Electric Two Wheeler Powertrain Market Size, Share & Industry Analysis, By Component Type (Motor {Motor Stator, Rotor, Shaft and Bearing, Permanent Magnet, Casing, and Wiring & Connectors}, Traction Inverter {IGBT/SiC Power Module, Microcontroller, Sensing Element, and Others}, and On-board Charger), By Vehicle Type (Electric Motorcycles and Electric Mopeds), By Power Output (<3 kW, 3-10 kW, and >10 kW), By Motor Type (Mid Drive and Hub Motor), By Battery Type (Lithium-Ion Batteries, Lithium Iron Phosphate (LiFePO4), and Lead-Acid Batteries), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

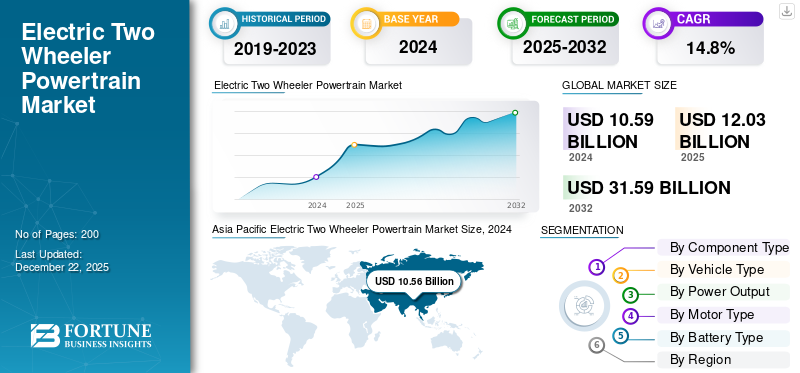

The global electric two wheeler powertrain market size was valued at USD 10.59 billion in 2024 and is projected to grow from USD 12.03 billion in 2025 to USD 31.59 billion by 2032, exhibiting a CAGR of 14.8% during the forecast period. Asia Pacific dominated the global market with a share of 99.72% in 2024.

An electric two-wheeler powertrain consists of components, including electric motors, batteries, and controller, which work together to power electric motorcycles and mopeds. It provides efficient energy conversion, offering sustainable, low-maintenance, and eco-friendly transportation for urban and rural commutes.

Government incentives, environmental concerns, urbanization, rising fuel prices, advancements in battery technology, improved charging infrastructure, and increasing consumer demand for cost-effective, sustainable, and efficient transportation solutions contribute to the growth of the market in the forecast period. Bosch Mobility, Yamaha Motor Co., Ltd., T&D, Varcheae Mobility MAHLE Powertrain Ltd , and Valeo SA are the key leading players contributing major share in the electric two wheeler powertrain market.

- In April 2025, Ather Energy, an Indian electric motorcycle manufacturer, unveiled its latest affordable electric motorcycle model, which promises enhanced performance, longer range, and faster charging. The new model is expected to rival global competitors and strengthen Ather's position in the rapidly growing electric two-wheeler market, with a focus on urban mobility and sustainability.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Last Mile Connectivity Advantage in Growing Urbanization and Traffic Congestion Scenarios Fuels Market Development

As urbanization grows, people are increasingly seeking compact, affordable, and flexible transportation options. Electric two-wheelers are well-suited for urban environments due to their small footprint, low maintenance needs, and ability to bypass traffic jams. Electric two-wheelers are an ideal solution for last-mile connectivity, particularly in cities with poor public transportation infrastructure. They are commonly used for deliveries and short-distance commuting, offering both economic and environmental benefits.

- In January 2025, EMX, the logistics arm of 7X, launched its inaugural fleet of electric scooters to enhance sustainable last-mile delivery operations across the UAE. These e-bikes are designed to increase energy efficiency by 16%, offering a range of up to 135 km on a dual battery system. Equipped with advanced safety features such as a Combined Braking System and hydraulic suspension, the initiative supports the UAE's commitment to green logistics and smart urban mobility. EMX aims to replace 98% of its traditional vehicles with electric alternatives by 2030.

MARKET RESTRAINTS

Battery Limitations such as Density, Range, and Charging Time Hamper Market Growth

Current battery technologies, such as lithium-ion, are not capable of matching the energy density of gasoline, resulting in limited range per charge, which deters consumers, especially those needing long-distance capabilities. Additionally, charging electric two-wheelers takes longer than refueling gasoline-powered vehicles, causing inconvenience. Fast-charging infrastructure remains limited, exacerbating the issue. Consumers may also worry about battery degradation over time, leading to high replacement costs. These factors hinder widespread adoption, particularly for long-distance riders or those in regions with underdeveloped charging networks.

