to exhibit the highest growth rate during the study period due to increasing investments in healthcare infrastructure and genomic research initiatives. Additionally, rising government initiatives to enhance the growth of the genomic sector are expected to increase the demand for DNA sequencing products and services in the region. China is estimated to hold USD 0.66 billion in 2026.

- For instance, in February 2022, Singapore's Ministry of Trade and Industry (MTI) and India's Department of Science and Technology (DST) collaborated on bioinformatics and genome research to map the Asian genome. This initiative aims to enhance the understanding of disease mechanism in Asian genes. The collaboration is expected to allow both organizations to launch joint genome research projects.

Latin America

Latin America is the fourth largest market projected to hit USD 0.97 billion in 2026. The increasing emphasis on personalized treatment options driven by the rising prevalence of chronic diseases, including cancer, is fostering the adoption of Next-Generation Sequencing (NGS) technologies for tailored therapeutic approaches based on individual genetic profiles.

Middle East & Africa

Rising investments in the healthcare infrastructure are facilitating the adoption of advanced sequencing technologies for clinical diagnostics and genomic research. Additionally, the growing prevalence of chronic diseases is expected to fuel market growth in the region. The GCC market is poised to grow with a valuation of USD 0.04 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on New Product Launches to Build Strong Product Portfolio

Illumina, Inc.'s has established itself as a leader in the market, driven by its strong portfolio of sequencing products and services, coupled with its wide presence globally. The company growth is further supported by strategic initiatives, such as the introduction of new products & services and expansion of their offerings through partnerships and other initiatives.

- For instance, in December 2023, Illumina Inc. and HaploX partnered to provide locally manufactured sequencing instruments in China.

Thermo Fisher Scientific Inc. is focused on continuous innovation, enhancing the efficiency and accuracy of DNA sequencing technologies. Their advancements in NGS and new product launches are significantly driving the company's growth.

Oxford Nanopore Technologies plc. and PacBio are significantly growing in the market due to their advanced long-read sequencing applications. Additionally, the incorporation of artificial intelligence and advanced bioinformatics tools is enhancing data analysis capabilities, strengthening their market positions.

BGI Genomics has expanded its presence in the market through its extensive portfolio of sequencing services, such as whole genome sequencing and metagenomics sequencing. These services cater to diverse applications, such as clinical diagnostics, agricultural genomics, and large-scale research projects. Additionally, the company's strategic positioning in the rapidly expanding Asia Pacific market, which is witnessing significant investments in genomics and a rising demand for precision medicine, further enhances its market prospects.

LIST OF KEY DNA SEQUENCING COMPANIES PROFILED

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Oxford Nanopore Technologies plc. (U.K.)

- PacBio (U.S.)

- QIAGEN (Netherlands)

- PerkinElmer Inc. (U.S.)

- Azenta US, Inc, (U.S.)

- BGI Genomics (China)

KEY INDUSTRY DEVELOPMENTS

- September 2023: Pillar Biosciences Inc. introduced oncoReveal Core LBx, a next-generation sequencing (NGS) kit for liquid biopsy-based tumor profiling.

- September 2023: Integrated DNA Technologies, Inc. launched xGen NGS products for the Ultima Genomics UG 100 platform. The xGen NGS products include primers, adapters, and universal blockers for numerous applications.

- July 2023: Integrated DNA Technologies, Inc. launched xGen Respiratory Virus Amplicon Panel. The single panel is designed to detect viral respiratory variants, including Respiratory Syncytial Virus (RSV) A, RSV B, Influenza B, Influenza A H1N1, Influenza A H3N2, and SARS-CoV-2.

- March 2023: Illumina, Inc. launched a high-performance, long-read human whole-genome sequencing (WGS) assay. The assay is designed for compatibility with Illumina NovaSeq X Plus, NovaSeq X, and NovaSeq 6000 Sequencing Systems, enabling enhance accuracy in human genome sequencing.

- October 2021: Promega Corporation introduced the ProDye Terminator Sequencing System. The system is designed to be used with Promega Corporation’s device.

REPORT COVERAGE

The global DNA sequencing market research report provides an in-depth analysis of the industry. It focuses on market segments, such as products & services, technique, type, application, end-user, and region. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19 pandemic, and the latest market trends. The report consists of the global DNA sequencing market share by various segments in country levels and provides an analysis of the factors driving the market growth. The report also provides the competitive landscape of the market.

TRADE PROTECTIONISM AND IMPACT

Trade protectionism significantly impacts the market through various factors, such as tariff barriers, export restrictions, and global supply chain disruptions. Tariff barriers imposed by certain countries on sequencing instruments and reagents increase costs for end users, potentially limiting access to essential technologies. Furthermore, export restrictions from countries with advanced sequencing technologies can protect intellectual property. However, it may also restrict the availability of advanced products to other markets, thereby affecting global collaboration and competitiveness. Additionally, the reliance on global supply chains for equipment and consumables makes the market vulnerable to disruptions caused by geopolitical tensions or pandemics, which can lead to delays in product availability and increased operational costs. These factors collectively create a challenging environment for companies operating in the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.32% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Products & Services

|

|

By Technique

|

|

|

By Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 12.31 billion in 2025 and is projected to reach USD 27.25 billion by 2034.

In 2025, the market value stood at USD 12.31 billion.

The market will exhibit a steady CAGR of 9.32% during the forecast period (2026-2034).

By products & services, the products segment leads the market.

Increased demand for personalized medicine and the growing use of whole genome sequencing are some of the key factor driving the market.

Illumina, Inc. and Thermo Fisher Scientific are some of the major players in the market.

North America dominated the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us