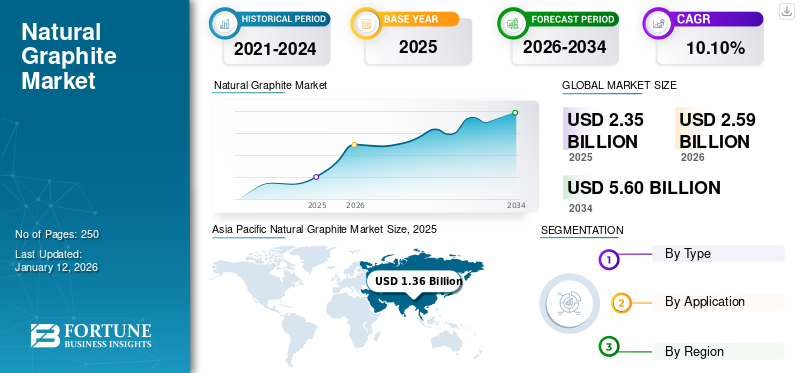

Natural Graphite Market Size, Share & Industry Analysis, By Type (Vein Graphite, Flake Graphite, and Amorphous Graphite), By Application (Refractories, Foundries, Batteries, Friction Products, Lubricants, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global natural graphite market size was valued at USD 2.35 billion in 2025. The market is projected to grow from USD 2.59 billion in 2026 to USD 5.6 billion by 2034, exhibiting a CAGR of 10.1% during the forecast period. Asia Pacific dominated the natural graphite market with a market share of 58% in 2025.

Natural graphite is a crystallized carbon widely used in batteries, refractories, lubricants, and conductive materials across various industries. Its importance lies in its excellent electrical conductivity, high thermal resistance, and lubricating properties, making it essential for electric vehicle batteries and energy storage systems. The market is witnessing rapid growth due to the global transition toward clean energy, rising demand for lithium-ion batteries, and increasing applications in electronics and metallurgy. Furthermore, supporting government initiatives for battery manufacturing and the increasing production of EVs, especially in emerging and developed economies, are expected to propel market growth during the forecast period.

Major manufacturers operating in the market include Graphit Kropfmühl GmbH, Superior Graphite, Asbury Carbons, Tirupati Carbons & Chemicals Pvt. Ltd, Syrah Resources Limited, and Skaland Graphite AS.

- According to the Observatory of Economic Complexity (OEC), global trade in natural graphite (in powder or flakes) was valued at USD 663 million in 2023, ranking as 2,557th out of 4,644 trade products globally.

NATURAL GRAPHITE MARKET TRENDS

Rising Trend in Recycling and Circular Economy Practices to Boost Market Growth

With increasing pressure to minimize environmental impact and conserve critical resources, the market is witnessing a rising trend in recycling and circular economy initiatives. Companies are exploring advanced methods to recover graphite from end-of-life batteries and industrial waste, aiming to meet sustainability goals and reduce dependency on virgin raw materials. This shift is gaining momentum, particularly in regions with strict environmental regulations and growing demand for responsible sourcing. The development of efficient graphite recovery technologies is expected to play a crucial role in supporting long-term supply security and stabilizing prices.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand from Energy Storage Systems and Electric Vehicles to Drive Market Growth

The accelerating shift toward electric mobility and renewable energy is significantly driving product adoption. As investments in electric vehicles (EVs) and large-scale energy storage systems increase, the need for efficient anode materials in lithium-ion batteries is also rising. Natural graphite plays a crucial role in these applications, making it an essential material in the energy transition. Additionally, advancements in battery technologies and increasing investments in clean energy solutions are further boosting product consumption. With a growing emphasis on decarbonization and energy efficiency, the market is poised for substantial growth in the coming years.

- According to the World’s Top Exports, lithium-ion battery exports reached USD 3.47 billion in 2023, with a 6.1% increase from the previous year. This surge highlights the increasing global demand for battery technology, which directly influences the consumption of natural graphite, a key material used in battery anodes.

MARKET RESTRAINTS

Volatility in Raw Materials and Processing Costs May Limit Product Demand

Changing costs of raw materials and processing inputs such as energy, chemicals, and mining equipment create uncertainty in graphite production for graphite producers. These fluctuations can affect profit margins and hinder long-term planning, especially in areas with limited refining infrastructure. Additionally, reliance on imports and exposure to geopolitical risks further increase costs and disrupt supply chain stability. As a result, some manufacturers may turn to more stable or synthetic alternatives, which could slow the overall growth of the market during the forecast period.

