Triethanolamine Market Size, Share & Industry Analysis, By Function (Emulsifier, pH Adjuster, Surfactant, and Others), By Application (Personal Care & Cosmetics, Detergents & Household Cleaners, Cement & Concrete, Metalworking & Industrial Fluids, Textiles & Leather Processing, Herbicide Intermediate, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

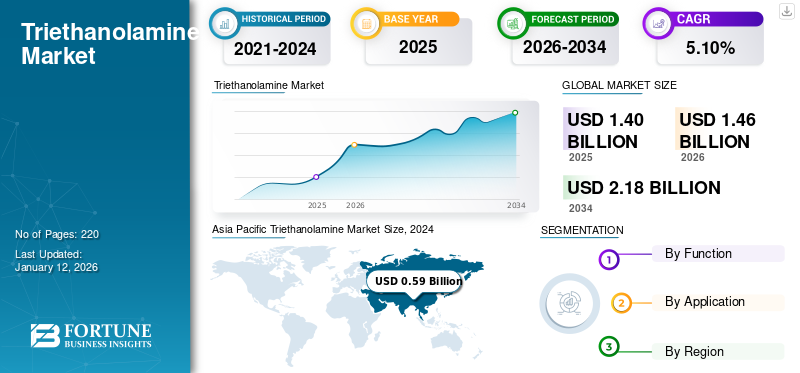

The global Triethanolamine market size was valued at USD 1.40 billion in 2025. The market is projected to grow from USD 1.46 billion in 2026 to USD 2.18 billion by 2034, at a CAGR of 5.10% during 2026-2034. Asia Pacific dominated the triethanolamine market with a market share of 45% in 2025.

Triethanolamine (TEA) is a multifunctional organic compound with the chemical formula N(CH₂CH₂OH)₃, classified as a tertiary amine and a triol. It is a colorless, viscous liquid with a mild ammonia-including odor, highly soluble in water and various organic solvents. TEA is synthesized through the reaction of ethylene oxide with aqueous ammonia, resulting in a compound widely used across industries due to its surfactant, emulsifying, and pH-balancing properties.

BASF SE, Dow Chemical, INEOS, Nouryon, & SABIC are some well-known key players operating in the market. BASF’s extensive product portfolio and Nouryon’s focus on sustainable formulations enhance their market presence in this sector. Major players such as BASF and INEOS Oxide are investing heavily in R&D to develop safer, more user-friendly, and environmentally sustainable TEA-based products.

Global Triethanolamine Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.40 billion

- 2026 Market Size: USD 1.46 billion

- 2034 Forecast Market Size: USD 2.18 billion

- CAGR: 5.10% from 2026–2034

Market Share:

- Asia Pacific dominated the triethanolamine market with a 45% share in 2025, driven by expanding personal care, agrochemical, and construction sectors, especially across China, India, and Southeast Asia.

- By function, emulsifier is expected to retain the largest market share in 2025, owing to TEA’s critical role in stabilizing emulsions in personal care formulations.

Key Country Highlights:

- China: The market was valued at USD 0.29 billion in 2024. Growth is supported by large-scale construction activity and demand for herbicides in agriculture.

- United States: A leading producer and exporter of TEA, the U.S. sees high demand from premium cosmetic brands and agrochemical manufacturers. Use in shale gas treatment and corrosion inhibitors also boosts industrial applications.

- India & Southeast Asia: Government initiatives, such as India’s PLI scheme, and infrastructure development are fueling increased TEA use in construction and chemical manufacturing.

- Germany & the U.K.: In Europe, regulatory compliance under REACH and rising demand for high-purity TEA in cosmetics and pharmaceuticals sustain market growth. BASF and INEOS are investing in sustainable production processes.

- Brazil & Argentina: TEA use in agrochemicals and infrastructure projects is driving growth. Mexico shows future potential amid industrial expansion.