MARKET OPPORTUNITIES

Improvement in Motor Efficiency, Range, and Acceleration Boosts Market Growth

By improving electric motors' efficiency, range, and acceleration, the advanced technology boosts the overall performance and cost-effectiveness of electric two-wheelers. This will likely increase consumer adoption, attract manufacturers, and accelerate infrastructure development. As a result, the growth of eco-friendly, high-performance electric motorcycles and mopeds becomes more viable, driving the demand for advanced electric two wheeler powertrain solutions, lowering production costs, and contributing to the broader shift toward sustainable urban transportation.

- In March 2022, Exro Technologies' Coil Driver technology demonstrated significant improvements in electric motorcycle performance, enhancing efficiency and range. The innovative system optimizes motor control, providing better acceleration and energy utilization. This breakthrough could lead to more efficient, longer-lasting electric motorcycles, pushing the industry toward sustainable mobility solutions with enhanced capabilities.

ELECTRIC TWO WHEELER POWERTRAIN MARKET TRENDS

Increased Localization and In-House Powertrain Development Trends Influence Market Growth

Manufacturers are investing in localized production to reduce costs, comply with government regulations, and shorten supply chains, especially in high-growth regions such as India and Southeast Asia. Simultaneously, many OEMs are shifting toward in-house development of motors, controllers, and battery management systems to gain better control over performance, integration, and intellectual property. This strategy enhances customization, ensures quality, and reduces reliance on third-party suppliers, positioning brands for long-term competitiveness in the fast-evolving electric mobility landscape. Thus, increased localization and in-house powertrain development trends influence market growth.

- In June 2024, Musashi Auto Parts India began mass production of e-Axles for two-wheel Electric Vehicles (EVs) at its Bangalore plant. These compact, high-performance drive units will power BNC’s Perfetto and Emobi EVs, targeting 10,000 units in 2024 and 1 million by 2030, supporting India’s rapid shift to electric mobility and carbon neutrality goals.

Segmentation Analysis

By Component Type

Efficient Power Conversion and Performance Boosts Traction Inverter’s Dominance

By component type, the market segments in various categories such as motor, traction inverter, and on-board charger. The motor sub-segment includes motor stator, rotor, shaft and bearing, permanent magnet, casing, and wiring & connectors. The traction inverter comprises IGBT/SiC power module, microcontroller, sensing element, and others.

The traction inverter segment dominated the market in 2024 driven by the rising demand for efficient, high-performance electric motorcycles and mopeds. Traction inverters are crucial for optimizing motor performance, enhancing acceleration, and extending range. As consumers seek longer-lasting, faster-charging, and more reliable electric two-wheelers, the need for advanced inverters grows. Moreover, innovations in inverter technology, such as higher power density, compact size, and cost reduction, are pushing growth, enabling manufacturers to meet the evolving demands for electric two wheeler powertrains.

- In January 2024, Damon Motors announced a collaboration with NXP Semiconductors to integrate high-performance automotive Integrated Circuits (ICs) into its electric motorcycles. The partnership enhances Damon’s traction inverters by incorporating NXP’s advanced automotive-grade components, including the S32K3 processor and MC33771 battery controller, optimizing motor control and efficiency. NXP’s EV traction inverter and battery management solutions ensure functional safety and high reliability in harsh environments, complying with ISO 26262 up to ASIL D. This collaboration also integrates advanced embedded security for real-time processing and cloud connectivity. Damon’s HyperFighter motorcycle was showcased at CES 2024, highlighting the breakthrough technology.

The motor segment is estimated to develop at the fastest growth rate driven by advancements in motor technology, rising demand for efficient and high-performance vehicles, and supportive government policies promoting e-mobility. Key components such as rotors, stators, and controllers are evolving to offer better torque, power density, and thermal management, contributing to the growth of the segment.

By Vehicle Type

Growing Urbanization and Affordability Contributed to Dominance of Electric Mopeds

The market is segmented by vehicle type into electric motorcycles and electric mopeds.

The electric mopeds segment accounted for the largest market share in 2024 driven by rising urbanization and demand for affordable and eco-friendly transportation. Electric mopeds offer cost-effective solutions for short-distance travel and last-mile connectivity. They are popular in densely populated cities, where their compact size, low operating costs, and ease of use offer a practical alternative to conventional vehicles. Additionally, government incentives and increasing environmental awareness further drive the adoption of electric mopeds, enhancing the electric two wheeler powertrain market growth.