MARKET OPPORTUNITIES

Rising Focus on Sustainability and Technological Advancements to Boost Market Growth

The increasing emphasis on sustainability is boosting product demand, particularly due to its importance in green technologies such as energy storage and renewable energy systems. As industries aim to decrease their environmental impact, the shift toward sustainable raw materials such as natural graphite is gaining momentum. Additionally, technological advancements, including automation and improved mining techniques, are enhancing production efficiency, reducing operational costs, and promoting more sustainable methods. These combined efforts in sustainability and technological progress are set to fuel natural graphite market growth in the near future.

- According to the Indian Bureau of Mines, India’s production of natural graphite saw a significant rise, reaching over 57 kilotons in 2021-2022, marking a 61% rise compared to the previous year.

MARKET CHALLENGES

Environmental Regulations and Competition from Synthetic Alternatives Pose Challenge to Market Growth

Natural graphite mining and processing can pose environmental challenges, including land degradation, water contamination, and dust emissions, which have led to the implementation of stricter environmental regulations. Complying with these standards often requires substantial investments in eco-friendly technologies and sustainable mining practices, thereby increasing operational costs. Additionally, the growing availability of synthetic graphite and technological advancements in its production are intensifying market competition. This shift is putting pressure on producers to enhance product quality and operational efficiency to remain competitive.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Flake Graphite Segment Leads Market Due to Rising Expansion of EV Production Lines

Based on type, the market is classified into vein graphite, flake graphite, and amorphous graphite.

The flake graphite segment holds the largest share of the market due to its high carbon content (typically 90-97% C) and remarkable versatility. It is used in a wide range of applications, from expandable forms used in flame-retardant barriers and conductive foils for EMI (electromagnetic interface)/RFI (radio frequency interface) shielding to ultra-pure, micronized grades essential for lithium-ion battery anodes. The ongoing expansion of EV production lines and large-scale energy storage projects has further boosted demand for high-purity flake grades.

Vein graphite, also known as lump graphite, is gaining popularity due to the growing demand for high-purity materials in advanced industrial applications. With a carbon content typically above 90% and a naturally crystalline structure, it is highly valued in specialized uses such as nuclear reactors and specialized lubricants where low impurity levels are essential. Its exceptional quality positions it as a premium material, particularly for industries requiring high-purity graphite.

Amorphous graphite, also known as microcrystalline graphite, typically contains around 80-90% carbon, and it is commonly used in products such as refractory bricks, foundry facings, brake linings, and pencils. Although it has lower purity compared to vein or flake graphite, its widespread availability makes it a highly cost-effective choice for various industrial and metallurgical applications. The steady rise in metallurgical processes and increased maintenance activities in heavy industries continue to support consistent demand for amorphous graphite.

By Application

Refractories Segment Dominates Market due to Rapid Expansion in Steel Production

Based on application, the market is segmented into refractories, foundries, batteries, friction products, lubricants, and others.

The refractories segment holds the largest natural graphite market share, driven by strong demand from the steel, glass, cement, and other high-temperature processing industries. This graphite is widely used in manufacturing refractory bricks, crucibles, and furnace linings due to its great thermal stability, high melting point, and resistance to thermal shock. With the ongoing expansion in steel production and increased investment in infrastructure and heavy industries, the need for durable, heat-resistant materials continues to rise, driving the refractories segment growth.

In the battery segment, this graphite is primarily used as a key material in lithium-ion battery anodes due to its excellent conductivity, energy storage capacity, and stability. The increasing adoption of electric vehicles and the global shift toward renewable energy are accelerating the need for high-performance, reliable batteries. This trend is further driven by large-scale investments in battery production, supporting government policies, and the rising importance of grid-level energy storage solutions. As a result, product demand in the battery segment is expected to grow in the coming years.

In the lubricants segment, this graphite is used in high-performance greases, dry lubricants, and anti-seize compounds due to its unique layered structure that enables low-friction movement between surfaces. This property makes it suitable for applications in high-temperature and heavy-load environments, including industrial machinery, automotive engines, and aerospace systems. Growing demand for durable and efficient lubrication solutions across various industries is contributing to the rapid expansion of natural graphite usage in the lubricants segment.

Natural Graphite Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Natural Graphite Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to dominate the market with a valuation of USD 1.36 billion in 2025 and USD 1.51 billion in 2026, accounting for a 58% market share in 2025, driven by strong industrial growth, expanding electric vehicle production, and increasing demand for energy storage solutions, particularly in countries such as China and India. China, in particular, dominates both graphite mining and processing, making it the most the key country for graphite supply and consumption. Government support for clean energy initiatives, rising investments in battery manufacturing, and the development of advanced industrial sectors continue to fuel regional demand. Additionally, rapid urbanization, infrastructure development, and growth in steel and metallurgy industries further contribute to the region’s dominant position in the market.