- Saudi Arabia: Mega-projects like NEOM are increasing TEA demand in construction. Imports dominate the market, but regional adoption of bio-based TEA is rising.

Triethanolamine Market Trends

Shift toward Eco-Friendly and Bio-Based Triethanolamine to Propel Market Growth

A significant trend shaping the market is the rising demand for eco-friendly and sustainable products, particularly in personal care, agriculture, and cleaning sectors. Manufacturers are focusing on developing TEA from renewable feedstocks, such as plant oils or sugarcane, to cater to environmentally conscious consumers and comply with stricter environmental regulations. This trend is further fueled by the proliferation of e-commerce, which broadens the reach of green products, and by product innovations that enhance the biodegradability and safety of triethanolamine-based formulations. The shift toward bio-based and sustainable solutions is expected to open new avenues and strengthen the position of companies investing in green chemistry.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Demand for Personal Care and Cosmetics to Fuel Product Demand

The personal care and cosmetics industry is a primary driver for the market. TEA is widely used as an emulsifier, pH adjuster, and viscosity modifier in products such as shampoos, conditioners, moisturizers, and skin creams. The global rise in consumer awareness about skincare routines, coupled with increasing disposable incomes and the popularity of premium beauty products, is boosting the product demand.

Expansion in Construction and Infrastructure Drives Market Growth

Triethanolamine is used as an additive in cement and concrete, where it acts as a grinding aid and helps in the agglomeration of powder, improving the efficiency of the grinding process and the quality of the final product. With the growing number of construction projects, particularly in emerging economies, the demand for building materials and coatings is on the rise. This trend is expected to continue growing with the rise in urbanization and industrialization, driving triethanolamine market growth.

MARKET RESTRAINTS

Stringent Regulatory Environment to Hamper Market Growth

A key restraint for the market growth is the increasingly stringent regulatory environment governing the use of chemicals in consumer and industrial products. Regulatory bodies in North America and Europe are imposing tighter restrictions on the use of certain chemicals, including triethanolamine, due to concerns about human health and environmental impact. Compliance with these regulations often require manufacturers to invest in costly research and development to create safer, more environmentally friendly formulations, which can limit profitability for smaller players.

MARKET OPPORTUNITIES

Growth in Emerging Economies and Diversity in Applications is Creating Beneficial Opportunities for Market Growth

Rapid urbanization, rising disposable incomes, and expanding agricultural and industrial sectors in these regions are driving demand for personal care products, construction materials, and advanced chemical solutions. Additionally, the development of new applications, such as advanced lubricants, detergents, coatings, and bio-based formulations, offer manufacturers opportunities to diversify their product portfolios and enter new markets. Companies investing in bio-based triethanolamine and exploring innovative uses in automotive, electronics, and environmental technologies are well-positioned to capitalize on these emerging opportunities.