In March 2025, Ola Electric, a leading electric two-wheeler manufacturer in India, began delivering its S1 Pro Gen 3 electric scooters. The S1 Gen 3 series includes eight models, such as the S1 Pro+, S1 Pro, S1X+, and S1X, each available with multiple battery options. Built on Ola's Gen 3 platform, the models feature a new mid-drive motor, chain drive, and an integrated Motor Control Unit (MCU) for improved performance, efficiency, and safety. The S1 Pro+ offers a range of 242 km to 320 km, while the S1 Pro provides up to 242 km. The Gen 3 variants include powerful motors, with the S1 Pro+ achieving top speeds of 128-141 km/h and the S1 Pro reaching up to 125 km/h.

The electric motorcycle segment is attributed to gain momentum fueled by push for performance-oriented bikes, such as sport and commuter models, battery solutions, and electric two wheeler powertrain advancement. Growing demand for higher-power motorcycles such as the OLA’s Roadster Pro spurs development in the segment.

By Power Output

Lower Purchase and Operating Costs Appeal Need for <3 KW Power Output

Based on power output, the market is categorized within <3 kW, 3-10 kW, and >10 kW.

The <3 kW segment dominates the market due to increasing urbanization, demand for affordable mobility, and the rise of last-mile connectivity solutions. Electric mopeds and entry-level motorcycles in this segment offer cost-effective, energy-efficient alternatives for short-distance commuting. Their lower purchase and operating costs make it appealing to consumers in developing regions. Additionally, government incentives, environmental concerns, and the convenience of compact battery electric vehicles contribute to the growing adoption of <3 kW electric two-wheelers.

In September 2024, Revolt Motors launched an electric motorcycle featuring a 3 kW mid-drive motor. This model is expected to offer enhanced performance and features compared to the existing RV400 series. The RV400, equipped with a 3 kW motor and a 3.24 kWh battery, delivers a range of up to 150 km on a particular charge. The upcoming motorcycle aims to compete with 150–160 cc internal combustion engine motorcycles, aligning with the growing demand for higher-performance electric two-wheelers in India.

The >10 KW segment’s growth in the electric two wheeler powertrain space is driven by rising demand for high-performance electric motorcycles that offer greater speed, acceleration, and range. This segment caters to urban commuters and enthusiasts seeking alternatives to traditional gasoline bikes. Also, advancement in lithium ion batteries and motor technologies support powerful lightweight designs.

By Motor Type

Superior Torque and Efficiency is Expected to Fuel Demand for Mid Drive Motors in E-Two-Wheelers

The market is categorized by motor type into mid drive and hub.

The mid drive segment is expected to dominate the market during the forecast period as these motors are increasingly favored for their superior efficiency, handling, and performance compared to hub motors. They provide better torque management, which enhances acceleration and range, making them ideal for higher-performance electric motorcycles. As consumers demand more powerful, efficient, and versatile vehicles, the mid-drive motor’s ability to deliver a premium riding experience positions it as a key player in the growing market.

In February 2025, Ola Electric launched its Roadster X series of electric motorcycles, featuring a 7 kW mid-drive motor. The Roadster X models deliver top speeds between 105 km/h and 118 km/h, accelerating from 0 to 40 km/h in 3.1 to 3.4 seconds, depending on the battery variant. The Roadster X+ models feature an 11 kW motor, reaching a top speed of 125 km/h and with acceleration from 0 to 40 km/h in just 2.7 seconds. These models are designed to provide enhanced performance and efficiency for urban and rural mobility.

The hub motor segment’s growth is attributed to the advances in motor types-notably brushed DC and brushless DC motors. Geared hub motors provide compactness and better speed control, while gearless units attract high-performance use. Thus, the advancement in motor technology, with the integration of technologies such as IoT, regenerative braking, and lightweight materials boosts appeal for them.

By Battery Type

High Energy Density and Fast Charging is Predicted to Drive Lithium-Ion Battery Adoption in Two-Wheelers

By battery type, the market is segmented into lithium-ion batteries, lithium iron phosphate (LiFePO4), and lead-acid.

The lithium-ion batteries segment is expected to dominate the market during the forecast period. As manufacturers increasingly integrate high-performance lithium-ion batteries into electric motorcycles and mopeds, the demand for these batteries will rise, driven by their higher energy density, lightweight, and longer lifespan compared to alternatives. This trend, especially in emerging electric two wheeler powertrain markets such as India, highlights the shift toward more efficient, reliable, and faster-charging battery technologies.