- According to the U.S. Geological Survey’s 2024 Mineral Commodity Summary, China was the world’s leading graphite producer, producing approximately 1.27 million metric tons of natural graphite in 2023, accounting for around 77% of the world’s total production.

North America

The market in North America is experiencing rapid growth, driven by rising demand across various industrial applications, including batteries, refractories, lubricants, and foundry operations. In addition to the growing focus on clean energy and electric mobility, the region is witnessing increased use of graphite in steel making, aerospace components, and high-temperature industrial processes. Government initiatives aimed at strengthening domestic critical mineral supply chains are encouraging the exploration and development of local graphite resources, particularly in the U.S. to reduce reliance on imports.

- According to OEC, the U.S. was the top importer of natural graphite, with an import value of USD 158 million in 2023, indicating strong and growing product demand in the U.S. market.

Europe

In Europe, the market is driven by the region’s strong commitment to green energy, electric mobility, and battery storage advancements. Stringent governmental policies and Europe’s carbon reduction goals are increasing the demand for graphite in EV batteries and renewable energy systems. Major economies such as Germany, France, and the U.K. are investing in electric vehicle manufacturing and energy storage infrastructure, positioning Europe as a major product consumer.

- According to the World's Top Exports, Germany exported USD 40.1 billion worth of electric cars in 2023, accounting for 26.6% of global electric car exports, reflecting its shift toward electric mobility and boosting natural graphite demand in the region.

Latin America

The market in Latin America is driven by its use in steel production, construction materials, lubricants, and renewable energy storage. Countries such as Brazil, which possess significant graphite reserves, are positioning themselves as a key supplier in the global market. This growth is supported by sustainable mining practices and rising industrial demand across sectors.

- According to the Government of Canada, Brazil holds the second largest reserves of natural graphite, estimated at 74 million metric tons, accounting for about 26.4% of the world’s graphite reserves.

Middle East & Africa

In the Middle East & Africa, the market is driven by growing investments in renewable energy, battery storage technologies, and industrial expansion. The demand is further fueled by the growth of steel, metallurgy, and refractory industries, along with infrastructure and construction development.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Technological Advancements to Boost Their Market Presence

The global market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Key global companies include Graphit Kropfmühl GmbH, Superior Graphite, Asbury Carbons, Tirupati Carbons & Chemicals Pvt. Ltd., and Syrah Resources Limited. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while also investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY NATURAL GRAPHITE COMPANIES PROFILED

- Graphit Kropfmühl GmbH (Germany)

- Superior Graphite (U.S.)

- Imerys (France)

- Asbury Carbons (U.S.)

- BTR New Material Group Co., Ltd. (China)

- Mineral Commodities Ltd. (Australia)

- Syrah Resources Limited (Australia)

- Nacional de Grafite (Brazil)

- Qingdao Haida Graphite Co., LTD. (China)

- Tirupati Carbons & Chemicals Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Syrah Resources signed an agreement to supply Lucid Motors with approximately 7 kilotons of natural graphite annually for lithium-ion battery production, starting in 2026, with the material to be sourced from Syrah’s Vidalia facility in Louisiana.

- December 2024: Skaland Graphite AS was acquired by the Anglo-Norwegian company, giving it full control over the world’s highest-grade operating flat mine, located on Norway’s Senja island.

- August 2023: Tirupati Carbons acquired Suni Resources SA, gaining ownership of the Montepuez and Balama Central graphite projects in Mozambique, which are fully permitted for a combined annual production of 158 kilotons of Natural Flake Graphite per annum.

- December 2021: Imerys signed an agreement to sell its non-core natural graphite assets, including its mothballed mine and plant in Namibia and its active mine in Canada, to Northern Graphite Corporation for approximately USD 43 million.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.10% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.35 billion in 2025 and is projected to reach USD 5.6 billion by 2034.

In 2025, the market value stood at USD 1.36 billion.

The market is expected to exhibit a CAGR of 10.10% during the forecast period of 2026-2034.

By type, the flake graphite segment leads the market.

The key factor driving the market is the rising demand for electric vehicles.

Graphit Kropfmühl GmbH, Superior Graphite, Asbury Carbons, Tirupati Carbons & Chemicals Pvt. Ltd, Syrah Resources Limited, and Skaland Graphite AS are the top players in the market.

Asia Pacific dominated the natural graphite market with a market share of 58% in 2025.

Rising focus on sustainability, growing demand from the energy storage and industrial sectors, and advancements in mining and processing technologies are some of the key factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us