MARKET CHALLENGES

Availability of Substitute Products Creates a Challenge for Market Development

The market faces a significant challenge from the availability of substitute products, such as monoethanolamine, diethanolamine, and other amino alcohols. These alternatives have similar chemical properties and can be used in similar applications, such as surfactants, corrosion inhibitors, and pH adjusters. The growing popularity and increasing sales of these substitutes, driven by their comparable performance and, in some cases, lower cost or regulatory advantages, can restrict the adoption and triethanolamine.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted global supply chains, including those for chemicals such as triethanolamine, which is widely used in personal care products, detergents, and industrial applications. Lockdowns, factory shutdowns, and transportation restrictions led to delays in the movement of raw materials and finished goods, highlighting the vulnerabilities in global chemical supply chains. Demand for certain TEA-based products, especially those related to hygiene and cleaning, surged, while other sectors faced reduced demand due to economic slowdowns and shifting consumer behaviors. Although some industries adapted quickly, the overall market experienced volatility, with short-term disruptions in both supply and pricing. The pandemic also accelerated digital transformation in trade, with companies adopting new technologies to manage logistics and sales more efficiently.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism marked by tariffs, quotas, and subsidies disrupts global commerce by inflating costs, triggering retaliatory trade wars (e.g., U.S.-China tensions), and realigning supply chains along geopolitical lines, as nations prioritize alliances over efficiency. Geopolitical rivalries increasingly drive trade policies, with measures including export controls (e.g., semiconductor bans) and "friend-shoring" reshaping industries into competing blocs, while third-party nations such as Vietnam or Mexico capitalize on redirected trade flows. This protectionist shift amplifies national security concerns, fosters economic sovereignty efforts (e.g., CHIPS Act subsidies), and risks long-term inefficiencies, stifled innovation, and fragmented global trade systems, ultimately undermining economic interdependence and stability.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Innovations including triethanolamine-based nanocoatings for antimicrobial surfaces (post-COVID demand) and flame-retardant additives for electric vehicle batteries are creating a new global trend in the market. Companies are investing in bio-based TEA, derived from renewable feedstocks (e.g., sugarcane ethanol) to reduce carbon footprints. For instance, BASF’s 2024 pilot plant in Germany aims to cut TEA production emissions by 40%.

Moreover, demand for TEA >99% purity is rising in the pharmaceuticals and electronics industries. For instance, Mitsui Chemicals developed an ultra-high-purity TEA variant in 2023 for use in semiconductor cleaning agents, capitalizing on the chip industry’s growth.

Recycling TEA from industrial waste streams (e.g., textile effluents) is gaining higher traction. For instance, Nippon Shokubai’s 2025 initiative targets recovering 80% of TEA from wastewater in partnership with EU chemical recyclers.

Segmentation Analysis

By Function

Emulsifier Action Dominated as it directly Impacts Product Stability and Shelf Life

Based on function, the market is classified into emulsifier, pH adjuster, surfactant, and others.

The emulsifier segment held the highest triethanolamine market share in 2024 and is estimated to grow at a significant rate during the forecast period. TEA chemically modifies ingredients to blend immiscible components (such as oil and water) into stable emulsions. This is critical for products including creams and lotions, where separation would compromise texture and performance.

The pH adjuster segment will register significant growth during the forecast period owing to the rising infrastructure development. TEA neutralizes acidic compounds and stabilizes formulations to match the skin’s natural pH (~4.5–5.5). This ensures compatibility with the skin’s acid mantle, preventing irritation and enhancing product safety. pH adjustment is fundamental in most cosmetic product formulations, as improper pH can degrade active ingredients or cause skin sensitivity.

By Application

Personal Care & Cosmetics to Hold Large Share Owing to Its Essential Functional Roles

Based on application, the market is classified into personal care & cosmetics, detergents & household cleaners, cement & concrete, metalworking & industrial fluids, textiles & leather processing, herbicide intermediate, and others.

The personal care & cosmetics formulation segment dominates the application of triethanolamine due to its versatile, multifunctional properties. As an emulsifier, it enables the thorough blending of oil and water-based ingredients, ensuring creams, lotions, and shampoos achieve a smooth, uniform texture. As a pH adjuster, it stabilizes formulations by bringing their acidity or alkalinity to levels that are both effective and gentle on the skin. Additionally, as a texture enhancer and thickener, it imparts body and consistency, improving the spreadability and sensory feel of products. These combined functions not only enhance product stability and shelf life but also contribute to the overall efficacy and user experience of personal care items, making TEA a vital ingredient in the cosmetics industry.

The detergents & household cleaners segment is anticipated to exhibit noteworthy growth over the projected timeframe. In cleaning formulations such as laundry detergents, dishwashing liquids, and all-purpose cleaners, TEA enhances the removal of oils and grease by emulsifying them, allowing these substances to be easily washed away. Its ability to increase the alkalinity of liquid detergents further boosts cleaning performance, especially against stubborn, non-polar soils, including sebum. Additionally, triethanolamine is valued for its compatibility with other surfactants, which helps to stabilize and improve the effectiveness of cleaning products, making it a staple ingredient in both household and industrial cleaning applications.