In January 2025, CBAK Energy Technology, Inc., a leading Chinese manufacturer of lithium-ion and sodium-ion batteries, with the help of its subsidiary, Nanjing CBAK New Energy Technology Co., Ltd., secured purchase orders from Ather Energy, one of India’s top five electric two-wheeler manufacturers. Ather Energy, also operating India's largest fast-charging network for electric two-wheelers, integrates CBAK's advanced Model 32140 cylindrical lithium-ion battery cells into its vehicles. These high-performance batteries are ideal for electric two-wheelers, three-wheelers, and Light Electric Vehicles (LEVs). The partnership reflects the growing demand for quality battery solutions in India’s expanding EV market, with expectations for long-term collaboration and steady orders.

Electric Two Wheeler Powertrain Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

Asia Pacific Electric Two Wheeler Powertrain Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds a significant share of the global market, with the U.S. being a major contributor. This region is driven by increasing environmental awareness, government incentives, and the shift toward sustainable urban mobility. The market is further fueled by rising fuel prices and demand for alternative transportation solutions. Federal and state-level subsidies, tax credits, and policies promoting clean energy are key growth drivers. Additionally, advancements in battery technology, infrastructure for EVs, and the rise of urban mobility solutions make electric two-wheelers more attractive to consumers, helping expand their market share across the region.

The U.S. represents a significant portion of the North American regional market. Government incentives, such as federal tax credits and rising environmental concerns, are crucial growth drivers. The demand for electric motorcycles and mopeds is further bolstered by urban mobility needs in congested cities, with fuel prices and environmental regulations pushing consumers toward sustainable options. Additionally, the growing EV infrastructure, including more charging stations and the continued development of long-range, fast-charging battery technologies, positions electric two-wheelers as a viable solution for eco-conscious, cost-effective transportation.

- In March 2025, Microchip Technology introduced an Electric Two-Wheeler Ecosystem to accelerate e-mobility innovation. The ecosystem combines advanced electric two wheeler powertrain, battery management, and charging solutions with microcontroller and analog technologies, enabling efficient and reliable electric two-wheelers. This initiative aims to upkeep the growing demand for eco-friendly transportation by helping manufacturers develop innovative, high-performance electric motorcycles and mopeds.

Europe

Europe holds a prominent share of the market, driven by stringent environmental regulations and incentives to reduce CO2 emissions. The region’s strong push toward sustainable urban mobility solutions, such as electric motorcycles and mopeds, is supported by government subsidies and investments in EV infrastructure, including widespread charging networks. Many European cities have implemented low-emission zones, creating a conducive environment for electric two-wheelers. As consumer preferences shift toward eco-friendly alternatives, the demand for electric two-wheelers continues to grow, with Europe playing a leading role in the transition to cleaner transport.

- In May 2024, EMCO Electroroller GmbH acquired unu, a leading German electric scooter company, marking a new chapter in German e-mobility. The acquisition combines EMCO's manufacturing expertise with unu’s innovative electric scooter designs. This strategic move aims to expand the portfolio of sustainable, high-performance electric vehicles, enhancing the growth and development of e-mobility solutions in Germany and beyond.

Asia Pacific

Asia Pacific held the largest electric two wheeler powertrain market share in 2024. China and India, in particular, are driving forces behind this growth, with massive urban populations, high pollution levels, and government policies promoting clean energy. Electric motorcycles and mopeds are seen as cost-effective, environmentally friendly alternatives to traditional vehicles across the region. Government subsidies, incentives, and aggressive EV adoption policies, along with the increasing availability of charging infrastructure, further bolster the demand. The region’s dominant position is also supported by the rapid development of battery technology and local manufacturing, driving down the costs.

- In February 2025, PlugNride Motors Pvt. Ltd. launched its indigenous high-speed electric two-wheelers, the APKE PNR 100 and APKE PNR 200, marking a significant step in India’s Electric Vehicle (EV) industry. These models, equipped with advanced lithium-ion batteries, offer a top speed reaching 70 km per hour and a range of 120 kilometers per charge. Approved by NATRAX, they meet high safety and performance standards. Manufactured in Sonipat, Haryana, the vehicles cater to both B2B and B2C markets, including urban commuters and quick-commerce companies.

Rest of the World

The rest of the world, which includes regions such as the Middle East & Africa and South America, holds a smaller yet emerging share of the market. Rising fuel costs and environmental concerns are gradually driving demand for electric motorcycles and mopeds. Urbanization, especially in large cities, is pushing consumers toward cost-effective transportation options. While infrastructure and charging stations are still developing in these regions, government incentives and the growing availability of affordable electric two-wheelers are expected to drive future growth. As awareness of sustainable mobility solutions increases, market share in these regions is likely to expand over the forecast period.

- In April 2025, UAE-based Sulmi launched 200 limited-edition, locally made e-motorbikes. These premium models are aimed to be sold directly to consumers, showcasing the company's commitment to sustainable transportation and innovation. The initiative underscores Sulmi's dedication to advancing the electric mobility sector in the UAE, aligning with the nation's vision for a greener future.

COMPETITIVE LANDSCAPE

Key Industry Players

Global Innovation, Regional Strengths, and Strategic Alliances Drive Competitive Dynamics

The electric two-wheeler powertrain market is highly competitive, featuring global and regional players focused on innovation and efficiency. Bosch Mobility and Valeo SA lead with integrated systems and advanced engineering. Yamaha and MAHLE Powertrain emphasize performance-centric solutions, while EMX Powertrain and Delta Electronics contribute strong modular designs. Chinese firms such as T&D, Varcheae Mobility, CBAK Energy, and BYD dominate cost-effective, scalable manufacturing. Hero MotoCorp targets emerging markets with strategic electrification. Taiwanese players FUKUTA and Delta bring motor and controller expertise. The competitive landscape is defined by rapid technological evolution, regional specialization, and collaborations aimed at expanding global footprints and meeting regulatory demands.

LIST OF KEY ELECTRIC TWO WHEELER POWERTRAIN COMPANIES PROFILED

- Bosch Mobility (Germany)

- Yamaha Motor Co., Ltd. (Japan)

- T&D (China)

- Varcheae Mobility (China)

- EMX Powertrain B.V. (Netherlands)

- Delta Electronics, Inc. (Taiwan)

- FUKUTA ELEC. & MACH. CO, LTD. (Taiwan)

- MAHLE Powertrain Ltd (U.K.)

- Valeo SA (France)

- Hero MotoCorp Ltd. (India)

- CBAK Energy Technology (China)

- BYD (China)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Hero MotoCorp explored hybrid technology for two-wheelers in India as part of its commitment to eco-friendly transportation solutions. The company is investigating the integration of hybrid systems into its existing portfolio, aiming to improve fuel efficiency and reduce emissions. This move aligns with India’s growing demand for sustainable mobility options in the two-wheeler segment.

- January 2025: Yadea unveiled its first electric scooters powered by sodium-ion batteries in Hangzhou, China. The new models, priced approximately between USD 450 and USD 590, offer enhanced safety, environmental benefits, and a lifespan of up to five years. Equipped with the HuaYu Superfast Charging Ecosystem, these scooters can reach 80% charge in just 15 minutes.

- September 2024: White Motorcycle Concepts (WMC) and MAHLE Powertrain unveiled the WMC300E+, the world’s first aero-electric motorcycle designed for fleets and first responders. This trike features WMC’s patented V-Duct for enhanced aerodynamics and a T-shaped 11.9 kWh battery developed by MAHLE, enabling a 100-mile range and 15-minute charging via CCS. The WMC300E+ offers zero-emission operation, improved acceleration, and compatibility with standard car licenses, making it ideal for emergency services and last-mile delivery.

- July 2024: At Misano World Circuit in Italy, Vmoto unveiled a prototype of its new Superfast charging battery. This compact and lightweight battery charges from 0% to 80% in just 30 minutes, offering urban commuters and delivery services reduced downtime.

- November 2022: Hero Electric introduced the 'Ultra Safe' battery packs for its electric two-wheelers, developed in collaboration with Battrixx. These advanced lithium-ion packs are designed and manufactured in India, featuring enhanced cell chemistry, IP67 thermal protection, smart Battery Management Systems (BMS), and IoT-enabled live data tracking. The partnership aims to supply 300,000 units within a year.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on the technological advancements and demand for tires in key regions/countries, porter’s five force analysis, key industry developments, new product launches, and details on partnerships, mergers & acquisitions in key countries. The electric two wheeler powertrain market report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.8% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component Type

|

|

By Vehicle Type

|

|

|

By Power Output

|

|

|

By Motor Type

|

|

|

By Battery Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 10.59 billion in 2024 and is projected to reach USD 31.59 billion by 2032.

In 2024, the market value stood at USD 10.56 billion.

The market is expected to exhibit a CAGR of 14.8% during the forecast period of 2025-2032.

Last mile connectivity advantage in growing urbanization and traffic congestion scenarios fuels the market development.

Bosch Mobility and Valeo SA, among others, are some of the leading market players.

Asia Pacific dominated the market in 2024 by holding the largest share.

Key factors favoring product adoption include rising fuel costs, government subsidies, stricter emission norms, advancements in battery technology, urbanization, growing environmental awareness, improved charging infrastructure, and increasing demand for efficient, low-maintenance, and sustainable personal mobility solutions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us