TRIETHANOLAMINE MARKET REGIONAL OUTLOOK

Based on geography, the market is divided into Europe, Latin America, North America, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific Triethanolamine Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.62 billion in 2025 and USD 0.66 billion in 2026. The market size in China accounted for USD 0.29 billion in 2024. It is anticipated to be the fastest-growing region during the forecast period. Expanding construction and agrochemical industries in India and Southeast Asia boost product use in cement additives and herbicides. Government initiatives such as India’s PLI scheme further stimulate chemical production.

Europe

Europe exhibits steady demand, led by Germany and the U.K., with stringent regulations promoting high-purity triethanolamine grades in cosmetics and pharmaceuticals. The EU’s REACH framework impacts production standards. Companies including BASF and INEOS prioritize green chemistry, integrating carbon capture technologies to reduce emissions from product manufacturing.

North America

The North American market is driven by strong demand from the personal care industry, with the United States leading as a key producer and exporter. The U.S. market is driven by premium cosmetics demand and agrochemical production. TEA’s use in shale gas treatment and corrosion inhibitors supports industrial applications. Investments in sustainable production and partnerships with biotech firms aim to develop next-generation TEA applications.

Latin America

Brazil and Argentina drive market growth, with TEA’s usage in agrochemicals (herbicides) and construction. Government infrastructure projects in Brazil encourage cement additive demand. Moreover, currency fluctuations and political instability in Venezuela limit market expansion, though Mexico shows potential due to industrial growth.

Middle East & Africa

TEA is used in oilfield chemicals and metalworking fluids, though regional production remains limited, relying on imports. In addition, Saudi Arabia’s infrastructure projects (e.g., NEOM) boost product demand in construction chemicals. Also, partnerships with Asian manufacturers and bio-based TEA adoption could unlock opportunities in sustainable industrial solutions.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Key Companies’ Focus on Sustainability to Gain Competitive Edge Drives Market Growth

ASF SE, DOW, INEOS, Nouryon, & SABIC are the key players in the market. These companies are making major investments in developing additives that address evolving demands for sustainability and performance. Key players in the market have invested a sizable amount in developing sustainable consumer goods products. Partnerships with raw material suppliers and chemical companies are the strategies used by the market players to increase their presence globally and maintain their mark in the competition.

List of Key Triethanolamine Companies Profiled

- BASF SE (Germany)

- DOW (U.S)

- Indorama Ventures Public Company Limited (Thailand)

- INEOS (U.K)

- Nouryon (Netherlands)

- SABIC (Saudi Arabia)

- Sintez OKA Group of Companies (Russia)

- OUCC (Taiwan)

- Kanto Kagaku (Japan)

- Shree Vallabh Chemical (India)

KEY INDUSTRY DEVELOPMENTS

- September 2024: BASF inaugurated a new world-scale production plant for alkyl ethanolamines, including TEA, at its Antwerp Verbund site in Belgium, increasing global annual production capacity by nearly 30% to over 140,000 metric tons. The facility strengthens BASF’s global network, which includes sites in Ludwigshafen (Germany), Geismar (Louisiana), and Nanjing (China).

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, functions, applications, compositions used to produce these products, and end-users of the product. Besides this, the report offers insights into the market, current industry trends, and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.10% from 2026 to 2034 |

|

Segmentation |

By Function

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 1.46 billion in 2026 and is projected to reach USD 2.18 billion by 2034.

In 2025, the market value stood at USD 0.62 billion.

Growing at a CAGR of 5.10%, the market will exhibit steady growth during the forecast period (2026-2034).

The personal care & cosmetics segment captured the largest market share in 2025.

Rapid urbanization & increase in construction activities are key factors driving the growth of the market.

Asia Pacific held the dominant market share in 2025.

The increasing demand for eco-friendly and bio-based TEA products will drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us